Polymethyl Methacrylate (PMMA) Market Report Scope & Overview:

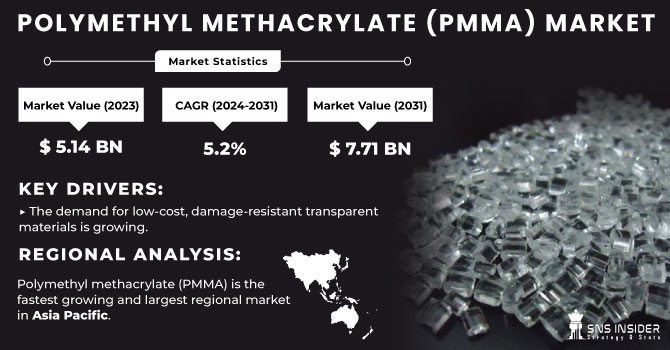

The Polymethyl Methacrylate (PMMA) Market size was valued at USD 5.68 billion in 2023 and is expected to reach USD 8.46 billion by 2032 and grow at a CAGR of 4.53% over the forecast period 2024-2032.

Get more information on Polymethyl Methacrylate (PMMA) Market - Request Sample Report

The Polymethyl Methacrylate (PMMA) Market Report provides in-depth statistical insights and trend analysis, covering global production capacity and utilization by country and type in 2023. It examines feedstock price fluctuations, particularly methyl methacrylate (MMA), and their impact on production costs. The report highlights regulatory and environmental compliance, focusing on sustainability initiatives and emission control measures. Additionally, it explores demand trends across key applications, including automotive, construction, and electronics. Technological advancements and R&D investments in bio-based and high-performance PMMA are analyzed, along with recycling and circular economy initiatives shaping the future of the market.

Polymethyl Methacrylate (PMMA) Market Dynamics

Drivers

-

Rising demand in automotive & transportation drives the market share.

The growth in automotive & transportation has a notable influence on the growth of the polymethyl methacrylate (PMMA) market, where manufacturers started to use PMMA for lightweight and durable vehicle components. Due to its high optical clarity, scratch resistance, and impact strength, PMMA has found its use quite popular in automotive glazing, headlamp covers, interior trims, and lighting systems, including LED. Consequently, the PMMA market has gained traction with a rising global focus on electrical vehicles (EVs) and fuel-efficient automobiles, given that reducing automotive weight directly contributes to energy efficiency and enhances performance. Moreover, PMMA has excellent weather and UV-resistant properties and is, therefore, a material of choice for exterior applications where it can not only improve vehicle appearance but also improve vehicle durability. Automakers are on the lookout for new solutions that would improve sustainability while looking chic and modern, further driving the share of PMMA in the automotive business.

Restraint

-

High raw material costs may hamper the market growth.

High raw material costs, particularly the price volatility of methyl methacrylate (MMA), a key feedstock for PMMA production, pose a significant restraint on market growth. Fluctuations in crude oil prices, supply chain disruptions, and geopolitical tensions directly impact the cost of MMA, leading to increased production expenses for manufacturers. Additionally, the energy-intensive nature of PMMA production further adds to the overall manufacturing costs. These rising costs are often passed on to end-users, making PMMA less competitive compared to alternative materials like polycarbonate (PC) and glass. As a result, industries such as automotive, construction, and electronics, which rely heavily on PMMA for lightweight and durable applications, may seek cost-effective substitutes, thereby limiting market expansion.

Opportunities

-

Advancements in 3D Printing & Additive Manufacturing create an opportunity for the market.

The increasing implementation of 3D printing and additive manufacturing is creating pathways for the growth of the Polymethyl Methacrylate (PMMA) market. The impressive optical clarity along with durability and light-weight properties of PMMA, allow quick realisation of prototypes as well as use in a medical implant and customized manufacturing from various industries. Growing penetration of advanced 3D printing technologies is mainly driven by increasing demand for precision components in the automotive, aerospace, and healthcare sectors which in turn escalates utilization of PMMA-based filaments and PMMA-based resins. Further, the manufacturing technology enables the integration of bio-based & recyclable PMMA formulations, which helps to meet sustainability targets and this also boosts the demand for PMMA in additive manufacturing applications.

