Saltwater Batteries Market Report & Overview:

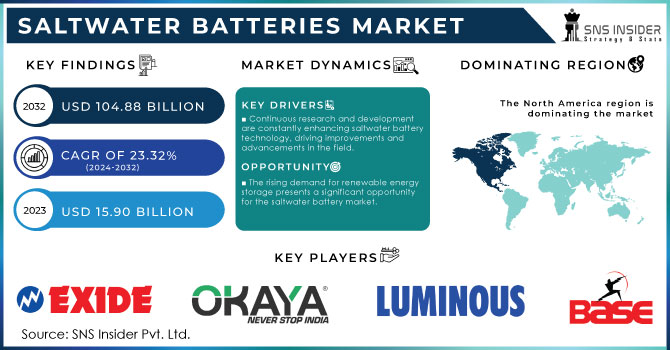

The Saltwater Batteries Market, valued at USD 15.92 billion in 2023, is expected to reach USD 105.03 billion by 2032, growing at a CAGR of 23.32% from 2024-2032. The leading trends include increasing technology adoption, improvements in energy density and performance metrics, and expanding emphasis on carbon footprint reduction and sustainability. Furthermore, investments in R&D are helping innovation & development in battery performance, which are further aiding the growth of this market.

Get More Information on Saltwater Batteries Market - Request Sample Report

Saltwater Batteries Market Dynamics

Drivers:

-

The growing demand for cleaner energy is boosting the adoption of eco-friendly saltwater batteries over traditional lithium-ion options.

The ongoing shift towards cleaner energy worldwide is driving demand for sustainable energy storage systems. Eco-friendly saltwater batteries are emerging as a promising alternative to conventional lithium-ion batteries, as they have a lower environmental footprint while addressing issues related to resource scarcity and pollution. As renewable energy demand rises, companies like Salgenx are leading the charge on saltwater-based grid-scale storage systems. However, technologies such as sodium-zinc hybrid batteries with hydrogel electrolytes and E-Dina's Water Light (which produces light from saltwater or urine) have blown the lid off energy storage, proving that sustainability can change the game.

Restraints:

-

Energy density and high material costs limit the adoption of saltwater batteries in sectors like electric vehicles and grid storage.

Saltwater batteries, including Zn–SA–PSN hydrogel electrolyte-containing saltwater batteries, are capable of achieving a performance of 220 Wh·kg⁻¹ and a 5 C capacity, but they are restricted by their reduced energy density compared with that of lithium-ion batteries (LIBs) in applications within the high-energy field, such as electric vehicles and grid storage. While hybrid-ion batteries have significant sustainability potential, their higher material costs, despite efforts to explore cheaper alternatives such as iron, present a considerable barrier to market adoption. These challenges in energy density and cost hinder the broader use of saltwater batteries, affecting their competitiveness in the rapidly growing energy storage market.

Opportunities:

-

Exploring the Role of Saltwater Batteries in Grid-Scale Energy Storage

As the demand for sustainable and reliable energy storage solutions grows, saltwater batteries offer significant potential for grid-scale applications, particularly in renewable energy systems. These batteries are particularly useful for bulk storage, allowing them to moderate supply and demand, and making it easier to embrace cleaner energy. Saltwater batteries are an eco-friendly alternative that, due to their lower environmental impact than traditional lithium-ion batteries, align with the worldwide movement toward sustainability. NaS batteries are a type of energy storage solution that can be deployed effectively, used between connected groups of varying scales, and can benefit from an increasing investment in energy storage projects across the world as grid resilience policies are passed and renewable energy is integrated.

Restraints:

-

Energy efficiency challenges in saltwater batteries limit their competitiveness in high-energy applications.

Despite being eco-friendly, saltwater batteries face significant challenges in terms of energy efficiency, particularly when compared to advanced technologies like lithium-ion batteries. Their performance, especially in fast-charging scenarios, still needs to improve to meet the demands of high-performance applications like electric vehicles and portable devices. Their performance, particularly at fast-charging pending, are still doing not satisfy utility needs in high-performance applications such same electric vehicles and portable devices. Recent progress with sodium energy storage systems, including high-efficiency batteries with 86% energy efficiencies, has shown promise, but saltwater batteries still fall short of achieving competitive energy output. In a particular case, a sodium-air battery showed enhanced energy density and maintained charge efficiency after 200 cycles, displaying considerable prospects for performance optimization. Saltwater batteries need more innovation to provide greater energy efficiency and performance to be competitive and applicable to a broad range of industries.

