Advanced Wound Care Market Statistics:

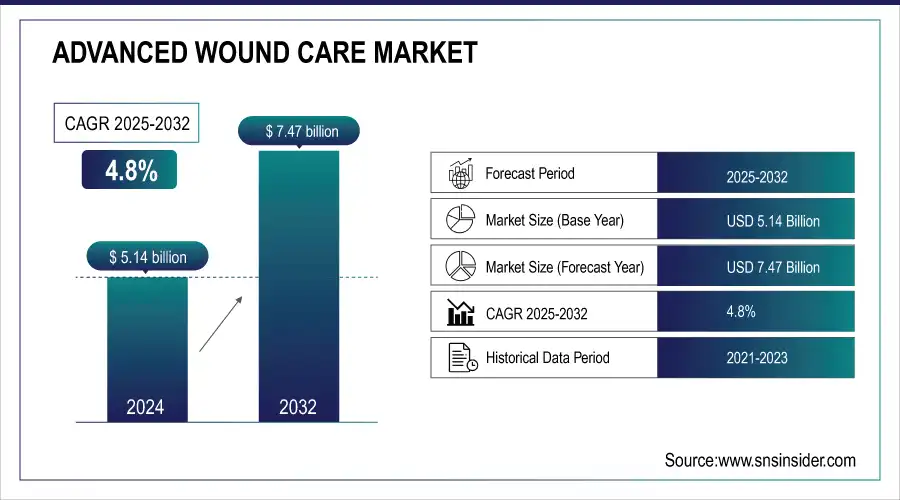

The Advanced Wound Care Market was valued at USD 5.14 Billion in 2025E and is expected to reach USD 7.47 Billion by 2033, growing at a CAGR of 4.8%. over the forecast period 2026-2033.

This rise in the incidence of chronic diseases across the world is creating demand for more advanced wound care products. Additionally, the increasing geriatric population that is known to experience slow healing is expected to boost the advanced wound care market revenues. For instance, for example, according to data from the United Nations Population Fund's India Aging Report 2023, the number of elderly people in India has doubled from 149 million by 2022 to 347 million by 2050.

Advanced Wound Care Market Size and Forecast:

-

Market Size in 2025E: USD 5.14 Billion

-

Market Size by 2033: USD 7.47 Billion

-

CAGR: 4.8% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Advanced Wound Care Market - Request Sample Report

Diabetic foot ulcers are a serious consequence of diabetes that presents in most people with diabetes. Conventional wound care is often used to treat these painful and debilitating conditions. According to an article published in ScienceDirect, more than 25% of diabetics end up with foot ulcers and in some severe cases lead to an amputee in about 20% of the population. Thus, Due to the incremental diabetic population, there are increased demands for advanced wound care products. Moisturizing products like these keep the moisture in and help you heal on the inside faster as well because keeping things moist is helpful to all ends. This is compounded by their efficiency in the absorption of necrotic tissues, so they have been and continue to be adopted by health professionals - especially for surgical site infections.

Advanced Wound Care Market Highlights:

-

Market recovery driven by accumulated surgical cases and growing requirement for advanced dressings NPWT devices and bioengineered skin substitutes to prevent complications such as amputations

-

Strategic developments include mergers acquisitions product launches and regional expansions for example in April 2023 ConvaTec Group PLC acquired the nitric oxide technology platform of Anti-infective Device Specialist Limited for wound care applications

-

Market drivers include rising prevalence of chronic diseases such as diabetes venous insufficiency cardiovascular disorders and obesity along with aging populations fueling demand for advanced wound care solutions

-

Market restraints include high costs of advanced wound care products such as NPWT systems and bioengineered dressings which limit adoption in cost-sensitive and low-reimbursement markets

-

Market opportunities driven by technological advancements including smart dressings sensor-integrated NPWT advanced hydrogels and telemedicine-enabled wound monitoring which enhance healing outcomes expand home care use and boost overall market growth

The market now for all advanced wound care products has been decent owing to both backlog from delayed surgeries plus an upsurge in cases needing better technology than old-fashioned wound dressings; here is yet another example where quite possibly without today's message those may have unknowingly faced amputation after unsuccessful treatment so let us get started with our BLOG Column Series and webinars. The key players are focusing on strategic mergers & acquisitions, new product launches, and regional expansions to sustain their leading position in the market. For example, in April 2023 Convatec Group PLC acquired the nitric oxide technology platform of Anti-infective Device Specialist Limited for wound care and to explore other applications. Therefore, it can be said that the rise in the adoption rate for advanced wound care products has created a resurgence of the market after the pandemic era.

