Wine Production Machinery Market Report Scope & Overview:

Get more information on Wine Production Machinery Market - Request Free Sample Report

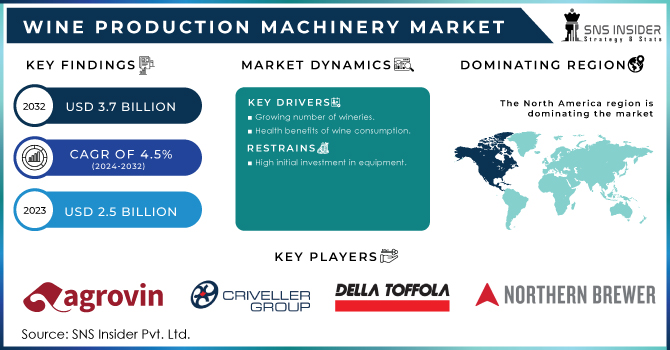

The Wine Production Machinery Market size was USD 2.5 billion in 2023 and is expected to Reach USD 3.7 billion by 2032 and grow at a CAGR of 4.5% over the forecast period of 2024-2032.

Wine production machinery is a set of equipment used to produce wine. It includes a wide range of machines, from simple grape crushers and presses to complex fermentation tanks and bottling lines. The traditional method of making wine is a labor-intensive process that has been used for centuries. Therefore, automation of the wine-making process is growing the market growth.

Wine is often regarded as one of the healthiest alcoholic beverages available. It has minimum calories and also has certain health benefits as it is high in antioxidants like proanthocyanidins, and resveratrol, which can help with cardiovascular health. As wineries invest in new equipment to match the expanding demand for wine, this indirectly drives the demand for wine production machinery.

Based on Equipment Type, the temperature control equipment segment is expected to grow at a CAGR of 4% in 2022. Temperature control equipment is used in winemaking operations to control machine temperature, which improves product quality while allowing efficiency and requiring fewer workers to monitor and control the equipment. The increased development of temperature controller equipment due to its widespread application in many sectors such as oil and gas, pharmaceuticals, food, and wine production industry has had a significant impact on the growth of the wine production machinery market.

MARKET DYNAMICS

KEY DRIVERS

-

Growing number of wineries

Wineries must invest in new technology to accommodate rising demand as wine consumption rises. This comprises equipment for all stages of the winemaking process, from grape crushing and pressing to fermentation, aging, and bottling. Furthermore, rising wine consumption is propelling the global wine business forward, with new wineries opening in emerging market areas such as China and India. This opens up new potential for wine machinery manufacturers. To accommodate the rising volume of grapes harvested, wineries are investing in new grape processing equipment. Wineries are likewise searching for methods to improve efficiency and cut costs by automating their operations. This is fueling the desire for automated winemaking machinery.

-

Health benefits of wine consumption

RESTRAIN

-

High initial investment in equipment

The cost of winemaking machinery varies according to the type of equipment, the size of the winery, and the level of automation. However, the initial investment in winemaking machinery can be substantial, particularly for small wineries. This can be a barrier to entry for new wineries, as well as a barrier to current wineries investing in new equipment. Furthermore, the high cost of wine production apparatus might make it difficult for small wineries to compete with larger wineries that can afford to invest in cutting-edge technology.

OPPORTUNITY

-

Increased use of automation and robotics in winemaking

Automation and robotics in the winemaking process consistently produce high-quality wine. This is because automation and robots may be programmed to follow specific methods that achieve the desired results. Winemakers can use automation to create more wine with less work. This is especially critical for wineries that are experiencing labor shortages. Winemakers can save money by removing the need for manual labor with the use of automation and robotics. This can be a considerable benefit for vineyards with small profit margins. It can assist wineries in decreasing their environmental impact by lowering waste and energy use.

-

Rising E-commerce, promotional activities

CHALLENGES

-

Reduction in demand for wine

Various factors such as concerns about the health dangers linked with alcohol consumption, may cause some people to restrict their wine consumption. Consumer preferences can shift over time, as individuals become more interested in various forms of alcoholic beverages, such as craft beer or cocktails. In addition, during an economic slump, people may spend less money on luxury commodities such as wine. These variables may cause a decrease in wine demand, which may impede the wine production machinery industry.

-

Consumers prefer traditional wine-making processes

IMPACT OF RUSSIA UKRAINE WAR

Russia and Ukraine are key exporters of raw materials and components used in winemaking machinery, such as steel, aluminum, and electronics, accounting for around 10% of global winemaking machinery exports. The war has also caused shipping lines to be disrupted and transportation prices to rise. The battle has hampered supply lines for critical raw materials and components needed in winemaking machinery. Wine production machinery manufacturers have had to boost their prices as a result of these delays. This has made it more difficult for wineries to purchase new machinery, potentially leading to a decrease in investment in wine production machinery.

