Pet Food Market Report Scope & Overview:

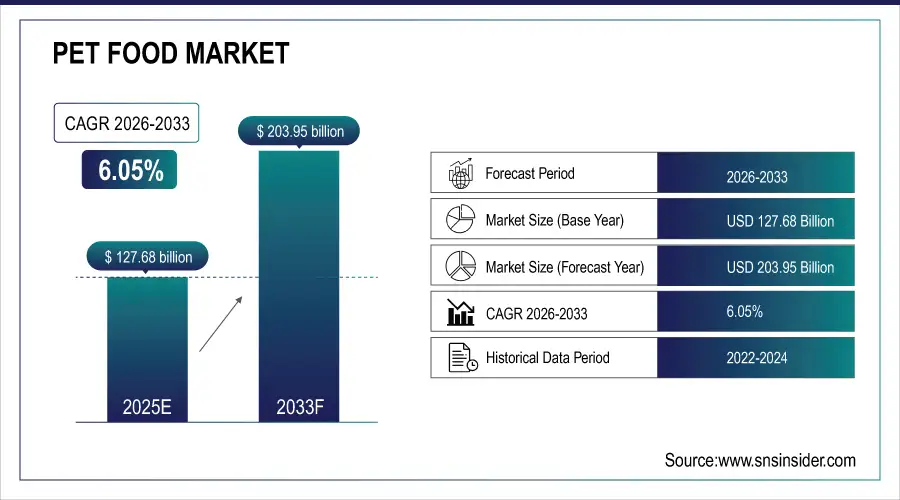

The Pet Food Market size was valued at USD 127.68 Billion in 2025E and is projected to reach USD 203.95 Billion by 2033, growing at a CAGR of 6.05% during 2026-2033.

The Pet Food Market analysis highlights the rising global pet ownership and premiumization trends driving product demand. Consumers increasingly favor natural, organic, and functional formulations focused on pet health and wellness. E-commerce and subscription models are expanding access and convenience. Manufacturers emphasize sustainable ingredients and eco-friendly packaging.

In 2025, global pet ownership exceeded 500 million households, with 65% of pet owners in North America and Europe considering pets as family members, fueling demand for premium nutrition.

Market Size and Forecast:

-

Market Size in 2025E: USD 127.68 Billion

-

Market Size by 2033: USD 203.95 Billion

-

CAGR: 6.05% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Pet Food Market - Request Free Sample Report

Pet Food Market Trends

-

Rising demand for premium and organic pet food driven by increased pet humanization and focus on animal health and nutrition.

-

Rapid growth of e-commerce and subscription-based pet food delivery models enhancing consumer convenience and brand loyalty.

-

Increasing adoption of sustainable and eco-friendly packaging solutions reflecting consumer environmental awareness and corporate responsibility.

-

Surge in plant-based and alternative protein pet food formulations catering to vegan and allergen-conscious pet owners.

-

Technological integration in pet nutrition, including smart feeders and personalized diet formulations, improving feeding accuracy and health monitoring.

The U.S. Pet Food Market size was valued at USD 40.09 Billion in 2025E and is projected to reach USD 62.07 Billion by 2033, growing at a CAGR of 5.64% during 2026-2033. Pet Food Market growth is driven by rising pet ownership and increasing consumer focus on pet health and wellness. Premium, organic, and functional pet food products are gaining popularity. E-commerce and direct-to-consumer channels are expanding accessibility. Innovation in plant-based and alternative protein formulations drives differentiation.

Pet Food Market Growth Drivers:

-

Rising Pet Humanization and Growing Preference for Premium, Nutritionally Balanced Pet Food Products

Increasing awareness among pet owners about animal health, wellness, and nutrition is driving the demand for premium, organic, and specialized pet food products. Consumers are treating pets as family members, leading to higher spending on functional and customized diets. This trend is supported by increased disposable incomes, urbanization, and a shift toward high-quality ingredients and formulations that promote longevity and well-being in pets, significantly boosting market growth.

In 2025, over 70% of pet owners in North America and Europe reported treating their pets as family members, directly influencing their willingness to spend 20–50% more on premium food.

