Regenerative Agriculture Market Size & Growth Trends:

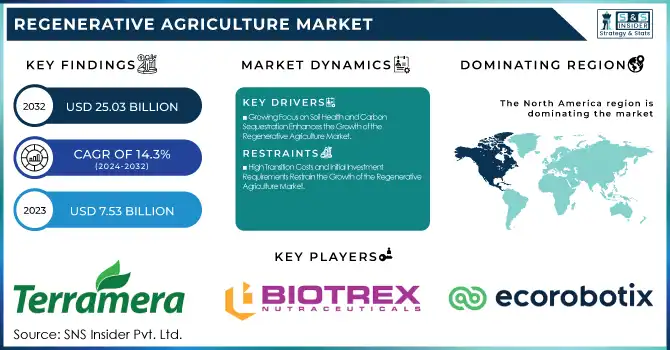

The Regenerative Agriculture Market Size was valued at USD 7.53 Billion in 2023 and is expected to reach USD 25.03 Billion by 2032 and grow at a CAGR of 14.3% over the forecast period 2024-2032. Regenerative agriculture market analysis highlights how regenerative agriculture is evolving as a sustainable alternative to conventional farming, emphasizing carbon sequestration, biodiversity, and soil healthcare. Techniques including cover cropping, agroforestry, and decreased tillage augmenting the productivity along with modifying climate change. Surging government incentives, high consumer demand, and corporate sustainability commitments are propelling the regenerative agriculture market growth.

To Get more information on Regenerative Agriculture Market - Request Free Sample Report

Farms using regenerative methods report improved soil carbon sequestration and up to 30% higher water efficiency. Surging number of investments in carbon markets, soil health, and digital monitoring is propelling market expansion. In spite of challenges, such as measurement standardization and transition costs, the process of regenerative agriculture provides long-term advantages for climate resilience and food security, further accelerating the regenerative agriculture market growth.

Regenerative Agriculture Market Dynamics:

Key Drivers:

-

Surging Focus on Carbon Sequestration and Soil Health Drives the Regenerative Agriculture Market Growth

The surging emphasis on carbon sequestration and soil health is a major driver for the regenerative agriculture market growth. Governments, corporations, and farmers recognize the urgent need to restore soil fertility and combat climate change by adopting sustainable agricultural practices. Regenerative farming techniques including agroforestry, cover cropping, and rotational grazing also improve soil organic matter, along with enhancing microbial activity, and raise carbon sequestration, further minimizing greenhouse gas emissions. Furthermore, growing consumer awareness related to sustainable food production has raised, which further led food companies to incorporate regenerative sourcing into their supply chains.

Policy frameworks and financial incentives are also boosting the adoption of regenerative agriculture, due to the subsidies provided by governments for several sustainable farming initiatives. The continuous incorporation of digital tools, such as soil monitoring and carbon credit platforms, further encourages farmers to transition. As soil degradation threatens long-term agricultural productivity, regenerative practices provide a viable solution for maintaining yield stability while ensuring environmental sustainability. With global food security concerns rising and climate change mitigation becoming a priority, the demand for regenerative agriculture continues to expand, positioning it as a vital approach to the future of farming.

Restraints:

-

High Transition Costs and Initial Investment Requirements Restrain the Growth of the Regenerative Agriculture Market

One of the primary restraints limiting the widespread adoption of regenerative agriculture is the high transition costs and upfront investment required. Shifting from conventional to regenerative farming involves significant changes in land management, requiring farmers to invest in soil regeneration practices, diverse crop rotations, and alternative pest management techniques. These transitions often demand new equipment, training, and technical expertise, which can be financially burdensome, especially for small and mid-sized farms. Furthermore, the return on investment is not immediate, as soil health improvements and increased productivity may take several years to materialize. Farmers may also face challenges accessing financial support, as traditional agricultural financing structures favor conventional farming methods.