IMPACT OF ONGOING RECESSION

The recession has impacted the wine production machinery market as the disruption of the supply chain of raw materials like steel, and grape farms, and factors affecting the growth of grapes may disrupt the exports of wine production machines. Many production plants of steel and aluminium metals are closed in Russia Ukraine war has decreased exports of steel. In 2023, sales of winemaking machinery in the EU and other developed markets are predicted to fall by 15%. Investment in new winemaking technology could fall by 20% in 2022.

MARKET SEGMENTATION

by Equipment Type

-

Tanks & Fermenters

-

Crushing & Pressing Equipment

-

Filtration Equipment

-

Temperature Control Equipment

-

other

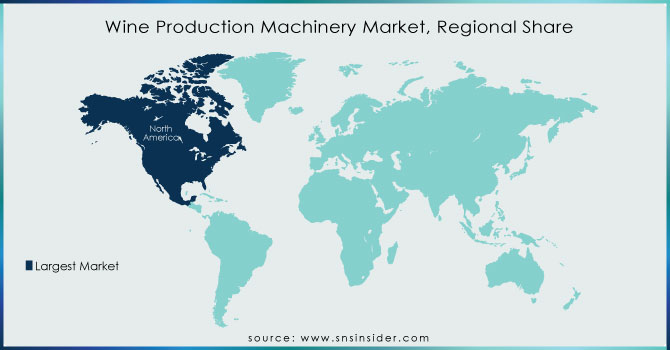

REGIONAL ANALYSIS

North America dominates the wine production machinery market, accounting for a share of over 32% in 2022. Growing production capacity and industrialization in North American countries such as the United States, Mexico, and Canada have assisted company leaders in establishing or expanding businesses, which is anticipated to boost the growth of the market for wine production machines.

Europe has a significant market for wine production machinery, accounting for a share of over 26% in 2022. The growing consumption of wine, changing lifestyles, and rising stress levels all have an impact on regional market growth. These factors are projected to raise the demand for wineries and the Wine Production Machinery Market in the area. Wineries are using such gear to raise the quality of their product.

Asia-Pacific is a fast-growing market for wine production machinery. This region accounted for a share of over 21% in 2022. This growth is attributed to rising consumer disposable income, the rising consumption of wine among young people has driven investment in the wine production machinery sector in countries such as China, India, Japan, and South Korea.

South America, the Middle East and Africa region have emerging markets for wine production machinery. It has a market share of 16% in 2022 and is predicted to grow substantially during the forecast period.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Wine Production Machinery Market are Agrovin, Criveller Group, Della Toffola Pacific, DT Pacific Pty. Ltd., Grapeworks Pty Ltd., GW Kent Inc, Love Brewing Limited, Northern Brewer LLC, Adamark Air Knife Systems, Paul Mueller Company, Vitikit Limited, and other key players.

Agrovin-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023, Monterey Wine Company (MWC), a Californian-based customized wine manufacturing facility, has committed to become the first US company to purchase a Frugal Bottle Assembly Machine from British sustainable packaging company Frugalpac.

In 2022, Zonda Machinery, a Chinese wine production machinery producer, collaborated with Frentauto, an Italian company. This collaboration provided Zonda with access to Frentauto's experience in automated grape harvest systems, a burgeoning trend in the wine business.

In 2022, American Bottling Systems, a manufacturer of winemaking machinery in the United States, acquired the Italian company Enoitalia. ABS now has a broader range of viticulture equipment and a better foothold in the European market as a result of this acquisition.

| Report Attributes | Details |

| Market Size in 2023 | US$ 2.5 Billion |

| Market Size by 2032 | US$ 3.7 Billion |

| CAGR | CAGR of 4.5 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment Type (Tanks & Fermenters, Temperature Control Equipment, Crushing & Pressing Equipment, Filtration Equipment, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Agrovin, Criveller Group, Della Toffola Pacific, DT Pacific Pty. Ltd., Grapeworks Pty Ltd., GW Kent Inc, Love Brewing Limited, Northern Brewer LLC, Adamark Air Knife Systems, Paul Mueller Company, Vitikit Limited |

| Key Drivers | • Growing number of wineries • Health benefits of wine consumption |

| Market Opportunity | • Increased use of automation and robotics in winemaking • Rising E-commerce, promotional activities |