Vision Processing Unit Market Size & Growth:

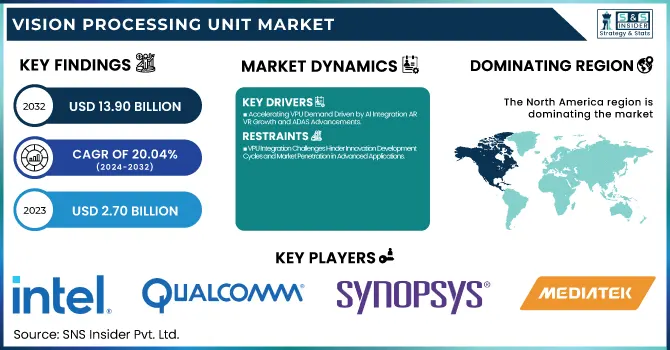

The Vision Processing Unit Market was valued at USD 2.70 billion in 2023 and is expected to reach USD 13.90 billion by 2032, growing at a CAGR of 20.04% over the forecast period 2024-2032. The Vision Processing Unit (VPU) market is anticipated to experience strong growth due to its specific-to-application nature, finding applications in various end-user industries such as automotive, surveillance, robotics, and consumer electronics. Built for technical excellence, the VPU handles AI-driven image processing tasks at high speed while minimizing power consumption. Rich toolsets like developer tools, and frameworks, that come with a strong software ecosystem, enable easier VPU integration and use. The deep learning algorithm, edge computing, and hardware architecture innovations continuously push the VPU capabilities further. VPU improvements here make possible enhanced object identification, facial recognition, and immediate data processing, which in turn help differentiate VPUs as standard or key elements in smart or artificial vision key apps.

To Get more information on Vision Processing Unit Market - Request Free Sample Report

The U.S. vision processing unit (VPU) market was valued at USD 0.70 billion in 2023 and is expected to grow at a CAGR of 19.84% from 2024 to 2032. The expansion is fueled by the escalating need for AI-based applications, improved computer vision technologies, and industry penetration in automotive, healthcare, and consumer electronics to gain advanced visual processing.

Vision Processing Unit Market Dynamics

Key Drivers:

-

Accelerating VPU Demand Driven by AI Integration AR VR Growth and ADAS Advancements

The rising integration of artificial intelligence (AI) and machine learning (ML) in devices such as smartphones, cameras, and drones has driven lucrative growth for VPU adoption. These image-processing units are meant to provide high performance while consuming a low amount of power and are critical for modern electronic devices. The recent rapid growth of AR and VR applications, particularly in gaming, healthcare, and industrial sectors, has further propelled the demand for VPUs. Moreover, the increasing adoption of AR devices in vehicles for higher safety with the introduction of sophisticated driver-assistance systems (ADAS) is another factor boosting the market. They utilize VPUs for instant image processing, object recognition, and resolving navigation precision.

Restrain:

-

VPU Integration Challenges Hinder Innovation Development Cycles and Market Penetration in Advanced Applications

High complexity in integrating VPU across various devices is one of the key restraining factors. While momentum is slowly building towards better VPU design, developing VPUs that should be able to effectively implement very different hardware architectures may require significant technical expertise to get right, causing innovations to creep along. Also, existing software frameworks might be a breaking point for a developer, particularly in applications that are reliant on fast image recognition and surrounding data processing. Such complexity often results in lengthy development cycles which postpone product launches and slow market penetration.

Opportunity:

-

VPU Market Opportunities Expand with Intelligent Surveillance Smart Devices Robotics and 5G Integration

New opportunities in the VPU market are associated with the growing need for intelligent surveillance, smart home gadgets, and robotics. The rise of devices that need efficient visual data processing opens up great opportunities for VPU manufacturers. Further, by extending data transfer speed at any time, even 5G technology will make it possible to apply more VPU-powered image processing, resulting in fast real-time-based applications more efficiently. Industry x is driving a transformation into automation and intelligence, creating a significant market for VPUs.

Challenges:

-

Enhancing VPU Efficiency Security and Design to Overcome Power Heat and Data Breach Challenges

The major issue is the need for power efficiency in a high-performance associate memory. The challenge is to continue processing the data using VPUs while creating less and less heat, a particularly important feature to maintain in power-dependent devices like smartphones, drones, and AR/ VR systems. Additionally, security issues related to devices driven by VPU are becoming more and more pressing. Because these processors have to deal with a large amount of visual data, they will become the target of data breaches and hacking efforts. To mitigate these risks, strong data encryption as well as secure processing environments will need to be employed. To sustain market growth, it is important to address these challenges with more advanced VPU design, better software support, and more robust security frameworks.

Vision Processing Unit Market Segmentation Overview

By Fabrication Process

The 16-28 nm of node technology led the vision processing unit market in terms of market share in 2023, capturing nearly 58.1% of the overall market share. This is because of its well-balanced performance, power efficiency, and cost-efficiency which is widely adopted in devices like smartphones, cameras, and automotive-based systems. It can process data optimally, while minimizing power losses and heat production, on the 16-28 nm nodes crucial features for many mobile and embedded devices.