Additionally, market volatility, fluctuating commodity prices, and the unpredictability of weather conditions create further hesitation among farmers considering the shift. While government subsidies and private investments are increasing, financial barriers remain a significant deterrent, slowing the overall growth of regenerative agriculture. Addressing these economic constraints through better incentives, risk-sharing mechanisms, and accessible funding programs is crucial to accelerating adoption.

Opportunities:

-

Expansion of Carbon Credit Programs Creates New Revenue Opportunities for the Regenerative Agriculture Market

The rising adoption of carbon credit programs presents a significant opportunity for the regenerative agriculture market. As corporations seek to offset their carbon footprint, carbon credit markets are expanding, offering financial incentives to farmers who implement regenerative practices that enhance soil carbon sequestration. Companies such as Indigo Ag and Nori have introduced platforms that allow farmers to earn carbon credits by quantifying their soil’s carbon storage capacity. This creates a dual benefit that farmers can monetize sustainable farming practices while corporations meet their sustainability targets.

Additionally, as climate policies become more stringent, demand for high-quality carbon offsets will rise, further boosting participation. However, ensuring accurate measurement, verification, and standardization of carbon sequestration remains a challenge. If addressed effectively, carbon credit programs could become a transformative financial mechanism, accelerating the adoption of regenerative agriculture globally. With growing corporate interest and regulatory backing, this opportunity has the potential to drive substantial market growth in the coming years.

Challenges:

-

Lack of Standardized Metrics and Certification Systems Hampers the Growth of the Regenerative Agriculture Market

A significant challenge facing the regenerative agriculture market is the lack of standardized metrics and certification systems to define and verify regenerative practices. Unlike organic farming, which has well-established global certification standards, regenerative agriculture lacks a universally accepted framework to measure its impact on soil health, biodiversity, and carbon sequestration. This inconsistency creates confusion among farmers, businesses, and consumers, making it difficult to establish trust in regenerative products.

Additionally, major food and agriculture corporations seeking to integrate regenerative sourcing into their supply chains struggle to ensure compliance due to varying definitions across markets. Efforts are being made by organizations such as Regenerative Organic Certified (ROC) and Soil Health Institute to develop structured certification programs, but widespread adoption remains slow. Without a unified approach, scalability becomes difficult, and farmers may hesitate to invest in regenerative transitions due to the uncertainty surrounding long-term recognition and financial benefits. Addressing this challenge through clear, science-based measurement frameworks and global certification standards is crucial to ensuring credibility and fostering trust in the regenerative agriculture market.

Regenerative Agriculture Market Segmentation Analysis:

By Type

Agroforestry, integrating trees and shrubs into agricultural landscapes, accounted for the largest regenerative agriculture market share in terms of revenue in 2023, holding 23% of total market revenue. This practice enhances soil fertility, improves water retention, and increases biodiversity, making it a key driver of sustainable farming. Nestlé and Danone have invested in agroforestry projects to support sustainable cocoa and coffee production, ensuring long-term soil health and carbon sequestration.

In 2023, Nestlé expanded its agroforestry initiative by planting millions of shade trees in cocoa-growing regions, enhancing carbon capture while stabilizing yields. Similarly, Danone has collaborated with local farmers to implement tree-planting programs in dairy supply chains, reducing soil degradation and improving forage availability.

Aquaculture and ocean farming are emerging as the fastest-growing segments within regenerative agriculture, expanding at a CAGR of 16.22% over the forecast period. Regenerative ocean farming integrates seaweed and shellfish cultivation to restore marine ecosystems, improve biodiversity, and absorb excess carbon and nitrogen from the water. Leading companies are investing heavily in this segment to develop sustainable seafood production while enhancing ocean health.

In 2023, Patagonia Provisions expanded its regenerative ocean farming projects, launching new kelp-based food products to promote sustainable marine agriculture. Similarly, Cargill partnered with aquaculture innovators to develop sustainable fish feed derived from seaweed and alternative proteins, reducing the industry’s reliance on wild fish stocks.

