3D Machine Vision Market Size & Growth Trends:

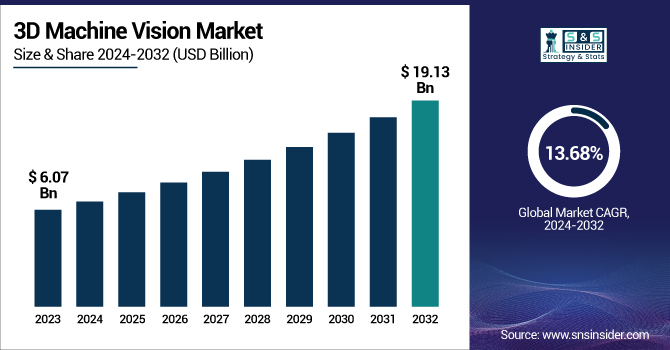

The 3D Machine Vision Market Size was valued at USD 6.07 billion in 2023 and is expected to reach USD 19.13 billion by 2032 and grow at a CAGR of 13.68% over the forecast period 2024-2032.

To Get more information on 3D Machine Vision Market - Request Free Sample Report

The expansion is driven by rising demands for automation, precision inspection, and quality assurance across numerous industries, such as automotive, electronics, pharmaceutical, and packaging. Various 3D machine vision solutions allow more precise detection of objects, measurement of space, and defect inspection. AI, deep learning and smart cameras continue to move adoption forward as well. Asia Pacific is the highest in terms of mass scale manufacturing despite being last in the line-up for overall market share followed by North America as the fastest growing region. The competition in the market is growing with advancement of hardware, software, and integration capabilities.

The U.S. 3D Machine Vision Market size was USD 0.97 billion in 2023 and is expected to reach USD 3.31 billion by 2032, growing at a CAGR of 14.70% over the forecast period of 2024–2032. Factor contributing to such high growth are increasing automation in automotive, electronics, logistics and pharmaceutical sectors. The US market is particularly prone to faster take-up of AI-based vision technology, significant R&D spend and depth of leading industry players. A growing demand for precision inspection, quality inspection, and robot guidance is further driving adoption. The synergy among 3D vision, smart manufacturing, and Industry 4.0 initiatives continues to revolutionize industrial processes and help the U.S. become one of the fastest-growing markets in the world for the 3D vision industry.

3D Machine Vision Market Dynamics

Key Drivers:

-

Growing Adoption of 3D Machine Vision in Automated Manufacturing and Industrial Robotics Drives Market Expansion Across Key Sectors.

The adoption of 3D machine vision technology in automation-based manufacturing and industrial robotics is a major inducer for market growth. Advanced analytics forms a core segment of machine learning, and this process requires a large chunk of data to draw insights. In the automobile, electronics, pharmaceutical food processing sectors, manufacturers are adopting 3D vision systems for assembly, inspection, and material handling processes. Such systems offer more precision, faster production speeds, and improved quality checks through the ability of machines to sense and understand three-dimensional worlds with real-time analysis. So it is bound to increase the total market as the requirement for 3D machine vision in automated systems is expected to continue to rise as companies are looking to make more areas of their operation automated, improving efficiency, reducing errors, and reducing labor costs.

Restrain:

-

Lack of Skilled Workforce to Operate and Maintain Complex 3D Machine Vision Systems Limits Market Growth.

Sophisticated systems need adequate manpower who can run, maintain and optimize them successfully. 3D machine vision technology requires comprehensive optical knowledge, software coding experience, and system integration capability. This expertise is in shortage in most industries, making it difficult to optimize and sustain these technologies. These types of systems are so complex that it involves ongoing training for engineers and operators to ensure peak performance and address issues. Without personnel adequately trained in operating 3D machine vision systems, firms will be unable to unlock the complete potential of these systems, and return on investment will remain in less-than-optimal stages, with applications being narrowed and limited segments dominating industries, especially in regions where firms experience poor access to technical training programs.