Saltwater Batteries market Segment Analysis:

By Type

In 2023, the 48-volt segment dominated the saltwater batteries market, accounting for 55% of the total market share. This growth is fueled by the rising need for energy storage in sectors like renewable energy, grid storage, and electric vehicles (EVs). Due to the use of environmental friendly components, saltwater batteries can store energy stored at a medium level, but they lack the safety risks associated with lithium-ion batteries. The new 48-volt systems are a preferred choice with increased thermal stability and durability as our demand for renewable energy increases. Advances in technology continue to drive down the cost of these systems, and they will have a role in future sustainable energy solutions and the strengthening of the resilience of the grid.

The 24-volt segment is expected to be the fastest-growing in the saltwater battery market from 2024 to 2032, driven by increasing demand for cost-effective, medium-scale energy storage in residential, commercial, and off-grid systems. As demand rises for relatively inexpensive, medium-scale energy storage in residential, commercial, and off-grid systems. Providing a cheaper alternative to 48-volt systems, 24-volt saltwater batteries are suited for smaller, decentralized energy applications, especially those in locations with unreliable grid infrastructure. They are also cheaper, more environmentally friendly, non-combustible, and have higher efficiency gains, making them desirable for renewable energy systems such as home solar panels.

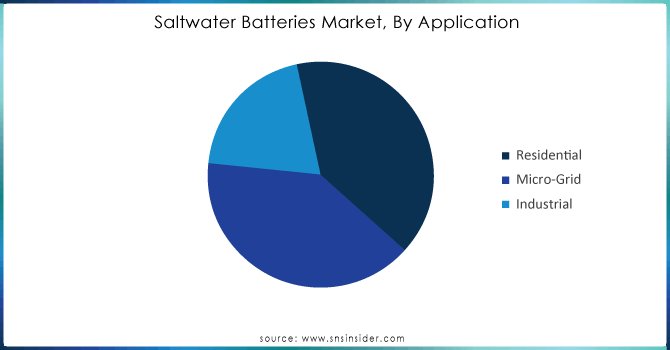

By Application

In 2023, the residential segment held the largest revenue share in the saltwater batteries market, accounting for approximately 39%. Due to the growing adoption of renewable energy sources including solar, rising demand for off-grid energy storage systems for homes, and growing energy efficiency investment. Saltwater batteries will certainly provide a cheaper, eco-friendly solution to lithium-ion batteries with less toxic properties and improved safety. With an increasing number of households looking to adopt reliable back-up power and energy storage systems for optimizing solar energy usage, the residential segment is projected to maintain its expansion trajectory powered by innovations in efficiency and affordability.

The industrial segment is expected to be the fastest-growing segment in the saltwater batteries market from 2024 to 2032. The large-scale industrial applications such as manufacturing facilities, warehouses, as well as energy-intensive operations have strengthened the demand for energy storage, which is driving the market growth. Saltwater batteries, with their enhanced safety, lower cost, and eco-friendly features, offer an ideal solution for industries looking to store renewable energy, reduce dependence on the grid, and optimize energy consumption. Industries are prioritizing sustainability and minimizing carbon footprints and the industrial segment is expected to grow significantly due to technological advancements and increasing regulatory support for green energy solutions.

Get Customized Report as per Your Business Requirement - Request For Customized Report

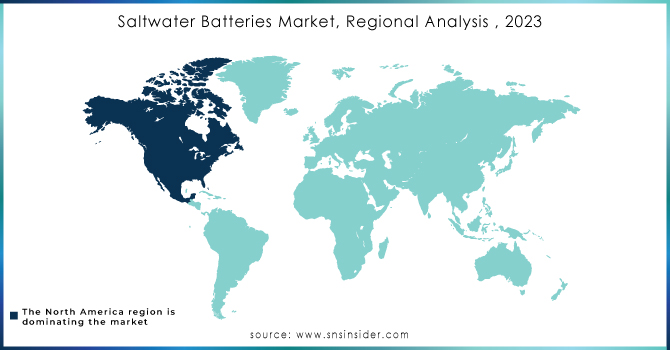

Saltwater Batteries market Regional Analysis:

In 2023, North America dominated the saltwater batteries market, capturing around 40% of the total market share. This dominance is attributed to strong investments in renewable energy, grid modernization projects, and increasing government support for green technologies. The United States, in particular, is a major player, with an increasing emphasis on new energy alternatives and transitioning to cleaner energy means. Tax incentives for renewable energy systems and environmental regulations encourage the use of saltwater batteries in energy storage applications. The countries market leadership is further driven by innovative breakthroughs in battery technology due to rising demand for sustainable and economical replacements to lithium-ion batteries.

