Personal Care Ingredients Market Analysis & Overview:

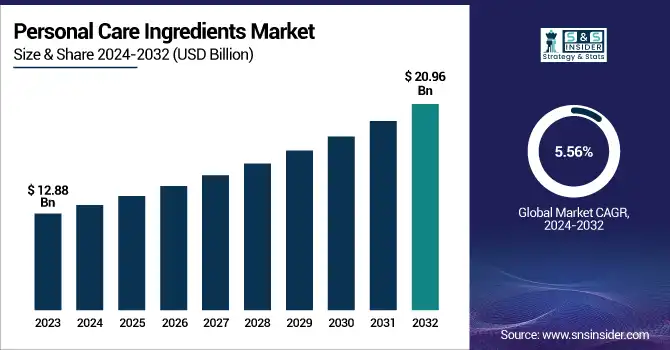

The Personal Care Ingredients Market size was USD 12.88 billion in 2023 and is expected to reach USD 20.96 billion by 2032 and grow at a CAGR of 5.56% over the forecast period of 2024-2032.

To Get more information on Personal Care Ingredients Market - Request Free Sample Report

This report offers ingredient-level production capacity and utilization rates across major countries for 2023, along with average pricing trends for key raw materials such as emollients, surfactants, and active ingredients. The analysis highlights region-wise adoption rates of sustainable and natural ingredients, along with the impact of regulatory frameworks such as EU Cosmetics Regulation and FDA guidelines. Additionally, it examines environmental metrics, including carbon footprint, water usage, and green manufacturing initiatives. R&D and innovation statistics, particularly for bio-based and multifunctional ingredients, are covered extensively. The report also features formulation trends and the integration of AI-driven personalization tools within product development.

The United States held the largest share in the Personal Care Ingredients Market in 2023, with a market size of USD 2.11 billion, projected to reach USD 3.55 billion by 2032, growing at a CAGR of 5.93% during 2024–2032. This is due to its well-established cosmetics and personal care industry, backed by high consumer spending on premium and specialized skincare, haircare, and wellness products. The country is home to several major personal care manufacturers and ingredient suppliers, including Procter & Gamble, Estée Lauder, and Johnson & Johnson, which consistently invest in innovation and product development. Moreover, a growing preference for clean-label, organic, and dermatologically tested ingredients has driven demand for high-performance raw materials. Regulatory clarity provided by the FDA and support for R&D through initiatives like the Personal Care Products Council (PCPC) have further supported industry growth. Additionally, increasing awareness of skin health, aging-related concerns, and rising male grooming trends continue to bolster ingredient consumption across the U.S. market.

Personal Care Ingredients Market Dynamics

Drivers

-

Rising consumer preference for clean beauty and natural formulations drives the personal care ingredients market growth.

The global shift toward clean beauty and naturally sourced personal care products is significantly propelling the growth of the personal care ingredients market. Consumers are increasingly demanding transparency in ingredient labeling and formulations that are free from parabens, sulfates, and synthetic chemicals. This trend is particularly prominent among millennials and Gen Z, who prioritize health-conscious and environmentally sustainable options. Consequently, manufacturers are investing heavily in research and development to create bio-based, organic, and multifunctional ingredients that align with evolving consumer expectations. Major players are also launching innovative formulations enriched with plant extracts, vitamins, and probiotics, further fueling market expansion. The growing availability of clean-label certifications and regulatory support for safer cosmetic ingredients reinforces this trend, encouraging manufacturers to reformulate existing products and introduce novel ingredients that meet consumer and regulatory demands alike.

Restrain

-

Stringent regulatory requirements for ingredient approval restrains the personal care ingredients market expansion.

The growth of the personal care ingredients market is hindered by complex and stringent regulatory frameworks that vary across regions. Compliance with safety standards such as REACH in Europe, FDA guidelines in the U.S., and other national cosmetic regulations demands rigorous testing, extended timelines, and high costs. These challenges particularly impact smaller and mid-sized manufacturers that lack the financial resources or technical capacity to navigate the regulatory landscape effectively. Frequent updates to ingredient approval lists and restricted substances further add to the burden, often requiring the reformulation of existing products or halting development altogether. Additionally, the demand for extensive toxicological and dermatological data to validate product claims can delay time-to-market. As global regulatory bodies place increasing emphasis on consumer health and environmental safety, the complexity of achieving compliance without compromising product performance continues to restrain market growth.

Opportunity

-

Advancements in biotechnology and active ingredient innovation offer lucrative growth opportunities in the market.

