Vegan Yogurt Market Report Scope & Overview:

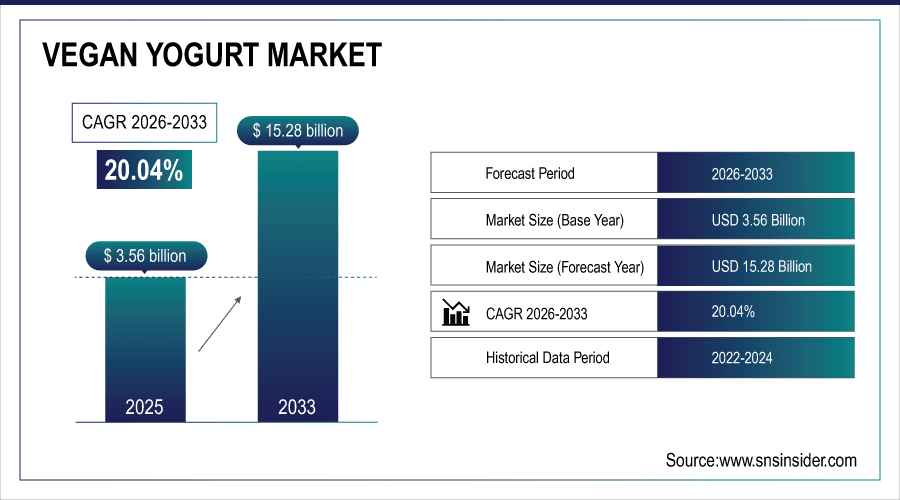

The Vegan Yogurt Market size was valued at USD 3.56 Billion in 2025E and is projected to reach USD 15.28 Billion by 2033, growing at a CAGR of 20.04% during 2026-2033.

The global market for vegan yogurt is witnessing rapid growth, driven by rising health consciousness, increasing veganism, and growing demand for plant-based alternatives. This report includes detailed analysis of market trends, competitive landscape, segmentation, regional insights, distribution channels, and consumer preferences. It also highlights innovations in product offerings, flavor profiles, end-user consumption patterns, and retail dynamics, providing stakeholders with comprehensive insights to strategize effectively in the expanding and evolving vegan yogurt market.

Over 45% of health-conscious consumers globally actively seek plant-based dairy alternatives in their daily diets.

To Get More Information On Vegan Yogurt Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2024: USD 3.56 Billion

-

Market Size by 2032: USD 15.28 Billion

-

CAGR: 20.04% from 2025 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Vegan Yogurt Market Trends

-

Rising consumer focus on health and wellness is driving demand for dairy-free, nutrient-rich vegan yogurt alternatives.

-

Vegan yogurt’s probiotics, plant proteins, low cholesterol, and functional ingredients like vitamins and fiber enhance consumer appeal.

-

Awareness of lactose intolerance, obesity, and lifestyle-related health issues encourages adoption of plant-based diets.

-

E-commerce, modern retail, and direct-to-consumer platforms expand market reach and reduce distribution costs.

-

Subscription and delivery models provide convenient access, boosting brand visibility, loyalty, and repeat purchases.

-

Omnichannel strategies, collaborations with supermarkets and specialty stores, and growing preference for digital shopping further support sales growth.

U.S. Vegan Yogurt Market Insights

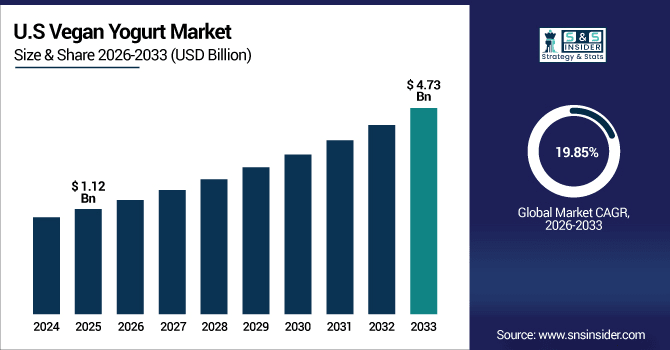

The U.S. Vegan Yogurt Market size was valued at USD 1.12 Billion in 2025E and is projected to reach USD 4.73 Billion by 2033, growing at a CAGR of 19.85% during 2026-2033.

