Industrial Data Management Market Report Scope & Overview:

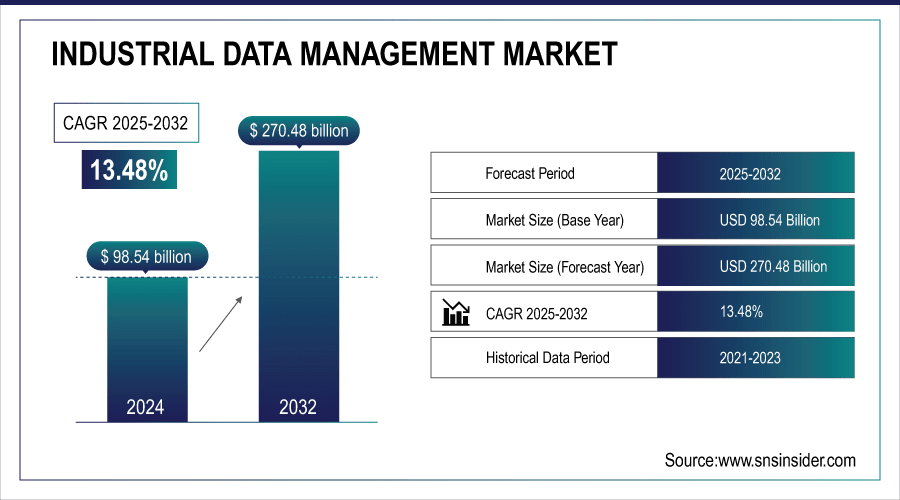

The Industrial Data Management Market size was valued at USD 98.54 Billion in 2024 and is projected to reach USD 270.48 Billion by 2032, growing at a CAGR of 13.48% during 2025-2032.

The Industrial Data Management Market is expanding due to the growing need for real-time data analytics, predictive maintenance and operation optimization is expected to boost the investments on data management platforms. With the advent of IoT, AI, and cloud computing, businesses can now store, process, and secure massive amounts of structured and unstructured data cost effectively. Moreover, strict government compliances and data governance are also contributing to the market’s growth.

Companies using advanced data management and analytics report up to 20–30% improvement in operational efficiency and 10–25% reduction in downtime.

To Get More Information On Industrial Data Management Market - Request Free Sample Report

Industrial Data Management Market Trends

-

AI, machine learning – easier than ever before applied to IoT The utilization of AI and machine learning in industries to make sense of IoT data is becoming a norm to make more informed and efficient decisions.

-

The use of real-time data analytics and predictive maintenance is becoming more common, minimizing downtime and improving overall performance.

-

The cloud and hybrid data management for industrial automation is providing flexible and economical access to manufacturing information and ensuring easily manageable integration and securing the industrial operations.

-

The manufacturing, energy, and logistics industries are some of the key industries driving market growth through digitization transformations and investments in data-enabled infrastructure.

-

Companies are using industrial data for supply chain optimization and expanding into new markets, providing new applications for creative uses.

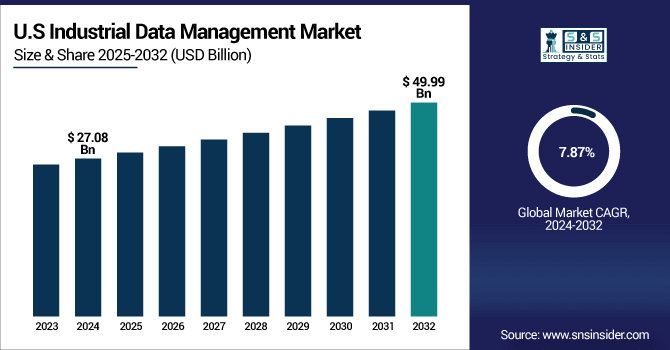

The U.S. Industrial Data Management Market size was valued at USD 27.08 Billion in 2024 and is projected to reach USD 49.99 Billion by 2032, growing at a CAGR of 7.87% during 2025-2032. Industrial Data Management Market growth is driven by increasing digitalization among major industrial verticals, such as manufacturing, energy, and logistics. With more organizations using Internet of Things (IoT) devices and sensors to gather volumes of operational data, the need for solid data management has never been more important. The evolution of robust analytics and AI capabilities for real-time insights, predictive maintenance, and process optimization improve productivity while minimizing time lost due to shut downs.

