Public Safety and Security Market Report Scope & Overview:

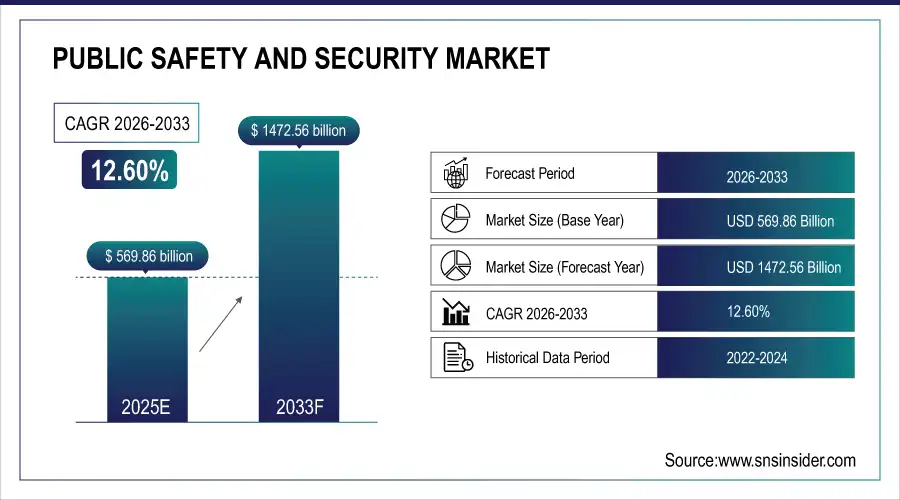

The Public Safety and Security Market was valued at USD 569.86 billion in 2025E and is expected to reach USD 1472.56 billion by 2033, growing at a CAGR of 12.60% from 2026-2033.

The Public Safety and Security Market growth is driven by increasing urbanization, rising crime rates, and the need for advanced surveillance and emergency response systems. Adoption of AI, IoT, and cloud-based security solutions enhances real-time monitoring, threat detection, and situational awareness. Governments and enterprises are investing in smart city initiatives, integrated communication networks, and cybersecurity measures, further accelerating market expansion globally and improving overall public safety infrastructure.

Public Safety and Security Market Size and Forecast

-

Market Size in 2025E: USD 569.86 Billion

-

Market Size by 2033: USD 1472.56 Billion

-

CAGR: 12.60% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information on Public Safety and Security Market - Request Sample Report

Public Safety and Security Market Trends

-

Rising global focus on citizen safety and crime prevention is driving the public safety and security market.

-

Growing adoption of surveillance systems, IoT sensors, and video analytics is enhancing real-time monitoring capabilities.

-

Expansion of smart city initiatives and integrated command-and-control centers is boosting market growth.

-

Increasing need for emergency response, disaster management, and law enforcement efficiency is shaping adoption trends.

-

Integration of AI, machine learning, and predictive analytics is improving threat detection and decision-making.

-

Rising concerns around terrorism, cybercrime, and critical infrastructure protection are fueling demand for advanced security solutions.

-

Collaborations between government agencies, technology providers, and system integrators are accelerating innovation and market deployment.

Public Safety and Security Market Growth Drivers:

-

Escalating Security Threats Fueling the Demand for Advanced Public Safety Solutions

Escalating security threats such as terrorism, cyber-attacks, organized crime, and natural disasters have heightened the need for advanced public safety solutions. The increasing frequency and sophistication of terrorist activities and cyber intrusions targeting critical infrastructure demand proactive security measures, with real-time monitoring and rapid response capabilities. Organized crime networks, leveraging technology for illicit activities, require enhanced surveillance and detection systems to combat emerging threats. Additionally, natural disasters have become more frequent and severe, pushing for better disaster management systems and early warning technologies. As these threats evolve, there is a greater urgency for integrated security solutions capable of addressing a wide range of challenges. This growing complexity of risks accelerates the demand for innovative, technologically advanced public safety tools, with governments and organizations investing heavily in systems that ensure safety, mitigate damage, and improve response times to critical incidents.

