Podiatry Chairs Market Report Scope & Overview:

Get more information on Podiatry Chairs Market - Request Free Sample Report

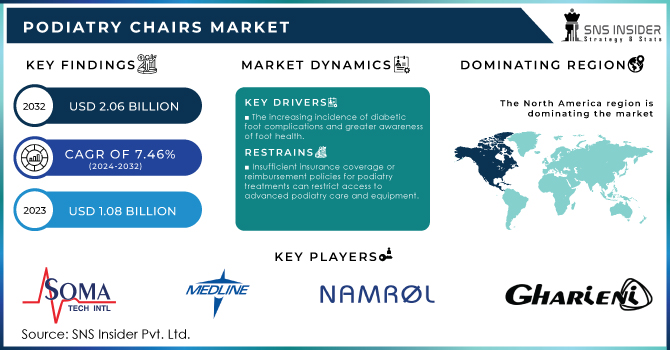

The Podiatry Chairs Market was worth USD 1.08 billion in 2023 and is predicted to be worth USD 2.06 billion by 2032, growing at a CAGR of 7.46 % between 2024 and 2032.

The podiatry chair market is growing due to the rising incidence of foot disorders, technological advancements in healthcare provision, and innovation-driven solutions for diabetic foot care among global consumers demanding the highest quality health products along with high awareness regarding foot hygiene. Foot Pain (AGS Health, 2023) claims up to 87% of people experience foot pain at some point which turns into mobility and can lead to weight gain or heart health problems. An estimated 1 in 3 adults aged over 65 experience foot pain, stiffness, or aching feet. Among this growth, especially pronounced is the demand for diabetic foot care where an estimated 18.6 million people worldwide are suffering from a DFU (diabetic foot ulcers) each year, 1.6M in the US alone, and nearly 50% of these ulcers becoming infected. According to the American Medical Association (2023), around 20% of infected ulcers lead to amputations, escalating the need for specialized care.

Technological improvements are also fuelling the market expansion. According to Medical Device Network in 2024, integrated digital controls and diagnostic tools have been included on approximately 45% of contemporary podiatry chairs. Another 25% of new chair models are made with eco-friendly materials and processes Healthcare Purchasing News,2024. Adherence to recommended foot care practices remains crucial, yet about 44.3% of diabetic individuals fail to follow them, as reported by NCBI (2023). This highlights the necessity of comprehensive foot care delivery. During National Foot Health Awareness Month, the increasing emphasis on foot health has contributed to podiatry chair sales. The ISO Reports, 2023 confirms that more than 70% of recently produced podiatry chairs conform to new edition international safety standards as well Healthcare Innovations, and 40% of them offer customizable features, catering to specific clinical needs.

Drivers

-

Increasing cases of foot disorders such as diabetic foot ulcers, arthritis, and general foot pain

-

Innovations in podiatry chair technology, including integrated digital controls and customizable features, enhance patient care

-

The increasing incidence of diabetic foot complications and greater awareness of foot health

The growing prevalence of foot diseases such as diabetic foot ulcers (DFUs) which are secondary complications of diabetes mellitus have been observed to foster the demand for podiatry chairs. According to the American Diabetes Association in January 2024, out of 144,564 individuals with diabetes who received treatment, 2,252 cases were complicated by infections resulting from DFUs. This high rate of infection highlights the importance of foot care from a podiatrist.

Diabetic foot ulcers can result in serious complications such as amputations. Roughly 18.6 million people suffer from DFUs globally each year, with nearly 1.6 million occurring in the US alone. Findings published in the American Medical Association (2023) also reveal that 20% of those with DFUs have to undergo either full or partial foot amputations the solution pending being that much more immediate. This increased requirement has given rise to the innovation of high-tech podiatry chairs that are specially designed for treating complicated foot issues. They come with technologies that improve the accuracy and comfort of procedures, leading to better clinical outcomes. Among recent innovations are seamless integration with digital controls and personalized faces for patients having a more severe foot need. A larger push to advance foot health management with improved equipment and specialized service is reflected by this trend.

Restraints

-

The high cost of advanced podiatry chairs and technologies may limit their adoption in smaller clinics and healthcare facilities operating on tight budgets.

-

Insufficient insurance coverage or reimbursement policies for podiatry treatments can restrict access to advanced podiatry care and equipment.

-

A shortage of specialized healthcare professionals, such as podiatrists and orthopaedic surgeons, can hinder the effective utilization of advanced podiatry chairs and services.

The high cost of advanced equipment hinders the podiatry chairs market in addition, the cost of podiatry treatment has been a major challenge that remains in isolation and poses several issues with regard to reimbursement due to stringent regulatory scenarios. The cost is directly related to these advances and as podiatry chairs become more advanced technologically, they come at a higher price. For example, a set of top-of-the-line modern electric podiatry chairs with built-in digital controls and additional customer features might run over $10.000 each. This range of cost can limit such a system for small clinics, and hospitals with less budget. Indeed, a study by Healthcare Innovations (2024) found that 30% of buy-in for the superior chairs isn’t possible due to financial reasons. These increased prices of medical chairs inhibit the capacity to access state-of-the-art technologies, which can lower adoption rates for advanced podiatry chairs in these cases. This financial obstacle can then affect the growth of specialized podiatry care in general.

Segment Analysis

By Product

The electric segment held the largest podiatry chair market share, accounted greater than 59% share in 2023. The dominance has been due to technological strategic moves made by key manufacturing companies and an increase in foot disorders. Functions like easy height adjustment, and backrest/leg lift support can be quickly executed all at the press of a button which is built into these electric chairs. Resulting in improved patient comfort & ergonomics, these features are a favorite among clinics that prioritize ease of use and the overall experience for both practitioners as well as patients. Tronwind, for its part offers motorized multi-function height adjusts and treatment demands are highly versatile electric podiatry chair labelled under TEP04 and presented as a new product in 2021 April which insists on providing the utmost feeling of comfort assisted with its durable upholstery.