Challenges

-

Limited recycling & circular economy initiatives are major challenges for the polymethyl methacrylate (PMMA) market.

The availability of recycling infrastructure and circular economy initiatives presents a major problem for the Polymethyl Methacrylate (PMMA) market. PMMA does not lend itself to recycling because mechanical processing is not practiced on an industrial scale and chemical depolymerization is complex and expensive. The low availability of effective recycling cannot, however, cope with the growing volumes of plastic waste, which poses a threat to the environment and has provided some stimulus for regulation. The adoption of PMMA recycling is compounded by the fact that consumer awareness is low, and collection systems are sparse. Increasing sustainability regulations, coupled with industrywide goals to decarbonize products, are now pushing manufacturers to invest in affordable and scalable recycling technologies.

Polymethyl Methacrylate (PMMA) Market Segmentation Analysis

By Form

The Extruded Sheets accounted for the highest revenue share of around 44% in 2023. This is owing to their low cost, high versatility, and better optical properties. With properties like lightweight, impact-resistant, and weather durable, these sheets have become one of the most widely used materials in various industries including automotive, construction, signage & displays, and electronics. Extruded sheets are preferred for large-scale operations because of their even thickness, reduced Process ability, and lower production costs as compared to cast sheets. This is further driving the increasing use of high-performance transparent materials due to their benefits in architectural glazing, LED lighting, and protective barriers. Furthermore, the development of more UV-resistant and anti-scratch coatings makes extruded PMMA sheets ever more durable and ensures their stronghold on the giant slice of the market.

By Grade

Extruded Sheets held the largest market share around 63% in 2023. It is owing to its versatility, cost-effectiveness, and wide-ranging applications across various industries. High transparency, weather-resistant, easy-to-fabricate grade PMMA ideal for automotive components, signage, lighting fixtures, and consumer goods. Along with all these advantages, the cost can also be a target when compared to high-performance grades. This fact directly contributes to its mass production rather than its low volume. The growing need for aesthetic and durable materials used in construction, retail displays, and medical equipment also helps to bolster the market standing of GP-grade PMMA.

By End-Use Industry

Signs & Displays segment held the largest market share around 32% in 2023. PMMA has been used for many years in advertising boards, retail displays, illuminated signs, and also billboards due to its high light transmission, good strength, and UV resistance making it suitable for indoor and outdoor applications. Particularly due to the growing demand for attention-grabbing, durable, and energy-efficient signage solutions in the retail sector, transportation hubs, and corporate branding, its adoption is additionally stimulated. Moreover, the growth of digital signage, LED displays, and point-of-sale advertising has increased the demand for premium quality PM MA sheets and films making it the most used type available in the market.

Polymethyl Methacrylate (PMMA) Market Regional Outlook

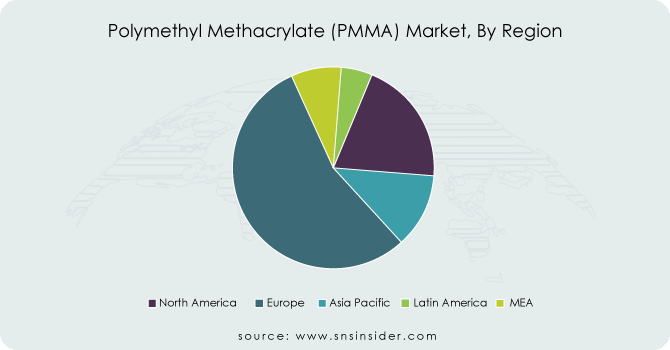

North America led the largest market share around 34% in 2023. PMMA demand has been driven by a well-established manufacturing sector, high adoption of advanced materials, and an increasing number of infrastructure projects in the region. PMMA is majorly used in the automotive industry in U.S. and Canada for weight-effective glazing, interior components, and LED lighting applications due to stringent fuel efficiency regulations. In addition, increased demand for high-quality signage and display solutions from the rapidly growing retail and advertising sector has consolidated the position of North America in the market. Factors such as a high number of global OEMs of PMMA, increasing R&D investments, and a resin-type high focus on sustainable alternatives also led the region to hold its dominant status in the global PMMA market.

