X-Ray Security Screening Market Report Scope & Overview:

Get More Information on X-ray Security Screening Market - Request Sample Report

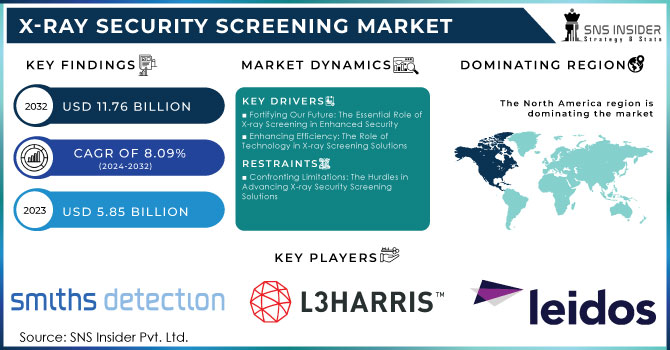

The X-ray Security Screening Market Size was valued at USD 5.85 Billion in 2023 and is expected to reach USD 11.76 Billion by 2032 and grow at a CAGR of 8.09% over the forecast period 2024-2032.

Primarily, the growth momentum of the X-ray Security Screening Market can be attributable to public concerns and the level of threat from terrorism and smuggling activities in such sectors as airport, port, and border control. The governments and private organizations are widely investing in advanced X-ray screening technologies to ensure security and comply with stringent regulatory requirements. It is further driven by the fact that X-ray security scanning helps in the detection of concealed weapons, explosives, drugs, and other contraband in transportation, government, and commercial sectors. A further boost to the market comes from increased demand from automated systems integrated with AI that detect faster and more accurately. In addition, rising passenger traffic worldwide and, importantly, at airports puts additional pressure on security systems to improve efficiency and handle screening volumes without conceding safety. Advancements in portable and mobile X-ray scanners also enhance the market.

The Transportation Security Administration of the United States is modernizing its X-ray security scanning across the country. They plan to commission 1,214 CT X-ray scanners at the country's airports across different checkpoints in a bid to spend USD 1.3 billion. That is 426 base-size units, 359 mid-size units, and 429 full-size units. Currently, there are about 634 CT scanners installed at TSA checkpoints; it is anticipated that new units would be installed up to 2024. This programme aims at the enhancement of aviation security and, by default, the effectiveness of the security process for passengers.

X-ray Security Screening Market Dynamics

KEY DRIVERS:

-

Fortifying Our Future: The Essential Role of X-ray Screening in Enhanced Security

The X-ray security screening market is significantly influenced by the ever-rising requirement for increased security levels in various fields, such as transportation, critical infrastructure, and public events. Rising concerns about terrorist attacks and crimes require governments and organizations to spend heavy amounts on advanced security technology. The need for effective and efficient screening solutions at airports and seaports, among other high-traffic areas, makes X-ray screening systems indispensable for passenger and asset security.

-

Enhancing Efficiency: The Role of Technology in X-ray Screening Solutions

This is further complemented by the advancement in technology with regards to X-ray screening equipment. An example of this is high-resolution imaging, and in real time, data analysis, and automation increase the productivity and effectiveness of security-screening processes. These improvement measures are not only meant to enhance the effectiveness of detection capabilities but also clear up the processes so that people are no longer made to spend a lot of time waiting while productivity in day-to-day activities is generally undermined. As companies seek to bridge the gap between being exigent with regard to security measures and convenience, more intriguing X-ray screening solutions appeal to customers and hence drive demand for the process.

RESTRAIN:

-

Confronting Limitations: The Hurdles in Advancing X-ray Security Screening Solutions

Several constraints also exist in the X-ray security screening market. Advanced X-ray equipment has high investment costs, which is intimidating organizations, especially small businesses, to invest in such technologies. This may provide a structural support system to public resistance due to privacy and health risks due to radiation exposure. Regulatory compliance and periodic maintenance besides up-grades add to the problems of implementation. However, the rate of change in technology is so rapid that it demands continuous manpower training, adding to operational complexities. Unleashing the full potential for growth in the X-ray security screening market would thus call for overcoming these challenges.

X-ray Security Screening Market Segmentation Overview

BY END USE

The Government segment had the highest revenue with 46.45% of the total market share in the year 2023. Extensive adoption of security screening by government and law enforcement agencies for safety purposes propels the X-ray screening security market. Governments and private organizations are significantly investing in security solutions due to expanding terror activities.

The transit segment is expected to grow at a CAGR of 8.78% over the forecast period. The growth in this segment can be primarily associated with an increase in passengers worldwide and continuous efforts to adopt security measures to ensure complete safety for citizens and global travelers. This will contribute significantly towards increasing the demand for X-ray security screening in the transit sector over the next couple of years.

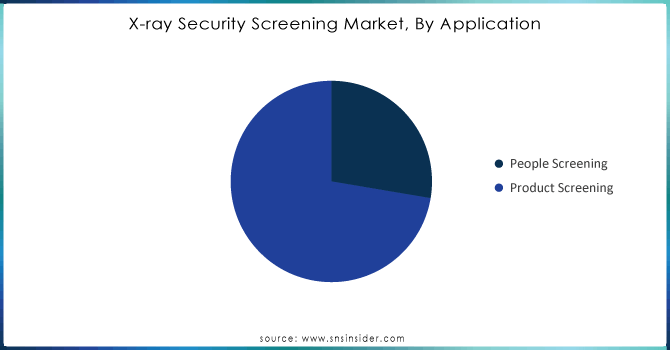

BY APPLICATION

The product screening segment held the largest market share of 72.34% in 2023. With advancements in technology, integrated screening systems are readily available in the market, allowing vendors to integrate screening and emerging scanning end-use into traditional products, thus augmenting the growth of the segment.