-

Technological Advancements Revolutionizing Public Safety and Security Solutions

The integration of AI, IoT, cloud computing, and big data analytics is transforming public safety and security systems. AI-powered surveillance cameras enhance threat detection by analyzing vast amounts of data in real time, allowing for quicker identification of suspicious activities. IoT devices connected through networks enable seamless communication between security systems, providing a more synchronized and efficient response to incidents. Cloud computing allows for the storage and processing of large data volumes, enabling more agile and scalable security operations. Big data analytics further strengthens threat prediction and response capabilities by identifying patterns and anomalies that may indicate potential risks. These technological advancements are revolutionizing the efficiency, accuracy, and speed of surveillance, emergency responses, and overall public safety management. As a result, these innovations are driving the demand for smarter, more effective security solutions in the market.

Public Safety and Security Market Restraints:

-

High Costs Limiting Widespread Adoption of Advanced Public Safety Technologies

The high costs associated with implementing and maintaining advanced public safety technologies, such as AI-powered surveillance systems and integrated security solutions, present a significant barrier to widespread adoption. These technologies require substantial investments in both initial setup and ongoing maintenance, including software updates, hardware upgrades, and personnel training. This financial burden can be particularly challenging for smaller law enforcement agencies or regions with limited budgets, as they may struggle to allocate resources for advanced security infrastructure. Additionally, the complex nature of these systems requires skilled professionals to operate and maintain them, further increasing operational costs. As a result, many public safety agencies are unable to fully leverage the potential of these advanced solutions, limiting their effectiveness in addressing growing security threats and improving overall safety in certain areas.

Public Safety and Security Market Segment Analysis

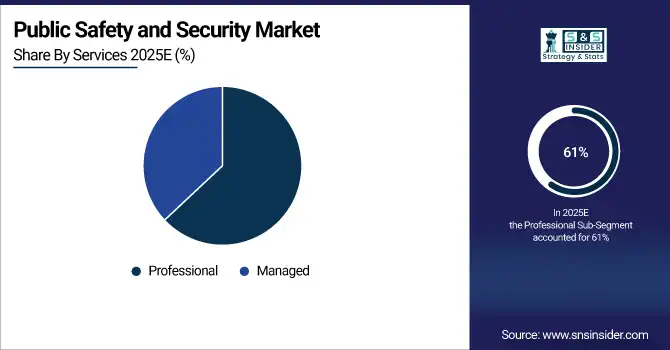

By Services, Professional Services dominated the Market, Managed Services are expected to grow at the fastest CAGR

The Professional Services segment dominated the Public Safety and Security Market in 2025, capturing approximately 61% of the revenue share. This dominance is driven by the increasing demand for expert consultation, system integration, and deployment of complex security technologies. Professional services offer tailored solutions, ensuring effective risk management, customized security strategies, and seamless implementation of advanced technologies, which are essential for organizations seeking to enhance their security infrastructure.

The Managed Services segment is expected to grow at the fastest CAGR of 13.69% from 2026 to 2033. This growth is fueled by the rising need for cost-effective, outsourced security management solutions. As organizations focus on core operations, they are increasingly relying on managed service providers to handle surveillance, monitoring, and threat detection. The scalability and flexibility of managed services, coupled with the growing complexity of cybersecurity threats, make them an attractive option for companies aiming to optimize their public safety and security efforts while reducing operational costs.

By Solution, Critical Communication Networks led the Market, Emergency and Disaster Management projected to register the fastest growth

The Critical Communication Network segment dominated the Public Safety and Security Market in 2025, accounting for approximately 26% of the revenue share. This dominance is largely attributed to the essential role communication networks play in public safety operations. Reliable and secure communication systems are critical for coordination during emergencies, law enforcement activities, and disaster response, driving continuous investment in this area. The growing need for real-time, mission-critical communication across various public safety sectors has solidified its position as a market leader.