The U.S. Advanced Wound Care market size was valued at an estimated USD 1.85 Billion in 2025 and is projected to reach USD 2.65 Billion by 2033, growing at a CAGR of 4.6% over the forecast period 2026–2033. Market growth is driven by the high prevalence of chronic wounds, including diabetic foot ulcers, pressure ulcers, and surgical wounds, along with a rapidly aging population and rising incidence of diabetes and obesity. Strong adoption of advanced wound care products across hospitals, outpatient centers, and home healthcare settings, coupled with continuous innovations in bioactive and antimicrobial dressings, supports market expansion. Favorable reimbursement frameworks and the presence of leading wound care manufacturers further reinforce the U.S. market’s growth trajectory.

Advanced Wound Care Market Drivers:

-

Prevalence of Chronic diseases generating the need for advanced wound care

The rising prevalence of chronic diseases is significantly driving the demand for advanced wound care solutions. Conditions such as diabetes, venous and arterial insufficiency, obesity, cardiovascular disorders, and aging-related health issues impair the body’s natural wound-healing process, leading to the formation of chronic wounds like diabetic foot ulcers, venous leg ulcers, arterial ulcers, and pressure injuries. Diabetes alone affects over 540 million adults globally, with up to 25% developing foot ulcers during their lifetime. Similarly, pressure ulcers affect more than 2.5 million patients annually in the U.S. The growing geriatric population further exacerbates this challenge. As a result, advanced wound care products including negative pressure wound therapy, bioengineered skin substitutes, and antimicrobial dressings are increasingly adopted to enhance healing and reduce complications.

Market Restraints:

-

The higher costs of advanced wound care products can limit the adoption of advanced wound care.

The high cost of advanced wound care products is a significant barrier to their widespread adoption, particularly in cost-sensitive markets and low- to middle-income regions. Products such as bioengineered skin substitutes, negative pressure wound therapy (NPWT) devices, and advanced antimicrobial dressings often come with premium prices due to complex manufacturing, research and development investments, and specialized application requirements. These costs can strain hospital budgets and increase out-of-pocket expenses for patients, especially in regions with limited reimbursement policies or inadequate healthcare insurance coverage. As a result, many healthcare providers and patients opt for traditional wound care methods despite their longer healing times. This price sensitivity hampers the overall market penetration of advanced wound care technologies and delays optimal patient outcomes.

Market Opportunities:

-

Technological Advancements in advanced wound care devices are responsible for advanced wound care market growth during the forecast period.

Technological advancements in advanced wound care devices are a key driver of market growth during the forecast period. Innovations such as smart dressings, negative pressure wound therapy (NPWT) systems with integrated sensors, bioengineered skin substitutes, and advanced hydrogels have significantly improved wound healing outcomes. These technologies enable real-time monitoring of wound conditions, controlled moisture balance, enhanced oxygenation, and reduced infection risks. Furthermore, the integration of digital health solutions, including connected wound care platforms and telemedicine-based monitoring, allows for remote patient management and faster clinical decision-making. Continuous investment in research and development is leading to cost-effective, patient-friendly, and minimally invasive wound care solutions, increasing adoption across hospitals, outpatient facilities, and home healthcare settings, thereby accelerating overall market expansion.

Advanced Wound Care Market Segment Analysis:

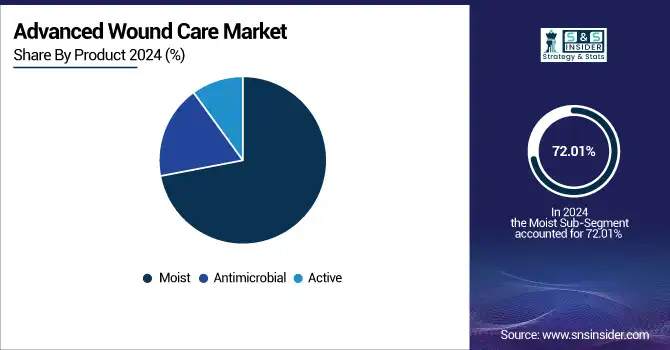

By Product

The moist wound care segment held the largest revenue share of 72.01% in the year 2025 based on product type due to the rise in various cases of wounds and surgeries across the globe. For example, Life Span Organization reports that approximately 500,000 open heart surgeries were performed in the U.S. just 2021. Moreover, as per AHA Journals, in the U. S., around 40 thousand children received congenital heart surgery in 2020. These surgeries require time to heal, and since they are complex & require advanced wound care products that provide suitable healing mechanisms and allow quick -healing of such wounds by supporting the regeneration process. This factor is responsible for rising advanced wounds demand which is estimated to fuel during the forecast period.

