Quantum Sensing in Medical Imaging Market Size:

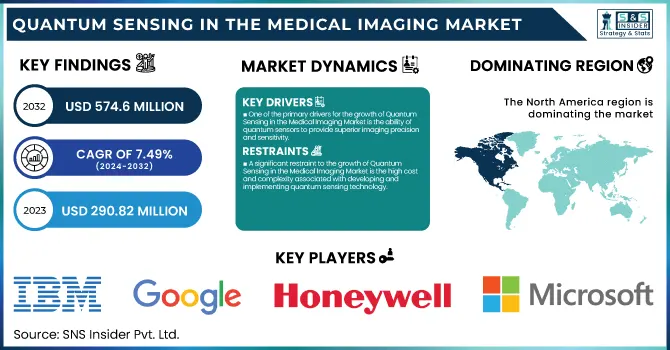

Quantum Sensing in Medical Imaging Market was valued at USD 312.60 million in 2024 and is expected to reach USD 574.6 million by 2032, growing at a CAGR of 7.49% from 2025-2032.

To Get more information on Quantum Sensing in the Medical Imaging Market - Request Free Sample Report

The Quantum Sensing in Medical Imaging Market is rapidly expanding, driven by advances in quantum technology and its growing adoption in diagnostics. Leveraging principles like superposition and entanglement, quantum sensors offer unparalleled sensitivity in MRI, PET, and CT scans, detecting subtle variations in magnetic fields and light to enhance image quality and diagnostic accuracy. In 2023, adoption grew significantly in North America, Europe, Japan, and South Korea, with clinical trials exploring quantum-enhanced MRI and PET devices. Collaborations between tech firms and healthcare organizations are advancing cost-effective, non-invasive imaging solutions, enabling earlier detection of cancer, neurological, and cardiac diseases.

Quantum Sensing in Medical Imaging Market Trends

-

Advances in quantum sensing are enabling higher-resolution and more accurate medical imaging.

-

Growing demand for early disease detection and precise diagnostics is driving market adoption.

-

Integration with MRI, PET, and CT technologies is enhancing imaging capabilities and patient outcomes.

-

Research on quantum-enhanced biomarkers and contrast agents is expanding clinical applications.

-

Increasing investments from healthcare institutions and tech companies are accelerating innovation.

-

Focus on non-invasive and real-time imaging solutions is boosting adoption in hospitals and research centers.

-

Collaborations between quantum technology firms, medical device manufacturers, and research institutes are fostering commercialization.

Quantum Sensing in Medical Imaging Market Growth Drivers:

-

One of the primary drivers for the growth of Quantum Sensing in the Medical Imaging Market is the ability of quantum sensors to provide superior imaging precision and sensitivity.

This reallocation of human resources has brought the emergence of quantum sensors, which offer unprecedented precision and sensitivity over classical imaging technology and are expected to revolutionize the field of medical imaging. This is largely made possible by the unusual nature of quantum mechanics, which allows quantum sensors to perceive changes in magnetic fields, light, and even gravity that range from subtle to small. In traditional imaging systems like MRI, PET, and CT, sensors are based on classic physical principles used to form images; therefore, they may have restrictions on resolution, sensitivity, and accuracy. Quantum sensing technologies leverage quantum phenomena such as superposition and entanglement to accurately measure processes at a microscopic scale that is very small for classical sensors to detect. For instance, quantum measurements can amplify sensitivity to weak processes in MRI, generating distinctively high-resolution pictures of soft matter. This accuracy is especially useful when diagnosing tumors, early-stage cancer, neurological diseases (like Alzheimer's disease), and even cardiovascular anomalies.

Quantum sensing technologies have the potential to detect diseases at much earlier and more treatable stages due to their susceptibility to very subtle variations. In turn, this improves patient outcomes and can not only reduce the cost of healthcare but eliminate the need for invasive procedures.

-

The increasing preference for non-invasive diagnostic solutions is another significant driver fueling the growth of quantum sensing technologies in medical imaging.