The people screening segment is expected to hold a high growth rate of 9.76% from 2023 to 2032. Citizens and corporates are under persistent risks of cyber-attacks, natural and man-made disasters, and dangers like terrorism. Governments of various regions are concentrating on the advanced solutions that can enhance and strengthen the already existing information technology infrastructure and security systems.

Need any customization research on X-Ray Security Screening Market - Enquiry Now

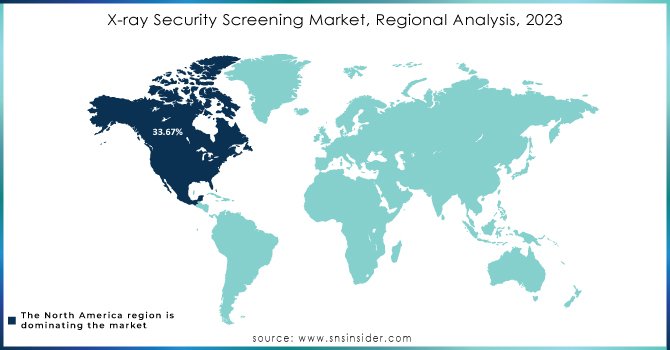

X-ray Security Screening Market Regional Analysis

In 2023, North America dominated the market with a market share of 33.67%. Massive public investments toward making the current infrastructure for public safety and security better, coupled with obliterating threats like terrorism and illegal immigration, will work as market drivers in the considered forecast period. The U.S. Customs and Border Protection department scans all containers at the point of entry into the U.S., be it land or sea. Such scanning is done to eliminate any traces of radiation.

Asia Pacific is projected to grow at the highest CAGR of 10.11% during the forecast period. Asia Pacific is one of the emerging markets of the world in terms of the fact that the region encompasses numerous social occasions, tourism, events, and sports that cause huge crowning of people gathering and moving. Consequently, the scope for growth in the market of security screening is high in this region. India, China, Japan, and South Korea are major constituting countries of this region. Rest of Asia Pacific includes Singapore, Australia, the Philippines, and Thailand. The public events at which people throng in great numbers occur more frequently in Asia Pacific than in other regions

Key Players in X-ray Security Screening Market

Some of the major players in the X-ray Security Screening Market are:

-

Smiths Detection (HI-SCAN 6040 CTiX, iLane A20)

-

L3Harris Technologies (ASCT, RSM-7)

-

Leidos (AXM, L-3 Dismounted Soldier System)

-

Nuctech Company Limited (TSA-600, T2000)

-

Safran (Morpho Detection, VDS-9)

-

Kromek Group (D5, D3)

-

TELEDYNE FLIR (Vega, ThermiCam)

-

Astrophysics Inc. (A-Series, V-Series)

-

Raytheon Technologies (Tactical X-ray Systems, Smart X-ray System)

-

General Electric (GE) (Infinia, Discovery CT750 HD)

-

Ametek Inc. (MCA-250, PICO-100)

-

Cannon Group (X-Scan, X-Check)

-

Hunan Yigao Group (YX-1, YX-2)

-

Varex Imaging Corporation (X-Ray Tubes, Flat Panel Detectors)

-

PerkinElmer (Pioneer, Multimodal Imaging Systems)

-

DHS Technologies (DHS X-ray Inspection, TSI System)

-

MARS Bioimaging (MARS X-ray Camera, MARS Imaging System)

-

Nippon Avionics Co., Ltd. (X-ray Inspection System, X-ray 3D Imaging)

-

Unisys Corporation (Unisys Security X-ray Solutions, Security Screening Systems)

RECENT TRENDS

-

In April 2024, Smiths Detection launched the SDX 10060 XDi - " revolutionary" X-ray scanner powered by diffraction technology, heralding a new era in security screening at airports.

-

Sep 2024, The Canadian Air Transport Security Authority said that it had plans of fitting airport checkpoints across the country with the technological equipment, which means a 360-degree view through computerized X-ray imaging, in the near future.

-

From July 2 2024, the Hong Kong International Airport introduces a new security scanning system that will allow passengers to carry their hand-carry luggage, with all their electronic devices and liquids in them, as they will no longer be asked to take out the laptop computer, mobile phone, game devices, and liquids, aerosols, and gels needed by the existing 2D scanning method.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.85 Billion |

| Market Size by 2032 | USD 11.76 Billion |

| CAGR | CAGR of 8.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End Use (Transit, Commercial, Government) • By Application (People Screening, Product Screening) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Smiths Detection, L3Harris Technologies, Leidos, Nuctech Company Limited, Safran, Kromek Group, TELEDYNE FLIR, Astrophysics Inc., Raytheon Technologies, General Electric (GE), Ametek Inc., Cannon Group, Zhejiang University, Hunan Yigao Group, Varex Imaging Corporation, PerkinElmer, DHS Technologies, MARS Bioimaging, Nippon Avionics Co., Ltd., Unisys Corporation. |

| Key Drivers | • Fortifying Our Future: The Essential Role of X-ray Screening in Enhanced Security • Enhancing Efficiency: The Role of Technology in X-ray Screening Solutions |

| RESTRAINTS | • Confronting Limitations: The Hurdles in Advancing X-ray Security Screening Solutions |