Additionally, the active wound care segment is projected to witness a rapid CAGR during 2026-2033. The growth of the segment is primarily attributed to the increase in prevalence of chronic diseases, such as diabetes and obesity which leads to slow wound healing processes. Furthermore, the rising geriatric population and increasing number of surgical procedures executed across the globe are poised to propel active wound care market growth over the forecast period.

By Application

By Application, it was the chronic wounds segment that led in market share, by having a higher revenue generated during 2025. A growing number of diabetic foot ulcers, venous leg ulcers, and other chronic wounds is expected to boost segment growth. For example, the Agency for Healthcare Research and Quality reports that pressure ulcers affect more than 2.5 million people in the U.S. each year. In the same way, The NCBI informs that the incidence of pressure ulcers in care varies between 4% and 38%. A report by the CDC also states that an estimated 37.3 million people, or around 11.3% of the U.S. population were living with diabetes in 2024. The increase in the number of diabetic patients is projected to cause a rise in the diabetes foot ulcer patient numbers and hence escalate growth opportunities for the chronic wound care market.

By End-Use

The hospital segment was the leader by end-use with a net revenue of 46.13% in 2025. The rise in surgical procedures and several hospital admissions are the major drivers for this segment to grow. The Australian Institute of Health and Welfare has stated that hospitalizations in Australia also appear to be on the rise. For example, in Australia, 11.6 million people were hospitalized throughout the year between 2021-22. Hence, the growth in hospital numbers and admission rates is likely to drive the market over the forecast period. This is due to a rise in the number of surgeries across the world, which again boosts market growth. For example, Business Insider reported that approximately 1 million patients undergo plastic surgery a year in South Korea. Also, One in three young women ages 19-29 have considered going under plastic surgery. Hence, the rise in the number of surgeries boosts demand for advanced wound care products fuelling the growth of the market.

The demand for home healthcare advanced wound care was high during the COVID-19 pandemic. Furthermore, the rise in the geriatric population drives the demand for advanced wound care products. The older community is more likely to suffer from chronic wounds and as we get older our body slows down on producing the ability for its wound healing process. In addition, the Wound Care Learning Network reported that elderly individuals have a higher prevalence of pressure ulcers. Hence, an increase in the older adult population is driving growth in the advanced wound care market.

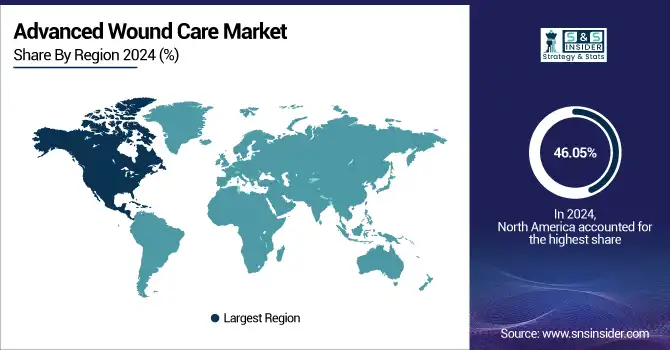

Advanced Wound Care Market Regional Analysis:

North America Market Insights:

North America led the market with a revenue share of 46.05% in 2025, owing to the well-established healthcare infrastructure & rising surgical procedures. For example, in 2023 alone, nearly 23.6 million Americans had minimally invasive cosmetic surgery according to the American Society of Plastic Surgeons (ASPS). As a result, the demand for advanced wound care products is on the rise which are being largely used to avoid surgical site infections. Moreover, the rising number of accidents such as road traffic injuries, burns incidents and trauma events is expected to drive the market in this region.

Need any customization research on Advanced Wound Care Market - Enquiry Now

The U.S. has accounted largest share in 2023 in the North American region. Growing incidence of chronic diseases along with rising surgical procedures, are the key factors driving the market. In other words, according to a report by the National Center for Chronic Disease Prevention and Health Promotion last updated on May 2023, six in ten people living U.S. carry at least one chronic state such as cancer, diabetes Mellitus, etc. Further, these factors are anticipated to increase the demand for advanced wound care. Therefore, generate the segment over the forecast timeline.

High disposable income, well-established healthcare infrastructure along the availability of skilled manpower are the factors that drive the Europe market The favorable reimbursement scenario added to the greater adoption of surgical processes. Moreover, the geriatric population and growing incidents of burns & trauma are other factors expected to propel the market.

