Industrial Automation Market Scope & Overview:

Get More Information on Industrial Automation Marke - Request Sample Report

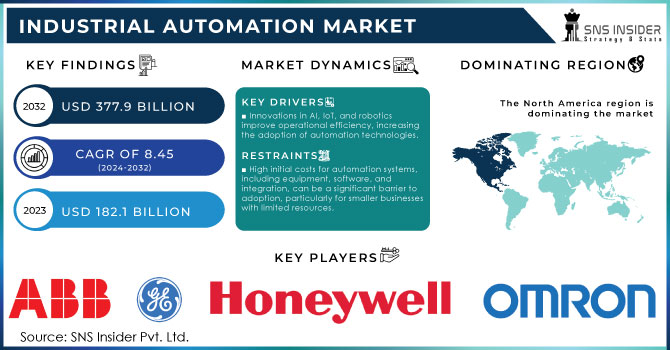

The Industrial Automation Market Size was valued at USD 182.1 Billion in 2023 and is expected to reach USD 377.9 Billion by 2032 and grow at a CAGR of 8.45% over the forecast period 2024-2032.

The use of equipment to automate systems or manufacturing processes is referred to as automation. The manufacturer’s purpose is to increase efficiency in the production process, cost optimization, and higher accuracy. Automation assists in collecting all the activities of the firm and it makes it easy to flow information throughout its components. The job that requires to do endurance or accuracy, and the works are dull and repetition-based and require specialized expertise are performed by the manufacturer. Automation in the manufacturing industry reduces human labor and improves precision, consistency, and operational efficiency. It does not only enhance production output but also offers dependable manufacturing. The sensors are mainly employed in linking production lines and also make use of devices that monitor the equipment and provide friendly data, visuals, and other outputs. All this provides other extra benefits such as reduced downtime, predictable maintenance, and improved decision-making. The adoption of digital twins and AR technologies in manufacturing is driving the growth of industrial automation as it has assisted the organization in recognizing the feasibility, reducing the risk, and making any essential improvements.

The implementation and management of digital twins have become possible with the invention of the industrial Internet of Things such as cloud systems and smart sensors and the use of disruptive technologies like AR. IoT Technology will play a crucial role in the future of Industrial IoT solutions. Automation technology enables us to drive the creation and flow of effective, inexpensive, and responsive systems architectures. The utilization of industrial IoT solutions allows the connection of industrial assets and the easy and quick meaning of increased transparency and productivity. The IIoT and edge solutions streamlined the device management and shop floor software throughout its lifecycle in terms of delivering the best customer experience. Other solutions such as AI, advanced analytics, edge computing and cloud computing will facilitate the analyses of machines’ data, providing invaluable information to optimize assets’ productivity and availability.

In September 1, 2024: Schneider Electric announced its goal to increase India's share in the global industrial automation market to 25% from less than 10% by leveraging growth in key sectors like water, transportation, mining, energy, and food and beverages.

MARKET DYNAMICS

DRIVERS

Innovations in AI, IoT, and robotics improve operational efficiency, increasing the adoption of automation technologies.

Innovations in automation technologies are being driven by breakthroughs in artificial intelligence, the internet of things, and robotics. Impacts on efficiency across a variety of domains are being seen with medium and large enterprises which is facilitating the continued rise of adoption. In this essay the contribution of these technologies will be discussed: artificial intelligence which allows machines to perform tasks that require intelligence and intervention in terms of adaptability with real-time decision-making processes, the internet of things which is the facilitation of devices being connected across vast networks, and robotics which is utilizing increasingly sophisticated machinery to replace and replicate physical tasks which would be hazardous for humans. The major effects of these technologies are the reduction of reliance on human factors for many operations along with an increase in efficiency in terms of speed and quality.

The move towards smart manufacturing and digital transformation drives higher demand for advanced automation solutions.

The growing popularity of smart manufacturing and digital transformation results in a high demand for modern automation solutions. Smart manufacturing implies the use of such advanced technologies as the Internet of Things pro, AI, big data pro, and other instruments that help to develop more flexible, fast, and responsive enterprise environments. Such an approach allows controlling all processes on the basis of real-time data. The associated benefits are that the speed and quality of items being produced increase, while waste reducing. In its turn, the concept of digital transformation is regarded to enhance every stage of the manufacturing lifecycle, such as design, production, maintenance, and supply chain management, and optimize it through the use of digital solutions and data. In these circumstances, businesses have to make their efforts to stay competitive and meet continuous changes in customer demands. Therefore, they start using modern automation solutions to optimize their job experience and guarantee high flexibility and scalability of enterprises. Nowadays, it is possible to observe a high demand for modern automation solutions. More companies aim to locate the power of sophisticated technical solutions that are expected to bring various benefits to the manufacturing process. The winning idea is to be in line with the fundamental principles of digital manufacturing and meet every possible demand with the help of appropriate toolsets.

RESTRAINTS

High initial costs for automation systems, including equipment, software, and integration, can be a significant barrier to adoption, particularly for smaller businesses with limited resources.