Increasing demand for centralized storage of data combined with features such as enhanced visualization tools is supplementing the market growth. Taken together, technological progress and regulatory and operational efficiency drivers are behind the U.S. market strong growth trajectory.

Industrial Data Management Market Segment Analysis

-

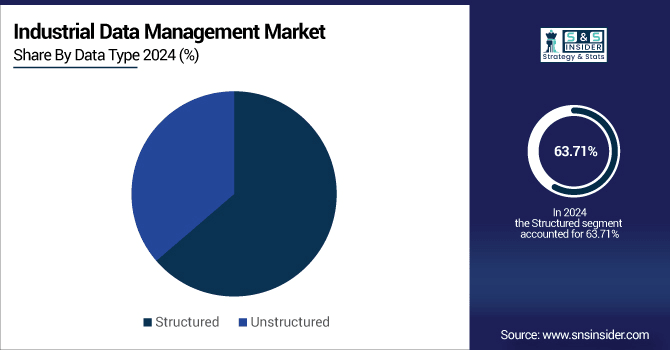

By Data Type, Structured dominated with ~63.71% share in 2024; Unstructured was the fastest growing with a CAGR of 14.01%.

-

By Type, Data Storage & Integration led with ~29.33% share in 2024; Data Orchestration & Analytics was the fastest growing segment with a CAGR of 14.43%.

-

By Application, Predictive Maintenance led with ~34.65% share in 2024; Supply Chain & Inventory Management was the fastest growing with a CAGR of 14.40%.

-

By End-User, Manufacturing & Processing held ~41.76% share in 2024; BFSI was the fastest growing with a CAGR of 14.35%.

By Data type, Structured Dominate While Unstructured Shows Rapid Growth

Based on data type, the Industrial Data Management market is led by Structured data segment, owing to its simpler storage, processing, and use in legacy systems, and it held the largest share in 2024. On the other hand, Unstructured data represents an exponentially growing data type, driven by the growth in IoT data, sensor streams, images, video and other non-traditional sources. Increasing use of AI, advanced analytics to help derive actionable insights from unstructured data.

By Type, Data Storage & Integration Leads Market While Data Orchestration & Analytics Registers Fastest Growth

Based on type, Data Storage & Integration segment dominates the Industrial Data Management market given the increasing demand for the centralized and effective data handling system in 2024. At the same time, Data Orchestration & Analytics is growing the fastest, fueled by increasing demand for real-time insights and advanced analytics in every sector. And the rapidly growing use of IoT, AI, and the cloud are driving faster adoption of these solutions.

By Application, Predictive Maintenance Lead While Supply Chain & Inventory Management Registers Fastest Growth

By application, Predictive Maintenance dominates the Industrial Data Management market space and it is expected to have the highest market share in 2024 because of its critical use in reducing equipment downtime and enhancing operational efficiencies. On the other hand, Supply Chain & Inventory Management maintains the highest growth, with the real-time visibility, forecast, and inventory control being in high demand across verticals. AI, IoT, and advanced analytics collaboration are fuelling adoption of these apps.

By End-User, Manufacturing & Processing Lead While BFSI Grow Fastest

Based on end-user, the Manufacturing & Processing segment dominates the Industrial Data Management market and is expected to lead the market in 2024 owing to the increasing adoption of smart manufacturing, predictive maintenance, and real-time operational analytics. At the same time, BFSI is seeing the highest growth, as data security and regulatory compliance (and analytics) for financial data grows in importance. The growth in these industries are also being propelled by cloud enabled and AI driven solutions.

Industrial Data Management Market Growth Drivers:

-

Rapid Adoption of AI, IoT, and Cloud Technologies Boosting Industrial Data Management Growth.

Market driver Growing adoption of AI, IoT and cloud solutions across industries for a full, detailed list, view our report. Productivity is getting a boost through real-time data analytics, predictive maintenance, and operational optimization. Business is spending on storage, integration and security projects. Increasing digital undergoing transformation activities by the manufacturing, energy, manufacturing, and logistics industries is driving the market expansion.

Companies using real-time data analytics report up to 25% improvement in production efficiency and 15–30% reduction in operational costs.

