3D Printing Market Report Scope & Overview:

Get more information on 3D Printing Market - Request Free Sample Report

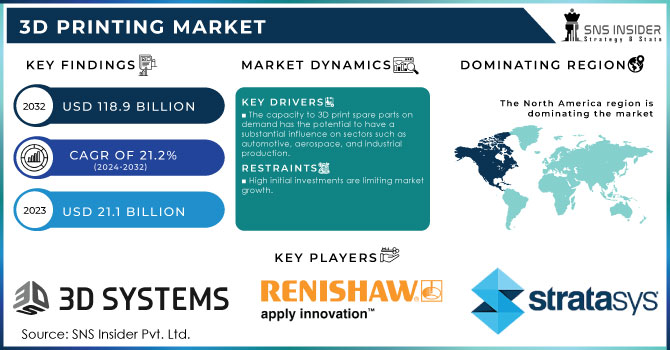

3D Printing Market Size was valued at USD 21.1 billion in 2023 and is expected to reach USD 118.9 billion by 2032, growing at a CAGR of 21.2 % over the forecast period 2024-2032.

The 3D printing market is growing rapidly because of continuous advancements in technology, and diverse application upgrades. As a result of research and development, manufacturers introduced printers that are more sophisticated than their predecessors and are able to create complicated objects with higher precision and speed. Additionally, the market is characterized by a high rate of mergers and acquisitions, as companies seek to consolidate, access complementary technologies, expand portfolios, and remain competitive in this dynamic and evolving landscape.

Additive manufacturing is known as 3D printing in industrial settings, involves the layer-by-layer addition of material to create objects based on three-dimensional files, using specialized software and 3D printers. Printing with addictive manufacturing helps to produce prototypes, design, modelling, and production. It assists manufacturers decrease time to market and lower output costs developing and producing products with superior quality at prices that are competitive. Manufacturers are anticipated to use 3D printing for shorter production times iincreasing demand for 3D printers, particularly in the small and medium manufacturing industries, is restricted by misconceptions regarding prototyping. However, misconceptions about prototyping, particularly among small and medium-sized enterprises (SMEs), are slowing adoption. Many SMEs view prototyping as an expensive pre-manufacturing phase rather than recognizing its value. This, along with limited technical knowledge and standard process controls, hampers market growth.

Market Dynamics

Drivers

-

The capacity to 3D print spare parts on demand has the potential to have a substantial influence on sectors such as automotive, aerospace, and industrial production.

-

Innovations in 3D printing technologies, such as improved materials and faster printing speeds, are driving market growth by expanding the range of applications and enhancing efficiency.

-

The ability to produce highly customized and personalized products is a significant driver, especially in industries like healthcare, automotive, and consumer goods, where tailored solutions are increasingly valued.

-

Governments throughout the world are investing in 3D printing initiatives.

Governments throughout the world are launching projects and sponsoring educational institutions, research centers, and research and technology organizations to further investigate and stimulate the development of 3D printing technology. The United States, the United Kingdom, and Canada have all launched government programs aimed at fostering university-level 3D printing research, accelerating technological innovation, and establishing start-ups. The advent of novel uses for 3D printing has piqued the interest of businesses and governments all around the world.

Restrains

-

High initial investments are limiting market growth.

-

While 3D printing excels in rapid prototyping, it may struggle with scalability and production speed compared to traditional mass manufacturing methods, affecting its adoption for high-volume production.

-

The ease of copying designs in 3D printing can lead to intellectual property issues and potential legal disputes, which may deter some companies from fully embracing the technology.

The most major impediment to the implementation of this technology is the high initial expenditure. This cost includes hardware, software, materials, certification, additive and manufacturing education, and people training. The cash and resources necessary to set up a 3-dimensional system are significantly more than those required for standard printing technologies. Manufacturers, on the other hand, are assisting end users in lowering the high initial costs with the advent of the industrial desktop 3D printer. Desktop printers are less costly and easier to operate than 3-dimensional systems.

Opportunities

-

Emerging 3D printing uses in automotive, printed electronics, jewelry, and education

-

Rapid prototyping is becoming increasingly popular and research and development opportunities are rising.