By End-User

Service organizations, including agribusiness consultancies, sustainability-focused NGOs, and ag-tech firms, dominated the regenerative agriculture market in 2023 with a 32% revenue share. These organizations provide crucial services such as soil health assessment, carbon credit certification, farm advisory programs, and digital monitoring platforms that help farmers transition to regenerative practices. Companies, such as Indigo Ag and Continuum Ag have expanded their service offerings, providing data-driven insights to improve soil carbon sequestration and optimize regenerative practices.

Additionally, global food corporations, including Nestlé and General Mills, have collaborated with service organizations to implement large-scale regenerative agriculture initiatives, ensuring supply chain sustainability. The increasing demand for carbon tracking, precision farming, and sustainability consulting has propelled the growth of this segment.

Farmers are the fastest-growing end-user segment in the regenerative agriculture market, adopting sustainable practices at an accelerating rate due to rising demand for climate-resilient farming and financial incentives. With growing consumer awareness and corporate commitments to sustainable sourcing, farmers are increasingly shifting to regenerative methods such as cover cropping, no-till farming, and integrated livestock management. With government subsidies, corporate funding, and new revenue streams from carbon markets, farmers are at the forefront of regenerative agriculture expansion, driving long-term sustainability and reshaping the global agricultural landscape.

By Component

The Solutions Organization segment led the regenerative agriculture market in 2023, accounting for 62% of total revenue, driven by the rising demand for innovative products that enhance soil health, carbon sequestration, and sustainable farming practices. Solutions in this segment include biological inputs, digital agriculture platforms, regenerative seed varieties, and soil health enhancers.

In 2023, Terramera launched a new bio-based soil amendment designed to enhance carbon sequestration and nutrient efficiency, reducing reliance on synthetic fertilizers. Similarly, Indigo Ag expanded its microbial seed treatment portfolio, enabling farmers to improve soil resilience and crop productivity.

The Services segment is experiencing the fastest CAGR in the regenerative agriculture market, driven by the growing need for farm advisory, carbon credit verification, soil health assessment, and digital precision farming support. As more farmers and agribusinesses transition to regenerative practices, service providers play a crucial role in guiding adoption, ensuring compliance with sustainability standards, and optimizing farming strategies.

In 2023, Continuum Ag introduced a digital soil health platform that helps farmers track carbon sequestration improvements and connect with carbon credit markets, increasing their revenue potential. Meanwhile, Agreena launched a farmer-centric carbon program that streamlines credit verification and trade, making carbon markets more accessible.

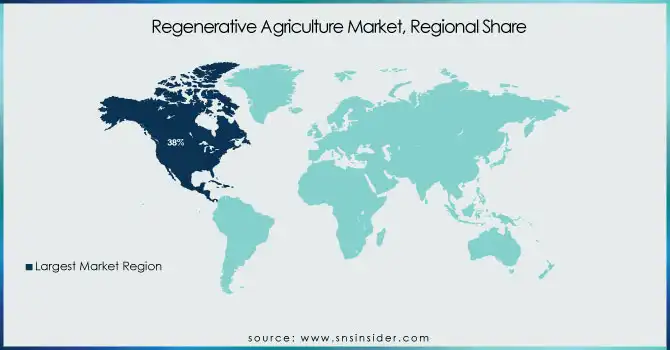

Regenerative Agriculture Market Regional Outlook

North America led the regenerative agriculture market in 2023, accounting for an estimated 38% market share, driven by strong corporate commitments, government support, and advanced agricultural technologies. The U.S. and Canada have witnessed increased adoption of regenerative farming practices, supported by major agribusinesses and food companies integrating sustainability into their supply chains. General Mills, Cargill, and Danone have launched large-scale regenerative agriculture initiatives aimed at improving soil health and reducing carbon emissions.

