Cocoa Powder Market Report Scope & Overview:

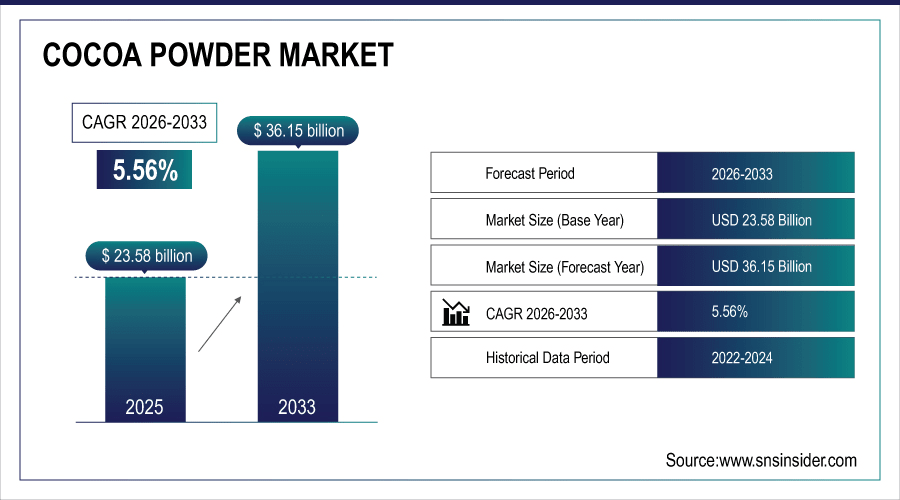

The Cocoa Powder Market size was valued at USD 23.58 Billion in 2025E and is projected to reach USD 36.15 Billion by 2033, growing at a CAGR of 5.56% during 2026-2033.

The global market is driven by rising demand for premium chocolate products, bakery goods, and cocoa-based beverages worldwide. Increasing consumer health consciousness and preference for natural antioxidants are significantly boosting cocoa powder consumption. Additionally, expanding applications in confectionery, nutraceuticals, and functional foods continue to enhance market growth. Its versatility across multiple industries establishes cocoa powder as a vital ingredient, ensuring sustained demand and positioning it as a key component in global food innovation.

More than 60% of global chocolate launches highlight “natural” or “clean-label” claims, reflecting consumer demand for minimally processed cocoa ingredients.

To Get More Information On Cocoa Powder Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 23.58 Billion

-

Market Size by 2033: USD 36.15 Billion

-

CAGR: 5.56% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Cocoa Powder Market Trends

-

Rising global demand for chocolate, confectionery, and cocoa-based food and beverages is fueling cocoa powder market growth.

-

Growing disposable incomes in emerging economies are boosting adoption of premium confectionery and functional food products.

-

Cocoa’s natural antioxidant properties are driving its use in health-oriented functional foods and nutritional beverages.

-

Expansion of bakery, dairy, and beverage industries worldwide is supporting sustained demand for cocoa powder.

-

Increasing consumer awareness of sustainability and ethical sourcing is boosting demand for fair-trade and organic cocoa products.

-

Major companies are investing in transparent, certified supply chains to meet eco-conscious consumer demand, especially in North America and Europe.

U.S. Cocoa Powder Market Insights

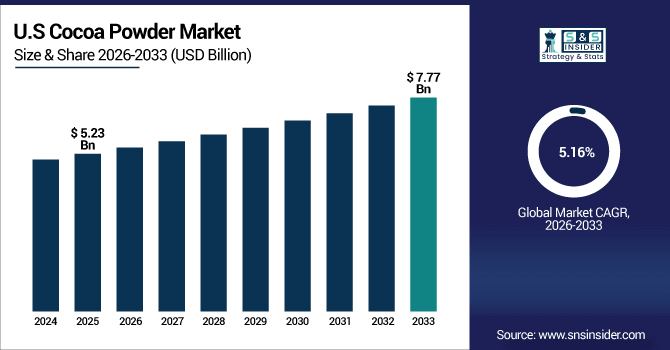

The U.S. Cocoa Powder Market size was valued at USD 5.23 Billion in 2025E and is projected to reach USD 7.77 Billion by 2033, growing at a CAGR of 5.16% during 2026-2033. The U.S. market is experiencing steady growth driven by rising consumer preference for clean-label and organic food ingredients. Increasing chocolate consumption, along with the widespread use of cocoa powder in bakery, beverages, and confectionery, is further boosting demand. Moreover, the shift toward healthier indulgence and premium cocoa-based offerings enhances its appeal. These factors collectively support market expansion, positioning the U.S. as a strong contributor to global cocoa powder growth over the forecast period.

