Health Supplements Market Report Scope & Overview:

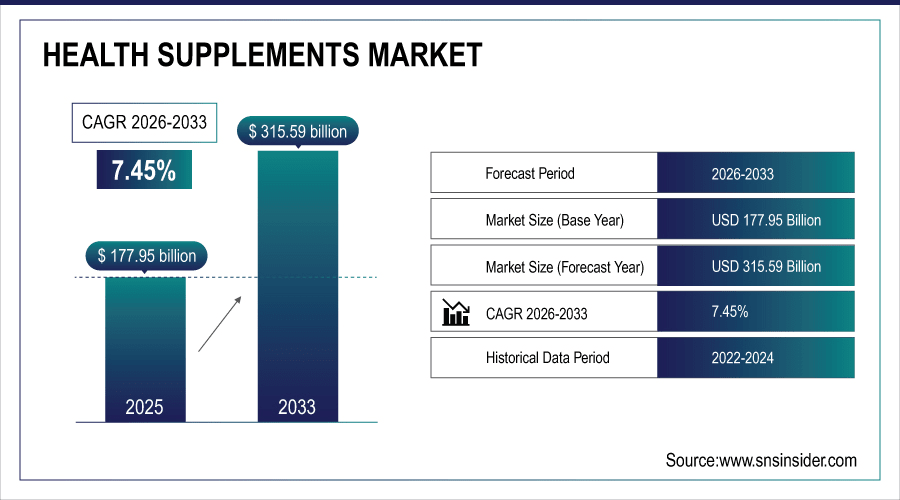

The Health Supplements Market Size was valued at USD 177.95 Billion in 2025 and is projected to reach USD 365.06 Billion by 2035, growing at a CAGR of 7.45% during the forecast period 2026–2035.

Health Supplements Market have highlighted the analysis on consumption by product types including vitamins, minerals, herbal supplements, proteins and omega fatty acids across various forms such as tablets, capsules, powders, gummies, and liquids along with key developments in the industry. On the basis of distribution channel, the market is classified into pharmacies, online retail, health stores, and supermarket. Countries across some of the major regions witness growing health-awareness, preventive healthcare trends and lifestyle-induced disorders which drive the adoption of dietary supplements globally increasing the market growth.

Vitamins, minerals, and protein supplements made up nearly 60% of the Health Supplements Market in 2025, driven by rising health awareness and growing demand across urban and semi-urban regions.

To Get More Information On Health Supplements Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 177.95 Billion

-

Market Size by 2035: USD 365.06 Billion

-

CAGR: 7.45% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

Health Supplements Market Trends:

-

Consumers are shifting from traditional diets to proactive health management, driving demand for vitamins, minerals, and herbal supplements.

-

Increasing awareness about fitness along with busy lifestyles is driving the demand for on-the-go formats such as gummies, powders and liquid shots.

-

The rise of e-commerce and the establishment of online pharmacies are opening alternative channels, allowing supplements to be within a click's reach for those who prioritize health.

-

Millennials and Gen Z are shifting towards natural, organic, and plant-based formulations.

-

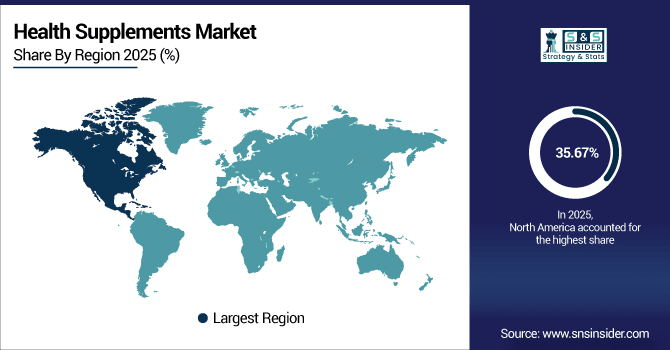

North America and Asia-Pacific are leading growth due to increasing preventive healthcare adoption and rising disposable incomes.