Opportunities:

-

Growing Demand for Quality Control and Precision Inspection in Manufacturing Sectors Presents Significant Growth Opportunities for 3D Machine Vision Systems.

The rising need for quality control and accuracy inspection in manufacturing industries is one of the major growth opportunities for the 3D machine vision market. With the emerge of 3D machine vision systems, though automated inspection is demanded more widely, it is a good solution because manufactures are under intense pressure to improve their product quality. These systems are capable of scanning minute defects, taking precise measurements, and inspecting product consistency, which ultimately leads to better production quality and less defect rates. They also enable easier workflows by eliminating the need for human inspection — an exercise in error and a time-waster. However, this shift towards improved quality assurance of manufacturing processes opens significant opportunities for 3D machine vision technologies to expand across a range of industries from automotive to electronics to consumer products.

Challenges:

-

Data Processing Limitations and Real-Time Integration Challenges Impact Performance and Scalability of 3D Machine Vision Systems.

Data processing and integration into a real-time environment present a challenge to the 3D machine vision industry due to the complexities involved. The benefits of 3D vision come along with a huge amount of data that must be processed extremely fast and accurate to provide real-time results. However, data processing can be very intensive on CPU capacity and not always available in most industrial environments. Moreover, the adaptation of such emergent systems with current production lines, sensors and automation platforms; not does not present any technical difficulties, which in turn causes system inefficiencies or delay. These limitations may limit the overall performance of 3D machine vision systems and inhibit scalability of their application, especially in high-volume production industries with stringent operational needs.

3D Machine Vision Market Segmentation Overview:

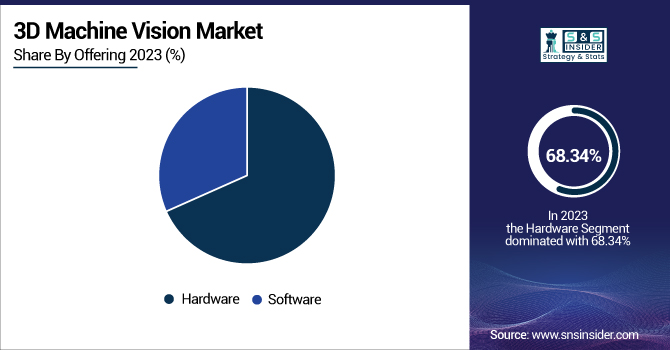

By Offering

The Hardware segment led the 3D machine vision market, with a 68.34% revenue share in 2023. Demand is driven by needs for parts that deliver high performance, for the processors, cameras, and sensors that comprise the real-time 3D image capture and processing. Companies including Basler AG, Cognex Corporation, and Teledyne DALSA continually launch advanced hardware solutions that enhance precision and speed. Cognex recently announced its latest product release, its "In-Sight 7000" vision system, which features high-performance vision software packed tightly into a compact, scalable solution. As industrial automation increases, the growth of the 3D machine vision hardware market will continue to be driven by the demand for higher-level hardware.

The Software segment is expected to grow at the Fastest CAGR during the projected period for the 3D machine vision market. With the advancement of AI, machine learning, and image processing software in a 3D vision system to deliver better results, faster performance, and increased efficiency. Companies like National Instruments and MVTec Software are developing very complex software solutions, such as MVTec's "HALCON 22.11" software package that allows for advanced 3D image processing. Recent advancements include technologies that improve automation and accuracy in industries like automotive and electronics. With the growing demand for smarter, more aware vision systems, we can expect software solutions to become the leading force for future growth in the space.

By Product

In 2023, PC-based segment accounted for largest in the 3D machine vision market in revenue, contributing 56.27% share of the total revenue. The reason is PC-based systems have high computing power that allows to process high-resolution 3D images in real time, used for complex industrial applications: quality control, robotics, and packaging. PC-based vision systems are continually evolving, with companies such as Teledyne DALSA and Cognex constantly working on them. For example, Cognex introduced its high-performance PC-based vision system, "In-Sight 9000," which brings speed and accuracy to customers. And while the PC-based system continue to be the mainstay of the 3D machine vision market as the industries for precision and automation grow ever.