Asia Pacific held a significant market share. This is due to the growing demand for lightweight and durable materials in assorted applications including electronics, signage & displays, and healthcare. Additionally, high growth in the adoption of High-Performance Plastics coupled with, a strong manufacturing-based economy and effective production across Eastern Asia have contributed further in promoting the market growth in the region. Moreover, the initiatives taken by the governments to promote the development of infrastructure and the growing consumer electronics industry are further aiding the consumption of PMMA. Surging adoption of energy-efficient LED lighting and premium advertising displays have further enhanced regional demand for PMMA and made Asia Pacific, a significant shareholder of the global PMMA market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

Mitsubishi Rayon Co. Ltd. (Acrypet, Shinkolite)

-

Polycasa N.V. (Polycasa Cast, Polycasa XT)

-

Gehr Plastics, Inc. (Gehr PMMA, Gehr XT)

-

Saudi Arabia Basic Industries Corporation (LUCITE, Plexiglas)

-

CHI MEI Corporation (Acrylic Resin, Wonderlite)

-

Arkema SA (Altuglas, Oroglas)

-

Kuraray Group (Acrylite, Parapet)

-

Evonik Industries AG (Plexiglas, Acrylite)

-

Sumitomo Chemical Co. Ltd. (Sumipex, Acryl-S)

-

Asahi Kasei Corporation (Asacryl, Acryrex)

-

Kolon Industries Inc. (Acrypoly, Kolon PMMA)

-

The Dow Chemical Company (Plexiglas, Lucite)

-

LG Chem Ltd. (LG PMMA, LUPOY)

-

Toray Industries, Inc. (Toraylite, Toray PMMA)

-

Trinseo S.A. (Plexiglas, Calibre)

-

Plaskolite LLC (OPTIX, DURAPLEX)

-

SABIC Innovative Plastics (Lexan, Cycolac)

-

Röhm GmbH (Plexiglas, DEGLAS)

-

Unigel Group (Unigel PMMA, Acrylite)

-

Perspex International Ltd. (Perspex, Spectrum)

Recent Development:

-

In June 2024, Trinseo S.A. opened a depolymerization plant in Italy to enhance PMMA recycling efforts. This initiative supports the circular economy by enabling efficient material recovery and reuse. The project aligns with the company's commitment to sustainable and eco-friendly solutions.

-

In March 2024, SABIC launched LNP ELCRES SLX1271SR, a scratch-resistant PMMA-based resin tailored for automotive applications. This innovation enhances durability and surface protection, catering to the industry's demand for high-performance materials.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.68 Billion |

| Market Size by 2032 | US$ 8.46 Billion |

| CAGR | CAGR of 4.53% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Extruded sheet, Cast acrylic sheet, Pellets, Beads, Others) • By Grade (General purpose grade, Optical grade) • By End-use Industry (Automotive, Building & Construction, Lighting Fixtures, Electrical & Electronics, Marine, Healthcare, Agriculture, Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Mitsubishi Rayon Co. Ltd., Polycasa N.V., Gehr Plastics, Inc., Saudi Arabia Basic Industries Corporation, CHI MEI Corporation, Arkema SA, Kuraray Group, Evonik Industries AG, Sumitomo Chemical Co. Ltd., Asahi Kasei Corporation, Kolon Industries Inc., The Dow Chemical Company, LG Chem Ltd., Toray Industries, Inc., Trinseo S.A., Plaskolite LLC, SABIC Innovative Plastics, Röhm GmbH, Unigel Group, Perspex International Ltd. |