RF Test Equipment Market Report Scope & Overview:

Get More Information on RF Test Equipment Marke - Request Sample Report

The RF Test Equipment Market size was valued at USD 3.40 billion in 2023 and is expected to reach USD 6.18 billion by 2032 and grow at a CAGR of 6.93% over the forecast period 2024-2032.

The RF test equipment market plays an important role in the expansion and operation of wireless communication systems by maintaining high device performance. RF signals are relevant to the development of telecommunication, automotive, aerospace, and defense systems. Advances in wireless-related technologies, such as 5G, the IoT, and contemporary satellite communications, have prompted the expansion of the RF Test Equipment market. According to the 5G Americas, 5G is the fastest-growing wireless technology that has already exceeded the connection of 4G LTE devices globally and is expected to reach over 3 billion connections by 2028. North America is the leading region that has 151 million of 5G connections in 2023. The introduction of 5G and 6G technologies requires very high frequency and complex modulations and the RF test equipment is capable of handling. For Example, Anritsu’s collaboration with AeroGT Labs in the area of 5G and aerospace testing solutions. The telecommunication industry requires different modulations and high frequencies to operate properly. Governments globally are investing in a high amount for better telecom infrastructure across the countries. For instance, in India, under the PLI scheme around Rs 12,195 crore is allotted for telecom and network products. Precise and reliable RF test equipment is a necessity and is in high demand by all of these stakeholders.

Development, production, and quality assurance of automotive radar systems rely mainly on RF test equipment. One of the key technologies that use CMOS radar is automotive radar systems. As reported by the International Telecommunication Union, it is expected that the availability of automotive radars in Europe will reach 65% by 2030, and in the United States, their availability will reach 50%. The relevant classification of automotive radar is made by dividing the technologies based on ranging capabilities and safety. The long-range category currently has the standard requirement for a 1 GHz bandwidth, and its EIRP maximum is 43 dBm, whereas the EIRP achieved by integrated radars is much lower. The power allowance of the medium/short-range category is lower, and the allowed bandwidth is wider because of the necessity to have higher range resolution for close targets, which is driven by the typical relation of range resolution and bandwidth as Δ R = c / (2 B), where Δ R is the range resolution, c is the speed of light, and B is the used bandwidth.

RF Test Equipment Market Dynamics

Drivers

Increase in demand for wireless technologies like Bluetooth, Wi-Fi, and LTE.

New wireless communication standards continue to evolve, requiring more sophisticated RF test equipment to assist in their deployment, development, and optimization. Device performance, signal quality, and wireless connectivity are becoming increasingly important for the given products, and RF test equipment is a vital technology to measure these features. The usage of wireless connections is growing, and equipment is applied to assess such parameters as signal strength, frequency response, modulation quality, or the levels of interference with other systems. The Internet of Things is becoming increasingly popular, and some of its devices do not offer a wired alternative. For instance, street lights or traffic sensors. These gadgets are tested and assessed to be compatible with the rest of the infrastructure of the places and times they work in.

Expansion of the telecommunications sector globally

The extensive growth of global telecommunications infrastructure stimulates the strong demand for RF test equipment. According to IBEF, the telecom industry in India is the second-largest country in APAC with 1.1 billion subscribers of wireless devices in 2024. RF test equipment helps measure the characteristic performance of a variety of network elements, such as base stations, antennas, or transmission lines. A significant driving force for the demand for RF test equipment is the spread of wireless services in the expanding market of developing countries. The substantial growth of global telecommunications infrastructure is an essential driving factor for RF test equipment.

Restraints

Limited availability of skilled RF engineers

The lack of skilled RF engineers is a major drawback for the RF test equipment market. The increasing complexity of RF designs results in the growing demand for engineers with experience in RF measurement and characterization. To reach the goal of overcoming this obstacle, several educational institutions and organizations throughout the industry offer specialized training in RF engineering. Some research about it may be required to ponder upon the problem.

Strict Regulatory Compliance Requirements

The RF test equipment market is affected by regulatory compliance including that being imposed by government agencies and industry standards organizations. These regulations tend to be time-consuming and costly on the part of the equipment manufacturer and the end users. As such, to restrict compliance concerns, manufacturers should invest in research and development to be certain that their products are at pace with the newest requirements and specifications. This also requires the provision of customers with complete documentation and support services, which can easily aid in compliance.

RF Test Equipment Market Segmentation

By Type

The oscilloscope segment has captured the maximum market share of over 28.14% in 2023. The growth can be attributed to the positioning of oscilloscopes as a superior signal-analyzing device. Oscilloscopes present a complete picture of a waveform signal in terms of frequencies or any other measurement allowing those devices to be used to design and troubleshoot RF circuits. The versatility of oscilloscopes allowed them to be frequently used in any industry or segment such as telecommunications automotive, aerospace, or consumer electronics. The spectrum analyzers segment is to show the fastest CAGR between 2024 and 2032. The anticipated growth is the result of the increasing demand for such tools throughout the years.