For instance, General Mills expanded its regenerative farming program in partnership with wheat and oat farmers, focusing on soil carbon sequestration. Similarly, Cargill invested in soil health projects, helping North American farmers transition to regenerative practices through financial incentives and training programs.

The Asia Pacific region is the fastest-growing in the regenerative agriculture market, expanding at an estimated CAGR of 17.5%, fueled by rising government initiatives, corporate investments, and the urgent need to combat soil degradation and climate change. Countries such as India, China, Australia, and Indonesia are rapidly adopting regenerative practices to enhance food security and restore degraded farmland. The Indian government has introduced incentives to promote natural and organic farming, supporting millions of smallholder farmers in shifting towards regenerative techniques including cover cropping, agroforestry, and no-till farming.

Australia, known for its innovative farming techniques, has seen agribusinesses including Grounded and Soil Capital expanding operations, offering regenerative solutions to farmers. With increasing awareness, government subsidies, and corporate sustainability goals, Asia Pacific is emerging as a key player in the regenerative agriculture movement, driving its fastest growth globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

Regenerative Agriculture Companies are:

-

Vayda (USA) – Corn, Soybeans, Rice

-

Terramera Inc. (Canada) – Bio-based Soil Amendments

-

Agreed.Earth (USA) – Regenerative Agriculture Solutions

-

Biotrex (USA) – Sustainable Farming Technologies

-

Ecorobotix SA (Switzerland) – Precision Weeding Robots

-

Ruumi (UK) – Carbon Tracking & Soil Health

-

Continuum Ag (USA) – Digital Soil Health Platform

-

Aker Technologies, Inc. (USA) – Crop Monitoring & Analytics

-

Indigo Ag, Inc. (USA) – Microbial Seed Treatments & Carbon Credits

-

Tortuga Agricultural Technologies, Inc. (USA) – Autonomous Harvesting Robots

-

Astanor Ventures (Belgium) – Agri-Food Investment

-

SATELLIGENCE (Netherlands) – Satellite-based Sustainability Monitoring

-

Nestlé SA (Switzerland) – Food & Beverage

-

Danone SA (France) – Dairy & Plant-based Products

-

General Mills, Inc. (USA) – Packaged Foods

-

Cargill Incorporated (USA) – Agriculture & Food Processing

-

Unilever PLC (UK/Netherlands) – Consumer Goods & Food Products

-

Grounded (Australia) – Regenerative Farming Solutions

-

Soil Capital Belgium SPRL (Belgium) – Carbon Farming & Soil Health

Recent Development

-

In May 2024, Vayda, a regenerative farming startup established in 2020 with support from Ontario Teachers' venture studio, Koru, and Goldcrest partners, aimed to facilitate farmers' transition to sustainable agriculture by mitigating associated risks.

-

In January 2023, enrichAg, a subsidiary of Canadian crop protection company Terramera, officially launched with a USD 6 million seed investment led by At One Ventures. The company introduced a novel soil testing and analysis platform designed to enable farmers and agronomists to conduct their soil assessments, potentially reducing fertilizer costs and enhancing opportunities in carbon markets.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.53 Billion |

| Market Size by 2032 | USD 25.03 Billion |

| CAGR | CAGR of 14.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Type (Agroforestry, Silvopasture, Aquaculture/Ocean Farming, No-Till and Pasture Cropping, Holistically Managed Grazing, Biochar, Others) • By End-User (Farmers, Service Organizations, Financial Institutions, Advisory Bodies, Consumer Packaged Goods Manufacturers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Vayda, Terramera Inc., Agreed.Earth, Biotrex, Ecorobotix SA, Ruumi, Continuum Ag, Aker Technologies, Inc., Indigo Ag, Inc., Tortuga Agricultural Technologies, Inc., Astanor Ventures, SATELLIGENCE, Nestle SA, Danone SA, General Mills, Inc, Cargill Incorporated, Unilever PLC, Grounded, Soil Capital Belgium SPRL. |