Biosensors Market Size & Trends:

The Biosensors Market Size was valued at USD 27.84 Billion in 2023 and is expected to reach USD 56.54 Billion by 2032 and grow at a CAGR of 8.2% over the forecast period 2024-2032.

The Biosensors Market has experienced significant growth over the past few years and is expected to continue its expansion due to increasing advancements in healthcare, agriculture, food safety, and environmental monitoring. Biosensors are analytical devices that combine a biological component, such as enzymes, antibodies, or cells, with a physicochemical detector to measure a specific substance or process. These sensors have become indispensable in a variety of applications ranging from medical diagnostics to environmental monitoring and food quality testing.

Get more information on Biosensors Market - Request Sample Report

The increasing demand for point-of-care (POC) testing, as consumers and healthcare providers seek rapid, convenient diagnostic solutions outside of traditional laboratories. The rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer is further fueling this demand, as biosensors offer continuous monitoring and early detection, crucial for managing these health issues.

Additionally, the growing emphasis on personalized healthcare solutions is propelling the need for real-time, patient-specific data, which biosensors can deliver. The expansion of biosensor applications beyond healthcare, such as in agriculture, food safety, and environmental monitoring, is broadening the market's potential. These combined factors are contributing to the rapid growth and diversification of the U.S. biosensors market, positioning it as a dynamic and critical sector for future advancements in healthcare and other industries.

Biosensors Market Dynamics

Key Drivers:

-

Rising Demand for Point-of-Care Diagnostics and Real-Time Monitoring Solutions Drives the Growth of the Biosensors Market

The increasing demand for point-of-care (POC) diagnostics is one of the major growth drivers of the biosensors market. With advancements in healthcare technologies, the need for quick, accurate, and accessible testing has grown significantly, especially for patients requiring continuous monitoring. Biosensors provide rapid results, enabling healthcare professionals to make timely decisions, which is crucial for patients with chronic conditions like diabetes, cardiovascular diseases, and infectious diseases.

This shift toward decentralized testing, where patients can test outside of medical facilities, empowers individuals with the ability to monitor their health regularly, improving long-term management and outcomes. Additionally, the rise in health-conscious individuals and the need for personalized healthcare solutions are further propelling the adoption of biosensors in various healthcare applications, such as early diagnosis, disease prevention, and management.

-

Technological Advancements in Biosensor Materials and Integration with Digital Health Platforms Drive Market Expansion

Technological innovations in biosensor materials and detection technologies are significantly advancing the biosensor market. These developments are making biosensors more efficient, cost-effective, and applicable across various industries. For instance, the integration of nanotechnology and the use of advanced sensor materials have enhanced the sensitivity, specificity, and portability of biosensors. These innovations enable biosensors to detect even the smallest biological changes, making them suitable for a wider range of applications, including medical diagnostics, environmental monitoring, and food safety.

Furthermore, the integration of biosensors with digital health platforms, such as mobile apps and cloud-based systems, has made real-time data collection and analysis more accessible to both consumers and healthcare providers. Wearable biosensors are now able to communicate with smartphones and other devices, enabling users to track their health data seamlessly. This connectivity facilitates personalized healthcare, as data from biosensors can be used for continuous monitoring, remote consultations, and even predictive health analytics.

Restrain:

-

High Manufacturing Costs and Complex Regulatory Approvals Pose Challenges for Biosensors Market Growth

Despite the promising growth prospects of the biosensors market, one of the major challenges hindering its expansion is the high manufacturing costs associated with biosensor production. Developing advanced biosensors often involves complex materials and technologies, such as nanotechnology, which can significantly increase production expenses. These high costs are particularly challenging for small and medium-sized companies that may lack the resources to scale up production.

Another significant barrier to market growth is the complex regulatory approval process for biosensor devices, especially in highly regulated industries like healthcare and food safety. Biosensors, particularly medical devices, must undergo stringent testing and approval procedures set by regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The lengthy and costly approval process can delay the time-to-market for new biosensor technologies, reducing the pace at which innovations reach consumers.