The integration of biotechnology in ingredient development presents significant opportunities for the personal care ingredients market. Through techniques such as fermentation, enzyme engineering, and plant cell culture, companies are able to produce high-purity, sustainable, and efficacious active ingredients tailored for skincare, haircare, and other personal care applications. These innovations cater to rising demand for personalized, anti-aging, and skin-brightening solutions, while also supporting environmental goals. Biotech-based ingredients like peptides, probiotics, and hyaluronic acid are gaining traction among formulators for their multifunctionality and superior performance. Start-ups and established companies alike are forming strategic collaborations with biotech firms to fast-track product development and enhance R&D capabilities. Furthermore, consumer interest in cruelty-free, vegan, and ethically sourced formulations aligns well with these scientific advancements, opening new revenue streams for companies focused on sustainable innovation and product differentiation.

Challenge

-

Fluctuating raw material prices and supply chain disruptions pose challenges to market stability and profitability.

Volatile raw material costs and persistent supply chain disruptions present a critical challenge to the stability and profitability of the personal care ingredients market. Many key raw materials, such as natural oils, plant extracts, and synthetic chemicals, are subject to price fluctuations due to geopolitical tensions, climate-related agricultural issues, and energy market instability. This unpredictability not only impacts production costs but also pressures manufacturers to adjust pricing strategies or reformulate products. In addition, global supply chains remain vulnerable to logistical challenges, including transportation delays, trade restrictions, and shortages of essential components. These disruptions disproportionately affect companies that rely on imported ingredients or operate on just-in-time manufacturing models. Maintaining consistent product quality and inventory levels under these constraints becomes increasingly difficult, forcing manufacturers to seek local sourcing, diversify supply networks, or invest in alternative ingredients—often at the expense of higher operational costs.

Personal Care Ingredients Market Segmentation Analysis

By Ingredient Type

Surfactants accounted for the largest share, 28% in 2023, of the personal care ingredients market due to their significant deployment in several personal care formulations, including shampoos, body wash, facial cleansers, toothpaste, etc. Due to their primary role as cleansing agents, emulsifiers and foaming agents, they are requirements in rinse-off and leave-on products. Surfactants are indispensable components that help change the surface properties of products; surfactants are extensively used in various daily-use products, owing to their high usage volume. Surfactant ingredients improve the texture of the product, ease and spread the ability of application, and overall benefit, thus contributing significantly to its overall market dominance. In addition, continuous developments in milder and bio-based surfactants due to increasing preference for skin-friendly and environmentally friendly products have additionally aided their extensive accessibility.

By Application

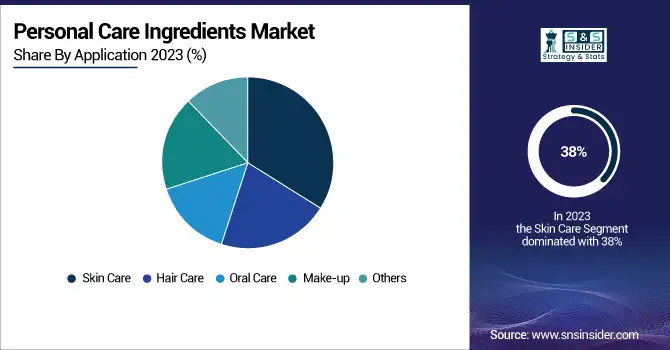

Skin Care held the largest market share, around 38%, in 2023. It is due to rise in skin issues like aging, acne, pigmentation, and dryness, there has been a rise in demand for functional and targeted skin care products. Simple skin care is out when it comes to consumers now, who are, in turn, more inclined towards investing in multi-functional products that contain anti-aging agents, SPF, hydration boosters, and skin-brightening ingredients, all of which pave way to innovation and voluminous consumption of ingredients. He said that the e-commerce boom and social media impact has made consumers more conscious and led to skin care routines becoming more widespread across demographic groups. In response, firms are introducing new ingredients including bio-based emollients, peptides, and ceramides for sensitive and aging skin.

