Student Information System Market Report Scope & Overview:

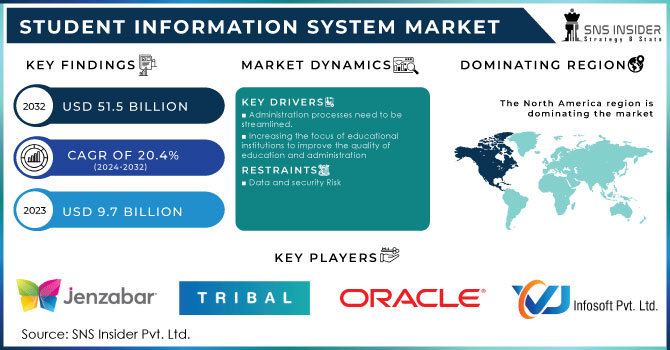

The Student Information System Market was valued at USD 10.73 billion in 2023 and is expected to reach USD 48.08 billion by 2032, growing at a CAGR of 18.18% over the forecast period 2024-2032.

Get more information on Student Information System Market - Request Sample Report

The market for Student Information Systems (SIS) is expanding at an impressive pace, fueled primarily by the rising need for digitization and standardization in educational institutions. In the era of digitalization, many schools, colleges, and universities are switching to SIS platforms to manage data efficiently and provide an overall enhanced experience. These platforms provide centralized management of data, making it easier to manage the process of admissions, student management, and academic record maintenance. COVID-19 has only increased the trend toward home and hybrid learning, and naturally, that has led to growing interest in student data and set of communications in the digital space. Consequently, the reliance of educational institutions on SIS has also increased, forcing institutes to invest handsomely towards a seamless operational performance. As of 2024, approximately 70% of North American educational institutions have adopted cloud-based Student Information Systems (SIS), with 60% of U.S. K-12 schools also transitioning to cloud solutions, up from 40% in 2019. Additionally, institutions using SIS have seen 15-20% higher student engagement due to integrated features like real-time tracking and personalized learning. Globally, over 80% of higher education institutions have adopted SIS platforms, underscoring the widespread shift towards centralized data management in education.

The SIS offerings are also expanding as there is an increasing need for an improved financial management solution for better financial management within educational institutions. Schools are increasingly looking for automated systems to facilitate fee collection, financial planning, and reporting due to tuition costs on the rise and a seemingly impenetrable financial process. In addition, a growing focus on student-centric engagement solutions such as personalized learning paths and communication tools is driving the market. As educational institutions focus on student satisfaction and operational efficiency, SIS platforms have also evolved to an extent, leveraging advanced technologies such as AI and data analytics, making this market one of the growth engines of the educational technology industry. Cloud-based Student Information Systems (SIS) have proliferated globally amongst higher education institutions, with over 60% of institutions worldwide adopting such solutions, and almost 90% of U.S. universities migrating to cloud solutions within the last few years. SIS Platforms AI in SIS platforms is used by about 45% of colleges and universities to enhance student engagement and outcome prediction. More than 70% of schools across the globe turned to digital learning platforms (including SIS tools) post-COVID pandemic.

Market Dynamics

Key Drivers:

-

Data Analytics and AI Empower Educational Institutions to Improve Student Success and Decision Making

One of the crucial drivers is the increasing emphasis on using data analytics to make better decisions in schools, colleges, and universities. Many SIS platforms now have high-end data analytics functionalities built-in, opening up the possibility of the institution collecting, processing, and analyzing enormous amounts of student data. Through the use of data, educators and administrators can make informed decisions regarding curriculum planning, student performance monitoring, and resource allocation. Institutions can discover areas of improvement, customize the content of education such as topics for individual students, and maximize operations by assessing trends and results. The advantage of tracking various statistics like student retention, presence, and academic progress enables institutions to adjust on a timely basis as well as offer individualized support and this is one of the reins for adoption of SIS platforms across the education sector. 71% of education professionals say data analytics are essential to student success and measuring ROI in 2024. 50% of the higher education institutions use AI-based analytics to track student progress with 65% using analytics to provide personalized learning. Data analytics institutions have seen retention rates up to 15% better than those without. 60% of schools are using data analytics for curriculum planning to change the content depending on the student's learning performance.

