Textile Finishing Agents Market Report Scope & Overview:

Get more information on Textile Finishing Agents Market - Request Sample Report

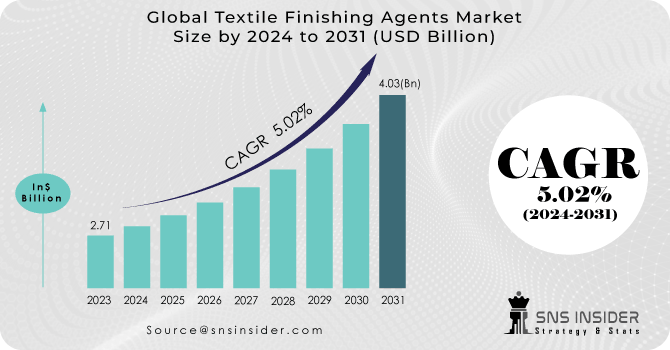

The Textile Finishing Agents Market Size was valued at USD 2.7 Billion in 2023 and is expected to reach USD 4.1 Billion by 2032, growing at a CAGR of 5.1% over the forecast period of 2024-2032.

The Textile Finishing Agents Market is dynamic with innovation-based performance and functionality improvements. This report is developed with a sustainability focus, reporting on the ecological finishes and dynamics of the supply chain, material sourcing, and consumer demand for specialty finishes. It further comprises cost structure details, patent analysis, and R&D trends. Technological uptake and investments will be discussed as to how innovations will drive market growth and determine prospects for textile finishing agents.

Market Dynamics

Drivers

-

Increasing demand from end-user industries like apparel, automotive, and home textiles drives market expansion

The growing demand in the main end-user industries, including apparel, automotive, and home textiles, is thus benefiting the textile finishing agents market. Consumers of apparel are increasingly demanding wrinkle-resistant, breathable, and water-repellent textiles, hence the increased application of specialized finishing agents. The automotive sector also contributes considerably to market growth since it calls for textiles to have particular properties like flame retardance, durability, and UV protection. The home textiles segment, meanwhile, witnesses increased demand for finishes that could deliver stain resistance, anti-bacterial, and easy-care properties. As the various industries continue to expand and transform, demand for high-quality textile finishes goes up, contributing to the advanced finishing agents in question. Textile finishes have multiple applications in various industries. This helps the market to continue growing steadily as different sectors stay strong.

Restraints

-

Rising Operational Costs for Manufacturers Due to Stringent Environmental Regulations

Chemical-intensive processing in the final stages of producing textiles may indeed leave significant traces on the environment. This explains why many government agencies and related regulatory authorities enact tough regulations concerning the textile sector's minimal footprint on the ecology. Such tough regulations have pressed the industry into more eco-friendly alternatives while significantly raising operational expenses for the producer. Compliance with REACH, GOTS, or OEKO-TEX standards, for example, may involve costly cleaner technologies, waste management systems, and eco-friendly raw materials that are relatively more expensive. The extra load of compliance under these regulations along with the burden of continuous monitoring and certification creates a cost barrier and may impact the profitability of manufacturers, particularly smaller ones. This regulatory pressure might, therefore serve as a constraining force behind the growth in the textile finishing agents market.

Opportunities

-

Growing demand for functional textiles opens new market opportunities for advanced finishing agents

The increasing demand for functional textiles among consumers is an exciting opportunity for the textile finishing agents market. These textiles, which provide added benefits such as antimicrobial properties, moisture-wicking capabilities, and stain resistance, are increasingly being used in various sectors such as healthcare, sportswear, and protective clothing. With the focus of industries on performance-driven textiles, there is a growing need for specialized finishing agents to enhance fabric properties. Manufacturers can take advantage of this trend by providing applied finishes that exactly answer the needs of each application. This emerging trend for multifunctional textiles not only opens up new market opportunities but also stimulates innovation within the textile finishing agents sector. Companies that successfully tap into the demand for advanced textiles are poised to reap huge market shares and further incite long-term growth.

Challenge

-

Difficulty in meeting consumer expectations for sustainable and high-performance textiles

Balancing consumer demands for sustainable products and the need for high-performance finishes is a significant challenge in the textile finishing agents market. The demand for products that are at once eco-friendly and functional with properties such as water resistance, flame retardancy, and durability is on the rise among consumers. It can be challenging to create finishes that meet these expectations while remaining environmentally friendly. Many of the high-performance agents use formulations that may not be environmentally friendly or may contain toxic components; therefore, the performance comes with a compromise for sustainability. Innovation pressure for such manufacturers leads them to create desired functionality without compromising on their environmental responsibility. This may often be an extremely complex and expensive challenge.

Segmental Analysis

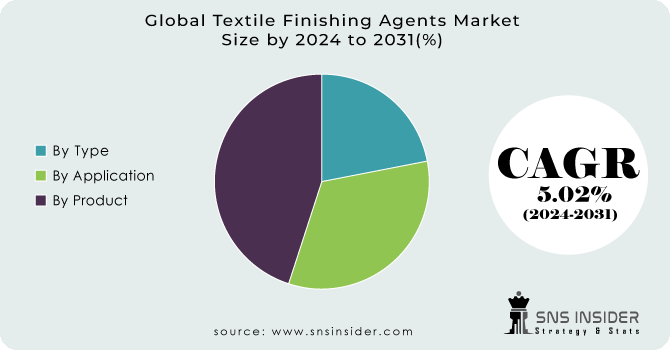

By Type

In 2023, functional textile finishing agents dominated the textile finishing agents market, with about 60% of the total market share. This dominance can be ascribed to the rising demand for textiles possessing improved functionalities such as water repellency, flame retardancy, and antimicrobial properties. The sectors of apparel, automotive, and home textiles are increasingly adopting such functional finishes to fulfill consumer expectations of high-performance materials. This has been seen as the automotive segment requires flame-resistant textiles for security purposes. Thereby, its demand is functional finishing agents, and in like manner, there is the textile industry, in which apparel businesses seek water-resistant finishes for longer durability and easier use of garment products.