By Frequency Range

The 1-6 GHz segment led the market in 2023 with a market share of 30.16%. The segment is growing rapidly due to its reliability, good performance, and compliance with radio frequency. It provides accurate solutions for complex RF devices which increases the demand for this market. The 1-6 GHz RF test equipment is mostly used for wireless networks like Wi-Fi, Bluetooth, and LTE. The >20 GHz segment is growing at a faster rate due to its mmWave technology which is highly used in the automotive radars.

By Form

The benchtop segment has managed a market share of over 47% in 2023. The rise in the adoption of benchtop RF test equipment is because of the testing and validation it provides in various sectors like aerospace, defense, automotive, and electronics. This form of RD test equipment is flexible for use in high-frequency bands and complex modulation schemes. The modular segment is showing a stable CAGR during the forecast period which can make the segment fastest-growing. This RF test equipment can be customized based on the customers' needs.

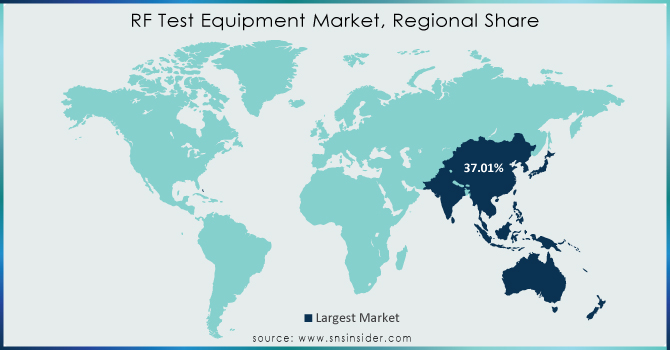

Regional Analysis

The RF test equipment market in Asia Pacific is dominating with a market share of over 37.00% in 2023. The region is the one experiencing the fastest growth in telecommunications, the manufacturing of electronics, and automotive. Since the Chinese market is developing in all possible directions, it is one of the market leaders in Asia Pacific. The rest of the regional growth factors include stable industries rich in every kind of knowledge and experience and the rising need for equipment. For example, Fortive, a leading supplier of advanced RF test equipment to various industries, stated in its annual report for 2023 that its intelligent operating solution segment has a growth in sales in 2023 of 4.7% in the APAC region. China is considered to be the major market to contribute to the rising sales of the company.

North America’s RF test equipment market is driven primarily by technological innovation, which makes the segment fastest-growing with a steady CAGR. Telecommunications, aerospace, and defense drive the need for ever more advanced testing solutions, and telecommunications infrastructure expansion, growing defense expenditures, and a leading position in electronics manufacturing only add to the growth of this market.

Key Players

RF Test Equipment manufacturers are Keysight Technologies Inc., Anritsu Group, Rohde & Schwarz, Tektronix, Teledyne Technologies Inc., National Instruments, Yokogawa Electric Corporation, Siemens, Fortive, Chroma, Cobham PLC, EXFO, Giga-Tronics, Atlantic, B&K Corp, and others.

Recent Development

-

Keysight Technologies launched the P9372A PathWave RF Signal Generator in July 2024, offering enhanced performance and flexibility for wireless communication testing.

-

Rohde & Schwarz introduced the R&S TSME6/8 Signal and Spectrum Analyzer in [Month, Year], providing advanced capabilities for 5G and beyond testing.

-

Mobix Labs introduced the MBX3110 SP10T high-power RF switch in April 2024, targeting the land mobile radio market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.40 billion |

| Market Size by 2032 | US$ 6.18 Billion |

| CAGR | CAGR of 6.93 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Oscilloscope, Spectrum Analyzers, Signal Generators, Network Analyzer, Power Meters, Others) • By Frequency Range (<1 GHz, 1-6 GHz, 7-20 GHz, >20 GHz) • By Form (Benchtop, Portable, Modular, Rackmount) • By End-User (telecommunications, Aerospace & Defense, Consumer Electronics, Automotive, Medical Devices, others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Keysight Technologies Inc., Anritsu Group, Rohde & Schwarz, Tektronix, Teledyne Technologies Inc., National Instruments, Yokogawa Electric Corporation, Siemens, Fortive, Chroma, Cobham PLC, EXFO, Giga-Tronics, Atlantic, B&K Corp |

| Key Drivers | • Increase in demand for wireless technologies like Bluetooth, Wi-Fi, and LTE. |

| RESTRAINTS | • Expansion of the telecommunications sector globally |