The Smart Camera-based segment is expected to grow at the Fastest CAGR during the forecast period. The rise of solutions that merge imaging and processing is a significant driver of this growth. They are compact, economical devices that have found applications wherever smaller form factors are required without sacrificing any level of performance assembly line inspection and robotics, for example. Among others, Basler AG and Omron Corporation are promoting new smart camera solutions. The pulse camera line from Basler, for example, integrates image capture and processing capability into one device. The smart camera-based segment would likely propel strong growth in the 3D machine vision market, with more flexible, modular designs sought after by industries.

By Application

In 2023, the Quality Assurance & Inspection segment is dominated with revenue share of 47.90%. This sub segment holds the largest share in the market owing to the significant need of defect free products for inspection among various sectors such as automotive, electronics, and food processing, where quality and consistency of the product is of utmost importance. Manufacturers automate the quest for quality checks to replicate, using advanced 3D machine colours systems created by players like Cognex and Keyence. Take Cognex’s line of In-Sight 9000 products as an example, bringing production quality with high-speed inspection and high-precision, even Fourier machine vision analysis. As industries start to fully embrace quality, demand for 3D machine vision systems for this particular use case will remain a huge growth driver.

The Positioning & Guidance market will lead all others in growth via CAGR over the forecast period 2024-2032 due to a growing demand for high precision robotic guidance and automated positioning in the manufacturing and logistics sectors. The application is driven by the need for highly precise navigation, with machines guided through 3D machine vision systems. FANUC and Omron are focusing on more 3D vision technology, as well, to enhance positioning quality. As a case in point, FANUC's 'iRVision' system integrates robot control and vision for seamless automation. Accordingly, as a greater number of manufacturing industries are moving to modern automated processes, the positioning & guidance segment will witness a significant boost towards overall 3D machine vision market growth.

By End-Use

The Automotive segment is dominated the 3D Machine Vision Market with a 21.30% revenue share in 2023, owing to its various applications in quality control, assembly verification, and robotic guidance. Automobile manufacturers heavily rely on 3D machine vision systems for weld inspection, surface defect detection, component alignment, and many other applications. Industry leaders like Cognex and Keyence have introduced advanced, automotive-specific 3D vision solutions. The Cognex 3D-A1000 dimensioning system, for example, provides real-time inspection of parts moving through lines and other environments. The automotive space is still moving toward automation and EV manufacturing, which both enables market propagation of 3D vision implementation.

The Food & Beverage segment will witness the Fastest CAGR in next forecast period 2024-2032. and owing to increasing needs for hygiene, safety, and quality assurance. Reducer of handling time and product defects 3D machine vision reduces human intervention for detecting packaging defects, monitoring fill levels, and ensuring product uniformity. SICK AG, OAL, etc. are developing camera–based solutions in food industry. The system OAL has integrated and is using for its legal-parties, food vision systems has been known as OAL's 'APRIL Eye' 3D vision system and is a proven solution for viewing food products with high accuracy, food portioning and checking the quality of the food item. Amid this growing threat of regulation and customer demands for 100% perfect goods, the food & beverage sector is rapidly adopting 3D machine vision technologies.