Pet Food Market Restraints:

-

Fluctuating Raw Material Prices and Supply Chain Disruptions Affecting Production and Profit Margins

Volatile prices of key ingredients such as meat, grains, and oils create cost uncertainties for pet food manufacturers. Additionally, supply chain challenges, including logistics constraints, transportation delays, and dependency on imported materials, disrupt consistent production. These issues increase overall manufacturing costs, forcing brands to either absorb losses or raise prices, which can negatively impact affordability and limit market expansion, particularly in developing and price-sensitive regions.

Pet Food Market Opportunities:

-

Expansion of E-Commerce Platforms and Personalized Nutrition Solutions for Pet Owners

The rapid growth of online retail platforms and subscription-based services is creating vast opportunities for pet food brands. E-commerce allows manufacturers to reach a wider audience with tailored offerings and convenient delivery. Moreover, the rising trend of personalized nutrition using data on pet age, breed, and health enables brands to offer customized diets, driving brand loyalty and accelerating innovation in the premium and functional pet food segments.

In 2025, online channels accounted for over 45% of global premium pet food sales, with direct-to-consumer websites and marketplaces enabling brands to bypass traditional retail markups and gather consumer insights.

Pet Food Market Segment Analysis

-

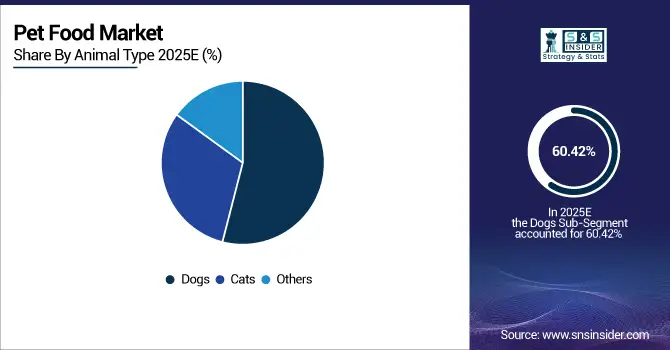

By Animal Type, dogs lead the market with a 60.42% share, while the others segment was the fastest growing, recording a CAGR of 9.21%.

-

By form, dry pet food dominated the market with a 40.56% share, whereas snacks and treats showed the fastest growth at a CAGR of 11.38%.

-

By distribution channel, supermarkets and hypermarkets held the largest share at 50.27%, while the online channel emerged as the fastest growing segment with a CAGR of 13.45%.

-

By source, animal-based pet food accounted for a 55.61% share in 2025, with the plant-based segment growing fastest at a CAGR of 12.10%.

By Animal Type, Dogs Leads Market While Others Registers Fastest Growth

In 2025, Dogs dominate the pet food market due to their higher ownership rates and growing demand for premium, breed-specific diets. Pet owners increasingly invest in high-quality dry and wet dog foods that support health, energy, and longevity. However, the “others” segment including birds, fish, and small mammals is witnessing rapid growth as pet diversification increases and manufacturers introduce specialized nutrition formulas catering to varied species and their unique dietary requirements.

By Form, Dry Pet Food Dominate While Snacks & Treats Shows Rapid Growth

Dry pet food remains the dominate market owing to its longer shelf life, convenience, and cost-effectiveness. It is widely preferred by pet owners for easy storage and portion control. While, the snacks and treats category is growing quickly, fueled by rising pet humanization trends and owners rewarding pets with indulgent, nutritious treats. Functional treats offering dental care, joint support, and digestive health benefits are driving strong innovation and adoption across regions.

By Distribution Channel, Supermarket/Hypermarket Lead While Online Channel Registers Fastest Growth

Supermarkets / hypermarkets lead the pet food market due to their wide product variety, easy accessibility, and consumer trust. Shoppers prefer these outlets for in-person comparisons and promotional offers. Meanwhile, the online distribution channel is expanding rapidly, driven by convenience, subscription services, and exclusive digital discounts. E-commerce platforms also allow for personalized recommendations, making them a preferred choice for tech-savvy pet owners seeking customized, premium, and specialty pet food products delivered to their doorstep.

