Zeolites Market Report Scope & Overview

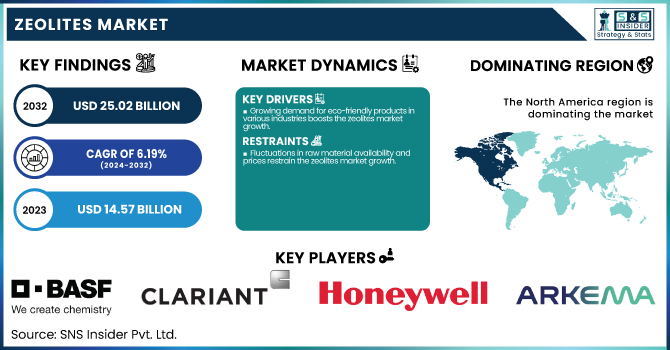

The Zeolites Market size was USD 14.57 billion in 2023 and is expected to reach USD 25.02 billion by 2032 and grow at a CAGR of 6.19% over the forecast period of 2024-2032.

To Get more information on Zeolites Market - Request Free Sample Report

The report offers a comprehensive view of key industry dynamics through quantifiable metrics and regional analysis. This includes production capacity and utilization rates of natural and synthetic zeolites by country as of 2023, along with feedstock pricing trends such as alumina and silica. The report evaluates regulatory impacts on manufacturing and exports across major economies, highlighting shifts driven by environmental mandates. Emissions data and waste management practices are covered to assess sustainability initiatives by region. Additionally, it explores innovation and R&D investments focusing on catalyst applications and green chemistry. Adoption trends in zeolite-based software solutions and digital integration in quality control processes are also analyzed for operational efficiency.

The United States held the largest share in the Zeolites Market in 2023, with a market size of USD 3.88 billion, projected to reach USD 6.88 billion by 2032, growing at a CAGR of 6.59% during 2024–2032. This is because of its established industrial base, demand from end-use sectors, and leading manufacturer presence. Synthetic zeolites are widely used as catalysts and adsorbents in on-purpose fluid catalytic cracking (FCC) and gas separation processes in the country, which is well-known for its oil refining and petrochemical industry. Besides, the increasing focus on water treatment and environmental protection has driven zeolite demand in municipal and industrial wastewater applications. Incentives for the use of green & low emission products from regulatory bodies, including the U.S. Environmental Protection Agency (EPA) promoting eco-friendly products & materials, and respective approvals of zeolites have significantly urged their usage in the detergent industry. Strong investments in research and development (R&D), as well as aggressive technology advancements, are key direct benefits the U.S. can expect from zeolite commercialization, yielding non-particulate zeolite structures that are highly tailored for performance.

Market Dynamics

Drivers

-

Growing demand for eco-friendly products in various industries boosts the zeolites market growth.

The rising emphasis on environmental sustainability across key industries is significantly driving the demand for zeolites, particularly synthetic types. As eco-friendly alternatives to phosphates in detergents and environmentally responsible catalysts in petrochemical refining, zeolites are increasingly being adopted due to their non-toxic, recyclable, and biodegradable nature. Governments and environmental bodies, especially in North America and Europe, are tightening regulations on chemical emissions and phosphate use, further supporting the shift toward sustainable materials. In addition, industries such as water treatment, agriculture, and animal feed are utilizing natural zeolites for their ability to adsorb heavy metals, remove ammonia, and improve nutrient absorption. With growing awareness among manufacturers and consumers about environmental impacts, the zeolites market is poised to benefit from the shift toward greener, safer chemical solutions across a broad spectrum of industrial applications.

Restrain

-

Fluctuations in raw material availability and prices restrain the zeolites market growth.

The zeolites market is significantly affected by the volatile availability and pricing of essential raw materials, particularly alumina, silica, and kaolin. These materials are heavily influenced by mining activities, global trade dynamics, and environmental regulations, making their supply chain vulnerable to disruptions. Any restrictions in mining output or shifts in environmental compliance requirements, especially in major producing countries like China and India can lead to inconsistent raw material availability, affecting production capacity and operational efficiency. Additionally, fluctuations in energy prices, which directly impact synthetic zeolite manufacturing processes, further contribute to cost uncertainties. Smaller manufacturers often face challenges maintaining stable profit margins due to these variable input costs. Such fluctuations hinder strategic planning and long-term investments, especially in price-sensitive applications like detergent manufacturing or agriculture, thereby restraining the overall growth potential of the zeolites market.