The ≤16 nm node segment is expected to expand at the fastest compound annual growth rate (CAGR) during the forecast period, from 2024 to 2032. That growth is attributed to the rising demand for high-end VPUs, driven by lots of powerful compute-heavy applications like AR/VR, AI devices, and self-driving cars. The ≤16 nm nodes provide for better. Power and area performance (PPA) are available for next-generation VPU architectures. Such a transition is anticipated to transform the industries dependent on visual data processing.

By Application

Smartphones accounted nearly for 39.3% of the total Vision Processing Unit (VPU) market share in 2023. The rise in dominance can be attributed to the latest smartphones including powerful camera modules, intelligent features powered by artificial intelligence, and enhanced image processing capabilities. However, VPUs are essential for high-end and even mid-ranges as augmented reality (AR) applications, battery optimization on cameras, and facial recognition are important for improving the camera performance of devices.

The AR/VR segment is estimated to grow at a robust compound annual growth rate (CAGR) from 2024-2032. Factors such as increasing demand for an immersive experience in gaming, healthcare, and training applications are propelling the growth of the market. VPUs are accelerating the adoption of AR/VR headsets with real-time motion tracking, object detection, and improved visual rendering. The expanding AR/VR market is expected to create significant VPU demand in the upcoming years, driven by the need for low-power visual process solutions in these applications.

By Vertical

The consumer electronics segment held the largest share of the Vision Processing Unit (VPU) market in 2023, globally, accounting for 28.5% of the total market share. The widespread use of VPUs inside smartphones, tablets, smart TVs, and wearables has driven this strong presence. Optional visual processing units (VPUs) add visual processing capabilities for advanced features such as enhanced image recognition, improved video enhancement, and battery efficiency. VPUs are becoming a critical electronics component because of increasing consumer demand for high-performance devices with ambient visual experiences.

The security & surveillance segment is anticipated to achieve the highest compound annual growth rate (CAGR) from 2024 to 2032. The need for high-end/civil quality is increasing, for the new video analytics system, ideally in real-time with facial and motion detection cameras, resulting in such growth. Thus, VPUs are crucial to enabling these smart features by providing rapid and power-efficient image processing. Increasing awareness of public safety and increasing adoption of smart security solutions are factors anticipated to bolster VPU demand in this sector Further.

Vision Processing Unit Market Regional Outlook

North America held the largest share of the video processing unit (VPU) market in 2023, contributing around 35.7% to the total market share. Factors bolstering this dominance are to vast presence of top-notch technology companies, high research & development expenditure, and rapid acceptance level for advanced technologies. Notably, the US hosts major entities like Intel, Qualcomm, and Ambarella that develop VPUs, and integrate these chips into smartphone chips, and applications in face-detection security systems, AR/VR systems, and more. For example, affordable visual processing is commonly found in smart cameras and drones found with Intel's Movidius VPUs. At the same time, the increase of ADAS systems in the automotive field of North America keeps increasing the demand for VPU, with companies such as Tesla Inc. and General Motors Company deploying cutting-edge Vision Processing technology in their autonomous vehicle platforms.

The fastest compound annual growth rate is estimated to be in the Asia Pacific from 2024 to 2032. Factors such as increasing demand for consumer electronics, investments in the construction of smart cities, and growth in automotive production are driving this increase. From this, growth can be seen in China, Japan, and South Korea leading the way globally with their technology. Huawei, for example, includes VPUs as part of the camera used on its flagship smartphones to boost AI-based photo ops, and the same goes for Samsung. The regional growth is also being ushered in by strengthening the surveillance market of China where Hikvision is using VPU-based smart cameras. Such speedy tech adoption makes Asia Pacific one of the high-growth areas for the VPU market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Vision Processing Unit Market are:

-

Intel Corporation (Movidius Myriad X)

-

Qualcomm Technologies Inc. (Snapdragon XR2)

-

NXP Semiconductors (i.MX 8M Plus)

-

Synopsys Inc. (DesignWare EV6x)

-

MediaTek Inc. (Dimensity 9200)

-

Ambarella Inc. (CV2)

-

Ceva Inc. (NeuPro-S)

-

Cadence Design Systems Inc. (Tensilica Vision P6)

-

Himax Technologies Inc. (WISEEye)

-

Rockchip Electronics Co., Ltd. (RK3588)

-

Samsung Electronics Co., Ltd. (Exynos 2200)

-

Texas Instruments Inc. (TDA4VM)

-

Google LLC (Coral Edge TPU)

-

Lattice Semiconductor Corporation (CrossLink-NX)

-

Mythic Inc. (Mythic Analog Matrix Processor - M1076)

Recent Trends

-

In March 2025, Qualcomm announced the acquisition of Edge Impulse to enhance its AI and IoT capabilities, aiming to accelerate edge device innovation and real-time data processing solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.70 Billion |

| Market Size by 2032 | USD 13.90 Billion |

| CAGR | CAGR of 20.04% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Fabrication Process (≤16 nm, >16-28 nm) • By Application (Smartphones, Drones, Cameras, AR/VR, ADAS, Others) • By Vertical (Consumer electronics, Security and surveillance, Automotive, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Intel Corporation, Qualcomm Technologies Inc., NXP Semiconductors, Synopsys Inc., MediaTek Inc., Ambarella Inc., Ceva Inc., Cadence Design Systems Inc., Himax Technologies Inc., Rockchip Electronics Co., Ltd., Samsung Electronics Co., Ltd., Texas Instruments Inc., Google LLC, Lattice Semiconductor Corporation, Mythic Inc. |