The U.S. market for vegan yogurt is experiencing significant growth, driven by rising consumer demand for dairy-free alternatives, increasing awareness of plant-based diets, and innovations by major players in flavors and functional ingredients. Expansion of distribution channels, including supermarkets and e-commerce platforms, further supports adoption. Additionally, growing trends in healthy snacking and the prevalence of lactose intolerance are contributing to robust market growth across the U.S.

Vegan Yogurt Market Growth Drivers:

-

Increasing Health Consciousness and Shift Towards Plant-Based Diets Driving Vegan Yogurt Demand Globally

Consumers are increasingly prioritizing health and wellness, leading to higher demand for dairy-free and nutrient-rich alternatives. Vegan yogurt, rich in probiotics, plant proteins, and low in cholesterol, aligns with this trend. Rising awareness of lactose intolerance, obesity, and lifestyle-related health issues encourages the shift towards plant-based diets. The inclusion of functional ingredients such as vitamins, minerals, and fiber enhances consumer perception, making vegan yogurt a preferred choice. This health-driven behavior significantly contributes to market expansion, particularly among millennials and Gen Z, who actively seek healthier, sustainable, and ethical food options globally.

Over 50% of consumers report choosing plant-based dairy alternatives for health and wellness benefits.

Vegan Yogurt Market Restraints:

-

Limited Awareness and Taste Preferences Hindering Consumer Acceptance in Certain Regions

Despite growing health trends, consumer awareness regarding vegan yogurt benefits remains limited in some markets. Traditional dairy consumption habits, taste preferences, and skepticism about plant-based alternatives slow adoption. Consumers may perceive vegan yogurt as inferior in taste, texture, or nutritional value. Cultural and regional preferences for conventional dairy further hinder market expansion. Lack of education on plant-based benefits and minimal product sampling opportunities contribute to hesitancy. As a result, market growth faces constraints in regions with strong dairy traditions, requiring targeted marketing and taste-focused innovation to overcome adoption challenges.

Vegan Yogurt Market Opportunities:

-

Expansion of Online and Modern Retail Channels Driving Market Accessibility and Sales Growth

E-commerce, modern retail, and direct-to-consumer platforms offer vast opportunities for market penetration. Online channels allow brands to reach untapped urban and semi-urban consumers efficiently, reducing distribution costs. Subscription-based and delivery models enable convenient access to fresh vegan yogurt products, enhancing brand visibility and loyalty. Collaborations with supermarkets, specialty stores, and health-focused outlets increase product availability. The growing preference for digital shopping experiences and contactless delivery post-pandemic further supports sales growth. Leveraging omnichannel strategies provides opportunities for companies to increase revenue streams while meeting evolving consumer purchasing habits globally.

Over 30% of vegan yogurt brands have increased sales by integrating omnichannel retail strategies.

Vegan Yogurt Market Segment Analysis

-

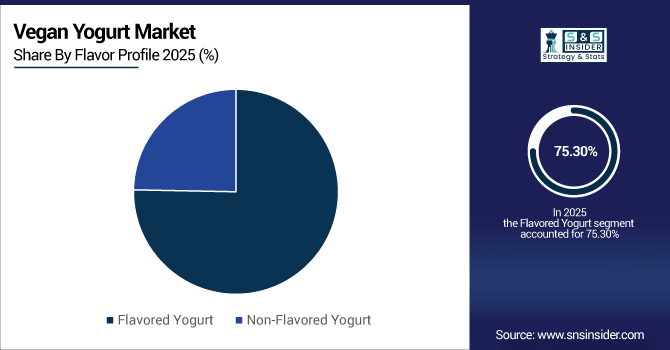

By Flavor Profile, the Flavored Yogurt sector dominated the market with 75.30% share in 2025E, whereas the Non-Flavored Yogurt segment is expected to grow fastest with a CAGR of 20.26%.

-

By Product Type, Soy Yogurt led the Vegan Yogurt Market with a 38.60% share in 2025E, while Almond Yogurt is the fastest-growing segment with a CAGR of 21.27%.

-

By End-User, Household led the market with 64.40% share in 2025E, while HoReCa (Hotels, Restaurants, and Catering) is registering the fastest growth with a CAGR of 20.17%.

-

By Distribution Channel, B2C held 70.90% share in 2025E, whereas B2B is growing the fastest with a CAGR of 21.12%.