Patients and healthcare providers looking for imaging methods that are safer, less invasive, and more accurate are driving up healthcare awareness. Quantum sensors allow high-resolution non-invasive procedures to be carried out in imaging technologies, which will reduce the need for more invasive tests (biopsies or exploratory surgeries) to be carried out. For instance, quantum-enhanced MRI and CT scans can capture detailed images of patients without exposing them to radiation, increasing the demand for these advanced diagnostic tools. The increasing prevalence of non-invasive measures is leading to a rise in the adoption of quantum sensing for medical imaging across oncology, cardiology, and neurology.

Quantum Sensing in Medical Imaging Market Restraints:

-

A significant restraint to the growth of Quantum Sensing in the Medical Imaging Market is the high cost and complexity associated with developing and implementing quantum sensing technology.

Quantum sensors necessitate advanced, costly materials, intricate devices, and highly specialized methods to function optimally. These sensors frequently require intricate calibration and maintenance processes that can render them challenging and expensive to implement in standard clinical environments.

The expense of incorporating quantum sensors into current medical imaging equipment, including MRI, PET, and CT scanners, represents another obstacle. Healthcare organizations, especially in developing areas, often encounter budget limitations that hinder their ability to implement these advanced technologies. Furthermore, the setup and functioning of quantum sensors demand extensively skilled staff, which increases operational expenses and complicates access to these technologies for smaller healthcare institutions or developing nations.

Additionally, the research and development necessary to enhance and expand quantum sensing technologies for healthcare uses are still in the initial phase, contributing to the unpredictability surrounding long-term cost efficiency and ROI. Consequently, even though quantum sensing holds great promise for medical imaging, its broader implementation is hindered by substantial initial costs and the challenges of incorporating these technologies into the healthcare system.

Quantum Sensing in Medical Imaging Market Segment Analysis

By Type of Sensing Technology, Quantum sensors segment dominated in 2024, Magnetometers segment is expected to grow fastest

Quantum sensors segment dominated the quantum sensing in the medical imaging market due to their exceptional accuracy and sensitivity, making them perfect for sophisticated imaging technologies such as MRI and PET. These sensors can identify slight variations in magnetic fields, temperature, and other physical characteristics, which is essential for accurate diagnostics. Their wide adaptability across various imaging technologies enhances their status as the top sensing technology, particularly with the increasing need for high-resolution and non-invasive medical imaging options.

The Magnetometers segment is the fastest growing segment in the quantum sensing for medical imaging market throughout the forecast period because of their unmatched sensitivity in identifying tiny magnetic fields, essential for sophisticated imaging methods such as Magnetic Resonance Imaging (MRI). Their use in enhancing imaging resolution and accuracy has picked up speed, particularly in neuroscience and cardiac imaging. Moreover, progress in quantum technologies has improved magnetometer efficiency, increasing their availability and dependability. The growing need for accurate diagnostics and heightened funding in research also drive their expansion.

By End-User, Hospital segment held around 61% market share in 2024.

The hospital segment dominated the market with around 61% of the market share in 2024, due to the leading healthcare provider so a major adopter of quantum sensing in the medical imaging market. Hospitals possess the infrastructure, financing, and know-how to deploy such cutting-edge solutions as quantum-enhanced MRI, PET, and CT scanners. Hospitals are mammoth users of these innovations, given a rising demand for accurate diagnostic tools to cater to a larger patient volume. Partnership with top quantum technology companies and greater investments in improving imaging facilities reinforces the position of these as the most prominent segment.