Cocoa Powder Market Growth Drivers:

-

Rising Consumer Demand for Chocolate, Functional Foods, and Cocoa-Based Beverages Across Global Markets

The increasing global demand for chocolate and cocoa-based products is significantly driving the cocoa powder market. With rising disposable incomes, consumers in emerging economies are adopting premium confectionery and functional food items that incorporate cocoa powder. Additionally, cocoa’s natural antioxidant properties make it a preferred ingredient in functional foods and nutritional beverages, boosting health-oriented consumption. The expansion of bakery, dairy, and beverage industries worldwide further supports the demand surge, positioning cocoa powder as a staple ingredient in both indulgent and health-focused products.

Over 70% of consumers associate cocoa-based products with improved mood and overall well-being.

Cocoa Powder Market Restraints:

-

Volatile Cocoa Bean Prices Caused by Climate Change and Supply Chain Disruptions Impacting Production Costs Globally

The cocoa powder market faces significant challenges due to fluctuations in cocoa bean prices. Climate change, unpredictable weather patterns, and diseases affecting cocoa plants directly disrupt supply, leading to price instability. Additionally, geopolitical tensions and logistics challenges across producing countries exacerbate supply chain inefficiencies. These factors increase production costs, ultimately affecting profitability and pricing strategies for manufacturers. Such volatility poses risks for both producers and buyers, limiting the ability to maintain stable product pricing in international markets.

Cocoa Powder Market Opportunities:

-

Growing Demand for Organic, Fair-Trade, and Sustainable Cocoa Products in Response to Ethical Consumerism Trends

Increasing consumer awareness regarding sustainability and ethical sourcing is creating new opportunities in the cocoa powder market. Fair-trade and organic cocoa products are gaining traction as consumers prefer environmentally friendly and socially responsible options. Major companies are investing in transparent supply chains and certifications to strengthen brand credibility. This shift is particularly prominent in North America and Europe, where consumer demand for eco-conscious and ethically sourced products is accelerating, pushing companies to innovate with sustainable cocoa powder offerings.

Over 55% of global chocolate launches now carry ethical or sustainable claims, reflecting rising eco-conscious consumption.

Cocoa Powder Market Segmentation Analysis

-

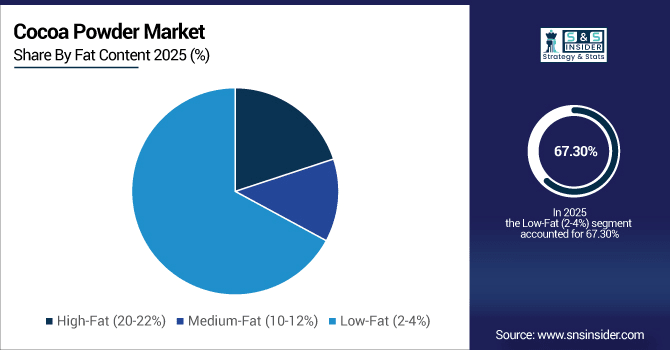

By Fat Content, Low-Fat (2-4%) led the market with 67.30% share in 2025E, and is registering the fastest growth with a CAGR of 5.96%.

-

By Product Type, Natural cocoa powder led the Cocoa Powder Market with a 64.30% share in 2025E, while Dutch-processed cocoa powder is the fastest-growing segment with a CAGR of 7.27%.

-

By Cocoa Variety, the Forastero sector dominated the market with 45.20% share in 2025E, whereas the Nacional segment is expected to grow fastest with a CAGR of 7.81%.

-

By End-User, Food and beverage held 72.40% share in 2025E, whereas Cosmetics and personal care sector is growing the fastest with a CAGR of 8.08%.

By Fat Content, Low-Fat (2-4%) Lead and Registers Fastest Growth

Low-Fat (2–4%) cocoa powder dominated the market with a 67.30% share in 2025E due to its health benefits, affordability, and widespread application in low-calorie food and beverage products. Companies such as Nestlé S.A. use low-fat cocoa powder across product lines to meet the rising demand for diet-friendly alternatives. Low-Fat (2–4%) cocoa powder is also expected to grow at the fastest CAGR of 5.96% during 2026–2033, supported by rising consumer demand for healthier, diet-friendly, and functional food formulations.