Industrial Data Management Market Restraints:

-

High Implementation Costs and Complexity Limiting Industrial Data Management Adoption

The main difficulty for small medium enterprises is the high costs and complexity of integration. Advanced infrastructure and personnel is needed to address the high volumes of both, structured and unstructured data. And here the things come to a standstill because of the IDS Legacy systems which are in the way to intuitive mentation of new IDM solutions. Regulatory and security concerns impose further operational costs.

Industrial Data Management Market Opportunities:

-

Increasing Demand for Real-Time Analytics and Predictive Insights Across Industries

Increasing acceptance of predictive maintenance, operational analytics, and supply chain optimization also provide market opportunities. The Cloud based and hybrid solutions provide scalability and economical qualities. With AI and machine learning in place, you can turn your industrial IoT data into actionable insights. The penetration Insights into new markets offer opportunity for innovative applications and market penetration.

Companies using predictive maintenance report 30–50% reduction in equipment downtime and 20–40% lower maintenance costs.

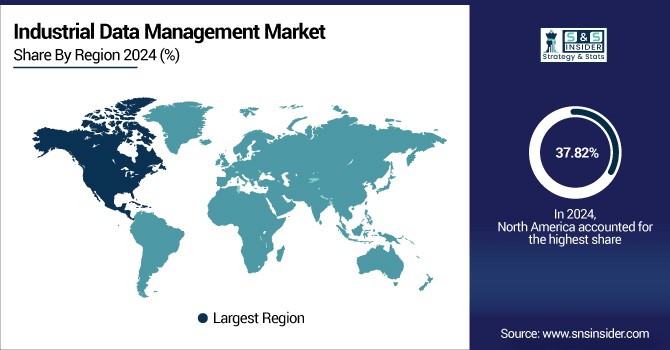

North America Industrial Data Management Market Insights

In 2024 North America dominated the Industrial Data Management Market and accounted for 37.82% of revenue share, this leadership is due to high penetration of advanced analytics, AI, and IoT solutions, significant presence of key industry players, as well as accelerated digitalization across manufacturing, energy and BFSI domains. Moreover, strict regulatory norms for data compliance along with increasing investments in cloud based solutions impart a significant edge to the global market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Industrial Data Management Market

The U.S. Industrial Data Management Market has dominated the global industry as there is widespread acceptance of AI, advanced analytics, and IoT in the manufacturing, energy, healthcare, and BFSI sector. Market growth is also driven by presence of world leading technology players, robust digital infrastructure and stringent regulatory compliance frameworks.

Asia-pacific Industrial Data Management Market Insights

Asia-pacific is expected to witness the fastest growth in the Industrial Data Management Market over 2025-2032, with a projected CAGR of 14.53% due to rapid industrialization, initiative expansion for smart manufacturing, growing adoption of IOT and cloud platforms, and government- backed digital transformation program. Moreover, increasing investments in the industry 4.0 technologies and increasing demand for real time data analytics in industries such as automotive, electronics, and energy is speeding up market growth in the region.

China Industrial Data Management Market

The China Industrial Data Management Market is growing at a faster pace, owing to high pace of industrial digitalization, increasing deployment of IoT, AI & big data platforms, and government initiatives, such as Made in China programmed. The adoption of Ethernet in the nation is being influenced by the strong manufacturing environment of the country, growth of smart factory and rising adoption of cloud-based factor.

Europe Industrial Data Management Market Insights

In 2024, Europe emerged as a promising region in the Industrial Data Management Market, due to strong regulations regarding the data governance, greater affinity of Industry 4.0, and investments across all digital infrastructure. To this were added key manufacturing centres and an increasing emphasis on sustainability-driven data solutions to shore up the regions market standing.

Germany Industrial Data Management Market

The Europe Industrial Data Management Market is growing due to increasing demand in industry 4.0 and the strict regulation imposed on data governance by regulatory bodies such as GDPR as well as the rise of IoT and cloud in the industry practices. A strong manufacturing base in countries like Germany, France, and the UK – plus increasing investment in digital infrastructure and data solutions driven by sustainability – is helping prop up the region.

Latin America (LATAM) and Middle East & Africa (MEA) Industrial Data Management Market Insights

The Industrial Data Management Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to slow pace in adoption of digital transformation initiatives, and increased investments in the oil & gas, energy, and manufacturing industries, and growing demand for advanced cloud-based data solutions. Small digital footprint, budget constraints and slower technology uptake in comparison to developed regions are some reason keeping the growth rates in check.