Quantum Sensing in Medical Imaging Market Regional Analysis

North America Quantum Sensing in Medical Imaging Market Insights

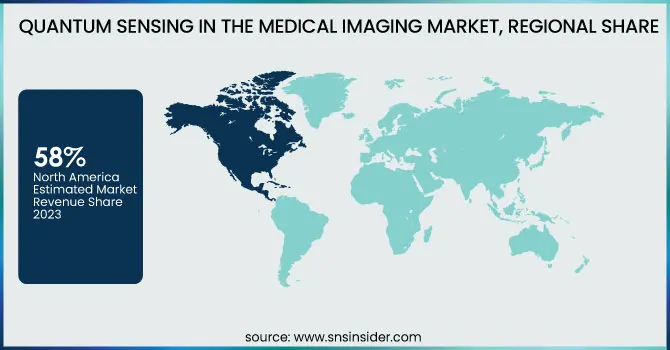

In 2024, North America dominated the quantum sensing in the medical imaging market with around 58% of the market share, owing to multiple reasons. Highly-developed healthcare infrastructure, large investments in medical technologies, and a wide presence of leading companies including IBM, Honeywell, GE Healthcare, etc. Moreover, huge government investment in research and development for quantum technology and the early adoption of advanced medical imaging solutions fuel the market growth. The need for advanced diagnostic capabilities, especially in MRI and PET, solidifies North America's dominance even more.

Asia Pacific Quantum Sensing in Medical Imaging Market Insights

The Asia Pacific region witnessed substantial growth in quantum sensing in the medical imaging market with a CAGR Of 9.74% throughout the forecast period, owing to the increase in healthcare expenditure, rapid technological advancements, and the growing adoption of diagnostic imaging solutions. Only a few countries such as China, Japan, and India are now investing in their healthcare systems in ways that will transform them by integrating state-of-the-art medical technologies. Governmental funding for quantum research, in addition to momentum in the private sector, also aids the swift uptake of quantum sensing technologies in medical imaging.

Europe Quantum Sensing in Medical Imaging Market Insights

Europe held a significant share in the quantum sensing in medical imaging market due to strong healthcare infrastructure, advanced research facilities, and government funding for quantum technology initiatives. Countries such as Germany, the UK, and France are investing heavily in R&D for quantum-enhanced imaging solutions, supporting adoption in hospitals and diagnostic centers. Rising focus on precision diagnostics further propels market growth in the region.

Middle East & Africa and Latin America Quantum Sensing in Medical Imaging Market Insights

The Middle East & Africa and Latin America are emerging markets for quantum sensing in medical imaging, driven by increasing healthcare investments, growing awareness of advanced diagnostic technologies, and rising demand for accurate imaging solutions. Limited infrastructure and higher costs currently restrain growth, but government initiatives, private sector funding, and expanding hospital networks are expected to gradually enhance adoption in these regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Quantum Sensing in Medical Imaging Market Competitive Landscape:

Siemens Healthineers

Siemens Healthineers has advanced quantum sensing in medical imaging by implementing Photon-Counting CT in its NAEOTOM Alpha scanners, leveraging QuantaMax detectors to capture individual photons for ultra-high-resolution imaging. This technology enhances spectral detail, reduces radiation exposure, and improves diagnostic accuracy. Additionally, Siemens Healthineers focuses on robotic and AI-integrated imaging solutions, streamlining workflows, accelerating image acquisition, and supporting precise, non-invasive diagnostics across clinical applications.

-

2025: Siemens Healthineers rolled out Photon-Counting CT (Quantum Technology) in its NAEOTOM Alpha scanners, utilizing QuantaMax detectors for ultra-high-resolution imaging, enhanced spectral detail, and lower radiation exposure.

-

2024: Siemens Healthineers introduced CIARTIC Move, a self-driving robotic C-arm for intraoperative imaging, featuring holonomic wheels and remote control, enabling up to 55% faster image acquisition while reducing staff workload.

Photonis

Photonis is driving innovation in quantum sensing for medical imaging through its advanced photon detection technologies. Their quantum photonic sensors enable highly sensitive imaging for MRI, PET, and other diagnostic modalities, capturing low-intensity signals with exceptional precision. By enhancing image clarity, reducing noise, and supporting real-time detection, Photonis’ solutions improve diagnostic accuracy, facilitate early disease detection, and contribute to the development of next-generation, non-invasive medical imaging systems.

-

2025: Photonis (Exosens) launched Cricket Pro and PhotonPix, advanced single-photon detection devices for low-light biomedical imaging and quantum applications, debuting at SPIE Photonics West with high speed and precision.

-

2024: Exosens (Photonis brand) partnered with Photonscore to distribute LINCam, a photon-counting camera with picosecond time resolution, enhancing time-resolved imaging for biomedical research and quantum optics.

