Well Testing Services Market Report Scope & Overview:

Get More Information on Well Testing Services Market - Request Sample Report

The Well Testing Services Market was valued at USD 7.16 Billion in 2023 and is projected to reach USD 12.36 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.29% from 2024 to 2032.

Well Testing Services are essential for the oil and gas industry. These services involve the measurement and analysis of various parameters such as pressure, flow rate, and temperature to determine the productivity and performance of a well. The data collected from well-testing services is crucial for making informed decisions about drilling, completion, and production operations. It helps operators to optimize production, reduce costs, and ensure safety and environmental compliance.

Well-testing services can be conducted at various stages of a well's life cycle, including exploration, appraisal, and production. The testing methods used depend on the type of well and the objectives of the test. Common well-testing techniques include drill stem, production, and well-interference testing. These methods involve the use of specialized equipment and skilled personnel to collect accurate and reliable data.

Market Dynamics

Drivers

-

Exploration of unconventional oil and gas resources

-

Increasing offshore Energy & Power activities

-

Technological advancement in the well-testing services

-

Increasing demand for the well-testing services

The rise of industrialization and the development of transportation infrastructure have resulted in an increased demand for fossil fuels. Consequently, there has been a surge in the need for surface well testing services. As the world continues to progress, the demand for energy sources has grown exponentially. Fossil fuels, being one of the most widely used sources of energy, have seen a significant increase in demand. This has led to the need for surface well testing services, which are crucial in determining the quality and quantity of oil and gas reserves in a particular area.

Restrain

-

Fluctuation in the prices of oil and natural gases

Opportunities

-

Continuous growth in discoveries of oilfields

-

Increasing investment in the oil and gas exploration activities

Challenges

-

Increasing adoption of renewable energy resources

The Well Testing Services Market is facing a significant challenge due to the growing adoption of renewable energy resources. This trend is limiting the demand for traditional oil and gas exploration, which is the primary focus of well-testing services. As the world shifts towards sustainable energy sources, the demand for well-testing services is expected to decline.

Impact of COVID-19

The COVID-19 pandemic affected various industries, including the well-testing services market. The pandemic has caused a decline in demand for oil and gas, leading to a decrease in drilling activities and subsequently, a reduction in the need for well-testing services. Furthermore, the restrictions on travel and social distancing measures have made it difficult for well-testing service providers to conduct their operations. The pandemic has also led to a decrease in investments in the oil and gas industry, which has further affected the well-testing services market.

Impact of Russia-Ukraine War:

The ongoing conflict between Russia and Ukraine affected the well-testing services market. This market is responsible for providing crucial information about the quality and quantity of oil and gas reserves in a particular area. However, the war has disrupted the operations of many companies in this sector, leading to a decline in their profitability. One of the main reasons for this decline is the instability in the region. The war has caused a significant reduction in the number of drilling activities, which has led to a decrease in demand for well-testing services. Additionally, the conflict has made it difficult for companies to transport their equipment and personnel to the affected areas, further hampering their operations.

Impact of Recession:

The recession has significantly affected the well-testing services market. This downturn has resulted in a decrease in demand for these services, as many companies have had to cut back on their exploration and production activities. As a result, the well-testing services market has experienced a decline in revenue and profitability.

Key Market Segmentation

By Services

-

Real Time Well Testing

-

Downhole Well Testing

-

Reservoir Sampling

-

Hydraulic Fracturing Method Testing

-

Surface Well Testing

By Well Type

-

Horizontal Wells

-

Vertical Wells

By Stages

-

Exploration, Appraisal, & Development

-

Production

By Application

-

Onshore

-

Offshore

Regional Analysis

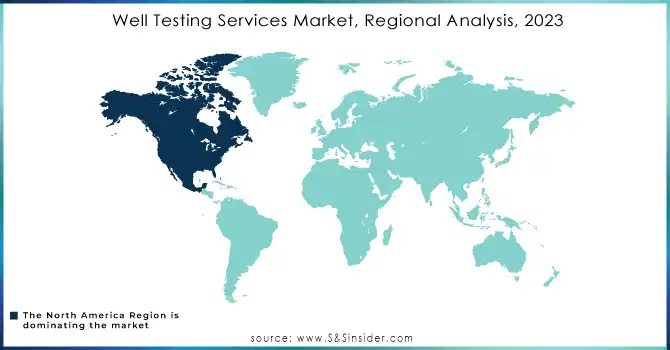

North America dominates the well-testing services market with the largest revenue share, and this region is predicted to experience remarkable growth with a significant CAGR during the forecast period. The availability of shale gas reservoirs, coupled with increasing investment in the exploration activities of oil and gas resources, drives the market for well-testing services in this region. The U.S. is the major contributor to the market share of North America, with technological innovation in drilling and completions causing rapid growth in U.S. oil and natural gas production. In 2021, U.S. oil production reached about 11.6 million b/d, and natural gas production reached about 118.7 Bcf/d (Billion cubic feet per day) in December 2021, both increasing due to higher demand and increased rig counts.

The Asia-Pacific region is the second-largest market for well-testing services and is expected to grow with the highest CAGR during the forecast period. This is owing to the increasing oil and gas production in this region, with oil production in the Asia-Pacific region amounting to around 7.34 million barrels per day in 2021.

Need Any Customization Research On Well Testing Services Market - Inquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are Schlumberger Limited, Rockwater Energy Solutions Inc., Halliburton Company, Baker Hughes, Weatherford International, Oil States International, Inc., Expro International Group, AGR Group ASA, Tetra Technologies Inc., FMC Technologies Inc, Mineral Technologies Inc., & other players

Key Developments:

-

In 2022, Baker Hughes, a leading energy technology company, revolutionized the industry with the launch of their latest subsea wellhead technology, the MS-2 Annulus Seal. This innovative technology is designed to significantly reduce operational rig costs by minimizing overall wellhead installation expenses through fewer rig trips. The MS-2 Annulus Seal builds upon the success of Baker Hughes' existing wellhead seal, the MS-SN, by providing increased operator confidence in good integrity and extending well life.

-

In 2018, Schlumberger, a global leader in oilfield services, unveiled their cutting-edge Concert* well-testing live performance technology at the prestigious Abu Dhabi International Petroleum Exhibition & Conference. This groundbreaking technology offers real-time surface and downhole measurements, data analysis, and collaboration capabilities for well-testing, providing unparalleled accuracy and efficiency.

| Report Attributes | Details |

| Market Size in 2022 | US$ 7.3 Bn |

| Market Size by 2030 | US$ 12.08 Bn |

| CAGR | CAGR of 6.5% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Services (Real Time Well Testing, Downhole Well Testing, Reservoir Sampling, Hydraulic Fracturing Method Testing, and Surface Well Testing) • By Well Type (Horizontal Wells and Vertical Wells) • By Stages (Exploration, Appraisal, & Development and Production) • By Application (Onshore and Offshore) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Schlumberger Limited, Rockwater Energy Solutions Inc., Halliburton Company, Baker Hughes, Weatherford International, Oil States International, Inc., Expro International Group, AGR Group ASA, Tetra Technologies Inc., FMC Technologies Inc, Mineral Technologies Inc. |

| Key Drivers | • Exploration of unconventional oil and gas resources • Increasing offshore Energy & Power activities |

| Market Opportunities | • Continuous growth in discoveries of oilfields • Increasing investment in the oil and gas exploration activities |