Segment analysis

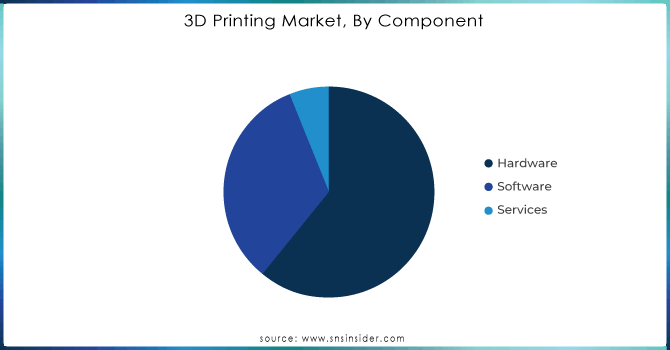

By Component

The hardware segment led the 3D printing market in 2023, accounting for over 61% of the global revenue. This growth was surging due to the expanding demand for rapid prototyping and advanced manufacturing practices. The key drivers of the hardware segment’s expansion are rapid industrialization, expanding uptake of consumer electronics, growing development of civil infrastructure, continued rapid urbanization, and optimized labour rates.

The software segment is expected to record significant CAGR over the forecast period. The use of 3D software is vital for many industries, as it enables oriented design of objects and parts for printing. As more and more manufacturing companies are drifting from their engraved practices, the use of 3D printing software surges, improving the efficiency of producing multiple manufacturing parts. The shift towards digital design and production processes is expected to further fuel the adoption of 3D printing software in the coming years.

Need any customization research on 3D Printing Market - Enquiry Now

By Technology

The 3D printing market in 2023 was led by the stereolithography segment, which accounted for over 10.2% of global revenue. Stereolithography is one of the oldest and most traditional technologies of 3D printing. However, conduction of research and the development of new technologies are creating favorable growth opportunities for the most efficient and reliable alternatives.

Although fused deposition modeling holds one of the significant shares of revenue as of 2023, it is also used in various 3D printing processes. Meanwhile, other technologies, such as DLP, EBM, inkjet printing, and DMLS, will capitalize on specialized additive manufacturing processes in the forecast period. The increased demand in industries like aerospace, defense, healthcare, and automotive will enable the utilization of some of the advanced technologies, thereby paving the way for innovation and the growth of the 3D printing market.

By Application

In 2023, the prototyping market segment led the 3D printing market, with more than 53% of the global revenue. The prototyping market segment’s leading position can be justified by its popularity among all other market sections that include the automotive, aerospace, and defense industries. It is beneficial to use prototyping in the precise design and creation of parts, components, and larger complex systems as a means of accurate design and development. With additional possibilities to increase accuracy and improve the reliability of the results, it is more than likely that the prototyping segment will maintain the leading positions in the market in the long-term and short-term perspectives. Though the final part’s creating also involves the functional section with the development of smaller details of a particular metal, including joints and connectors, which is vital in the machinery and systems development, so far, the necessity of the prototyping segment is greater.

The functional parts market segment is expected to grow with the significant compound annual growth rate from 2024 to 2032 due to the analyzed increasing interest in designing and manufacturing functional parts connected to the higher demand for the components with the increased level of precision.

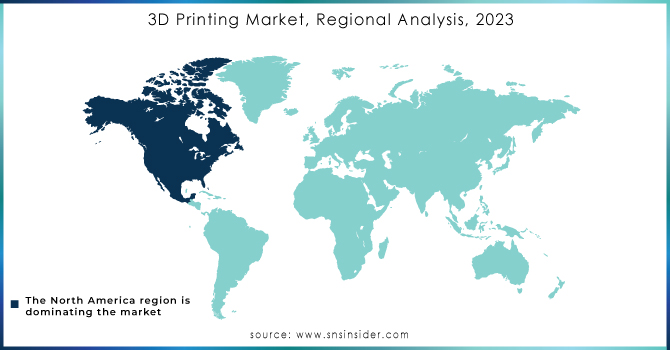

Regional Insights

The 3D printing market was dominated by North America in 2023, which held over 34% of total revenue share. This occurred largely due to the extensive implementation of additive manufacturing across the region. The U.S. and Canada were among the first countries to adopt these technologies into all branches of manufacturing. In the U.S., the growth of the 3D printing market is primarily associated with the popularity of technology as a permit to rapid prototyping and product development. This allows additive manufacturing to actively develop in aerospace, automotive, healthcare, and consumer goods, which leads to its broad application.

Asia Pacific region is growing with the highest CAGR during the forecast period of 2024 to 2032. The large spread of additive manufacturing in the region is due to its significant progress and advancement in the manufacturing sector. There is also an assumption that the Asia Pacific region strives to become a production point of automotive and healthcare industries in addition to consumer electronics. Centralized on the production of consumer electronics devices, as well as significant progress in rapid local urbanization, allows us to highlight the high potential of 3D printing demand in the region.