U.S. Health Supplements Market Insights:

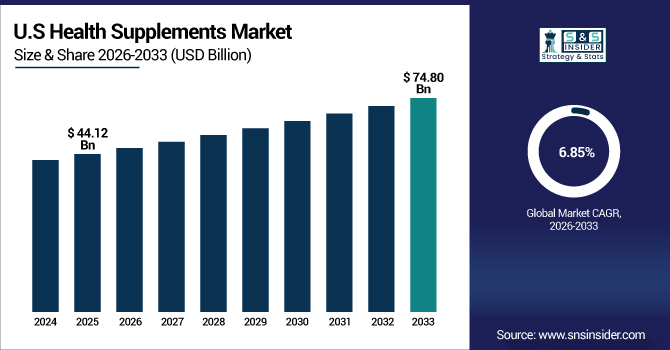

The U.S. Health Supplements Market is projected to grow from USD 44.12 Billion in 2025 to USD 85.58 Billion by 2035, at a CAGR of 6.85%. The growing awareness for preventive healthcare, increasing fitness trends, expanding online retail marketplace, the rising consumption of vitamins and minerals as well as protein supplements are the factors leading to the growth of the market.

Health Supplements Market Growth Drivers:

-

Growing demand for vitamins, minerals, and herbal supplements is driving rapid expansion of the global health supplements market.

The Health Supplements Market is expanding globally, with vitamins, minerals, and protein supplements accounting for nearly 60% of the market in 2025. Rising consumer focus on wellness, preventive healthcare, and balanced nutrition is driving demand. Urbanization, busier lifestyles, and health awareness are encouraging regular supplement intake. Growth is supported by expanding e-commerce and retail networks, innovative product formats, convenient on-the-go options, and changing habits prioritizing immunity and overall well-being.

Growing preference for on-the-go and immunity-boosting supplements accounted for nearly 55% of global health supplements consumption in 2025.

Health Supplements Market Restraints:

-

Stringent regulations, safety concerns, quality issues, and misinformation hinder global supplements market growth.

The Health Supplements Market faces challenges from stringent regulations, safety concerns, and quality issues. Almost 35% of new product launches in 2025 that are natural, vegan, or fortified, marketed, or branded for a variety of health needs and lifestyles. The growing availability of e-commerce and at retail makes these products even more accessible, while continued innovation in functional ingredients and delivery formats as well as personalized nutrition will continue to spur growth for the global health supplements market through 2035; However, due to their inherent dietary nature to ensure baseline amounts of nutrient(s) that they represent/target functional food & beverage products have a larger overlapping between hFS products and food items.

Health Supplements Market Opportunities:

-

Growing consumer preference for immunity-boosting, organic, and plant-based supplements creates significant global market expansion opportunities.

Increasing consumer preference for immunity-boosting, organic, and plant-based supplements supports global market growth. In 2025, nearly 35% of new product launches focused on natural, vegan, or fortified formulations catering to diverse health needs and lifestyles. Broader e-commerce and retail accessibility enhances the reachability, and the functional ingredients, convenient formats, and personalized nutrition innovations are anticipated to propel growth through to 2035 for the global health supplements market.

Introduction of immunity-boosting, organic, and plant-based supplements accounted for nearly 35% of global product launches in 2025.

Health Supplements Market Segmentation Analysis:

-

By Product Type, Vitamins held the largest market share of 28.45% in 2025, while Herbal Supplements are expected to grow at the fastest CAGR of 8.21%.

-

By Form, Tablets dominated with a 34.67% share in 2025, while Gummies are projected to expand at the fastest CAGR of 9.02%.

-

By Distribution Channel, Pharmacies & Drug Stores held the largest share of 40.23% in 2025, while Online Retail is expected to grow at the fastest CAGR of 10.15%.

-

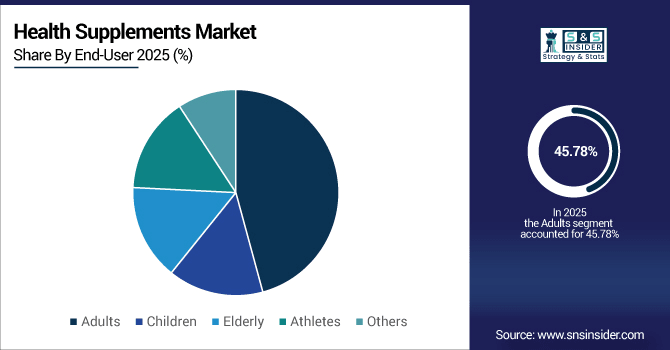

By End User, Adults accounted for the highest market share of 45.78% in 2025, while Athletes are projected to record the fastest CAGR of 9.45%.