Biosensors Market Segmentation Analysis

By Product

In 2023, the Non-Wearable Biosensors segment accounted for the largest market share, with a revenue share of 64.00%. This dominance is largely due to the extensive application of non-wearable biosensors in medical diagnostics, environmental monitoring, and food safety. Non-wearable biosensors, such as glucose meters, pregnancy tests, and diagnostic test kits, have become integral in healthcare due to their high accuracy and ease of use.

For example, companies like Abbott Laboratories have launched advanced glucose monitoring systems, such as the Freestyle Libre, which offers accurate blood glucose measurement without the need for multiple daily finger pricks.

The Wearable Biosensors segment is experiencing the largest CAGR of 8.89% within the forecasted period, reflecting growing consumer and healthcare interest in continuous, real-time health monitoring solutions. Wearable biosensors, which include devices like smartwatches, fitness trackers, and medical monitoring devices, are revolutionizing personal healthcare by enabling individuals to track vital health metrics such as heart rate, blood oxygen levels, and glucose levels.

By Application

In 2023, the Medical Testing Application segment dominated the biosensors market with a substantial revenue share of 42.00%. This dominance is driven by the increasing need for rapid, accurate, and cost-effective diagnostic solutions in healthcare. Biosensors play a critical role in monitoring disease biomarkers, managing chronic conditions like diabetes, and enabling early detection of various health issues.

For instance, Abbott Laboratories launched the Freestyle Libre 3, a continuous glucose monitoring (CGM) system, which provides real-time glucose data without the need for finger pricks, revolutionizing diabetes management.

The Agricultural Testing Application segment is witnessing the largest compound annual growth rate (CAGR) of 10.75% within the forecasted period. This growth is attributed to the rising need for sustainable farming practices, enhanced crop yields, and efficient resource utilization in agriculture. Biosensors in agriculture are increasingly used for detecting soil conditions, monitoring crop health, and ensuring food safety by detecting pathogens or contaminants.

For example, companies like Agilent Technologies have developed biosensor technologies used to measure various environmental parameters and soil quality, enabling farmers to make data-driven decisions to optimize agricultural output.

Biosensors Market Regional Outlook

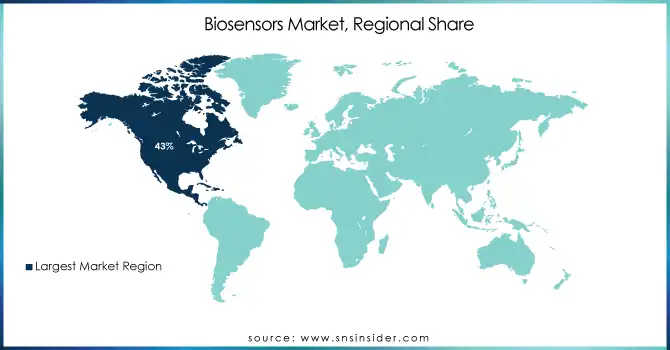

In 2023, North America dominated the biosensors market, holding a significant share of approximately 43%. This dominance is attributed to the region’s advanced healthcare infrastructure, technological innovations, and strong demand for diagnostic solutions. The United States, in particular, plays a key role, with its well-established medical device industry and growing adoption of biosensor technologies for both medical and non-medical applications.

Additionally, North America benefits from substantial investments in research and development (R&D) in biosensor technologies, as well as government support through initiatives like the U.S. Food and Drug Administration (FDA) approvals, which streamline the introduction of new biosensor products into the market.

In 2023, the Middle East & Africa (MEA) region emerged as the fastest-growing region in the biosensors market, with an estimated CAGR of 10.34%. This rapid growth can be attributed to several factors, including an increasing emphasis on healthcare improvements, rising chronic disease incidences, and growing government investments in healthcare infrastructure.