-

Regulatory Compliance Drives Demand for Robust Student Information Systems in Education Sector

The desire of educational institutions to adhere to local, national, and international rules and regulations is also a major driver for the market. The education sector has become more complex than ever before with institutions facing growing pressure to comply with regulatory requirements in the areas of student data privacy, financial reporting, and academic accreditation. SIS platforms provide data security, compliance with regulated storage locations, and report and audit trails, all of which can be automated and enable you to comply with these regulations more seamlessly than any other system. For example, the U.S. Family Educational Rights Privacy Act (FERPA), and, the General Data Protection Regulation (GDPR) in Europe, provide specific requirements for the use of student data and therefore schools must utilize systems that enable compliance. The need for a strong SIS solution, that contains tools to manage compliance and legal risks efficiently, is being propelled by this rising regulatory burden. Hundreds of U.S. higher education institutions were cited for FERPA violations in 2024, flagging the importance of solid data security protocols. Since the introduction of GDPR over 50 fines have been applied to EU educational institutions, the highest being just over EURO 2 million. Also, 14 U.S. states have passed their own data privacy laws, with 5 more expected on the way. More than 60% of U.S. institutions are leveraging automated audit trail features baked into SIS platforms to keep audit trails in compliance with actions and access to data protection regulations.

Restrain:

-

Overcoming Integration Challenges and Skill Gaps Hindering the Expansion of Student Information Systems

System integration remains one of the critical restraints in the Student Information System (SIS) market. When it comes to any administrative or academic processes, educational institutions usually, depend on a large number of legacy systems. The process of integrating a new SIS with existing infrastructure generally has more fragile, brittle, and costly infrastructure, which may lead to technical difficulties and disruptions to operations. The integration process is long and tedious due to compatibility issues, data migration hurdles, and the need for extensive customization. The absence of technical knowledge among end-users is another major obstacle. On the other hand, SIS platforms find it tough to implement and maintain as most of the institutions particularly small scale face trouble due to a lack of IT knowledge about the system integration and infrastructure to handle the system. It will take far too long and expend far too many resources to train faculty and administrative staff to use these systems effectively. Institutions often underutilize SIS because the people using their platforms have not been trained appropriately on what their vendors can do, and not doing that will lead to a loss of ROI. Despite the increasing demand, these challenges obstruct market expansion.

Segment Analysis

By Component

The software segment represented 75.7% of the Student Information System (SIS) Market share in 2023, owing to the growing adoption of digital platforms by educational institutions. Software solutions have a variety of equipment, from pupil statistics to admit, to attendance and management, all to make these management tasks extra efficient, this dominance has been further accelerated by the popularity of cloud-based SIS software, with institutions opting for scalable and accessible solutions while reducing infrastructure requirements. In addition, the software offers the best analytics and reporting tools, allowing institutions to make data-driven decisions and contribute to the large-scale adoption of software in schools, colleges, and universities.

The service segment is projected to witness the fastest CAGR growth during the forecast period from 2024 to 2032 owing to the increasing needs for implementation, integration, and support services. With SIS solutions becoming increasingly complex, institutions need the guidance of professionals who can customize and configure these systems to their unique needs. Moreover, the need for training services to help staff and administrators get to know these platforms has also gained traction. Sustained technical assistance, upkeep, and periodic upgrades are also pivotal for smooth functioning, thereby boosting the service segment. This change mirrors a wider trend among universities and colleges to become more excited about operational efficiency, but outsourcing the actual work of system optimization and support to a service provider.

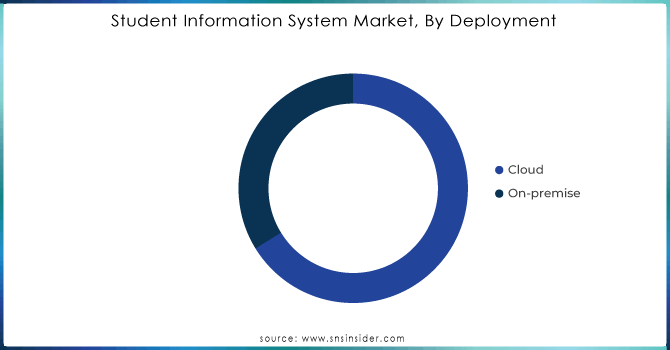

By Deployment

In 2023, the cloud segment accounted for 64.2% of the total Student Information System (SIS) market share led by the increased acceptance of cloud solutions in educational institutions. A cloud-based SIS platform has many benefits, including scalability, flexibility, and ease of access from remote locations. These cloud-based solutions allow institutions to manage student data as well as administrative processes by eliminating the need for large amounts of hardware infrastructure and providing a significantly lower upfront cost as well as lowering IT maintenance. In addition, Cloud platforms allow for seamless integration with other educational tools and enable collaboration in real-time between students, faculty, and administrators. The rise in coronavirus cases and work-from-home related job environments have increased the demand for remote and hybrid learning models, which will only further increase the demand for cloud need-based systems, as accessibility and smooth operations will be independent of boundary locations.

