Proteomics Market Size & Trends:

Get More Information on Proteomics Market - Request Sample Report

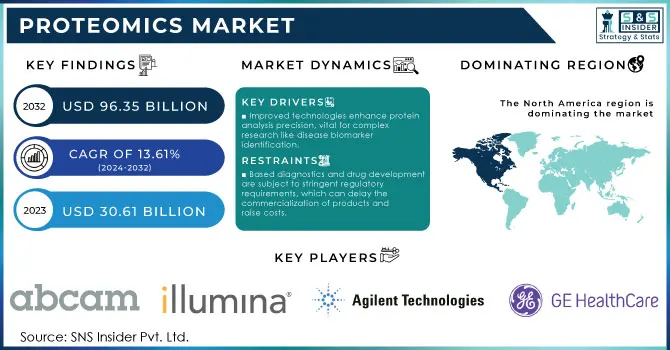

The Proteomics Market Size was valued at USD 30.61 billion in 2023 and is expected to reach USD 96.35 Billion by 2032, growing at a CAGR of 13.61% from 2024-2032.

The proteomics market, centered on analyzing protein structures and functions, is growing rapidly due to technological innovations and rising demand from the healthcare, biotech, and pharmaceutical industries. Advances in mass spectrometry, protein separation, and bioinformatics have greatly improved protein analysis, supporting the expansion of personalized medicine. Proteomics is now essential for detecting disease biomarkers, enabling earlier diagnosis and customized treatment for conditions like cancer, cardiovascular diseases, and neurodegenerative disorders.

Research funding and public initiatives are also accelerating market growth. For instance, in 2024, significant investments in the U.S. and Europe have boosted projects like the Human Proteome Project, which seeks to map the human proteome, offering valuable insights for drug discovery and medical research. Clinical applications are expanding as well; recent studies, including a 2023 study, highlight proteomics' effectiveness in identifying early markers for Alzheimer’s disease, underscoring its potential in improving diagnostics for complex conditions.

In the pharmaceutical field, proteomics enhances drug discovery by facilitating the study of protein interactions, leading to more efficient drug design and reduced trial-and-error processes. The Asia-Pacific region is also emerging as a major market, driven by increased healthcare investments and supportive government policies in countries like China and India. This growth not only advances global proteomics but also introduces cost-effective innovations, making proteomic technologies more accessible worldwide. With ongoing technological advancements, global funding, and crucial applications in disease research, the proteomics market is positioned to play a transformative role in healthcare and biotechnology.

Proteomics Market Dynamics

Drivers

-

Improved technologies enhance protein analysis precision, vital for complex research like disease biomarker identification.

-

Proteomics offers insights for tailored treatments by identifying specific biomarkers for diseases like cancer and cardiovascular conditions.

-

Pharmaceutical companies leverage proteomics to study protein interactions, streamlining drug discovery and improving treatment efficacy.

The data is increasingly leveraged by pharmaceutical companies to study protein interaction, a practice which when used at the right stage, can reduce drug discovery turn-around time and bring more effective drugs in market. Proteomics studies proteins on a large scale, giving an overview of the way these macromolecules act in biological systems. It is important because proteins are the primary targets of many therapeutic drugs, and understanding how they interact can help us design more specific and effective drugs.

The identification of disease-specific biomarkers is one of the major advantages of proteomics in drug discovery. Biomarkers are quantifiable measures of biological states, and in drug development they assist in pinpointing locations within the human body that a potential drug is most likely targeting. In cancer research, for example, proteomic analyses may also help to identify proteins that are exclusive to cancerous cells, which can then be targeted by treatments specifically developed with these cancers in mind while limiting exposure and harm to healthy cells. Such targeting increases the effectiveness of the treatments while reducing side effects for patients as well. In addition, proteomics enables predictions on the way drug would interact with its target protein and other proteomes in the body to eliminate trial-and-error during a drug design phase. Being able to predict 6 months ahead of time the cost and duration drug development. It has been reported recently that the expense of developing a new drug exceeds USD2 billion, while it can take more than 10 years. By identifying promising compounds earlier in the development cycle, proteomic research shortens this timeline. This helps pharmaceutical companies to funnel their resources towards leading candidates with the highest chance of success.