Personal Care Ingredients Market Regional Outlook

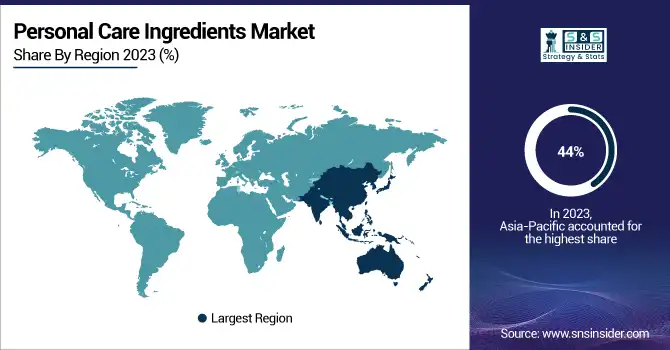

Asia Pacific held the largest market share, around 44%, in 2023. It is due to the existence of long-standing cosmetic markets in many of the European nations, the presence of stringent regulatory standards, and from a more consumer cognition perspective, the high demand for high-quality and sustainable products. Home to several international beauty and personal care brands that have large R&D budgets, the region is witnessing strong demand for innovative and high-quality ingredients. Moreover, the European Union's stringent policies regarding cosmetics like REACH and the Cosmetics Regulation (EC) No 1223/2009 requiring safe and sustainable ingredients also build consumer trust and stimulate product innovation. Greater consumer acceptance of natural, organic, and vegan beauty products in Europe has translated into a trend toward plant-based and biodegradable ingredients. With many production and consumption centers located in countries such as Germany, France, and the U.K., this has further cemented Europe as a major player in the market.

North America held a significant market share. It is owing to the high per capita spending of North Americans on beauty and personal care products, along with a strong presence of key market players and increased demand for clean-label and functional products, that North America held the greatest share of the personal care ingredients market. The U.S. and Canada are also the hotbeds of a plethora of multinational cosmetics companies and ingredient makers that habitually reinvest proceeds into advancements in bio-based, anti-aging & multifunctional ingredients. The increasing consumption of synthetic and natural goods across the region, compounded with the rising consumer demand for sustainable, cruelty-free, and dermatologically tested goods, has also further propelled the market graph. Moreover, the rapidly increasing awareness of skincare routines and customized beauty, with the help of digital platforms and influencer marketing, is driving the demand for premium personal care products. These, along with a well-established distribution network and changing consumer trends, continue propelling a steady share for North America in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Emulgade, Cetiol)

-

Ashland (Polyquaternium, AquaStyle)

-

Croda International Plc (Cithrol, Arlasilk)

-

Clariant (Genamin, Velsan)

-

Evonik Industries AG (Tego Care, Dermofeel)

-

Dow Chemical Company (EcoSmooth, Ucare)

-

Solvay (Jaguar, Miracare)

-

Symrise AG (SymSave, Hydrolite)

-

Lonza Group (Geogard, LaraCare)

-

Lubrizol Corporation (Carbopol, Pemulen)

-

Givaudan Active Beauty (Silibiome, Unimer)

-

Seppic (Montanov, Sepiplus)

-

Innospec Inc. (Empicol, Iselux)

-

Stepan Company (Stepanol, Stepan-Mild)

-

Wacker Chemie AG (Belsil, Vinex)

-

DSM Nutritional Products (Tilamar, Alpaflor)

-

Lucas Meyer Cosmetics (Regenesea, Progeline)

-

Sensient Technologies Corporation (Sensibright, Natpure)

-

Kobo Products Inc. (Floratech, MST Treated Pigments)

-

Vantage Specialty Chemicals (Lipovol, Natralite)

Recent Development:

-

In March 2023, BASF introduced a new range of sustainable cosmetic active ingredients tailored to meet the growing demand in the clean beauty segment. Later, in September 2023, the company unveiled Epispot, a sustainably sourced ingredient specifically formulated to support skin clarity and boost confidence among individuals with blemish-prone skin.

-

In June 2023, Croda International Plc entered into a strategic partnership with RAHN AG. The collaboration focuses on the development of innovative, naturally derived cosmetic ingredients. This move aligns with growing consumer demand for sustainable and effective personal care solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.88 Billion |

| Market Size by 2032 | USD 20.96 Billion |

| CAGR | CAGR of 5.56% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Ingredient Type (Emollients, Surfactants, Emulsifiers, Rheology Modifiers, Conditioning Polymers, Others) •By Application (Skin Care, Hair Care, Oral Care, Make-up, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Ashland, Croda International Plc, Clariant, Evonik Industries AG, Dow Chemical Company, Solvay, Symrise AG, Lonza Group, Lubrizol Corporation, Givaudan Active Beauty, Seppic, Innospec Inc., Stepan Company, Wacker Chemie AG, DSM Nutritional Products, Lucas Meyer Cosmetics, Sensient Technologies Corporation, Kobo Products Inc., Vantage Specialty Chemicals |