For instance, the Saudi government has been investing in health tech to modernize the healthcare infrastructure, and initiatives such as "Vision 2030" are prioritizing technological integration into healthcare systems.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in the Biosensors Market are:

-

Bio-Rad Laboratories Inc. (Droplet Digital PCR System, Bio-Plex Multiplex Immunoassays)

-

Medtronic (Guardian Connect Continuous Glucose Monitoring System, Enlite Sensor)

-

Miltenyi Biotec (MACSQuant Analyzer, CliniMACS Prodigy)

-

Intricon Corporation (Micro-Medical Sensors, Integrated BioMonitors)

-

Abbott Laboratories (FreeStyle Libre, i-STAT System)

-

Biosensors International Group, Ltd. (BioMatrix Alpha, BioMatrix NeoFlex)

-

Pinnacle Technologies Inc (FlexiForce Sensors, Capacitive Pressure Sensors)

-

Ercon, Inc. (Conductive Inks, Thick Film Biosensor Materials)

-

DuPont Biosensor Materials (Kapton Polyimide Films, Intexar Smart Sensors)

-

Johnson & Johnson (OneTouch Verio Reflect, Thermocare Smart Temperature Sensor)

-

Koninklijke Philips N.V. (IntelliVue Guardian Solution, Lumify Handheld Ultrasound)

-

LifeScan, Inc. (OneTouch Ultra, OneTouch Verio IQ)

-

QTL Biodetection LLC (Rapid Pathogen Detection Kits, Handheld Bio-Sensors)

-

Molecular Devices Corp. (SpectraMax iD3 Microplate Reader, FLIPR Penta High-Throughput Cellular Screening System)

-

Nova Biomedical (StatStrip Glucose Meter, Lactate Plus Analyzer)

-

Molex LLC (Temp-Flex Micro-Coaxial Cables, Premo-Flex Cable Jumpers)

-

TDK Corp. (Micronas Hall Sensors, TMR Angle Sensors)

-

Zimmer & Peacock AS (Screen-Printed Electrodes, Glucose Sensors)

-

Siemens Healthcare (ADVIA Centaur XP Immunoassay System, RAPIDPoint 500e Blood Gas System)

Recent Trends

-

In February 2023, Miltenyi Biotec acquired Lino Biotech AG, a leader in the development of innovative biosensors aimed at enhancing quality control in bioprocessing, measuring viral load in cell and gene therapy production, and testing for off-target responses in living cells to aid drug discovery.

-

In January 2023, Intricon Corporation, known for its development and manufacturing of medical devices powered by advanced miniaturized electronics, launched a new Biosensors Center of Excellence (CoE). This center is dedicated to advancing the integration of biosensor devices into the medical industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 27.84 Billion |

| Market Size by 2032 | USD 56.54 Billion |

| CAGR | CAGR of 8.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Wearable Biosensors, Non-Wearable Biosensors) • By Type (Sensor Patch, Embedded Device) • By Technology (Piezoelectric Biosensors, Thermal Biosensors, Electrochemical Biosensors, Optical Biosensors, Nanomechanical Biosensors) • By Application (Medical Testing, Industrial Process, Agricultural Testing, Home Diagnostics, Research Labs, Environmental Monitoring, Food & Beverages, Biodefense) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bio-Rad Laboratories Inc., Medtronic, Abbott Laboratories, Biosensors International Group, Ltd., Pinnacle Technologies Inc., Ercon, Inc., DuPont Biosensor Materials, Johnson & Johnson, Koninklijke Philips N.V., LifeScan, Inc., QTL Biodetection LLC, Molecular Devices Corp., Nova Biomedical, Molex LLC, TDK Corp., Zimmer & Peacock AS, Siemens Healthcare. |

| Key Drivers | • Rising Demand for Point-of-Care Diagnostics and Real-Time Monitoring Solutions Drives the Growth of the Biosensors Market. • Technological Advancements in Biosensor Materials and Integration with Digital Health Platforms Drive Market Expansion. |

| Restraints | • High Manufacturing Costs and Complex Regulatory Approvals Pose Challenges for Biosensors Market Growth. |