Subsea Well Access System Market Report Scope & Overview:

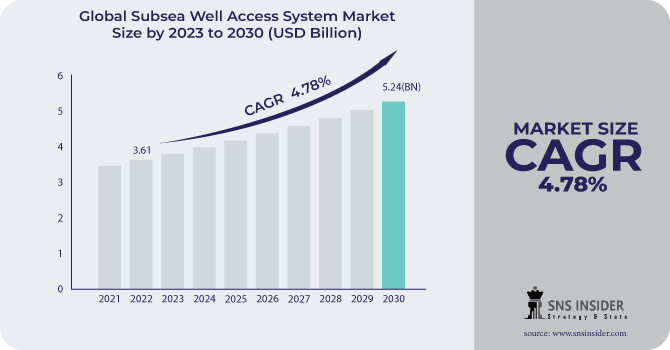

The Subsea Well Access System Market size was valued at USD 3.61 billion in 2022 and is expected to grow to USD 5.24 billion by 2030 and grow at a CAGR of 4.78 % over the forecast period of 2023-2030.

The market for subsea good access systems is largely driven by aging offshore fields and declining oil and gas production from reserves. A growing trend in the oil and gas production industry that represents a significant departure from conventional techniques of production is the shift toward subsea areas. Parts of the subsea environment are found in uncharted and isolated regions of the planet. Working in such a setting makes intervention and monitoring very challenging. It presents particular difficulties for both businesses and employees in terms of the environment.

To Get More Information on Subsea Well Access System Market - Request Sample Report

For wellhead systems and oil well digging offshore, subsea well access systems handle many technologies that are organized into a portfolio. Since more people are becoming aware of the safety risks associated with oil field work, the global upstream oil sector is observing strict regulations relating to oil spill prevention and rig tools management. For instance, the deepwater horizon oil leak accident spurs strict safety regulations for the offshore industry to prevent future oil spillage incidents.

MARKET DYNAMICS

KEY DRIVERS:

-

Increasing need for deepwater oil and gas production

-

Increasing investment by rising economies

-

Growing petrochemical consumption

-

Increasing oil exploration activities

RESTRAIN:

-

Oil price volatility

The market price of oil is a crucial problem for the subsea oil production sector. The economics of oil production and oilfield development can be disrupted when circumstances outside the control of producing firms influence oil prices often. A long-term decline in oil prices is possible since subsea production includes comparatively higher expenses for exploration, drilling, production, and transport. Prices may be more detrimental to offshore production than to traditional onshore production. E&P tasks in offshore wells take a lot of time.

OPPORTUNITY:

-

New offshore discoveries

-

Demand for heavy intervention system in the aging subsea wells

-

Use of offshore inventions

Rig-based systems can be further classified into complete workover riser and landing string systems. However, the rig-based well access technique, which is expensive and time-consuming, is anticipated to provide plenty of chances for rig-less technologies. Additionally, the expected rise in energy consumption will need the use of offshore interventions.

CHALLENGES:

-

Maintaining and manufacturing of the subsea systems equipment

-

High-temperature invention

IMPACT OF RUSSIAN-UKRAINE WAR

The dispute may cause supply chains for subsea well access systems to be interrupted. These systems frequently include intricate engineering and parts from other nations. Subsea well access system production, shipping, and installation can all be delayed by supply chain disruptions, especially if they include Russia or Ukraine. Timelines for projects and the general effectiveness of offshore drilling operations may be impacted by this. Regulation changes and geopolitical tensions Regulations in the offshore oil and gas industry may alter, and there may be more monitoring as a result of geopolitical tensions brought on by the conflict. Subsea operations, safety requirements, and environmental issues may be subject to harsher government laws. Operators may need to modify their subsea well access systems to comply with new regulations, which might raise compliance costs.

KEY MARKET SEGMENTATION

By Technology

-

Rig based

-

Rig less

By Product

-

Annular BOP

-

Ram BOP

By Location

-

Shallow Water

-

Deepwater

-

Ultra-Deepwater

.png)

Do You Need any Customization Research on Subsea Well Access System Market - Enquire Now

REGIONAL ANALYSIS

The markets for subsea well access systems in North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa may be divided based on geography.

The maturation of offshore oilfields in the Gulf of Mexico will likely cause North America to dominate the worldwide subsea well access system market throughout the projected period. Additionally, recent shale finds in Mexico and Canada are anticipated to present the industry in the area with enormously attractive opportunities.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The Major Players are Drill-Quip Inc., GE Oil & Gas, Aker Solutions, FMC Technologies Inc., OneSubsea, Halliburton, Weatherford International Ltd., Dril-Quip, Oceaneering International, Proserv Group, Kongsberg Oil and Gas Technologies, and other players

Aker Solutions-Company Financial Analysis

| Report Attributes | Details |

| Market Size in 2022 | US$ 3.61 Bn |

| Market Size by 2030 | US$ 5.24 Bn |

| CAGR | CAGR of 4.78 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Rig based, Rig less) • By Product (Annular BOP, Ram BOP) • By Location (Shallow Water, Deepwater, Ultra-Deepwater) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Drill-Quip Inc., GE Oil & Gas, Aker Solutions, FMC Technologies Inc., OneSubsea, Halliburton, Weatherford International Ltd., Dril-Quip, Oceaneering International, Proserv Group, Kongsberg Oil and Gas Technologies |

| Key Drivers | • Increasing need for deepwater oil and gas production • Increasing investment by rising economies • Growing petrochemical consumption • Increasing oil exploration activities |

| Market Restraints | • Oil price volatility |