By Source, Animal Lead While Plant Grow Fastest

In 2025, Animal-based pet food holds the largest share owing to its rich protein content and palatability that supports pet growth and health. Ingredients like meat, poultry, and fish remain key components of most pet diets. While, plant-based pet food is growing fastest, propelled by sustainability concerns and increasing vegan trends among pet owners. Brands are developing high-protein, nutrient-rich plant formulas that mimic traditional diets, appealing to environmentally conscious consumers and pets with meat sensitivities.

Pet Food Market Regional Analysis:

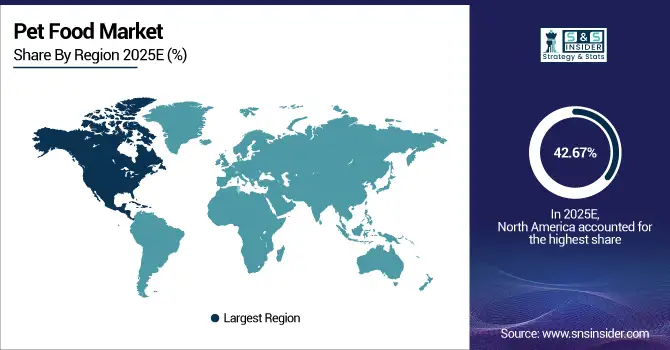

North America Pet Food Market Insights

In 2025 North America dominated the Pet Food Market and accounted for 42.67% of revenue share, this leadership is due to the high pet ownership rates and strong consumer spending on pet wellness. The region’s demand is dominated by premium, organic, and grain-free products emphasizing health, longevity, and sustainability. Innovation in functional and customized pet nutrition continues to shape growth. The presence of major industry players, advanced manufacturing capabilities, and widespread retail networks further strengthen the region’s dominance.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Pet Food Market Insights

The U.S. is the largest market for pet food worldwide, supported by strong consumer focus on pet health and wellness. Pet humanization trends and demand for clean-label, organic, and customized diets are driving continuous innovation. Leading brands invest heavily in R&D and sustainable packaging. Online sales are rising rapidly through subscription-based and direct-to-consumer models.

Europe Pet Food Market Insights

Europe is expected to witness the fastest growth in the Pet Food Market over 2026-2033, with a projected CAGR of 6.98% due to mature demand, strict regulations, and a strong focus on sustainability. Consumers prefer products with natural, locally sourced ingredients and transparent labeling. The region is witnessing rising interest in plant-based and eco-friendly formulations.

Germany Pet Food Market Insights

Germany is one of Europe’s largest pet food markets, driven by high pet ownership and preference for premium, healthy, and sustainable products. Consumers emphasize quality ingredients, traceability, and functional nutrition for pets. The rise of e-commerce and specialty pet stores enhances product accessibility.

Asia-pacific Pet Food Market Insights

In 2025, Asia-pacific emerged as a promising region in the Pet Food Market, due to rising pet ownership, urbanization, and increasing disposable incomes. Growing awareness about pet nutrition and the humanization trend are fueling demand for premium and functional pet foods. This region is emerging as key markets with expanding retail and e-commerce distribution. Regional manufacturers are also innovating with locally sourced ingredients.

China Pet Food Market Insights

China represents one of the fastest-growing pet food markets globally, driven by rapid urbanization and rising middle-class spending. Increasing adoption of dogs and cats as companions, particularly among younger consumers, fuels the demand for premium, natural, and organic products. E-commerce giants such as Alibaba and JD.com play a crucial role in distribution.

Latin America (LATAM) and Middle East & Africa (MEA) Pet Food Market Insights

The Pet Food Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the increasing urbanization, growing middle-class populations, and rising pet adoption. Brazil, Mexico, South Africa, and the UAE are key contributors to growth. Consumers are gradually shifting toward branded and nutritionally balanced products. Local manufacturing and affordable product offerings drive accessibility, while international brands expand their footprint through retail and online platforms.

