Acetonitrile Market Report Scope & Overview:

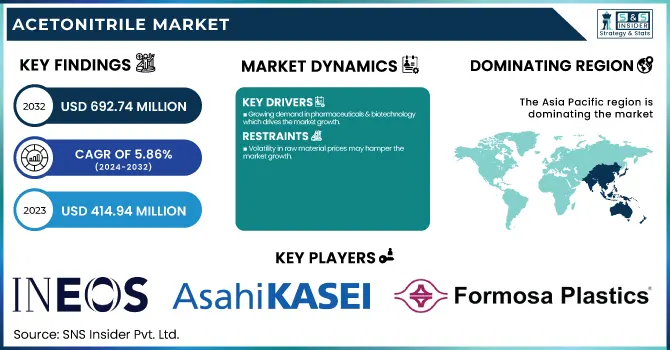

The Acetonitrile Market size was USD 414.94 Million in 2023 and is expected to reach USD 692.74 Million by 2032 and grow at a CAGR of 5.86 % over the forecast period of 2024-2032. This report provides comprehensive statistical insights and emerging trends in the Acetonitrile Market, covering key factors such as global production capacity and utilization rates by country in 2023, along with feedstock price fluctuations and supply chain dynamics across major regions. It examines the regulatory landscape, including trade policies and environmental compliance standards influencing market growth. Additionally, the report highlights emissions data, waste management practices, and sustainability initiatives adopted by key players. Innovation and R&D trends are analyzed, focusing on advancements in purification technologies and high-purity acetonitrile applications. Lastly, the report delves into market demand patterns by end-use industries, offering valuable insights into sector-specific consumption trends.

To Get more information on Acetonitrile Markett - Request Free Sample Report

Acetonitrile Market Dynamics

Drivers

-

Growing demand in pharmaceuticals & biotechnology which drives the market growth.

Acetonitrile, a polar organic solvent that is colorless, has wide usage in pharmaceutical and biotechnological applications The growth in pharmaceuticals and biotechnology is one of the major factors helping the Acetonitrile Market growth as it is an extensively vital solvent in high-performance liquid chromatography (HPLC), drug synthesis and formulation. Due to its high solvency power and volatility level, Acetonitrile is unable to be replaceable by pharmaceutical test analytical applications, quality control, and purification processes. The growing biopharmaceutical industry, escalation in drug discovery processes, along rising investments in genomics and proteomics research are also some of the factors burgeoning its demand specifically for DNA & RNA synthesis and peptide sequencing. In addition to this, regulatory authorities’ expectations for high-purity solvents in drug production have made pharma companies use ultra-pure acetonitrile to meet stringent regulatory standards, proving to be a market growth factor. In addition, the increasing prevalence of chronic diseases coupled with the advancements in personalized medicine will furnish huge opportunities for acetonitrile-based applications over the forecast period.

Restraint

-

Volatility in raw material prices may hamper the market growth.

The fluctuations in the raw material prices impact the growth of the acetonitrile market significantly since Acetonitrile is primarily produced using acrylonitrile which is a derivative of petroleum compounds. The volatility in this field becomes a great concern related to the growth of the acetonitrile market. Being directly derived from acrylonitrile, the fluctuation in crude oil prices, the seasonal availability of feedstock (Acrylonitrile), and the tense geopolitical situations take an immediate toll on acrylonitrile pricing, which in turn negatively impacts acetonitrile production stability. In particular, the supply chain of chemicals used in many of our goods is also disrupted, not to mention the trade restrictions and the further rise of energy prices that will add to the price differences. As a secondary product of acrylonitrile production, manufacturers don't have much control over its supply, thus it is subject to shortage and price spikes.

Opportunity

-

Growing demand for acetonitrile in battery electrolytes creates an opportunity in the market.

The rising use of acetonitrile in battery electrolytes is likely to open cost-effective opportunities in the acetonitrile market owing to the booming electric vehicle (EV) and energy storage industry. Abstract Acetonitrile (AN) has attracted great attention as a high-performance solvent in lithium-ion battery electrolytes due to its favorable electrochemical stability, low viscosity, and high dielectric constant, which can effectively improve battery efficiency and performance. With governments around the globe accelerating the green energy transition, and implementing stringent carbon reduction mandates, the need for advanced batteries in both EVs and renewable energy storage systems is skyrocketing. Secondly, ongoing research & development in electrolyte formulations are expected to increase the usage of acetonitrile in this sector due to the rising requirement for high-performance battery life spanning thermal stability & conductivity.