Industrial Data Management Market Competitive Landscape:

Microsoft is a leading manufacturer, worldwide, of Industrial Data Management utilizing the Azure cloud platform and AI based analytics and IoT connectivity for unparalleded data integration, storage, and visualization in real time for industry. Clear focus in three sectors—manufacturing, energy and BFSI—along with investment in cybersecurity, compliance, and hybrid cloud adoption underscores its leadership.

-

In June 2025, Microsoft extended its strategic partnership with Databricks, reinforcing its commitment to data + AI innovation on Azure. This collaboration includes tighter native integration between Azure Databricks, Azure AI Foundry, and Microsoft Power Platform, with new support for SAP Databricks on Azure. The move enhances organizations' ability to unify data management and AI within their industrial operations

Siemens is a leading presence in the global Industrial Data Management Market, offering innovative technologies through its IoT platforms, AI-based analytics and digital twin technologies. The company provides real-time data integration, visualization, and process optimization to manufacturing, energy and others industries. Siemens Industrial Copilot, Teamcenter Digital Reality Viewer and immersive engineering toolbox enhance operational efficiency and predictive intelligence.

-

In February 2025, Siemens unveiled its new Immersive Engineering toolset at CES 2025, developed in collaboration with Sony. This mixed-reality solution integrates Siemens NX software with Sony's head-mounted display, enabling high-fidelity, 3D-focused collaboration for product engineering and manufacturing.

Alphabet Inc. is one of the players in the Industrial Data Management Market, especially with its Google Cloud platform and AI-based analytics offerings. It provides real-time data gathering, processing and visualization for industrial operations in the manufacturing, energy and logistics segments. Predictive maintenance, process optimization, and operational efficiencies are supported by Alphabet offerings such as BigQuery, Vertex AI, and IoT Core.

-

In December 2024, Google Cloud partnered with Air France-KLM to implement generative AI technology across the airline's operations. This collaboration aims to analyze extensive data to enhance operational efficiency, predict aircraft maintenance needs, and optimize flight and airport operations.

Honeywell International Inc. is a key player in the Industrial Data Management Market, providing advanced products with its Honeywell Forge platform and the Experion Process Knowledge System (PKS). These systems allow for real-time incorporation of data, predictive analytics and process optimization applications within manufacturing / energy / industrial markets.

-

In May 2024, the company introduced Honeywell Forge Performance+ for Utilities, an AI-enabled software solution designed to enhance the digital transformation and modernization of utility grid assets. This platform integrates artificial intelligence, machine learning, and digital twin technologies to provide real-time insights, predictive analytics, and automation capabilities, thereby improving energy reliability and resiliency.

Industrial Data Management Market Key Players:

Some of the Industrial Data Management Market Companies are:

-

Microsoft

-

Siemens

-

Alphabet Inc.

-

Honeywell International Inc.

-

SAP

-

Hewlett-Packard Enterprise (HPE)

-

Oracle

-

DELL Inc.

-

IBM

-

Databricks

-

AWS Inc.

-

Palantir Technologies Inc.

-

Snowflake Inc.

-

ABB

-

Informatica Inc.

-

Cloudera

-

AVEVA Group Limited

-

Ataccama

-

Talend Inc.

-

Aspen Technology, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 98.54 Billion |

| Market Size by 2032 | USD 270.48 Billion |

| CAGR | CAGR of 13.48% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Data Orchestration & Analytics, Data Storage & Integration, Data Sharing, Data Security, Data Visualization, and Data Governance & Compliance) • By Data Type (Structured and Unstructured) • By Application (Predictive Maintenance, Asset Monitoring & Optimization, Real-Time Operational Analytics, Manufacturing Process Optimization and Supply Chain & Inventory Management) • By End-User (Manufacturing & Processing, BFSI, Energy & Utilities, Logistics & Supply Chain and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Microsoft, Siemens, Alphabet Inc., Honeywell International Inc., SAP, Hewlett-Packard Enterprise (HPE), Oracle, DELL Inc., IBM, Databricks, AWS Inc., Palantir Technologies Inc., Snowflake Inc., ABB, Informatica Inc., Cloudera, AVEVA Group Limited, Ataccama, Talend Inc., Aspen Technology, Inc. |