3D Machine Vision Market Regional Analysis:

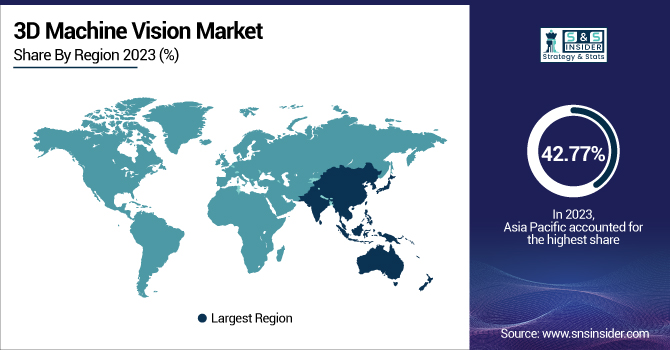

In 2023, Asia Pacific region was the dominated region for the 3D machine vision market with an revenue share of 42.77%, which is due to high rate of industrialization, manufacturing growth, and adoption of automation solutions across the economies of China, Japan, South Korea, and India. The abundance of top electronics and automotive manufacturers in the region that invest heavily in next-generation inspection tools is a key contributor to the growth. Product innovation in this space is being propelled by global competitors such as Keyence (Japan) and Hikrobot (China), with releases like Keyence's LJ-X8000 series offering ultra-high-speed 3D profiling. As more Asian Pacific industries move toward Industry 4.0, the demand for 3D machine vision systems will likely remain strong.

The market for 3D machine vision is anticipated to grow at the highest CAGR in North America during the forecast period 2024 to 2032 owing to increasing automation adoption, adoption of new technologies, and increased R&D expenditure in sectors including aerospace, automotive, and pharmaceuticals. The presence of leading companies such as Cognex Corporation and Teledyne Technologies, who are consistently introducing innovative offerings, also bodes well for the region. Cognex is an example of this with its VisionPro software release, which boosts AI-driven 3D inspection capabilities. In addition, government funding for smart manufacturing and robotics R&D accelerates adoption. During the forecast period, these drivers will make North America a high growth market for 3D machine vision.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in the 3D Machine Vision Market are:

-

Basler AG – (Basler blaze 3D Camera, Basler ToF Camera)

-

Cognex Corporation – (In-Sight L38 3D Vision System, VisionPro 3D Laser Displacement Sensor)

-

National Instruments Corporation – (NI Vision Development Module, NI Smart Camera)

-

OMRON Corporation – (FH-SMD 3D Vision Sensor, FH-3D Vision Sensor)

-

Sick AG – (Ranger3 3D Camera, TriSpector1000 3D Vision Sensor)

-

Allied Vision Technologies GmbH – (Alvium 1800 U-501m, Goldeye G-032 SWIR)

-

Softweb Solutions Inc. (An Avnet Company) – (Smart Vision Inspection System, AI-based Defect Detection System)

-

Visionatics Inc. – (VisionMaster 3D Inspection System, VisionMaster 3D Profilometer)

-

Keyence Corporation – (XT Series 3D Vision System, XG-X Series Customizable Vision System)

-

National Instruments Corporation – (NI Vision Development Module, NI Smart Camera)

-

Microscan Systems, Inc. – (MicroHAWK MV Smart Camera, Omron Microscan Vision HAWK 5X)

Recent Development:

-

July 2024, SICK AG expanded its Nova software platform to support the Ruler3000, enabling fast and precise high-end 3D vision applications. This advancement allows users to deploy custom applications quickly, enhancing production efficiency.

-

May 2024, Allied Vision showcased its Alvium camera equipped with a liquid lens from Optotune at the Automate trade show in Chicago. This combination offers enhanced flexibility and performance for various imaging applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.07 Billion |

| Market Size by 2032 | USD 19.13 Billion |

| CAGR | CAGR of 13.68 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Offering - (Hardware, Software) •By Product - (PC Based, Smart Camera Based) •By Application - (Quality Assurance & Inspection, Positioning & Guidance, Measurement, Identification) •By End Use - (Automotive, Pharmaceuticals & Chemicals, Electronics & Semiconductor, Pulp & Paper, Printing & Labeling, Food & Beverage ,Glass & Metal, Postal & Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Basler AG, Cognex Corporation, National Instruments Corporation, OMRON Corporation, Sick AG, Allied Vision Technologies GmbH, Softweb Solutions Inc. (An Avnet Company), Visionatics Inc., Keyence Corporation, National Instruments Corporation. |