The Emergency and Disaster Management segment is projected to experience the fastest CAGR of 16.46% from 2026 to 2033. This rapid growth is fueled by the increasing frequency and severity of natural disasters and emergencies, which demand more sophisticated management solutions. Governments and organizations are prioritizing investments in early warning systems, disaster response tools, and recovery strategies to improve resilience. As the global focus shifts towards mitigating the impact of disasters and ensuring quick recovery, the demand for advanced disaster management technologies is expected to surge, driving significant growth in this segment.

By Application, Homeland Security led the Market, Transportation Systems are anticipated to grow at the highest CAGR

The Homeland Security segment dominated the Public Safety and Security Market in 2025, holding the largest revenue share of about 35%. This dominance is driven by the increasing global focus on national security, particularly in the wake of rising terrorism threats, border security concerns, and cyber-attacks. Government agencies are investing heavily in advanced surveillance, threat detection, and intelligence-sharing systems to protect citizens and critical infrastructure, fueling continuous growth in this segment.

The Transportation Systems segment is poised to grow at the fastest CAGR of 14.89% from 2026 to 2033. This rapid expansion is largely driven by the growing need for smarter, safer, and more efficient transportation networks. With rising concerns about public safety in airports, railways, and roadways, there is an increasing demand for advanced security technologies like automated surveillance, AI-based monitoring, and traffic management systems. As urbanization and mobility increase globally, investments in secure, intelligent transportation infrastructure are expected to rise, propelling the sector’s growth.

Public Safety and Security Market Regional Analysis

North America Public Safety and Security Market Insights

North America dominated the Public Safety and Security Market in 2025, capturing the highest revenue share of about 38%. This leadership is largely driven by substantial investments from both government and private sectors in advanced security technologies. The region’s strong infrastructure, high adoption of cutting-edge solutions, and growing concerns over cybersecurity and terrorism have led to the widespread deployment of sophisticated surveillance systems, emergency response tools, and intelligence-sharing platforms, ensuring its continued dominance in the market.

Do You Need any Customization Research on Public Safety and Security Market - Enquire Now

Asia Pacific Public Safety and Security Market Insights

Asia Pacific is expected to grow at the fastest CAGR of 15.53% from 2026 to 2033. This rapid growth is fueled by the region’s increasing urbanization, rising security concerns, and expanding investments in smart city initiatives. Governments across Asia Pacific are prioritizing the modernization of their public safety infrastructure to address evolving threats, including cyber risks and natural disasters. The region’s growing technological adoption, along with the need for advanced surveillance and emergency response systems, positions it for robust growth in the coming years.

Europe Public Safety and Security Market Insights

Europe’s Public Safety and Security Market is growing due to increasing investments in smart city initiatives, advanced surveillance systems, and emergency response solutions. Rising concerns over terrorism, cyber threats, and crime prevention are driving adoption of AI-enabled video analytics, IoT-based monitoring, and integrated communication networks. Government regulations and funding for public safety infrastructure further support market expansion. Additionally, the shift toward digital transformation and enhanced situational awareness is accelerating growth across European countries.

Middle East & Africa and Latin America Public Safety and Security Market Insights

The Middle East & Africa and Latin America Public Safety and Security Market is expanding due to rising urbanization, increasing crime rates, and growing government investments in surveillance and emergency response systems. Adoption of AI-driven video analytics, IoT-based monitoring, and integrated communication solutions enhances threat detection and situational awareness. Additionally, smart city initiatives, cybersecurity measures, and focus on public safety infrastructure are driving market growth across these regions.

Public Safety and Security Market Competitive Landscape:

Motorola Solutions, Inc.