By Flavor Profile, Flavored Yogurt Dominate While Non-Flavored Yogurt Shows Rapid Growth

Flavored Yogurt segment dominated the Vegan Yogurt Market with the highest revenue share of about 75.30% in 2025E due to the wide availability of fruit, chocolate, and exotic flavors catering to diverse consumer preferences. Oatly has launched innovative flavored vegan yogurt options that appeal to a wide audience, reinforcing its market presence. Non-Flavored Yogurt segment is expected to grow at the fastest CAGR of about 20.26% during 2026-2033 as health-conscious consumers prefer plain, low-sugar, and versatile options suitable for cooking, smoothies, and personalized flavoring.

By Product Type, Soy Yogurt Leads Market While Almond Yogurt Registers Fastest Growth

Soy Yogurt segment dominated the Vegan Yogurt Market with the highest revenue share of about 38.60% in 2025E due to its rich protein content, widespread availability, and consumer familiarity. Danone has been actively promoting its soy-based yogurt variants, strengthening brand recognition and driving adoption. Almond Yogurt segment is expected to grow at the fastest CAGR of about 21.27% during 2026-2033 owing to its mild taste, low-calorie profile, and rising popularity among vegan and lactose-intolerant populations.

By End-User, Household Lead While HoReCa (Hotels, Restaurants, and Catering) Registers Fastest Growth

Household segment dominated the Vegan Yogurt Market with the highest revenue share of about 64.40% in 2025E due to frequent daily consumption and convenience for family meals. Chobani has expanded its home-consumption-oriented vegan yogurt portfolio, boosting sales among household consumers. HoReCa (Hotels, Restaurants, and Catering) segment is expected to grow at the fastest CAGR of about 20.17% during 2026-2033 owing to increasing incorporation of vegan yogurt in menu items, dessert offerings, and specialty beverages.

By Distribution Channel, B2C Leads While B2B Grows Fastest

B2C segment dominated the Vegan Yogurt Market with the highest revenue share of about 70.90% in 2025E due to direct availability to end consumers via supermarkets, hypermarkets, and e-commerce platforms. Ripple Foods has focused on direct-to-consumer and retail distribution strategies, increasing its visibility and accessibility. B2B segment is expected to grow at the fastest CAGR of about 21.12% during 2026-2033 driven by increasing demand from restaurants, catering services, and food processing industries for bulk vegan yogurt supplies.

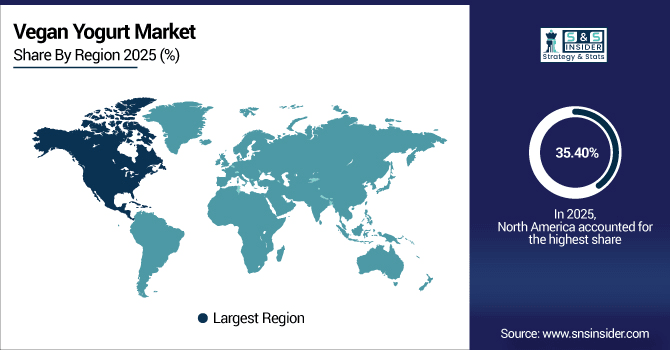

Vegan Yogurt Market Regional Analysis:

North America Vegan Yogurt Market Insights

North America region dominated the Vegan Yogurt Market with the highest revenue share of about 35.40% in 2025E. This leadership is driven by high health awareness among consumers, well-established distribution networks, and the strong presence of major market players, which facilitate widespread product availability and adoption.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Vegan Yogurt Market Insights

The U.S. dominates the North American vegan yogurt market due to high consumer health awareness, widespread adoption of plant-based diets, advanced retail and e-commerce networks, strong presence of major brands, and continuous product innovation catering to diverse taste and nutritional preferences.

Asia-Pacific Vegan Yogurt Market Insights

The Asia Pacific segment is expected to grow at the fastest CAGR of about 20.80% during 2026-2033. Growth in this region is supported by rising veganism, expanding retail infrastructure, increasing disposable incomes, and growing awareness of plant-based diets across urban populations.

China Vegan Yogurt Market Insights

China leads the Asia Pacific vegan yogurt market owing to rising veganism, growing disposable incomes, rapid urbanization, expanding modern retail and online grocery channels, increasing awareness of health and wellness trends, and rising demand for plant-based, functional, and fortified dairy alternatives.

Europe Vegan Yogurt Market Insights

Europe is a key region for the vegan yogurt market, driven by high health consciousness, widespread vegan and flexitarian adoption, and strong demand for plant-based alternatives. Advanced retail infrastructure, increasing product innovations, and the presence of major market players support growth.