Pet Food Market Competitive Landscape:

Mars Petcare Inc. is a global leader in the pet food market, offering brands like Pedigree, Whiskas, and Royal Canin. The company emphasizes research-driven nutrition and sustainability initiatives. Its focus on premiumization, functional ingredients, and pet health innovation helps maintain strong global dominance and consumer trust across multiple pet categories.

-

In October 2025, Mars Petcare launched its “Mars Is Closer Than You Think” campaign, showcasing over 38 U.S. factories, laboratories, and offices. The initiative highlights the company’s deep U.S. roots, manufacturing strength, and commitment to local pet food production.

Nestlé Purina PetCare, a subsidiary of Nestlé S.A., is a key player known for brands like Purina ONE, Friskies, and Pro Plan. The company focuses on science-based nutrition, quality assurance, and pet wellness. Its investment in product innovation, digital marketing, and global expansion reinforces its leadership in the premium pet food segment.

-

In March 2025, Nestlé decided to launch its own pet food business in South Korea, ending the joint venture with Lotte Wellfood. The move enhances operational control, brand visibility, and market reach for Purina’s growing premium pet food segment.

The J.M. Smucker Co. operates prominent pet food brands including Meow Mix, Milk-Bone, and Rachael Ray Nutrish. The company emphasizes premium, natural, and functional pet food offerings. Strategic acquisitions, innovation in treats, and expansion across e-commerce and retail platforms strengthen its position in the competitive North American pet food industry.

-

In February 2025, Smucker announced leadership changes, naming Judd Freitag to lead U.S. Retail Pet Foods & Sweet Baked Snacks segments and strengthening supply chain/manufacturing structure. The company also strengthened its supply chain and manufacturing framework to enhance efficiency and category growth potential.

Blue Buffalo Co., Ltd., a subsidiary of General Mills, specializes in natural, grain-free, and high-protein pet food. Its “True Blue Promise” emphasizes real meat, fruits, and vegetables. Strong brand loyalty, transparent ingredient sourcing, and continuous innovation in functional and holistic nutrition drive its rapid growth in the premium pet food market.

-

In June 2025, General Mills announced Blue Buffalo’s entry into the U.S. fresh pet food segment with its “Love Made Fresh” line. The launch expands its premium offerings and aligns with consumer demand for natural, minimally processed pet nutrition.

Pet Food Market Key Players:

Some of the Pet Food Market Companies are:

-

Mars Petcare Inc.

-

Nestlé Purina PetCare

-

The J.M. Smucker Co.

-

Blue Buffalo Co., Ltd.

-

Colgate-Palmolive Company

-

WellPet LLC

-

Farmina Pet Foods S.p.A.

-

Tiernahrung Deuerer GmbH

-

Heristo AG

-

Schell & Kampeter Inc.

-

Diamond Pet Foods

-

Spectrum Brands Holdings Inc.

-

General Mills Inc.

-

Unicharm Corporation

-

ADM Animal Nutrition

-

InVivo NSA (Neovia)

-

Lupus Alimentos

-

Affinity Petcare SA

-

United Petfood Producers

-

De Haan Petfood

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 127.68 Billion |

| Market Size by 2033 | USD 203.95 Billion |

| CAGR | CAGR of 6.05% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Animal Type (Dogs, Cats, and Others) • By Form (Dry Pet Food, Wet Pet Food, and Snacks & Treats) • By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Online Channel, and Others) • By Source (Animal and Plant) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Mars Petcare Inc., Nestlé Purina PetCare, The J.M. Smucker Co., Blue Buffalo Co., Ltd., Colgate-Palmolive Company, WellPet LLC, Farmina Pet Foods S.p.A., Tiernahrung Deuerer GmbH, Heristo AG, Schell & Kampeter Inc., Diamond Pet Foods, Spectrum Brands Holdings Inc., General Mills Inc., Unicharm Corporation, ADM Animal Nutrition, InVivo NSA (Neovia), Lupus Alimentos, Affinity Petcare SA, United Petfood Producers, De Haan Petfood. |