High initial costs are one of the most significant problems, as they serve as a considerable entry barrier for companies that want to implement automation systems. Investing funds in advanced equipment, software, and the processes of their integration into the workflow is an essential issue for both kinds of companies. High initial costs have some impact on small- and medium-sized businesses. Automated systems require realizations that would meet the needs of a specific industry, which makes the situation more complicated and demands more costs. In addition, the necessity for continuous maintenance of the systems, employee training, and account of regular updates to improve the work conditions are required. It means that the combined financial burden does not allow the companies to spend sufficient funds to be able to enter the market and compete with companies that can afford this expensive but prospective investment. It should be stated that benefits in the form of increased productivity, reduced expenses on the labor force, and improvements in general operational conditions can be observed in the long run.

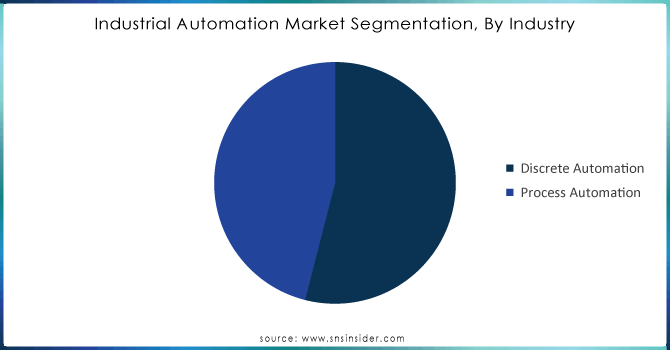

Market Segmentation Analysis

In 2023, sensor segment accounted for the highest revenue share of over 25.2%, the servo was the major fragment, followed by the sensor. However, the robot segment is anticipated to grow at the most moderate rate. The players operating in the market are focusing on introducing highly advanced robots for automation.

In 2023, the discrete automation segment accounted for the highest revenue share of over 54% and is further segmented as automotive, electronics, heavy manufacturing, packaging, and others. The automotive and heavy manufacturing industry enforced for the growth of the segment.

Need any customization research on Industrial Automation Market - Enquiry Now

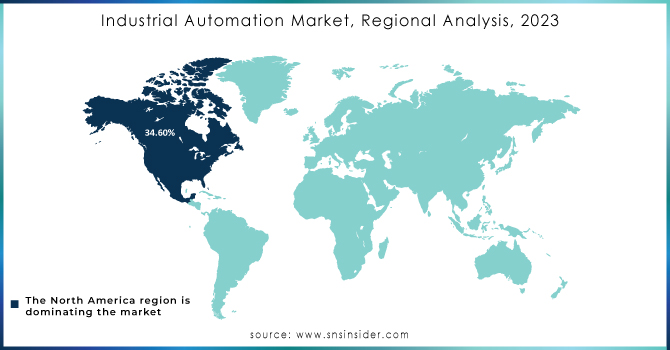

REGIONAL ANALYSIS

In 2023, North America has emerged as the dominant region, representing more than 34.6% of the total revenue., the Industrial Automation Market due to the high level of technological advancement and early adoption of automation solutions. The U.S. and Canada have a strong industrial base with substantial investments in automation technologies, driven by sectors such as automotive, aerospace, and electronics. North America’s focus on technological innovation and a well-established infrastructure supports its dominant position in the market.

The Asia-Pacific region is the fastest-growing market for industrial automation, driven by rapid industrialization and urbanization, particularly in countries like China, India, and Japan. The region’s manufacturing sector, including electronics and automotive industries, is expanding swiftly, fueling the demand for automation solutions. The burgeoning middle class and increasing technological adoption are significant factors driving the expansion of the industrial automation market in APAC.

KEY PLAYERS

The major key players are Siemens, Rockwell Automation, Honeywell, Schneider Electric, ABB, Mitsubishi Electric, Emerson Electric, Fanuc, Bosch Rexroth, Omron, Yokogawa Electric, General Electric, Delta Electronics and other players

RECENT DEVELOPMENTS

In May 2023: Mitsubishi Electric invested in Otto Motors the leading producer of autonomous mobile robots to promote global industrial automation as well as elaborate factory automation and business collaboration.

In October 2022: Rockwell Automation Inc., a company specializing in industrial automation and digital transformation, purchased CUBIC, the producer of modular systems for the installation of electric panels.

| Report Attributes | Details |

| Market Size in 2023 | US$ 182.1 Bn |

| Market Size by 2032 | US$ 377.9 Bn |

| CAGR | CAGR of 8.45% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Components (Hardware (Photoelectric, Laser, Inductive, Others, Motor (AC, DC)), Drive, Sensors (PLC, HMI, Servo, Laser Markers, Safety Light Curtain, Robots), Software) • By Industry (Discrete Automation (Automotive, Electronics, Heavy Manufacturing, Packaging, Others), Process Automation (Oil and gas, Chemicals, Pulp and paper, Mining and Metals, Healthcare, Others)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | ABB Ltd., Emerson Electric Co., General Electric Company, Honeywell International Inc., Mitsubishi Electric Corporation, Omron Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Yokogawa Electric Corporation |

| Key Drivers | • Operational efficiency in automation increases production effectiveness, lowers manual errors, and boosts the speed and consistency of all processes. • Cost By reducing labor costs, increasing resource efficiency, and reducing downtime, a reduction in automation can result in cost savings. • By reducing differences and deviations, quality improvement in automation helps maintain consistent product quality. |

| Market Restraints | • Integration challenges, a significant initial investment. • Change resistance |