By Product

In 2023, water-repellent and soil-resisting agents dominated the market with more than 35% market share. These agents are the mainstay for generating textiles with superior durability and low maintenance, which are sought after in numerous applications. For example, in the apparel industry, garments are treated with water-repellent finishes, this ensures that consumers get garments that resist water and stains which results in a prolonged lifetime of a product and customer satisfaction. Likewise, in upholstery and curtains, the finishes ensure that the fabric retains its aesthetic appeal and functionality with use. Increasing consumer demand for textiles that are low potable and highly durable has significantly impacted the market for water and soil-repellent agents.

By Application

The apparel segment dominated the textile finishing agents market in 2023, with a market share of around 48%. This is because of the high demand for textiles with enhanced properties such as water resistance, flame retardancy, and antimicrobial features, which consumers increasingly demand. For example, the outdoor and activewear trend is on a roll, thereby driving demand for garments that can be water-repellent and durable, giving way to consumers' high-performance clothing requirements. In addition, the apparel industry is moving toward sustainable and functional textiles, thereby driving the demand for advanced finishing agents that fulfill the evolving needs of consumers. The continuous innovation in textile finishes for comfort, safety, and performance would be one of the primary drivers for growth in this segment.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Analysis

In 2023, Asia Pacific dominated and accounted for the largest share of the Textile Finishing Agents Market at about 32%. The major countries for textile manufacturing such as China, India, Bangladesh, and Vietnam, collectively contribute a large share of global textile products production and exports and dominate this sector. The textile industry, large and expanding in China, coupled with its manufacturing infrastructure, logistics, and low-cost labor drives the country to the top. Government initiatives such as the "Atmanirbhar Bharat" and PLI schemes aid India's textile sector by increasing production. Low-cost manufacturing in Bangladesh is another important factor. Textile finishing agents are widely produced in these countries to comply with global quality standards and evolving sustainability regulations, which is anticipated to drive the demand for various finishes, such as water-repellent and flame-retardant agents. Textile export volume in China exceeded $150 billion in 2022, resulting in huge demand for advanced finishes. Such investments, including India’s recent $1.3 billion push to boost production and exports under the new National Textile Policy, also buttress the region’s growth. This surge in demand for functional and aesthetic finishes contributes to the regional supremacy of APAC.

Recent Highlights

-

August 2024: BASF has announced a collaboration with Stockmeier Urethanes USA, Inc., to develop sustainable polyurethane surfacing products for use in playgrounds and recreational applications. This synergistic effort, in the partnership sector, also promotes sustainable development solutions to minimize environmental footprint by switching to renewable inputs.

-

March 2024: Archroma introduced a new fixation agent to increase the wet fastness of textiles in an effort to increase fabric resistance to washing and exposure to water. This innovation is in line with the company’s sustainable textile solutions focus.

Key Players

-

AB Enzymes (Biofinishing Enzymes, Textile Enzyme Preparations)

-

Archroma (Color of Nature, EcoFast Pure)

-

BASF SE (Rohovit, AcROmote)

-

BioTex Malaysia (BioTex Super, EcoWash)

-

Dow (Dow Corning Textile Finishing, Repel-O-Tex)

-

DyStar Singapore Pte Ltd. (Dystar Textile Chemicals, Levafix)

-

Evonik Industries (TEGO Cera, TEGO Resist)

-

Fineotex Chemical Ltd. (FinoSoft, FinoClear)

-

Huntsman International LLC (Noflam, Noflam NEO)

-

Kemin Industries Inc. (Kemin Finish, Kemin Touch)

-

Lubrizol Corp. (Lubrizol Textile Solutions, Texcare)

-

Organic Dyes and Pigments LLC (ODP-DyeFix, ODP-Finish)

-

Resil Chemicals Pvt. Ltd. (Resil R-129, Resil Soft)

-

Sarex (Sarex CSM, Sarex Softener)

-

Sumitomo Chemicals (Sumithix C, Sumisoft)

-

Synthomer plc (Acrysol EM, Synocure)

-

Tiarco Chemical (Tiarco Finish, Tiarco Water Repellent)

-

Transfar Chemical (Transfar Water Repellent, Transfar Softener)

-

Wacker Chemie AG (Silres BS, Wacker Silicone Emulsions)

-

Zydex Group (Zydex Finish, Zydex Soft)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.7 Billion |

| Market Size by 2032 | USD 4.1 Billion |

| CAGR | CAGR of 5.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Aesthetic, Functional) •By Product (Water-Repellent & Soil Resisting Agents, Flame-Retardant, Softeners, Antibacterial & Antimicrobial, Fragrance Agents, Others) •By Application (Apparel, Home Textiles, Technical Textiles, Automotive Textiles, Industrial Textiles, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Dow, Huntsman International LLC, Archroma, DyStar Singapore Pte Ltd., Synthomer plc, Lubrizol Corp., Kemin Industries Inc., Fineotex Chemical Ltd., Zydex Group and other key players |