The on-premise segment will grow at the fastest CAGR from 2024 to 2032 owing to its stickiness to institutional clients that favor more data security and control. On-premise solutions provide a way for educational organizations to host and manage SIS platforms in-house, giving them control over sensitive student data and accommodating strict privacy regulations like GDPR or FERPA. This becomes especially important for institutions in areas with strict data privacy laws or within sectors where cybersecurity is front of mind. Moreover, organizations in the education sector choose to stay with on-premise systems to eliminate the reliance on a third-party vendor for data storage, they could still operate in cases of internet impairment. Consequently, the cloud will still dominate, but for institutions that care about security and independence, the on-premise segment will experience gradual growth.

By Application

The Admission & Recruitment segment held the largest share of the Student Information System (SIS) market at 32.7%, in 2023, as these features play an integral part in attracting and enrolling students, which is the highest priority of the educational institutes. Amid growing competition of schools, colleges, and universities planning to over-enroll and then progressively shrink, institutions are using advanced SIS platforms to manage the whole admission cycle. These systems automate essential functions like application handling, document status checking, and communication with prospective learners, thus relieving the administrative burden on admissions staff. In addition to this, the SIS solutions for admission and recruitment are equipped with advanced analytic features to trail the trends, prospects, and outreach under one umbrella, thus making them the key tool for enrollment success.

The financial management segment is expected to grow at a significant CAGR from 2024 to 2032. Increasing college prices, different income streams, and the increasing need for fiscal year accounting above rates of success are driving SIS software buyers to implement commercial enterprise control equipment. They help institutions automate fee collections, and scholarships, and get in-depth reports for reporting according to financial regulations. Also, international establishments necessitate multi-currency transactions and regional taxation needs, which have further driven the need for the reqd-sophisticated financial management modules. Furthermore, the adoption of artificial intelligence (AI)-based financial analytics that provides predictive insights regarding budgeting and resource allocation towards driving operational efficiency and financial sustainability among institutions is further fueling this segment at a rapid pace.

By End-Use

In 2023, the Higher Education segment accounted for 64.3% of the global Student Information System (SIS) market, as colleges and universities typically have unique and multifaceted administrative needs. Most institutions of higher learning deal with thousands of students, hundreds, if not thousands of courses, and millions of dollars worth of financial aid, therefore, SIS platforms help prevent it from requiring too much manual intervention by automating the complex processes of enrollment and course registration, academic tracking, and financial aid management. Furthermore, the global trend of student mobility through international admissions and exchange programs has created a need for Student Information System (SIS) systems which support multi-language, multi-currency, and other cross-border compliance aspects. This, along with enhanced analytics and reporting capabilities in higher education SIS solutions, provides the power for institutions to make decisions that would enhance student outcomes and contribute to operational efficiency, which makes them the market leaders.

The K-12 segment is projected to experience the highest CAGR during the forecast period from 2024 to 2032, owing to the increasing usage of digital tools in K-12 institutions. There have been significant investments in modernizing K-12 education infrastructure including SIS to streamline student and administrative engagement by governments and private institutions around the globe. This segment is being driven by the demand for instant parent-teacher-student communication which is a key utility in K-12 SIS as it often consists of features such as parent portal, attendance, and behavioral analytics. In addition, increasing focus in K-12 schools on personalized learning and early academic intervention is also propelling school districts to seek data-driven solutions to monitor and assess student achievement and performance at both the individual and classroom levels. As more and more people realize the advantages technology provides in education.

Need any customization research on Student Information System Market - Ask For Customization

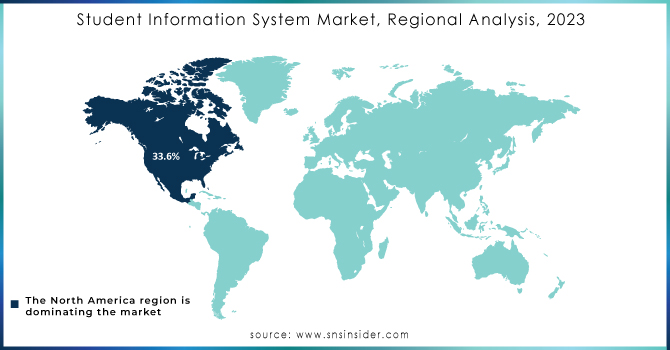

Regional Analysis

In 2023, North America had the largest share, at 34.7%, as this region includes a mature education sector and increasing adoption of technology in higher education. SIS platforms are now widely used within schools, colleges, and universities (NOO in the U.S. and Canada) to streamline administrative efficiencies and improve student experience. The market is also expected to remain dominant in North America due to the large number of leading SIS provider's respective presence in this region, including Ellucian and PowerSchool. As an example, Ellucian's Banner and Colleague systems populate universities such as the University of California system, while PowerSchool serves thousands of K-12 institutions across the United States; federal mandates, such, as FERP, that require better systems to secure compliance with data privacy standards have also propelled adoption.