Motorola Solutions is a global leader in mission-critical communications, public-safety technology, and enterprise security solutions. The company develops integrated hardware, software, and services that enhance situational awareness, safety, and operational efficiency for public-safety agencies and commercial enterprises. By combining AI, video analytics, and advanced communications, Motorola Solutions enables faster incident response, smarter security operations, and streamlined workflows, supporting both emergency responders and enterprise security teams.

-

2025: Unveiled “Inform,” merging video, access-control, and sensor data into one AI-assisted incident-response suite, providing real-time situational awareness and faster security response for enterprises and public-safety clients.

-

2025: Launched the “SVX,” a hybrid device combining radio, body-cam, and AI-assistant “Assist,” aimed at speeding emergency response, automating license-plate/ID checks, and reducing officers’ administrative burden.

-

2024: Demonstrated new AI-driven enterprise security tools at ISC West 2024, including intrusion detection, access control integration, video analytics, and alert workflows.

Cisco Systems, Inc.

Cisco Systems is a global technology leader specializing in networking, cybersecurity, and digital infrastructure solutions. The company focuses on enabling secure, scalable, and resilient enterprise networks, integrating advanced technologies like AI, zero-trust security, and quantum-resistant encryption. Cisco helps organizations safeguard critical infrastructure, optimize network performance, and protect digital workloads in increasingly complex threat environments, supporting the transition to AI-driven and hybrid-cloud operations.

-

2025: Released “AI Defense,” a solution embedding zero-trust, advanced threat detection, and network-native security controls to protect enterprise networks and AI workloads.

-

2025: Announced a next-generation secure network architecture featuring hybrid-mesh firewalls, zero-trust access, quantum-resistant encryption, and AI-powered management for enterprise and critical-infrastructure networks.

Public Safety and Security Market Key Players

-

Cisco (Cisco Meraki, Cisco Firepower)

-

Honeywell (Honeywell Galaxy Flex, Honeywell Pro-Watch)

-

Motorola Solutions (APX Radios, CommandCenter Software)

-

IBM (IBM Security QRadar, IBM Resilient)

-

Siemens (Siveillance, Desigo CC)

-

NEC (NeoFace, Intelligent Video Analytics)

-

Thales (Safran, Video Surveillance Solutions)

-

Hexagon (Safety & Infrastructure, SmartCity)

-

Ericsson (Public Safety, Mobility Management)

-

Huawei (Safe City, Video Surveillance)

-

Atos (Digital Security, Cloud Security Solutions)

-

Idemia (MorphoWave, Secure Identity Solutions)

-

General Dynamics (Mission Systems, Security Solutions)

-

ESRI (ArcGIS, ArcGIS for Public Safety)

-

L3 Harris Technologies (P25 Radios, Public Safety Communications)

-

Alcatel-Lucent Enterprise (OmniAccess, OpenTouch Communication Server)

-

BAE Systems (NetReveal, Security Solutions)

-

Verint Systems (Situation Management, Video Intelligence)

-

SAAB AB (Surveillance Solutions, 9L Systems)

-

Nice (Public Safety Solutions, Investigate)

-

Teltronic (Tetra Radios, Control Room Solutions)

-

Secure Passage (Access Control, Security Solutions)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 569.86 Billion |

| Market Size by 2033 | USD 1472.56 Billion |

| CAGR | CAGR of 12.60% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Critical Communication Network, C2/C4ISR System, Biometric Security and Authentication System, Surveillance Systems, Scanning and Screening System, Emergency and Disaster Management, Cybersecurity) • By Services (Professional, Managed Services) • By Deployment Mode (On-premises, Cloud) • By Application (Homeland Security, Emergency Services, Critical Infrastructure Security, Transportation Systems) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco, Honeywell, Motorola Solutions, IBM, Siemens, NEC, Thales, Hexagon, Ericsson, Huawei, Atos, Idemia, General Dynamics, ESRI, L3 Harris Technologies, Alcatel-Lucent Enterprise, BAE Systems, Verint Systems, SAAB AB, Nice, Teltronic, Secure Passage. |