Prepreg Market Report Scope & Overview:

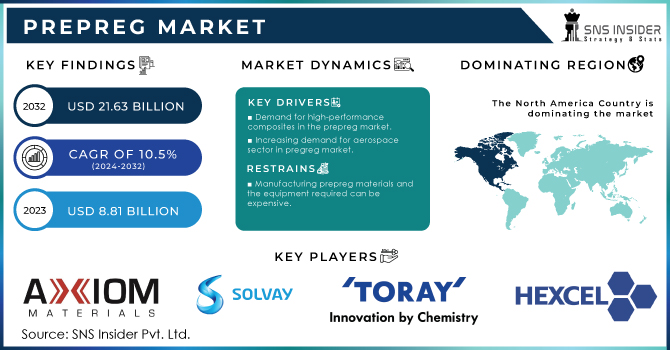

The Prepreg Market size was valued at USD 10.62 billion in 2023 and is expected to reach USD 27 billion by 2032 and grow at a CAGR of 10.93% over the forecast period 2024-2032.

Get E-PDF Sample Report on Prepreg Market - Request Sample Report

The prepreg report provides a comprehensive analysis of production capacity and utilization rates across key manufacturing countries, highlighting thermoset and thermoplastic prepreg trends. It examines raw material pricing fluctuations, supply chain dynamics, and regulatory impacts shaping the industry. The report also delves into environmental metrics, including carbon footprint and recycling practices, along with advancements in sustainable prepregs. Innovation and R&D trends, such as bio-based resins and out-of-autoclave processing, are explored. Additionally, the study covers market adoption across aerospace, automotive, wind energy, and other high-growth applications, offering a data-driven outlook on industry growth.

Prepreg Market Dynamics

Drivers

-

Rising demand from aerospace & defense drives the market share.

The increasing demand from aerospace and defense is fueling the demand for lightweight and high-strength components to reduce fuel consumption, and weight and improve structural integrity. Carbon fiber-based prepregs, due to their enhanced mechanical properties, provide corrosion resistance and durability making it ideally suited for aircraft fuselage, wings, and interior components. As global aircraft manufacturing capacity gathers speed and national budgets for key accounts expand, so too, do the needs for composite materials intelligence. Moreover, due to robust safety and performance regulations in aerospace, the adoption of prepregs is expected to further grow, being characterized by uniform quality and improved damage resistance. Growing space and electric aircraft markets also help push prepregs to a steady position as the material of choice for next-gen aerospace applications.

Restraint

-

Manufacturing prepreg materials and the equipment required can be expensive and may hamper the market growth.

High manufacturing cost of prepreg materials along with high cost of equipment necessary for production acts as a major barrier for the growth of the market. This is done by carefully impregnating the fibers with resin using high-tech machinery and rigorous quality checking, making the manufacturing process expensive. Also, these market segments require separate specialized autoclave or out-of-autoclave (OOA) curing systems, which increase the capital investment further and restrict market entry for small and mid-sized manufacturers. High costs of prepregs are stressed by high material costs, ever making it less preferable for low-cost industries or applications. Additionally, the complexities associated with storing and handling materials, especially including the requirement of refrigeration to preserve prepreg shelf life (indicating a limited functional life), increase logistical challenges and actual costs. All of these factors combine to restrict market growth, especially in regions with low technology or low financial power.

Opportunities

-

Growth in the urban air mobility (UAM) sector creates an opportunity for the market.

The Urban Air Mobility (UAM) sector has been anticipated as a wellspring of tremendous, diverse prospects for the growth of the global prepreg market, as the appetite for lightweight, high-strength materials grows typically in the development of electric vertical take-off and landing (eVTOL) airplanes, air taxis, and drones. Lightweight, high strength-to-weight ratio, fuel-efficient, and durable prepreg composites, mostly carbon-fiber-based, are suitable materials for the UAM vehicle structure. Urban congestion combined with sustainability concerns has already seen investments in advanced air mobility solutions, and the demand for adaptable materials continues to increase as investments by governments and private players pour into the domain. Further, to ensure the safety and efficiency of UAM applications, bodies such as the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency) are promoting certified composite materials. As leading aerospace firms as well as new entrants compete to invest in next-generation air transportation, such prepregs are well-positioned to experience an explosive increase in demand as an enabling material for the urban air mobility of tomorrow.

Challenges

-

Shortage of skilled workers in the prepreg manufacturing sector could pose a challenge.