Challenges

-

Limited production and supply shortages may create a challenge for the market.

One of the biggest obstacles in the way of the market's growth is the limited production of acetonitrile its production is entirely dependent on the availability of its precursor, acrylonitrile, as it is produced as a by-product and not through dedicated manufacturing - as well as supply challenges related to this compound. As production is chiefly tied to the demand for acrylonitrile, variations in the acrylonitrile market can impact the supply of acetonitrile, resulting in the product being available in unstable quantities, which can generate both shortage and price movement fluctuations. Furthermore, the global supply chain faces more insurmountable hurdles due to occasional shutdowns of petrochemical plants, unrest in some countries, and raw material shortages. Such supply constraints add apprehension to the end-use industries notably, these include pharmaceuticals, agrochemicals, and specialty chemicals, in which Acetonitrile is a vital solvent. With demand ever increasing, the industry is under pressure to create alternative forms of production or efficient recovery methods to ensure a constant supply.

Acetonitrile Market Segmentation Analysis

By Product

The solvent segment held the largest market share around 63% in 2023. This is due to its high use in pharmaceuticals analytical applications, and chemical processing. Acetonitrile, an efficient polar aprotic solvent, finds appeal in being utilized largely in high-performance liquid chromatography (HPLC), drug synthesis, and laboratory analysis. The acetonitrile industry is one of the largest consumers of acetonitrile, which is used as a solvent in drug formulation, purification, and quality control testing. In addition, its broad application in extraction processes, organic synthesis, and electrophysical application ensures its full-strength domination. In addition, the burgeoning need for high-purity solvents in the biotech, agrochemical, and specialty chemicals sectors has also spurred market growth. The solvent segment dominates the market and is projected to maintain its leading position due to continuous development in analytical methodologies and rising investment in R&D activities in the pharmaceutical field.

By End-Use Industry

Pharmaceuticals held the largest market share around 28% in 2023. It is owing to its wide-scale use as a solvent in drug formulation, synthesis, and analytical applications. Acetonitrile is an important mobile phase used in high-performance liquid chromatography (HPLC), an analytical technique used across a broad range of applications including pharmaceutical quality control and drug development. Due to it being a good solvent with high solvability, low viscosity, and chemical stability, thus making it a needed solvent for the purification extraction, or synthesis of active pharmaceutical ingredients (APIs). Moreover, the rising utilization of acetonitrile in the pharmaceutical industry, owing to the increasing production of drugs, research and development (R&D) activities, and biotechnology-related applications, is fueling market growth. The high-purity solvent demand is further strengthened by the stringent regulations related to drug testing and quality assurance, making the pharmaceutical sector the most prominent end-use industry in the market.

Acetonitrile Market Regional Outlook

Asia Pacific held the largest market share around 48% in 2023. This is owing to booming pharmaceutical, agrochemical, and electronics industries. The countries which are considered to be the production and contract manufacturing hubs for pharmaceuticals, including China, India, and Japan, will serve to create demand for acetonitrile as an essential solvent in drug synthesis and quality testing. Moreover, expanding agrochemical industry, owing to the growing agricultural activities and increasing consumption of pesticides and herbicides, is further aiding the market growth. It also has a strong base of chemical manufacturing, relatively inexpensive labor, and pro-industrial government policies. Further, the improvement in the utilization of high-performance liquid chromatography (HPLC) methods for research and diagnostics is also projected to fuel the product demand for acetonitrile. Asia-Pacific will continue to lead the market due to growing investments in biotechnology, specialty chemicals, and lithium-ion battery manufacturing.