The fastest CAGR growth is anticipated to be seen in Asia-Pacific during the forecast period (2024-2032), owing to the rapid digital transition of the education sector in countries such as India, China, and Southeast Asia. EdTechs in this region are attracting large amounts of funds from governments and private institutions due to the increasing demand for quality education and the growing student population. In India, SIS solutions such as MyClassCampus and Fedena are emerging in K-12 schools and colleges, for instance. The unprecedented adoption of homegrown SIS platforms by educational institutions in China coincides with the national agenda for promoting digital education, reflected in recent documents such as the Education Informatization 2.0 Action Plan.

Key players

Some of the major players in the Student Information System Market are:

-

Oracle Corporation (Oracle Student Cloud, Oracle PeopleSoft Campus Solutions),

-

Ellucian Company L.P (Ellucian Banner, Ellucian Colleague),

-

Workday, Inc (Workday Student, Workday Financial Management),

-

SAP SE (SAP Student Lifecycle Management, SAP S/4HANA),

-

PowerSchool (PowerSchool SIS, PowerTeacher Pro),

-

Jenzabar, Inc. (Jenzabar One, Jenzabar SONIS),

-

Skyward, Inc (Skyward Student Management Suite, Skyward Family Access),

-

Anthology Inc. (CampusNexus Student, CampusNexus CRM),

-

Veracross (Veracross SIS, Veracross Enrollment),

-

Blackbaud, Inc. (Blackbaud Student Information System, Blackbaud Learning Management System),

-

Illuminate Education (Illuminate Student Information, Illuminate Data & Assessment),

-

Foradian Technologies (Fedena, Uzity),

-

Beehively (Beehively SIS, Beehively Gradebook),

-

Classe365 (Classe365 SIS, Classe365 LMS),

-

Gradelink (Gradelink SIS, Gradelink Gradebook),

-

Rediker Software (Administrator's Plus, TeacherPlus Gradebook),

-

FACTS Management (FACTS SIS, FACTS Tuition Management),

-

Campus Management Corp. (CampusNexus Student, CampusNexus Finance),

-

OpenSIS (openSIS Community Edition, openSIS Professional Edition),

-

Focus School Software (Focus SIS, Focus Gradebook)

Some of the Raw Material Suppliers for Student Information System Companies:

-

Intel Corporation

-

Microsoft Corporation

-

Amazon Web Services (AWS)

-

NVIDIA Corporation

-

Cisco Systems, Inc.

-

Hewlett Packard Enterprise (HPE)

-

Dell Technologies

-

Oracle Corporation

-

Apple Inc.

-

VMware, Inc.

Recent Trends

-

In December 2024, Ellucian partnered with Prolifics Testing to accelerate the SaaS transformation of higher education in the UK, helping universities seamlessly transition to cloud-based Student Information Systems.

-

In December 2024, Workday launched its AI-powered student management system, Workday Student, in Australia and New Zealand to enhance student engagement and streamline administrative processes.

-

In September 2024, PowerSchool launched AI-driven solutions, PowerBuddy for College and Career, and PowerBuddy for Custom AI, to enhance college planning and streamline district information access. These tools aim to improve student engagement and communication within school communities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.73 Billion |

| Market Size by 2032 | USD 48.08 Billion |

| CAGR | CAGR of 18.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Service) • By Deployment (Cloud, On-premise) • By Application (Financial Management, Student Management, Admission & Recruitment, Student Engagement & Support, Others) • By End-Use (K-12, Higher Education) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Oracle Corporation, Ellucian, Workday, Inc., SAP SE, PowerSchool, Jenzabar, Inc., Skyward, Inc., Anthology Inc., Veracross, Blackbaud, Inc., Illuminate Education, Foradian Technologies, Beehively, Classe365, Gradelink, Rediker Software, FACTS Management, Campus Management Corp., OpenSIS, Focus School Software. |

| Key Drivers | • Data Analytics and AI Empower Educational Institutions to Improve Student Success and Decision Making • Regulatory Compliance Drives Demand for Robust Student Information Systems in Education Sector |

| RESTRAINTS | • Overcoming Integration Challenges and Skill Gaps Hindering the Expansion of Student Information Systems |