Germany Vegan Yogurt Market Insights

Germany dominates the European vegan yogurt market due to its high vegan population, strong consumer awareness of sustainability and animal welfare, supportive retail presence in cities like Berlin and Munich, and expanding plant-based offerings from major retailers such as Aldi and Lidl.

Latin America (LATAM) and Middle East & Africa (MEA) Vegan Yogurt Market Insights

In the Middle East & Africa, the UAE dominates the Middle East & Africa vegan yogurt market due to high health awareness, growing plant-based food demand, and strong retail and e-commerce networks. In Latin America, Brazil leads, driven by rising veganism, increasing disposable incomes, urbanization, and expanding modern retail and online grocery channels.

Vegan Yogurt Market Competitive Landscape:

Danone, a global leader in plant-based products, owns Alpro, a pioneer in Europe’s plant-based dairy alternatives. Alpro offers a diverse range of vegan products catering to health-conscious consumers. Its Alpro Greek Style Plain yogurt delivers a thick, creamy texture, while the Alpro Vanilla Flavored Yogurt provides a sweet, smooth taste enriched with plant-based nutrients, combining flavor and nutrition for consumers seeking sustainable and lactose-free alternatives.

-

In July 2025, Alpro launched a new line of fortified plant-based drinks and yogurts tailored for children. This range includes chocolate-flavored oat-based drinks, strawberry-flavored soy drinks, and soy-based yogurt alternatives in vanilla and strawberry flavors.

Chobani, a U.S.-based company renowned for dairy and plant-based innovations, offers high-quality vegan alternatives. Its Non-Dairy Coconut Yogurt provides a creamy, tropical flavor, while the Non-Dairy Vanilla Yogurt combines smooth texture with plant-based nutrition. Chobani’s commitment to taste and quality ensures its non-dairy yogurts meet consumer demand for lactose-free, ethical, and sustainable products, appealing to health-conscious and vegan audiences alike.

-

In April 2025, Chobani released two new limited-time yogurt flavors for the summer season: Fruit Punch Greek Yogurt and Red, White & Poppin' Flip Yogurt. The Fruit Punch variety blends creamy Greek yogurt with real orange, pineapple, and cherry flavors, while the Red, White & Poppin' flavor features lemon Greek yogurt topped with red, white, and blue popping candies.

Oatly, a Swedish company specializing in oat-based products, focuses on sustainability and plant-based nutrition. Its Oatgurt Plain offers a versatile, neutral-flavored yogurt alternative, while the Oatgurt Greek Style delivers a thicker, creamy texture for a richer experience. Oatly’s product range meets the rising demand for dairy-free, eco-friendly options, catering to consumers seeking healthy, ethical, and innovative vegan yogurt choices globally.

-

In February 2024, Oatly introduced climate footprint labeling to select U.S. products, starting with its newly reformulated Oatgurts. This initiative aims to provide consumers with transparent information about the environmental impact of their food choices.

Vegan Yogurt Market Key Players:

Some of the Vegan Yogurt Market Companies are:

-

Danone S.A.

-

General Mills Inc.

-

Oatly A.B.

-

Chobani Global Holdings

-

Forager Project

-

COYO Pty Ltd

-

Nancy's Probiotic Foods

-

Kite Hill

-

Daiya Foods Inc.

-

G.T.'s Living Foods LLC

-

Hain Celestial Group

-

Hudson River Foods

-

Good Karma Foods Inc.

-

Ripple Foods

-

Lactalis

-

Nush Foods

-

Alpro

-

So Delicious Dairy Free

-

Califia Farms

-

Yoconut Dairy Free

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 3.56 Billion |

| Market Size by 2033 | USD 15.28 Billion |

| CAGR | CAGR of 20.04% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Soy Yogurt, Almond Yogurt, Rice Yogurt and Other Sources) • By Flavor Profile (Flavored Yogurt and Non-Flavored Yogurt) • By End-User (Household and HoReCa (Hotels, Restaurants, and Catering)) • By Distribution Channel (B2B and B2C) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Danone S.A., General Mills Inc., Oatly A.B., Chobani Global Holdings, Forager Project, COYO Pty Ltd, Nancy's Probiotic Foods, Kite Hill, Daiya Foods Inc., G.T.'s Living Foods LLC, Hain Celestial Group, Hudson River Foods, Good Karma Foods Inc., Ripple Foods, Lactalis, Nush Foods, Alpro, So Delicious Dairy Free, Califia Farms, and Yoconut Dairy Free. |