By End User, Adults Lead While Athletes Expand Rapidly:

Adults consumed more than 8.5 billion servings of supplements in 2025, reflecting daily wellness and preventive care routines. Athletes represented around 2.7 billion servings with the highest growth driven by increasing fitness awareness and growing sports nutrition adoption. North America, Europe and Asia Pacific region witnesses a fast expansion driven by increased intake of performance based nutrition as well as high involvement in recreational and professional sports.

By Product Type, Vitamins Lead While Herbal Supplements Expand Rapidly:

In 2025, more than 5.2 billion servings of vitamins were consumed globally, making them the most widely used supplement for daily wellness. For reference, herbal supplements total approximately 2.8 billion servings, indicating rising consumer demand for natural and plant-based based options. Healthy awareness, preventive care trend among the population along with increasing recovery support, and growing preference for immunity-boosting products in countries such as, the U.S., Germany, China, and others will further accelerate the overall growth in North Ameria, Europe, and Asia-Pacific regions.

By Form, Tablets Dominate While Gummies Grow Fastest:

Tablets accounted for over 6.1 billion units consumed globally in 2025 due to their convenience and stability. Gummies reached approximately 1.9 billion units, reflecting increasing popularity among children and adults seeking tasty, easy-to-consume formats. he growth will be powered by broader retail and e-commerce channels, changing lifestyles, and increasing health-conscious consumer behaviour trends, especially in the Asia-Pacific region, North America and Europe.

By Distribution Channel, Pharmacies Lead While Online Retail Expands Rapidly:

Pharmacies and drug stores distributed over 7.3 billion supplement units in 2025, being the most trusted and accessible source. Online retail sold nearly 3.1 billion units, the fastest-growing channel, driven by increased convenience, broad product selection, and growing e-commerce adoption. North America, Europe, Asia-Pacific especially sees rise in consumption supported by increasing digital literacy and interest on home delivery.

Health Supplements Market Regional Analysis:

North America Health Supplements Market Insights:

The North American health supplements market is on a strong growth path, holding a 35.67% share in 2025. Growing awareness about preventive healthcare, fitness trends, and demand for vitamins, minerals, and protein boosters increased annual consumption > 6.8 billion servings. Growing retail and online sales channels increase access, and rising interest in immunity-enhancing, organic, and convenient supplement formats among adults and athletes will continue to drive regional market expansion over 2035.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Health Supplements Market Insights:

By 2025, the U.S. consumed over 3.6 billion servings of vitamins, minerals, and protein supplements from more than 150 active brands. This came from nearly 1.1 billion orders placed through online retail, and 2.0 billion servings allocated via pharmacies. Preventative healthcare trends, fitness adoption, and digital/retail accessibility drive growth.

Asia-Pacific Health Supplements Market Insights:

The Asia-Pacific health supplements market is growing at a CAGR of 8.44%, reaching over 4.8 billion servings in 2025, with China (2.1 billion) and India (1.2 billion) leading consumption. Tablets and powders were the most consumed forms, and online retail and pharmacies provided around 1.6 billion servings across all types. Due to the high growth of the regional market in the major countries attributable to factors such as rapid urbanization, growing health awareness, rising health and fitness trends, and increasing demand for supplements that can enhance immunity and supplements that can contain plant-based ingredients.

China Health Supplements Market Insights:

In 2025, China consumed over 2.1 billion servings of health supplements (1.2 billion vitamins, 0.9 billion minerals and herbal products). The remaining was delivered through pharmacies for online orders or from stores (approximately 0.8 billion online orders). Factors such as increasing awareness about health, urbanization, fitness trends, and a rise in demand for immunity-oriented, and easy-to-consume supplement products is driving the growth.

Europe Health Supplements Market Insights:

In 2025, Europe’s health supplements market accounted for over 3.2 billion servings, with Germany leading at 0.9 billion, followed by the UK (0.75 billion) and France (0.6 billion). Approximately 1.8 billion servings were distributed from pharmacies and health stores, versus 0.7 billion processed from online retail. An upsurge in the prevention healthcare awareness among citizens, fitness trends, the geriatric population, and the demand for vitamins, minerals, and plant-based supplements will have a positive impact on the growth in the target region.

Germany Health Supplements Market Insights:

In 2025, Germany consumed over 0.9 billion servings of health supplements, with vitamins accounting for 0.5 billion and minerals plus herbal products for the rest. Online retail fulfilled 0.4 billion orders in total, which leaves the others to pharmacies and health stores. Market growth can be credited to rising awareness about preventive healthcare, fitness trends, and the increasing use of convenient, immune-boosting dietary supplements.