One of the major issues faced is a dearth of skilled workers in the prepreg manufacturing industry as the production and processing of prepregs require specialized knowledge in handling composite materials, resin impregnation techniques, and precision curing process. Demand is growing for trained professionals in automated prepreg layup, quality control, and advanced composite fabrication, but the industry is experiencing a talent gap because of the complexity of the materials involved and the lack of hands-on training. At the same time, the movement of manufacturing towards automation and OOA drives the requirement for technicians in robotics, material science, and digital fabrication. However scarce training programs and a sluggish workforce adjustment to novel technologies are squeezing the supply of skilled workers. In regions such as emerging markets where composite manufacturing is on the rise but there is still an underdeveloped training infrastructure, this challenge is painfully evident. Tackling this challenge will entail investing in workforce development, tailored training programs, and a partnership between industry stakeholders and educational institutions to close the skills gap.

Prepreg Market Segmentation Analysis

By Fiber Type

The carbon fiber accounted for the highest revenue share of around 64% in 2023. It offers a high weight-to-strength ratio, with high rigidity and corrosion resistance as well as high fatigue performance which is the preferred type among the aerospace, automotive, wind energy, and sports equipment industries. Huge demand from aerospace & defense is generating significant attention, since in aircraft manufacturing, carbon fiber prepregs are largely used across the aircraft fuselage, wing, and other structural parts to improve fuel efficiency & durability. In addition, the growing adoption of carbon fiber prepregs in the automotive industry to manufacture lightweight vehicles for transitioning to electric vehicles (EVs) and better fuel economy is expected to drive the market.

By Resin Type

Thermoset prepreg held the largest market share around 72% in 2023. It is attributable to its mechanical properties, its wide application in aerospace, automotive, wind energy, and other industrial sectors, and its availability in a variety of forms, and processing capabilities. There are thermoset resins like epoxy, phenolic, and polyester that are high-strength, adhesive, and chemical and thermal resistant, which makes them perfect for structural applications for aircraft, automobiles, and industrial equipment. For high-end applications wherein maximum stiffness and durability are required as per safety and regulatory standards, the aerospace industry widely adopts epoxy-based thermoset prepregs for manufacturing fuselages and wings, as well as interior components.

By Manufacturing

Hot-melt segment held the largest market share around 72% in 2023. It has very high fiber impregnation efficiency and carriers’ better material properties. As hot-melt prepregs don't use any solvent, they do not contain volatile organic compounds (VOCs) like their solvent-based counterparts, which helps them become compliant with intense regulations on emissions while mitigating the environmental impacts of solvent use. In addition, it allows for better control of resin content and fiber wet-out, resulting in improved final composite mechanical properties and consistency. Hot-melt prepregs have been widely utilized in the aerospace, automotive, and wind energy industries, combining high strength and lightweight with cost-effectiveness in manufacturing. In addition, hot-melt prepregs have a longer shelf-life and do not need refrigeration, which helps reduce storage and transport costs.

By Application

The aerospace & defense held the largest market share around 32% in 2023. This industry has the highest requirement of lightweight, high-strength, and durable materials which can improve fuel efficiency, structural integrity, and overall performance. Prepregs offer excellent mechanical properties and corrosion and fatigue performance, especially with carbon fiber, which is prevalent in aircraft fuselages, interior parts, and defense applications. Demand for prepregs remains high due to continued demand from major drivers, such as the increased production of commercial aircraft from key manufacturers, including Boeing and Airbus, the rising global air traffic, and the requirement for next-generation fuel-efficient aircraft.

Prepreg Market Regional Outlook

North America led the largest market share around 42% in 2023. The key aircraft manufacturers, such as Boeing, Lockheed Martin, and Northrop Grumman are located in the region, which will lead to high demand for prepregs for application in aircraft fuselages, wings, and structural components. Moreover, increasing the defense budget by the U.S. government for military aircraft, drones, and missile systems also is a key factor credited for escalating the market growth. In the U.S., the automotive industry is embracing prepregs to produce lightweight vehicles that help to prepare for the transition to EVs and increase engine fuel economy. In addition, it held the largest wind energy industry share, with increased investment in offshore and onshore wind farms that utilize prepregs for large and durable wind turbine blades. Additionally, high R&D investment along with well-developed manufacturing infrastructure and key prepreg producers in the region enable the region to retain its dominant global position.