Key Players

-

Stratasys Ltd. (F370 CR, J750 Digital Anatomy)

-

3D Systems Corporation (ProX 800, Figure 4 Standalone)

-

Materialise NV (Mimics Innovation Suite, Magics)

-

GE Additive (Concept Laser M2 Series 5, Binder Jet Line)

-

HP Inc. (Jet Fusion 5200 Series, Metal Jet S100)

-

SLM Solutions Group AG (SLM® 280 2.0, NXG XII 600)

-

EOS GmbH (EOS M 300-4, EOS P 500)

-

Voxeljet AG (VX1000, VJET X)

-

Renishaw plc (RenAM 500Q, AM250)

-

Desktop Metal (Production System™ P-50, Fiber™)

-

Carbon, Inc. (M3 Max, Carbon DLS™)

-

Markforged, Inc. (Mark Two, Metal X)

-

ExOne (X1 160Pro, Innovent+®)

-

Ultimaker (Ultimaker S5, Ultimaker 3)

-

XYZprinting (da Vinci Pro 3-in-1, da Vinci Super)

-

Tiertime (Beijing TierTime Technology Co. Ltd.) (UP300, Cetus MK3)

-

Formlabs (Form 3B+, Fuse 1)

-

Zortrax (M300 Plus, Endureal)

-

Proto Labs, Inc. (3D Printed Prototypes, Injection Molding)

-

Raise3D Technologies, Inc. (Pro2 Plus, RMF500)

and others in final Report.

Recent development

-

In March 2023, Neotech AMT entered a partnership with APES with the goal of expanding the reach of 3D printed electronics in North America. It can be concluded that the partnership allows the companies to utilize the resources and technologies of one another. This way, it is possible to improve the development and manufacturing capacity in additive manufacturing.

-

In November, 2023, the launch of Autodesk AI, a new technology that was embedded into the product lineup of Autodesk Inc. It has been devised to provide the customers with the generative capabilities and intelligent assistance, thus helping them to automate the implementation of their tasks. In turn, such an approach can allow the employees of the companies to reduce task repetition and, as a result, diminish the number of errors.

-

Materialize partnered with Exactech, a producer of new instruments, implants, and other smart technologies for joint replacement surgery, in March 2023 to give enhanced treatment options for patients with severe shoulder abnormalities.

-

Stratasys and Ricoh USA, Inc. will partner in February 2023 to provide on-demand 3D-printed anatomic models for clinical settings. Under this agreement, Stratasys' patient-specific 3D solutions integrated with its 3D printing technology; Axial3D's cloud-based segmentation-as-a-service solution; and Ricoh's precision additive manufacturing services were combined to create a single, convenient solution.

-

Desktop Metal released Einstein Pro XL in February 2023, an economical, high-accuracy, high-throughput 3D printer perfect for dentistry labs, orthodontists, and other medical equipment producers.

| Report Attributes | Details |

| Market Size in 2023 | USD 21.1 Bn |

| Market Size by 2032 | USD 118.9 Bn |

| CAGR | CAGR of 21.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Technology (Stereolithography, Fuse Deposition Modeling, Selective Laser Sintering, Direct Metal Laser Sintering, Polyjet Printing, Inkjet printing, Electron Beam Melting, Laser Metal Deposition, Digital Light Processing, Laminated Object Manufacturing, Others) • By Process (Powder Bed Fusion, Vat Photopolymerization, Binder Jetting, Material Extrusion, Material Jetting, Others) • By Application (Prototyping, Tooling, Functional Part Manufacturing) • By Vertical (Automotive, Aerospace & Defense, Healthcare, Architecture & Construction, Consumer Products, Education, Industrial, Energy, Printed Electronics, Jewelry, Food & Culinary, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | 3D Systems, Ultimaker, HP, EOS GmbH, Voxeljet, Materialise, Stratasys, CleanGreen3D Limited, Protolabs, Tiertime Technology, SLM Solutions, Optomec, GE, Groupe Gorgé, Renishaw, Beijing, Autodesk Inc., Made In Space, Canon Inc. |

| Key Drivers | • The capacity to 3D print spare parts on demand has the potential to have a substantial influence on sectors such as automotive, aerospace, and industrial production. • Governments throughout the world are investing in 3D printing initiatives. |

| Market Restraints | • High initial investments are limiting market growth. |