Latin America Health Supplements Market Insights:

In 2025, Latin America consumed over 0.48 billion servings of health supplements, led by Brazil (0.20 billion), Mexico (0.15 billion), and Argentina (0.08 billion). This included about 0.30 billion servings that were sold through pharmacies and health stores, and 0.18 billion that were distributed via online retail. The rising growth in health awareness and adoption of preventive care is impacting the growth of the regional market.

Middle East and Africa Health Supplements Market Insights:

The Middle East & Africa distribution segmentation in billion servings consumed of health supplements in 2025 is 0.35 billion, with 0.22 billion through pharmacies and health stores and 0.13 billion through online retail, respectively. The growth can be attributed to the increasing health awareness and prevention healthcare, urbanization, and growing demand for the immunity-boosting features in product convenient intake, and many more.

Health Supplements Market Competitive Landscape:

Nestlé Health Science, a subsidiary of Nestlé, is a global leader in nutrition and health science. By 2025, its products were reached in more than 1.2 billion consumers worldwide within more than 2,500 product SKUs across medical nutrition, digestive health, and immunity categories. Through strategic acquisitions, innovation, and delivery systems that span 75 nations, its presence has only worsened, allowing it to cater to a range of consumer health demands globally.

-

In May 2025, Nestlé Health Science launched Osteo Bi-Flex® with plant-based omega-3s to support joint and whole-body health. They also introduced a GLP-1 nutrition support platform targeting adults on GLP-1 weight loss journeys, expanding their functional nutrition portfolio.

Abbott Laboratories is one of the titan players in nutrition, diagnostics and medical devices. By 2025, it had reached children, adults and the elderly in over 60 countries, with its adult nutrition brands including Ensure and Glucerna consumed in more than 900 million servings of its products. By centering wellness and innovation and making these nutritional solutions widely accessible, Abbott reestablished its dietary supplement leadership position while also building products across the spectrum for preventive care and specialty nutrition.

-

In July 2025, Abbott introduced the Healthy Food Rx program, promoting “Food is Medicine” for diabetes management. They also launched personalized nutrition packs designed to improve dietary habits and overall wellness among adults and elderly consumers.

Amway is the biggest direct selling company in the world and its health supplement Nutrilite range is extensive. By 2025, there are 850 million consumers globally considering 100+ countries and over 3,000 SKUs of Nutrilite products. Focusing on plant-first nutrition, tailored health options and supply chain sustainability, Amway continues to stay on top by harnessing its large distributor network and strong consumer confidence to fuel the worldwide consumption of vitamins, minerals and herbs.

-

In January 2025, Amway launched the Nutrilite Begin 30 Holistic Wellness Program, focusing on gut health and overall well-being. They also expanded their Nutrilite plant-based protein range, offering convenient supplements for immunity and fitness-conscious consumers.

Health Supplements Market Key Players:

-

Nestlé Health Science

-

Abbott Laboratories

-

Amway

-

Herbalife Nutrition Ltd.

-

Glanbia PLC

-

BASF SE

-

DSM Nutritional Products

-

ADM (Archer Daniels Midland Company)

-

Lonza Group

-

Pfizer Consumer Healthcare

-

Nature’s Bounty Co.

-

NOW Foods

-

Jamieson Wellness Inc.

-

Swisse Wellness

-

Blackmores Limited

-

Nature Made (Pharmavite)

-

Ritual

-

Garden of Life

-

Thorne Research

-

Life Extension

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 177.95 Billion |

| Market Size by 2035 | USD 365.06 Billion |

| CAGR | CAGR of 7.45% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Vitamins, Minerals, Herbal Supplements, Protein & Amino Acids, Omega Fatty Acids, Others) • By Form (Tablets, Capsules, Powders, Gummies, Liquid, Others) • By Distribution Channel (Pharmacies & Drug Stores, Online Retail, Health & Wellness Stores, Supermarkets/Hypermarkets, Others) • By End User (Adults, Children, Elderly, Athletes, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Nestlé Health Science, Abbott Laboratories, Amway, Herbalife Nutrition Ltd., Glanbia PLC, BASF SE, DSM Nutritional Products, ADM (Archer Daniels Midland Company), Lonza Group, Pfizer Consumer Healthcare, Nature’s Bounty Co., NOW Foods, Jamieson Wellness Inc., Swisse Wellness, Blackmores Limited, Nature Made (Pharmavite), Ritual, Garden of Life, Thorne Research, Life Extension |