Opportunity

-

Rising use of zeolites in emerging economies offers significant growth opportunities.

Emerging economies in Asia Pacific, Latin America, and the Middle East are witnessing a surge in infrastructure development, industrial expansion, and environmental awareness, all of which open new avenues for zeolites market growth. These regions are increasingly investing in wastewater treatment, refining operations, and sustainable agriculture, where both natural and synthetic zeolites play critical roles. The affordability and multi-functionality of zeolites make them particularly appealing in developing countries where cost-effective and environmentally friendly solutions are in high demand. Moreover, as governments in these regions implement stricter environmental norms and incentivize green technologies, the adoption of zeolites is expected to rise. Growing urbanization and population growth also contribute to increased detergent and animal feed consumption, further expanding the application base. As global players focus on expanding their manufacturing footprints and distribution networks in these markets, the growth potential becomes even more pronounced.

Challenge

-

Complex manufacturing processes and technical limitations pose challenges to market expansion.

The production of synthetic zeolites involves complex manufacturing processes, including hydrothermal synthesis under high-pressure and high-temperature conditions, requiring advanced technical know-how and significant capital investment. These processes must be precisely controlled to produce zeolites with uniform pore structures and desired ion-exchange capacities, which is crucial for high-performance applications such as petrochemical refining and gas separation. Additionally, scale-up from lab to industrial production can be difficult due to sensitivity to impurities and reaction conditions. Not all regions possess the technical infrastructure or expertise to manufacture high-quality zeolites consistently, leading to regional disparities in production quality and supply. Moreover, natural zeolites vary significantly in mineral composition depending on the source, which limits their uniform application across industries. These challenges increase dependency on a few specialized producers and constrain market expansion, especially in technologically underdeveloped or cost-sensitive regions.

Segmentation Analysis

By Product

The synthetic segment held the largest market share, around 75%, in 2023. It is due to several personal care formulations, including shampoos, body wash, facial cleansers, toothpaste, etc. Due to their primary role as cleansing agents, emulsifiers, and foaming agents, they are requirements in rinse-off and leave-on products. Surfactants are indispensable components that help change the surface properties of products; surfactants are extensively used in various daily-use products, owing to their high usage volume. Surfactant ingredients improve the texture of the product, ease and spread the ability of application, and overall benefit, thus contributing significantly to its overall market dominance. In addition, continuous developments in milder and bio-based surfactants due to increasing preference for skin-friendly and environmentally friendly products have additionally aided their extensive accessibility.

By Application

Catalysts held the largest market share, around 38%, in 2023. It can be attributed to their significant usage in the refining and petrochemical industries. The conversion of heavy crude oil, such as heavy fractions that yield little value, into interpretable lighter fractions (gasoline, diesel, and other petrochemical products) is traditionally carried out in fluid catalytic cracking (FCC) processes, in which zeolites are widely used as catalytic agents. Due to their unique porous structure, high surface area, and excellent ion-exchange capabilities, they provide an efficient and selective medium for chemical reactions. Rising consumption of clean fuel across the globe, especially in developed countries such as North America and Europe, has boosted the uptake of zeolite-based catalysts at the refinery level of production to comply with strict environmental regulations regarding the emissions of fuels.

Regional Analysis

North America held the largest market share, around 35%, in 2023. It is due to having a basic refining and petrochemical infrastructure, coupled with abundant demand for advanced catalytic materials, North America accounted for the largest market share in zeolites market. Some of the largest oil refineries and chemical manufacturing facilities in the world are located in the region, which depend significantly on zeolite-based catalysts for fluid catalytic cracking (FCC) and hydrocracking operations. Countries like the U.S. have even stricter environmental regulations, with agencies like the Environmental Protection Agency (EPA), increasing demand for cleaner fuel and the need to efficiently control emissions – applications that zeolites are used for. The presence of major market players like Albemarle Corporation and Honeywell UOP in the region also adds to the regional innovation, manufacturing capabilities, and supply chain for the same reason. Strong consumption of zeolites from residential and industrial sectors in North America is further driven by the increase in demand for water treatment solutions, detergents, and sustainable construction materials.