-

2023: Photonis (Exosens) showcased advanced single-photon and imaging solutions Cricket², Mantis³, and ultra-fast MCP-PMT sensors capable of high temporal resolution, targeting quantum optics and biomedical imaging markets at SPIE Photonics West.

Key Players in Quantum Sensing in Medical Imaging Market

-

IBM (IBM Quantum Imaging, IBM Quantum Sensors for MRI)

-

Google (Alphabet Inc.) (Quantum Enhanced MRI Technology, Quantum Imaging Solutions for Oncology)

-

Honeywell (Quantum Magnetometers for MRI, Quantum Sensors for PET Imaging)

-

Microsoft (Azure Quantum for Medical Imaging, Quantum Computing for MRI Diagnostics)

-

D-Wave Systems (Quantum Machine Learning for Medical Imaging, D-Wave Quantum Imaging Solutions)

-

Bosch Healthcare Solutions (Quantum Sensor-based MRI, Quantum Sensors for PET Scanners)

-

Qnami (Quantum Sensing Solutions for Bio-imaging, Quantum Imaging Tools for Cancer Detection)

-

Oxford Instruments (Quantum Sensors for Biomedical Imaging, High-Sensitivity Quantum Magnetic Imaging Devices)

-

Siemens Healthineers (Quantum-Enhanced MRI Scanners, Quantum PET Imaging Solutions)

-

GE Healthcare (Quantum Sensors for Diagnostic Imaging, Quantum-enhanced MRI Technologies)

-

Quantum Surgical (Quantum Sensing in Image-guided Surgery, Quantum Imaging Solutions for Targeted Treatment)

-

Toshiba Medical Systems (Quantum Sensors for CT Imaging, Quantum MRI Imaging Devices)

-

Medtronic (Quantum Imaging Sensors for Neurological Applications, Advanced Quantum Sensors for Cardiac Imaging)

-

Xanadu Quantum Technologies (Quantum Imaging for Cancer Detection, Quantum Sensing Solutions for Brain Imaging)

-

Fujifilm Healthcare (Quantum-enhanced X-ray Imaging, Quantum Sensors for Digital Mammography)

-

Photonis (Quantum Photon Detectors for Imaging, Quantum Sensing Solutions for Advanced Imaging)

-

Southwest Research Institute (Quantum Imaging Systems for Neuroimaging, Quantum Sensors for Multi-modal Imaging Applications)

-

Arxspan (Quantum Sensing Technology for MRI, Quantum Imaging Solutions for Biomedical Applications)

-

ID Quantique (Quantum Photonic Sensors for Medical Imaging, Quantum Imaging Solutions for Radiation Therapy)

-

Qontrol (Quantum Sensing Technology for Bio-imaging, Quantum-enhanced Microscopy and Imaging Devices)

Suppliers (Supplier of quantum sensing in image-guided surgery and quantum imaging solutions for targeted treatment) on Quantum Sensing in Medical Imaging Market

-

Oxford Instruments

-

ID Quantique

-

Siemens Healthineers

-

GE Healthcare

-

Qnami

-

Honeywell

-

D-Wave Systems

-

Photonis

-

Bosch Healthcare Solutions

-

Quantum Surgical

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 290.82 million |

| Market Size by 2032 | US$ 574.6 million |

| CAGR | CAGR of 7.49% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Sensing Technology (Quantum Sensors, Magnetometers, Gravitational Sensors, Quantum Light Sensors) • By Application (Magnetic Resonance Imaging (MRI), Positron Emission Tomography (PET), Computed Tomography (CT) Scanning, X-ray Imaging, Optical Imaging, Other Diagnostic Imaging) • By End-User (Hospitals, Diagnostic Centers, Research Institutions, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Google (Alphabet Inc.), Honeywell, Microsoft, D-Wave Systems, Bosch Healthcare Solutions, Qnami, Oxford Instruments, Siemens Healthineers, GE Healthcare, Quantum Surgical, Toshiba Medical Systems, Medtronic, Xanadu Quantum Technologies, Fujifilm Healthcare, Photonis, Southwest Research Institute, Arxspan, ID Quantique, Qontrol, and other players. |