By Product Type, Natural Cocoa Powder Leads Market While Dutch-processed Cocoa Powder Registers Fastest Growth

Natural cocoa powder segment dominated the market with a 64.30% share in 2025E due to its wide acceptance in bakery and confectionery for its strong flavor, affordability, and less intensive processing requirements. Companies such as Barry Callebaut leverage natural cocoa powder extensively in chocolate manufacturing, ensuring consistent demand across global supply chains. Dutch-processed cocoa powder is expected to grow at the fastest CAGR of 7.27% during 2026–2033, driven by its smoother taste, better solubility, and increasing use in premium chocolates and beverages catering to evolving consumer preferences.

By Cocoa Variety, Forastero Dominate While Nacional Shows Rapid Growth

Forastero dominated the market with a 45.20% share in 2025E owing to its high yield, strong flavor, and widespread cultivation across Africa, ensuring cost-effectiveness and availability. Producers such as Cargill Incorporated actively invest in sourcing Forastero beans, making them central to large-scale cocoa powder production. Nacional is expected to grow at the fastest CAGR of 7.81% during 2026–2033 due to rising demand for premium and aromatic cocoa varieties, especially in gourmet chocolate and specialty food applications.

By End-User, Food and beverage Leads While Cosmetics and Personal Care Sector Grows Fastest

Food and beverage segment dominated with 72.40% share in 2025E, as cocoa powder is extensively used in chocolates, bakery, dairy, and beverages across global markets. Leading players such as Mondelēz International continue expanding product portfolios in chocolate and snacks, ensuring stable cocoa powder usage. Cosmetics and personal care segment is projected to grow at the fastest CAGR of 8.08% during 2026–2033 due to increasing adoption of cocoa in skincare and beauty products for its antioxidant and moisturizing properties.

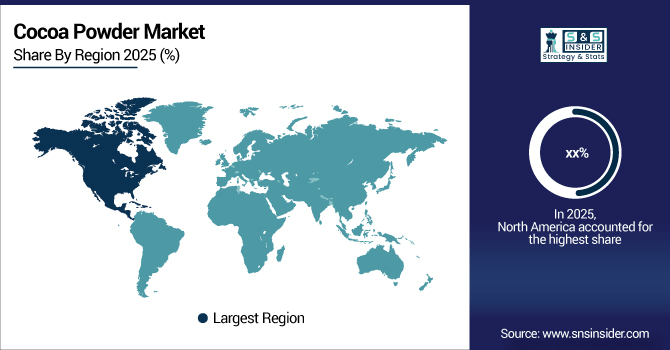

Cocoa Powder Market Regional Analysis:

North America Cocoa Powder Market Insights

North America’s cocoa powder market is driven by high chocolate consumption, a robust bakery sector, and strong demand for premium and clean-label products. The U.S. leads the region, supported by innovation in organic and functional foods. Growing applications in beverages, confectionery, and nutraceuticals, combined with consumer preference for ethically sourced cocoa, further enhance North America’s position as a key growth hub.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Cocoa Powder Market Insights

The U.S. dominates the North American cocoa powder market due to its strong chocolate consumption, extensive bakery industry, and demand for premium cocoa-based products. Major players and innovation in clean-label, organic, and functional foods further reinforce its market leadership.

Asia-Pacific Cocoa Powder Market Insights

Asia Pacific is projected to grow at the fastest CAGR of 6.59% from 2026–2033, driven by rising middle-class incomes, urbanization, and growing demand for bakery and chocolate products. Companies such as Meiji Holdings Co., Ltd. are expanding operations to meet the surge in consumer preferences. Increasing Western influence on diets accelerates cocoa powder adoption across China, India, and Southeast Asia.

China Cocoa Powder Market Insights

China leads the Asia Pacific cocoa powder market driven by rising urbanization, growing middle-class spending, and surging demand for bakery, confectionery, and beverages. Expanding Western food culture and increasing consumer interest in premium chocolate strengthen China’s dominant market position.

Europe Cocoa Powder Market Insights

Europe dominated the cocoa powder market with a 40.90% share in 2025E, supported by high chocolate consumption, strong bakery culture, and premium confectionery demand. Leading brands such as Ferrero and Lindt strengthen regional dominance through innovation and sustainability practices. Favorable regulatory standards and focus on ethically sourced cocoa further enhance Europe’s position as the global leader in cocoa powder consumption.

Germany Cocoa Powder Market Insights

Germany dominates Europe’s cocoa powder market with strong chocolate consumption, advanced bakery traditions, and global confectionery leaders like Ritter Sport. Its emphasis on premium quality, sustainability, and innovation strengthens Germany’s role as a central hub for cocoa-based products.