Asia-Pacific is expected to be the fastest-growing region in the saltwater battery market from 2024 to 2032. Due to Rapid industrialization, rising renewable energy adoption, and governmental efforts to lower carbon emissions are driving this growth. Through an investment in sustainable energy solutions, with energy storage systems such as saltwater batteries, nations such as China, India, and Japan are ready to facilitate the shift toward greener energy. The region's emphasis on renewable energy sources, including solar and wind, as well as the need to produce cost-effective and environmentally friendly energy; storage is driving the adoption of saltwater batteries in the region. In particular, the Asia-Pacific market growth is further driven by increasing demand for decentralized energy systems and off-grid solutions in rural and remote areas.

Saltwater Batteries Key Players:

Some of the major key players in Saltwater Batteries Market along with their product:

-

Aquion Energy (USA) - Saltwater Batteries

-

BlueSky Energy (Germany) - Lithium-ion and Saltwater Batteries

-

Green Energy Storage (USA) - Energy Storage Solutions

-

SaltX Technology (Sweden) - Saltwater Batteries

-

ESS Inc. (USA) - Iron Flow Batteries

-

Faradion Limited (UK) - Sodium-ion Batteries

-

NantEnergy (USA) - Zinc-air Batteries

-

Zinc8 Energy Solutions (Canada) - Zinc-air Flow Batteries

-

Invinity Energy Systems (UK) - Vanadium Flow Batteries

-

Redflow Limited (Australia) - Zinc-bromine Flow Batteries

-

EnerVault (USA) - Vanadium Flow Batteries

-

Primus Power (USA) - Zinc-based Flow Batteries

-

ViZn Energy Systems (USA) - Zinc-iron Flow Batteries

-

Eos Energy Storage (USA) - Zinc Hybrid Cathode Batteries

-

Ambri Inc. (USA) - Liquid Metal Batteries

-

CellCube Energy Storage Systems Inc. (Canada) - Vanadium Flow Batteries

-

Sonnen GmbH (Germany) - Lithium-ion Batteries for Energy Storage

-

UniEnergy Technologies (USA) - Vanadium Flow Batteries

-

Lockheed Martin (USA) - Advanced Energy Storage Solutions

-

Sumitomo Electric Industries Ltd. (Japan) - Lithium-ion Batteries and Energy Storage Systems

List of Suppliers who provide Raw material and Component in Saltwater Batteries market:

-

ESS Tech, Inc. (USA)

-

Aquion Energy (USA)

-

BlueSky Energy (Austria)

-

Innolith AG (Switzerland)

-

Zynth Energy (India)

-

Bettery, Inc. (USA)

-

Salgenx (USA)

-

Stafl Systems (USA)

-

Greenrock (Bluesky Energy brand) (Austria)

-

Seawater Battery Systems (South Korea)

Recent Development

-

5th February 2025 – Sumitomo Electric started the 4,000 kW redox flow battery business in the Oki Islands to expand renewable energy and strengthen disaster resilience The system is long-lived, very safe to use, and maintenance friendly.

-

February 6, 2025 – Energy and storage company ESS Tech is also thriving as AI data centers accelerate demand for long-duration energy storage through its iron redox flow batteries They are more fire-resistant than lithium-ion batteries.

| Report Attributes | Details |

| Market Size in 2023 | USD 15.92 Billion |

| Market Size by 2032 | USD 105.03 Billion |

| CAGR | CAGR of 23.32% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(12 Volt, 24 Volt, 48 Volt) • By Application(Residential, Micro-Grid, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aquion Energy (USA), BlueSky Energy (Germany), Green Energy Storage (USA), SaltX Technology (Sweden), ESS Inc. (USA), Faradion Limited (UK), NantEnergy (USA), Zinc8 Energy Solutions (Canada), Invinity Energy Systems (UK), Redflow Limited (Australia), EnerVault (USA), Primus Power (USA), ViZn Energy Systems (USA), Eos Energy Storage (USA), Ambri Inc. (USA), CellCube Energy Storage Systems Inc. (Canada), Sonnen GmbH (Germany), UniEnergy Technologies (USA), Lockheed Martin (USA), and Sumitomo Electric Industries Ltd. (Japan). |