Underfloor Heating Market Report Scope & Overview

Get more information on Horticulture Lighting Market - Request Sample Report

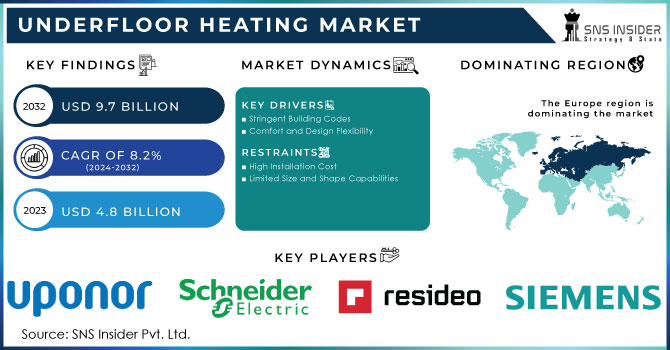

The Underfloor Heating Market Size was valued at USD 4.8 billion in 2023 and is expected to reach USD 9.7 billion by 2032 and grow at a CAGR of 8.2 % over the forecast period 2024-2032.

The growth of underfloor heating is due to its energy efficiency, comfort, design flexibility, zoning options, improved indoor air quality, technological advances, and environmental sustainability and modernization opportunities. Together, these factors have led to the widespread use of underfloor heating in residential and commercial spaces.

Underfloor heating boasts efficiency ratings of around 80%, compared to traditional radiators at 60-65%. This leads to significant energy cost savings. For instance, a study by the European Commission found that underfloor heating can reduce energy consumption for space heating by 10-30%. As people's disposable income increases, they are more likely to invest in home improvement projects that enhance comfort and energy efficiency. Underfloor heating can be seen as a luxury upgrade that delivers on both fronts. The global population is aging, and there's a growing demand for senior-friendly housing solutions. Underfloor heating offers a safe and comfortable heating option, especially for those with mobility limitations.

MARKET DYNAMICS:

KEY DRIVERS:

-

Stringent Building Codes

-

Comfort and Design Flexibility

Underfloor heating provides a more even heat distribution throughout the room, eliminating cold spots and drafts. Additionally, it frees up wall space typically occupied by radiators, offering greater design flexibility. A 2020 survey by the National Association of Home Builders (NAHB) revealed that 68% of custom home builders reported an increased demand for radiant heating systems, which includes underfloor heating

RESTRAINTS:

-

High Installation Cost

-

Limited Size and Shape Capabilities

When installing underfloor heating systems, various flooring and installation problems can arise that affect the efficiency and functionality of the system. Compatibility with different floor materials is crucial, as certain types, such as thick carpets or certain types of wood, can prevent heat transfer or require additional insulation. Subfloor pretreatment is essential to ensure even heat distribution, as uneven or damaged subfloors can create hot spots or cold areas. Design considerations such as room size, shape and insulation must be taken into account to achieve optimum efficiency and avoid uneven heating due to poor system design or insufficient coverage. Integrating underfloor heating into existing buildings is a challenge that requires modifications and careful planning to harmonize without interfering with plumbing or electrical systems.

OPPORTUNITIES:

-

Integrating underfloor heating with smart home technologies offers remote control, scheduling, and further efficiency optimization.

An IoT-compatible underfloor heating system integrates Internet of Things (IoT) technology into underfloor heating systems. With IoT, users can remotely control and monitor their underfloor heating systems using smartphones, tablets or other devices. It allows convenient access to temperature settings, timing and real-time energy usage monitoring. Smart thermostats and sensors, IoT integration enables the use of smart thermostats and Sensors that collect real-time data on temperature, humidity and occupancy. These devices provide accurate feedback and enable intelligent heating control based on user preferences and environmental conditions. With IoT-compatible underfloor heating, energy optimization is possible through advanced algorithms that analyse data and adjust heating power accordingly.

CHALLENGES:

-

Consumer Perception of High Maintenance

The misconception about the complexity of underfloor heating upkeep can be a significant hurdle to wider adoption. Modern underfloor heating systems use high-quality, long-lasting pipes embedded within concrete or subfloors. These are designed to last for decades without needing replacement. Similar to any system, periodic checks are recommended. This might involve a qualified professional inspecting the system every 5-10 years to ensure proper operation and identify any potential minor issues before they escalate. However, these checks are not complex or overly frequent.

IMPACT OF RUSSIA-UKRAINE WAR

Russia is a major supplier of raw materials like nickel, copper, and steel, all these crucial components in underfloor heating systems. Sanctions and disruptions due to the war can lead to Price Increases, Production Delays, and Energy Price Fluctuations, the war has caused significant volatility in the global energy Market, with natural gas prices surging. This can impact the attractiveness of underfloor heating, which often relies on efficient gas boilers. If natural gas prices remain high, some consumers might opt for alternative, potentially less efficient heating solutions due to perceived higher running costs of underfloor heating. on the other hand, the war has highlighted Europe's dependence on Russian energy supplies. This could lead to a renewed focus on energy efficiency in buildings, potentially benefiting the underfloor heating market due to its efficiency advantages.