Latin America (LATAM) and Middle East & Africa (MEA) Cocoa Powder Market Insights

The Middle East & Africa cocoa powder market is driven by rising bakery, confectionery, and hospitality demand, with the UAE and Saudi Arabia leading adoption of premium cocoa-based products, while South Africa dominates Africa’s consumption. In Latin America, Brazil’s strong cocoa production and Argentina’s vibrant confectionery sector fuel regional growth, supported by rising consumer indulgence.

Cocoa Powder Market Competitive Landscape:

Barry Callebaut, a Switzerland-based leader in cocoa and chocolate manufacturing, provides high-quality cocoa ingredients to global food and beverage companies. Its Natural Cocoa Powder is widely used for strong flavor and color in bakery and confectionery, while the Dutch-Processed Cocoa Powder offers a smoother taste and better solubility, ideal for premium chocolates and beverages. With a strong commitment to sustainability, Barry Callebaut invests heavily in ethical sourcing, innovation, and supply chain transparency to meet rising global cocoa demand.

-

In April 2025, Barry Callebaut announced a strategic shift toward non-cocoa products, including precision-fermented sunflower alternatives, aiming to mitigate the impact of high cocoa prices and expand its chocolaty portfolio.

Cargill, headquartered in the U.S., is a global powerhouse in cocoa processing, serving confectionery, bakery, and beverage industries worldwide. Its Gerkens® Natural Cocoa Powder is valued for consistent flavor, high versatility, and stability across applications, while Gerkens® Dutch Cocoa Powder provides enhanced solubility and mild flavor for premium formulations. The company emphasizes sustainability through farmer support and traceable supply chains, ensuring ethical sourcing and long-term cocoa availability, while meeting growing consumer demand for both indulgent and health-focused cocoa products.

-

In October 2024, Cargill launched a new cocoa production line at its Indonesia facility to better serve Asian markets. Introduced Gerkens® Max80 and Max78 cocoa powders tailored for rich flavor and deep color in bakery, confections, and beverages.

Nestlé, based in Switzerland, is a world-leading food and beverage company with a strong footprint in cocoa-based products. Its Nestlé Cocoa Powder is used widely in beverages, desserts, and home baking, while Nestlé Toll House Baking Cocoa caters to premium bakery and confectionery needs. The company integrates sustainability through its Cocoa Plan, focusing on improving farmer livelihoods and promoting responsibly sourced cocoa. By combining innovation with ethical practices, Nestlé strengthens its position as a key player in the global cocoa powder market.

-

In April 2025, Nestlé partnered with ofi to launch a global agroforestry initiative, marking their largest collaboration to date. The project supports Nestlé's Cocoa Plan and 2050 Net Zero targets, contributing to regenerative agriculture and sustainable cocoa sourcing through agroforestry systems.

Cocoa Powder Market Key Players:

Some of the Cocoa Powder Market Companies are:

-

Barry Callebaut

-

Cargill Incorporated

-

Olam International

-

Nestlé S.A.

-

The Hershey Company

-

Mondelez International

-

Mars, Incorporated

-

Ferrero Group

-

Meiji Holdings Co., Ltd.

-

Guan Chong Berhad

-

Blommer Chocolate Company

-

Touton S.A.

-

ECOM Agroindustrial Corp.

-

Archer Daniels Midland (ADM)

-

JB Cocoa Sdn. Bhd.

-

Natra S.A.

-

Cemoi Group

-

Ghirardelli Chocolate Company

-

Valrhona

-

Cocoa Processing Company Limited

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 23.58 Billion |

| Market Size by 2033 | USD 36.15 Billion |

| CAGR | CAGR of 5.56% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Natural Cocoa Powder, Dutch-Processed Cocoa Powder, Blended Cocoa Powder, and Cocoa Rouge) • By Cocoa Variety (Criollo, Forastero, Trinitario, and Nacional) • By Fat Content (High-Fat (20–22%), Medium-Fat (10–12%), and Low-Fat (2–4%)) • By End-User (Food and Beverage, Cosmetics and Personal Care, Pharmaceutical, Nutraceuticals, and Others (Dyes, Inks, Coatings)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Barry Callebaut, Cargill Incorporated, Olam International, Nestlé S.A., The Hershey Company, Mondelez International, Mars, Incorporated, Ferrero Group, Meiji Holdings Co., Ltd., Guan Chong Berhad, Blommer Chocolate Company, Touton S.A., ECOM Agroindustrial Corp., Archer Daniels Midland (ADM), JB Cocoa Sdn. Bhd., Natra S.A., Cemoi Group, Ghirardelli Chocolate Company, Valrhona, and Cocoa Processing Company Limited. |