Asia-Pacific Market Insights:

Asia Pacific is projected to witness the fastest growth in the advanced wound care market during the forecast period 2026-2033, driven by a rising prevalence of chronic diseases such as diabetes, growing trauma and burn cases, and rapidly improving healthcare infrastructure. Increased adoption of innovative wound care technologies, government healthcare initiatives, and the rising preference for home-based care further support market expansion. However, high product costs and limited reimbursement policies in several countries pose challenges, particularly in rural and low-income areas.

Europe Market Insights:

Europe holds a significant share in the advanced wound care market, supported by favorable reimbursement policies, a well-established healthcare system, and high adoption of surgical procedures. The growing geriatric population, coupled with increasing cases of chronic wounds, burns, and trauma injuries, drives the demand for advanced wound management solutions. Countries like Germany, the UK, and France lead the market with strong R&D investments and innovative product launches. However, high product costs and varying reimbursement structures across regions pose challenges to uniform market expansion.

Latin America Market Insights:

The advanced wound care market in Latin America is growing steadily due to the rising incidence of diabetes, pressure ulcers, and traumatic injuries. Countries such as Brazil and Mexico are leading this growth with expanding healthcare infrastructure and increasing awareness of advanced wound care solutions. Government initiatives to improve chronic disease management and a gradual shift toward modern wound care techniques further support the market. However, limited reimbursement policies and high product costs continue to hinder broader adoption.

Middle East & Africa Market Insights:

The Middle East & Africa region shows moderate growth in the advanced wound care market, driven by increasing surgical procedures, rising road traffic accidents, and a growing prevalence of chronic conditions like diabetes and vascular diseases. Countries like Saudi Arabia, the UAE, and South Africa are key contributors due to improving healthcare systems. However, the market faces challenges such as high treatment costs, limited access to advanced technologies, and uneven healthcare infrastructure across rural and underserved regions.

Advanced Wound Care Market Key Players:

-

Mölnlycke Health Care AB

-

3M

-

Derma Sciences Inc. (Integra LifeSciences)

-

Medline Industries, Inc.

-

Smith & Nephew PLC

-

Baxter International

-

B. Braun Melsungen AG

-

Tissue Regenix

-

Integra LifeSciences

-

URGO Medical

-

Organogenesis Inc.

-

Acelity (a 3M Company)

-

Cardinal Health

-

Johnson & Johnson (Ethicon)

-

Hartmann Group (Paul Hartmann AG)

-

Essity AB

-

MiMedx Group, Inc.

Advanced Wound Care Market Competitive Landscape:

DuPont, established in 1802, is a global innovation leader specializing in materials science, biotechnology, and advanced solutions for industries including electronics, healthcare, construction, and safety. The company develops high-performance materials, adhesives, and protective technologies that enhance sustainability and efficiency. With a strong R&D focus, DuPont drives advancements in mobility, energy, and digital transformation worldwide.

-

In October 2023, DuPont came up with an innovative product: a soft skin adhesive; called the Liveo MG 7-9960 that is capable of delivering stronger adhesion and reduced cyclic silicone. This innovative adhesive has been engineered for wound care dressings and medical device fixation to provide longer wear times with less risk of damage upon removal.

JeNaCell, founded in 2012, is a biotechnology company specializing in the development and production of innovative, bio-based materials derived from bacterial nanocellulose. Its products are widely used in advanced wound care, dermatology, and cosmetic applications, offering superior moisture management, healing support, and biocompatibility for medical and skincare solutions globally.

-

In June 2023, the JeNaCell, a German-based pharmaceutical giant launched the epicite balancing wound dressing. In particular, the dressing is suitable for managing low to medium-exudating chronic wounds such as soft tissue defects, diabetic foot ulcers (DFU), venous leg ulcers (VLU), and peripheral arterial disease wounds.

| Report Attributes | Details |

| Market Size in 2025 | USD 5.14 Billion |

| Market Size by 2033 | USD 7.47 Billion |

| CAGR | CAGR of 4.8 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Moist, Antimicrobial, Active) •By Application (Chronic Wounds, Acute Wounds) •By End-Use (Hospitals, Specialty Clinics, Home Healthcare & Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Mölnlycke Health Care AB, ConvaTec Group PLC, Coloplast Corp., Medtronic, 3M, Derma Sciences Inc. (Integra LifeSciences), Medline Industries, Inc., Smith & Nephew PLC, Baxter International, B. Braun Melsungen AG, Tissue Regenix, Integra LifeSciences, URGO Medical, Organogenesis Inc., Acelity (a 3M Company), Cardinal Health, Johnson & Johnson (Ethicon), Hartmann Group (Paul Hartmann AG), Essity AB, MiMedx Group, Inc. |