The manual segment is expected to witness substantial growth over the forecast period. Small- and medium-sized clinics with relatively little budget will more likely prefer manual podiatry chairs as they are generally cheaper than the electric model. They are trying to find less expensive solutions than routine treatments i.e. toenail trimming and callus removal. Manual chairs offer a more practical choice when electric chairs advanced features are not as crucial and only require basic podiatric services in reverse on reliable equipment. Because of their simplicity and cost reductions, they are better suited to clinics or hospitals that specialize in basic foot care treatments.

By End Use

Hospitals accounted for a substantial share of more than 39%, in the podiatry chair market, and are anticipated to expand at a higher CAGR over the projection period; since many patients prefer hospitals as their primary choice point due to continuous monitoring by medical staff involved in surgeries on hospital premises with patient-friendly equipment requirements like other structural provisions compared to any small specialty centers across a geographic area. Increasing need for podiatry chairs in hospitals because the patient volume as well as case difficulty is on the rise. With orthopedic surgeons in short supply, as well as long waiting lists at the hospital level for surgery both of which figures to get worse in time if unchecked. Accordingly, hospitals are focusing on advanced podiatry chairs to improve the productivity of their surgical services with less time for patient flow and waiting lists.

The development of the clinics segment is expected to increase over 2024-2032. The increase in focus on foot health has resulted in an increased demand for specialized care, a key fact that will drive the market, leading to the availability of private podiatry clinics. NCBI Dec 2023 clinics are increasingly offering non-invasive and preventative foot care services, which are gaining popularity among patients seeking early intervention and routine check-ups. This has created a need for better podiatry chairs in clinics that are functional as well aesthetically so. These modern chairs help provide quality without sacrificing comfort levels which ultimately is when attracting clients.

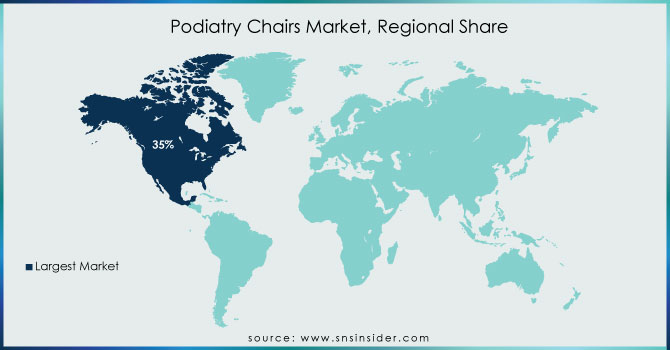

Regional Analysis

The North America held more than 35% market share in 2023. The prominent share is attributable to a surge in foot disorders, an increase in the prevalence of diabetic foot ulcers, new product launches, a growing number of regulatory approvals, and improved healthcare infrastructure. For example, the American Diabetes Association reported 144,564 patients with diabetes were treated, and 2,252 cases were complicated by infections associated with DFU. The huge number of cases of DFU complicated by infection indicators and the urgent demand for specialized podiatric services, resulted in a rise in the application of advanced podiatry chair technologies in multiple health facilities. The U.S. dominated the North American market in 2023 due to a high prevalence of foot conditions and a high number of sports-related foot injuries. Medscape revealed that 15% of all sports-related injuries occurred in the foot. It is an important indicator that the sports medicine sector requires effective foot care solutions.

Asia Pacific is expected to grow at the highest CAGR over the forecast period likely due to more prevalence of food disorders patients and a rise in R&D expenditure. For example, Singaporean researchers developed the WellFeet mobile application in March 2024 to help people with diabetes understand ulcers and provide expert self-care. The app includes animations for various languages and tools for monitoring medicine administration and physical activities. The application’s deployment has indicated the importance of applying technology to increase foot self-awareness and care in the Asia Pacific region.

Key Players

The Major players in the market are Soma Tech Intl., ARIA Chairs, Medline, Namrol Medical S.L., Hill Laboratories, Angelus Medical and Optical, Lemi MD, Gharieni Group, TitanMed, Midmark Corporation. and others in the final report.

Recent Developments

In January 2024, Atrium Health Wake Forest Baptist opened a new clinic in Kernersville, focusing on orthopaedics, sports medicine, and podiatry. This facility is designed to offer comprehensive care for musculoskeletal and foot health issues, improving access to specialized treatment in the area.

Aria Care Partners, a premier integrator of healthcare services tailored to skilled nursing facilities (SNFs), and PrevMed/Xtend Healthcare Holdings acquired Mission Dental and Perspective Vision Care (PVC) in October 2022. The acquisitions will allow Aria Care Partners to offer dental, audiology, optometry, and podiatry care services that improve residents' well-being in a broader range of facilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.08 Billion |

| Market Size by 2032 | USD 2.06 Billion |

| CAGR | CAGR of 7.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Electric, Manual) • By End Use (Hospitals, Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Soma Tech Intl., ARIA Chairs, Medline, Namrol Medical S.L., Hill Laboratories, Angelus Medical and Optical, Lemi MD, Gharieni Group, TitanMed, Midmark Corporation |

| Key Drivers | • Increasing cases of foot disorders such as diabetic foot ulcers, arthritis, and general foot pain • Innovations in podiatry chair technology, including integrated digital controls and customizable features, enhance patient care |

| RESTRAINTS | • The high cost of advanced podiatry chairs and technologies may limit their adoption in smaller clinics and healthcare facilities operating on tight budgets. |