Furthermore, proteomics allows a better insight into one of the major hurdles in therapies for diseases like bacterial infections and cancer — drug resistance. Through the analysis of proteins that change in relation to drug-resistant cells, they can be tailored therapies so that resistant cells are found further away from the target and superior therapeutic effects can be achieved. Overall, these studies show how proteomics science can transform pharmaceutical discovery. Through improving target specificity, minimizing drug design trial-and-error, and overcoming drug resistance, proteomics lays a strong platform for the routine advancement of more efficient personalized therapies towards diverse diseases.

Restraints

-

The absence of standardized protocols for proteomics experiments and data interpretation can hinder reproducibility, which is crucial for scientific progress and commercial applications.

-

Based diagnostics and drug development are subject to stringent regulatory requirements, which can delay the commercialization of products and raise costs.

-

Proteomics instruments and technology are expensive.

Proteomics research spans various applications, such as discovering new drugs, vaccines, and diagnostic biomarkers, as well as analyzing protein-based products, toxicology, and surrogate markers in clinical research to investigate drug mechanisms. These applications require advanced platforms, instruments, software, and databases, all contributing to the high costs of protein analytics.

Additionally, conducting proteomics experiments demands specialized expertise in areas like sample preparation, data analysis, and interpretation. This expertise is often difficult and expensive to acquire, especially for smaller businesses. The high costs of instruments and the specialized skill sets needed for proteomics can impede market growth, slowing the adoption of new technologies. These financial constraints can also hinder innovation and technological progress while intensifying competition among proteomics instrument manufacturers.

Segmentation Analysis

By Technology

In 2023, the spectrometry segment led the proteomics market in revenue and is expected to maintain robust growth, with a projected compound annual growth rate (CAGR) of 15.10% during the forecast period. Spectrometry is essential for protein identification, characterization, detecting post-translational modifications, and analyzing protein-protein interactions. Advancements in mass spectrometry, such as improved resolution, faster speeds, and greater automation, have significantly boosted its efficiency, solidifying its role as a preferred method in proteomics research. Moreover, integrating spectrometry with bioinformatics has expanded its use in drug discovery, biomarker identification, and personalized medicine, fueling continued segment growth.

The next-generation sequencing (NGS) segment is also set for rapid expansion from 2024 to 2032, largely driven by decreasing sequencing costs, which have made NGS technology more accessible across a wide array of research and clinical fields. Technological improvements that enhance speed and accuracy are accelerating NGS adoption in oncology, genetic disease research, and personalized medicine. To capitalize on this trend, companies are taking strategic actions, such as the February 2024 partnership between Pixelgen Technologies and BioStream Co. Ltd., which aims to distribute next-generation sequencing spatial proteomics tools for single-cell applications. These efforts are likely to accelerate the growth of the NGS segment further.

By Application

In 2023, drug discovery dominated the proteomics market with a 54.76% revenue share. This dominance is mainly due to the introduction of innovations in structure-based drug design, a rise in personalized medicine efforts and more investments. Using proteomics technologies can genuinely aid in early assessment of drug efficacy, saving pharmaceutical companies millions, increasing patient and healthcare system gains. This is what fuels the continued growth of drug discovery.

The clinical diagnostics segment is anticipated to show fastest growth rate in the near future. However, the increasing employment of protein analysis in clinical research for applications like biomarker discovery relevant to early-stage disease diagnosis and predicting individual risk factors for different diseases is the major growth driving factor. Rising application of proteomics based diagnostic tools for the identification of biomarkers and protein expression profiles, which help in better classification of tumors, predicting disease prognosis, allowing timely intervention will accelerate the growth of the segment over next few years.

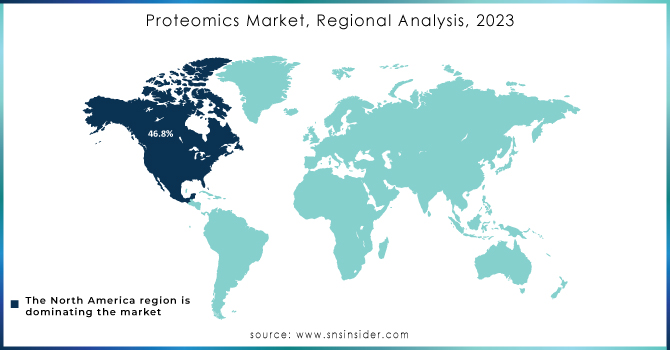

Proteomics Market Regional Analysis

The North America dominated the Proteomics market and represented significant revenue share of more than 46.87% in 2023, driven by technological advancements and need for advanced diagnostics capabilities in diseases. Strong investments in precision medicine and government funding splash pools on biotechnology, and healthcare throughout the surrounding region provides a foundation of support for this effort. A thriving biotechnology and life science research sector, technological advances of mass spectrometry, and presence of major industry participants are the factors facilitating the growth of U.S market.