North America held a significant market share. This is attributed to the presence of leading pharmaceutical companies and research institutes in the region, especially the U.S. that uses acetonitrile for use in the synthesis and quality testing of drugs and high-performance liquid chromatography (HPLC). The rising demand is also attributed to the increasing adoption of advanced analytics in the biotechnology and life sciences field. The region also enjoys a long established agricultural chemical base, as acetonitrile is used in pesticides. In addition, stringent regulatory requirements of the FDA and EPA exhibit high standards of drug and chemical testing, thereby favoring high purity acetonitrile consumption. North America has emerged as one of the major consumers of acetonitrile owing to continuous investment in R&D, growing biopharmaceutical applications and surging demand for specialty chemicals.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

INEOS AG (Acetonitrile, Acetone Cyanohydrin)

-

Asahi Kasei Corporation (AN Grade Acetonitrile, Ultra-High Purity Acetonitrile)

-

Formosa Plastic Corporation (High Purity Acetonitrile, Industrial Grade Acetonitrile)

-

Nova Molecular Technologies (HPLC Grade Acetonitrile, Anhydrous Acetonitrile)

-

AlzChem Group AG (Ultra Dry Acetonitrile, Custom Purity Acetonitrile)

-

Zibo Jinma Chemical Factory (Chemical Grade Acetonitrile, Electronic Grade Acetonitrile)

-

Shanghai Secco Petrochemical Company (Refined Acetonitrile, Technical Grade Acetonitrile)

-

Shandong Shida Shenghua Chemical Group (Solvent Grade Acetonitrile, Pharma Grade Acetonitrile)

-

Avantor Performance Materials (HPLC Acetonitrile, LC-MS Acetonitrile)

-

Tedia Company Inc. (High Purity Acetonitrile, GC Grade Acetonitrile)

-

Honeywell International Inc. (Burds Acetonitrile, ACS Reagent Acetonitrile)

-

Thermo Fisher Scientific Inc. (Optima Acetonitrile, LC-MS Ultra Acetonitrile)

-

GFS Chemicals, Inc. (Anhydrous Acetonitrile, HPLC Grade Acetonitrile)

-

Spectrum Chemical Manufacturing Corp. (Reagent Acetonitrile, ACS Grade Acetonitrile)

-

J.T. Baker Chemicals (HPLC Acetonitrile, Ultra Gradient Acetonitrile)

-

Merck KGaA (LC-MS Acetonitrile, SupraSolv Acetonitrile)

-

MP Biomedicals, LLC (Analytical Grade Acetonitrile, Solvent Acetonitrile)

-

VWR International, LLC (Chromatography Acetonitrile, Technical Grade Acetonitrile)

-

Central Drug House (CDH) (Reagent Acetonitrile, HPLC Grade Acetonitrile)

-

Biosolve Chemicals B.V. (Gradient Grade Acetonitrile, Anhydrous Acetonitrile)

Recent Development:

-

In August 2024: Nova Molecular Technologies, Inc. expanded its high-purity solvents division by establishing a new manufacturing facility in South Carolina, USA, with full-scale operations expected to commence by the end of 2024.

-

In April 2024: INEOS launched INVIREO, the first-ever bio-based acetonitrile designed for pharmaceutical applications, aiming to reduce carbon emissions by 90%.

-

In May 2023: Jindal Specialty Chemicals Private Limited allocated an investment exceeding ₹100 crore to set up a new acetonitrile production plant in Kheda, Gujarat, with an annual production capacity of 10,000 tonnes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 414.94 Million |

| Market Size by 2032 | USD 692.74 Million |

| CAGR | CAGR of 5.86% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Derivative, Solvent) •By End-Use Industry (Pharmaceutical, Analytical, Agrochemicals, Electronics, Chemical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | INEOS AG, Asahi Kasei Corporation, Formosa Plastic Corporation, Nova Molecular Technologies, AlzChem Group AG, Zibo Jinma Chemical Factory, Shanghai Secco Petrochemical Company, Shandong Shida Shenghua Chemical Group, Avantor Performance Materials, Tedia Company Inc., Honeywell International Inc., Thermo Fisher Scientific Inc., GFS Chemicals, Inc., Spectrum Chemical Manufacturing Corp., J.T. Baker Chemicals, Merck KGaA, MP Biomedicals, LLC, VWR International, LLC, Central Drug House (CDH), Biosolve Chemicals B.V. |