Asia Pacific held a significant market share. It is owing to rapid urbanization and flourishing infrastructure and industrialization in the region. The demand is driven by countries such as China and India and is coming from significant growth in sectors including petrochemicals, agriculture, water treatment, and construction. Zeolite-based catalysts are crucial because of zeolite requirements in catalytic processes, especially fluid catalytic cracking (FCC) and hydrocracking, which form a part of the region-specific large-scale industrial activities, such as refining and chemical production. On top of that, environmental regulations are on the rise in the Asia Pacific region, thus creating a demand for eco-friendly and efficient technologies, including zeolite-based materials for emission control, water purification, and sustainable agricultural practices. Higher disposable incomes and an expanding middle class in the region are also driving the increased use of zeolites in such applications as detergents and animal feed. Additionally, the presence of major zeolite producers, including Nippon Chemical Industrial Co.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Zeolite A, Sorbead)

-

Clariant (Zeoclear, Tonsil)

-

Honeywell International Inc. (UOP ZSM-5, UOP HX)

-

Arkema Group (Siliporite, Altuglas)

-

Albemarle Corporation (Zeocat, Filtrol)

-

W. R. Grace & Co. (SYLOBEAD, Dried Zeolite Powder)

-

Zeochem AG (ZEOflair, ZEOsphere)

-

Tosoh Corporation (HSZ-320, HSZ-960)

-

KNT Group (KNT Z10, KNT S7)

-

PQ Corporation (Zeolite 4A, Zeolite MAP)

-

Zeolyst International (CBV-28014, CBV-901)

-

Bear River Zeolite Company (Clinoptilolite, BRZ Zeolite)

-

Shijiazhuang Jianda High-Tech Chemical Co., Ltd. (JDZ-13X, JDZ-5A)

-

Interra Global Corporation (InterZeolite, IGZ-3A)

-

St. Cloud Mining Company (SCM Zeolite, Natural Zeolite Granules)

-

Blue Pacific Minerals (ZeoFert, Optimate Zeolite)

-

Rota Mining Corporation (EcoZeo, ZeoAgri)

-

Challs International Ltd. (PowerZeo, Challs-Z10)

-

Ningbo Jiahe New Materials Technology Co., Ltd. (Jiahe 13X, Jiahe ZSM-5)

-

Canadian Zeolite Corp. (Clinopure, ZeoGreen)

Recent Development:

-

In March 2023, BASF introduced a new range of sustainable cosmetic active ingredients tailored to meet the growing demand in the clean beauty segment. Later, in September 2023, the company unveiled Epispot, a sustainably sourced ingredient specifically formulated to support skin clarity and boost confidence among individuals with blemish-prone skin.

-

In June 2023, Croda International Plc entered into a strategic partnership with RAHN AG. The collaboration focuses on the development of innovative, naturally derived cosmetic ingredients. This move aligns with growing consumer demand for sustainable and effective personal care solutions.

| Report Attributes | Details |

| Market Size in 2023 | USD 14.57 Billion |

| Market Size by 2032 | USD25.02 Billion |

| CAGR | CAGR of6.19 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Natural, Synthetic) •By Application (Catalysts, Adsorbents, Detergent Builders, Cement, Animal Feed, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Clariant, Honeywell International Inc., Arkema Group, Albemarle Corporation, W. R. Grace & Co., Zeochem AG, Tosoh Corporation, KNT Group, PQ Corporation, Zeolyst International, Bear River Zeolite Company, Shijiazhuang Jianda High-Tech Chemical Co., Ltd., Interra Global Corporation, St. Cloud Mining Company, Blue Pacific Minerals, Rota Mining Corporation, Challs International Ltd., Ningbo Jiahe New Materials Technology Co., Ltd., Canadian Zeolite Corp. |