The Asia Pacific proteomics market is expected to have 16.47% of compound annual growth rate (CAGR) from 2024 to 2032, highest among all regional segments. The demand for proteomics technologies is growing due to all these reasons such as the increasing burden of chronic diseases, outsourcing trend in proteomics projects, increasing public & private funding and favorable government policies. It also has a large biotechnology and biopharmaceutical presence in this area. In particular, Japan will be one of the more clearly driven markets due to drug discovery programs and personalized medicine, as well such continual evolution in technology propelled by governmental acceptance.

Do You Need any Customization Research on Proteomics Market - Enquire Now

Key Players

The major key players are

-

Thermo Fisher Scientific – Orbitrap Fusion Lumos Mass Spectrometer

-

Agilent Technologies – SureScan Dx Microarray System

-

Waters Corporation – Xevo TQ-S Micro Mass Spectrometer

-

PerkinElmer – AxION iQT Mass Spectrometer

-

Bio-Rad Laboratories – ChemiDoc Imaging System

-

Abcam – Proteomics Antibody Array

-

GE Healthcare Life Sciences – IN Cell Analyzer 2200

-

Danaher Corporation – Cytiva Proteomics Solutions

-

Bruker Corporation – Ultraflex III MALDI-TOF Mass Spectrometer

-

Qiagen – QIAseq Targeted RNA Panels

-

Merck KGaA – Milli-Q Advantage A10

-

Promega Corporation – Madonna Mass Spectrometry Kit

-

Illumina – NextSeq 2000 Sequencing System

-

Sartorius AG – Octet Red96e System

-

Shimadzu Corporation – Nexera X2 UPLC System

-

Agilent Technologies – 5960 Series GC-Mass Spectrometer

-

Sysmex Corporation – XN-3100 Automated Hematology Analyzer

-

Pacific Biosciences – Sequel IIe System for long-read sequencing

-

Roche Diagnostics – Cobas 4800 System for PCR-based diagnostics

-

Becton, Dickinson and Company – BD FACSymphony S6 Flow Cytometer

Recent Developments

In July 2024, the Agilent launched the Agilent ExD Cell, a tool designed to enhance protein and peptide characterization when used in conjunction with the 6545XT AdvanceBio LC/Q-TOF system.

The Agilent also highlighted its latest innovations and mass spectrometry products at the 72nd ASMS Conference on Mass Spectrometry and Allied Topics, held in California in June 2024.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 30.61 Billion |

| Market Size by 2032 | USD 96.35 Billion |

| CAGR | CAGR of 13.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product & Services (Instruments, Reagents & Consumables, Services) • By Application (Drug Discovery, Clinical Diagnostics, Others) • By Technology (Next-generation Sequencing Microarray Instruments, X-Ray Crystallography, Spectrometry, Chromatography, Protein Fractionation Systems, Electrophoresis,Surface Plasma Resonance (SPR) Systems,Other Technologies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Agilent Technologies, Waters Corporation, PerkinElmer, Bio-Rad Laboratories, Abcam, GE Healthcare, Danaher Corporation, Bruker Corporation, Qiagen, Merck KGaA, Promega Corporation, Illumina, Sartorius AG and other players |

| Key Drivers | • Improved technologies enhance protein analysis precision, vital for complex research like disease biomarker identification. • Proteomics offers insights for tailored treatments by identifying specific biomarkers for diseases like cancer and cardiovascular conditions. |

| RESTRAINTS | • The absence of standardized protocols for proteomics experiments and data interpretation can hinder reproducibility, which is crucial for scientific progress and commercial applications. • Based diagnostics and drug development are subject to stringent regulatory requirements, which can delay the commercialization of products and raise costs. |