Asia Pacific is expected to grow fastest due to the growth of aerospace, automotive, and wind energy industries in countries such as China, India, and Japan, which make this the biggest market share for prepregs. Booming aircraft production, increasing defense expenditure, investment in indigenous aerospace manufacturing, and military modernization programs, all provide a flourishing market for advanced composite materials in the region. Apart from this, the manufacturing of electric vehicles (EVs), where the need for prepregs is imperative for lightweight and high-performance components, will also contribute to the demand for prepreg in the automotive industry in the Asia Pacific, especially in China and Japan. Wind power is also a driving force for growth, with prepregs used in longer blades for larger, more efficient wind turbines installed in China than anywhere else. In addition, the region is characterized by a cheap labor cost, presence of raw materials, and growing foreign investment in composite manufacturing plants, which place the region as a prepreg production and consumption center.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

Axiom Materials (AX-5201 Epoxy Prepreg, AX-5215 Cyanate Ester Prepreg)

-

Solvay Group (MTM49-3 Epoxy Prepreg, CYCOM 5250-4 BMI Prepreg)

-

Toray Industries, Inc. (Torayca T700S Prepreg, Torayca T1100G Prepreg)

-

Hexcel Corporation (HexPly M91 Prepreg, HexPly M81 Prepreg)

-

Teijin Limited (Tenax TPCL Thermoplastic Prepreg, Tenax Dry Reinforcements)

-

Mitsubishi Chemical Group Corporation (PYROFIL MR70 Prepreg, PYROFIL TR50S Prepreg)

-

SGL Group (SIGRAPREG C U150-0/NF-E340, SIGRAPREG C U1000/MTM46U)

-

Gurit Holding AG (SE70 Epoxy Prepreg, SC110 Epoxy Prepreg)

-

Park Aerospace Corp (Nexus 100 Epoxy Prepreg, CoreFix Prepreg Adhesive)

-

Plastic Reinforcement Fabrics Ltd. (PRF’s RP542-4 Epoxy Prepreg, PRF’s RP800 Phenolic Prepreg)

-

Royal TenCate (Toray Advanced Composites) (TC275-1 Epoxy Prepreg, TC380 Epoxy Prepreg)

-

Ventec International Group (VT-901 Prepreg, VT-47 Prepreg)

-

SHD Composite Materials (MTC510 Epoxy Prepreg, MTC400 Epoxy Prepreg)

-

GMS Composites (GMS EP-540 Prepreg, GMS EP-630 Prepreg)

-

Isola Group (IS680 Prepreg, Astra MT77 Prepreg)

-

Taiwan First Li-Bond Co., Ltd. (TFL-3000 Epoxy Prepreg, TFL-5000 Phenolic Prepreg)

-

Park Electrochemical Corp. (Nelco N4000-13 Prepreg, Nelco N7000-2HT Prepreg)

-

Celanese Corporation (Fortron PPS Prepreg, Celstran Thermoplastic Prepreg)

-

Cristex Composite Materials (Cristex Epoxy Prepreg, Cristex Carbon Prepreg)

-

Bally Ribbon Mills (BRM Carbon Prepreg, BRM Aramid Prepreg)

Recent Development

-

In October 2023, Solvay Group unveiled its next-generation high-performance polymer solutions. These innovative materials offers benefits beyond just weight reduction. They impress with exceptional mechanical strength for durability, superior chemical resistance to withstand cabin environments with pleasing travel experience.

-

In May 2023, Hexcel opened a new engineered core operations facility in Morocco to address the growing demand for lightweight and advanced composite materials in the aerospace sector.

-

In March 2024, Teijin Aramid, received a prestigious honor, They were awarded the Tire Technology International Materials Innovation of the Year Award, a recognition voted on by a panel of over 25 tire industry experts. This innovative approach utilizes physical processes to achieve aramid fiber recycling.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.62 Billion |

| Market Size by 2032 | USD 27 Billion |

| CAGR | CAGR of 10.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Fiber Reinforcement (Carbon Fiber Prepreg, Glass Fiber Prepreg, Others) • By Resin Type (Thermoset Prepreg, Thermoplastic Prepreg) • By Manufacturing Process (Hot-Melt Process, Solvent Dip Process) • By Application (Aerospace & Defense, Wind Energy, Automotive, Sporting Goods, Electronics (PCB), Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Axiom Materials, Solvay Group, Toray Industries, Inc., Hexcel Corporation, Teijin Limited, Mitsubishi Chemical Group Corporation, SGL Group, Gurit Holding AG, Park Aerospace Corp, Plastic Reinforcement Fabrics Ltd., Royal TenCate (Toray Advanced Composites), Ventec International Group, SHD Composite Materials, GMS Composites, Isola Group, Taiwan First Li-Bond Co., Ltd., Park Electrochemical Corp., Celanese Corporation, Cristex Composite Materials, Bally Ribbon Mills |