IMPACT OF ECONOMIC SLOWDOWN

Economic slowdowns often see a decline in new construction projects. Since underfloor heating is often integrated during the building phase, this can significantly impact market demand. Obtaining financing for home improvement projects, including underfloor heating installations, can become more difficult during an economic slowdown due to strict lending criteria by banks. In some cases, homeowners seeking to save money on energy bills during an economic slowdown might be drawn to the long-term energy-saving benefits of underfloor heating. However, the high upfront cost might still be a deterrent. Overall, an economic slowdown is likely to have a negative impact on the underfloor heating market. The industry might experience a decline in demand, sales, and potentially even job losses.

KEY MARKET SEGMENTS:

By Offerings

-

Hardware

-

Services

Based on Offerings, the Services segment will grow at the highest CAGR during the forecast period 2024-2031. Underfloor heating services include installation, maintenance, repair, renovation, and energy efficiency consulting. As underfloor heating has grown, so has the demand for these services. Industrial specialists are expanding their offer to meet the growing needs of customers looking for efficient and comfortable heating solutions.

By Product Type and Component

-

Hydronic Underfloor heating (wet system)

-

Heating Pipes

-

Thermostats and Sensors

-

Thermal Actuators

-

Zone Valves

-

Wiring Centres

-

Manifold and Valves

-

-

Electric Underfloor heating (dry system)

-

Heating Cables

-

Heating Cables

-

Thermostat and Sensors

-

By Installation Types

-

Retrofit installations/Existing building

-

New Installations/ New Building

By Application

-

Industrial

-

Healthcare

-

Sports & Entertainment

-

Residential

-

Commercial

-

Others

Based on Application, Residential applications are expected to register the highest CAGR during the forecast period 2024-2031. The growth of residential floor heating is driven by its comfort, energy efficiency, design flexibility, zoning options, compatibility with different floor types, improved indoor air quality and integration with smart home. technology These factors have led to its growing popularity among homeowners who prefer a comfortable, energy-efficient and customizable home heating solution.

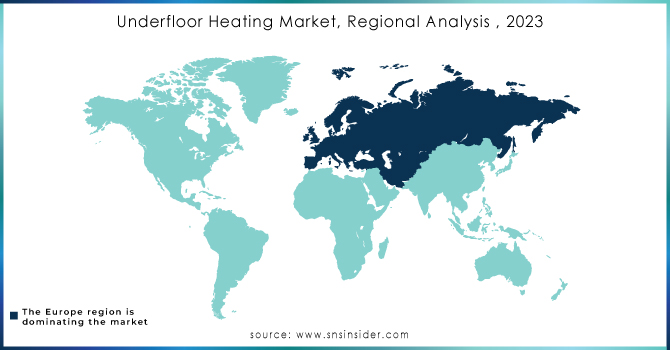

REGIONAL ANALYSES

Europe is expected to lead the global underfloor heating market with highest CAGR during the forecast period 2024-2031. this growth due to its focus on energy efficiency, comfort, and sustainability. Factors like retrofitting capabilities, easy integration with renewable energy sources, and compliance with stricter building regulations are driving widespread adoption in both residential and commercial applications. The UK and Germany are established leaders, but Eastern European countries also hold promise. Alongside international giants like Uponor and Resideo, prominent European players are shaping the market. With growing consumer preference for comfort and rising government support for energy-efficient solutions, Europe's underfloor heating market is poised for continued expansion. For eg. In February 2024, The European Commission announced a new initiative promoting the adoption of energy-efficient building technologies, including underfloor heating, with a goal of reducing energy consumption in buildings by 20% by 2031.

Need any customization research on Underfloor Heating Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

The major key players are Siemens Ag (Germany), Resideo Technologies Inc. (US), Schneider Electric (France), Incognito Heat Co. (Scotland), Uponor Corporation (Finland), nVent Electric Plc (UK), Warmup (UK), Rehau Ltd (Switzerland), Emerson Electric Co. (US), Robert Bosch Gmbh (Germany), Danfoss (Denmark), Mitsubishi Electric Corporation (Japan), and other key players.

RECENT DEVELOPMENT

In January 2024, LG Electronics (South Korea) unveiled a new line of underfloor heating mats featuring self-regulating technology for optimal heat distribution and improved energy efficiency.

In January 2023, Resideo Technologies delivered its industry-leading Honeywell Home evohome smart thermostat to British national housebuilder Bellway. Resideo Technologies specializes in comfort, heat and security solutions and its Honeywell Home evohome system was selected for its intelligent zoning technology. This technology uses radiator controllers to wirelessly measure and adjust the temperature of up to twelve individual zones covering nine rooms, twelve radiators and three underfloor heating zones.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.8 Billion |

| Market Size by 2032 | US$ 9.7 Billion |

| CAGR | CAGR of 8.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Services) • By Product Type and Component (Hydronic Underfloor heating, Electric Underfloor heating) • By Installation Types (Retrofit installations/Existing building, New Installations/ New Building) • By Application (Industrial, Healthcare, Sports & Entertainment, Residential, Commercial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Upono, Honeywell, Vent Electric, Warmup, Rehau, Emerson Robert Bosch, Danfoss, Pentair, Mitsubishi Electric, Siemens, Schneider Electric and Other. |

| Key Drivers | • Government support • Adoption of SSL Technology. |

| RESTRAINTS | • Huge installation cost. • Cultivating a limited number of agronomic traits. |