Cosmetic Surgery Market Size & Trends:

To Get More Information on Cosmetic Surgery Market - Request Sample Report

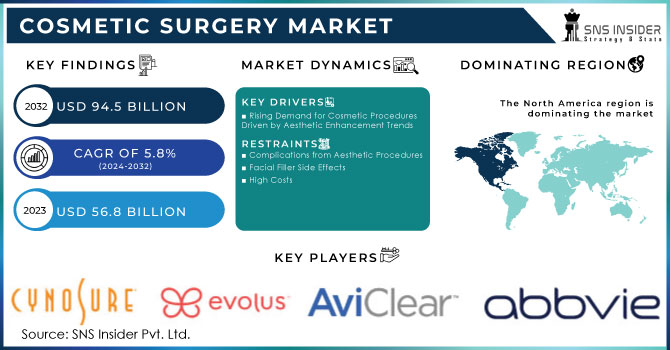

The Cosmetic Surgery Market was estimated at USD 56.8 billion in 2023 and is poised to reach 94.5 billion in 2032 anticipated to expand at a compound annual growth rate of 5.8% for the forecast period of 2024-2032.

The cosmetic surgery market has recorded a rapid growth that is influenced by such factors, including a growing prevalence of skin diseases and an increasingly desirable young look. Currently, around 1.8 billion people worldwide suffer from skin diseases at any one time, according to a report by the World Health Organization in March 2023. According to the data published by the British Skin Foundation, nearly 60% of the UK population reported having some sort of skin disorder. Advances in new technology and devices for treating cosmetic conditions, coupled with better reimbursement for the same, will propel greater patient involvement in such cosmetic treatments. Of course, also the fact that most patients prefer non-invasive procedures due to their ease and low risk of complications.

However, the COVID-19 outbreak initially depressed demand due to a decline in elective procedures in 2020, and in any case, the lifting of lockdown restrictions and growing preference for home care solutions are likely to drive the market from 2024 to 2032. Interestingly, there has been an increase in demand for cosmetic procedures among males too, and about 2 million cosmetic surgeries are said to have been performed on males in 2022, according to the International Society of Aesthetic Plastic Surgery. Common surgical procedures for men include eyelid surgery, liposuction, and botulinum toxin injections.

Advanced aesthetic devices help shift the market dynamics. Notable among these was the release of Avéli by Revelle Aesthetics, Inc. in 2022 as an FDA-cleared cellulite treatment device. Again, the emphasis remains on precise solutions for common aesthetic concerns, as witnessed in the industry. Other notable releases are the approval of VOLUX XC by AbbVie Inc. as part of the Juvéderm line, a cohesive hyaluronic acid gel, and utilized for jawline augmentation. Also, Cutera launched AviClear, the first FDA-approved laser treatment for acne, in 2022.

All in all, the market for cosmetic surgery will show robust growth with technologies and ideas introducing themselves to this world. Acceptance of cosmetic procedures would also grow among different age groups and men.

Cosmetic Surgery Market Dynamics

Drivers

-

Rising Demand for Cosmetic Procedures Driven by Aesthetic Enhancement Trends

Increased attention to aesthetic enhancement has surely pushed the demand for cosmetic procedures higher over the last few years. As society is becoming increasingly concerned about looks, the market here offers attractive growth opportunities. Women are driving the momentum here as they are keen to spend more on their physical appearance. Some of the most preferred procedures include- liposuction, smoothening eyelids through eyelid surgery, and flattening abdomens through abdominoplasty. According to ISAPS, more than 2.1 million breast augmentation treatments were done in 2022 alone worldwide.

There are now more and more patients who are oriented towards minimally invasive cosmetic procedures, rather than traditional surgeries. One of the attractive benefits offered by non-surgical procedures is their multiple benefits, which include short periods of recovery, less pain, and lower healthcare costs. A report from the Aesthetic Society shows that 5.8 million non-surgical cosmetic procedures took place within the U.S. borders in 2022, further demonstrating this shift in patients' preferences.

Greater investments in research and development help to bring in new product launches, hence further supporting the growth of the market. The industry is always gearing towards delivering aesthetic enhancement results, further driving demand and increasing the cosmetic surgery market's tendency towards very significant growth. As more and more women and men are likely to seek procedures that match their aesthetics, the industry is well-positioned to grow further.

Restraints

-

Complications from Aesthetic Procedures

-

Facial Filler Side Effects

-

High Costs

Cosmetic Surgery Segment Outlook

By Procedure

Surgical Procedures held the highest market share in 2023, occupying approximately 63.2% of the market, primarily because of increased demand for surgical procedures like breast augmentation and liposuction. These surgeries are mostly preferred because most do not require follow-up within the short term; they have long-term effects. Growth in this segment is also nurtured by the presence of approved aesthetic devices from industry leaders. For instance, in October 2023, Fit.ai and The Marena Group introduced 3D body-scanning technology with artificial intelligence to allow plastic surgeons to size and select the right garment at the time of surgery for safe recovery. In July of this year, Bausch Health Companies Inc's wholly-owned subsidiary company Solta Medical launched the Thermage FLX system - the radiofrequency-based device to contract the skin and it is a device approved only for eyelid treatment under the FDA.

The Non-Surgical Procedures segment is forecasted to witness the highest CAGR during the forecast period. The rising demand for non-surgical treatments - from dermal fillers, botulinum toxin, and hyaluronic acid - will drive growth in the non-surgical procedures segment. Such non-invasive treatments boast several merits, such as smaller recovery periods, lower hospitalization rates, and less pain. Non-surgical interventions are increasingly being used worldwide, and an estimated 18.9 million cases were conducted in 2022, ISAPS reported.

By Gender

The market for cosmetic surgery, dominated by females in 2023 with a 56.4% share and accounting for the largest share, has been driven by the increasing numbers of women who are undergoing a range of different cosmetic procedures, which include skin resurfacing and tightening, hair removal, and breast reduction. In the case of plastic surgeons, breast augmentation is the most commonly performed procedure globally. ISAPS states that women account for approximately 86.2% of all cosmetic procedures conducted worldwide in 2022 and head the market by a wide margin.

The growth of the market for males is likely to be moderate over the forecasting period. There appears to be rising awareness and acceptability regarding cosmetic procedures amongst men along with this resultant younger look that helps in further expanding this segment. The ever-rising trend of cosmetic treatments like gynecomastia and eyelid surgery among men is expected to remain a driving force for this category from 2024 through 2032. According to statistics from ISAPS, around 305,340 gynecomastia procedures were performed worldwide in 2022. This reflects an increase in the popularity of cosmetic treatments among men to have beauty work done.

By Age Group

The market share of 32.1% in 2023 is anticipated to be held by the age group of 35 to 50 years, with tremendous growth during the forecast period. A spurt in the adoption of non-surgical procedures, especially botulinum toxin treatments, among patients in that age range has been one of the factors driving this growth. Increasing awareness of anti-aging and body contouring treatments among women within the age group of 35 to 50 further signifies tremendous scope for growth in this segment.

In 2023, the second largest market share was held by the age group of 19 to 34 years. Growing demand for cosmetic procedures such as breast augmentation and rhinoplasty is enhancing this segment's presence. Interestingly, as per the International Society of Aesthetic Plastic Surgery, in 2022, about 66.7% of patients belonging to the category of 19 to 34 years underwent rhinoplasty surgery which reflects growing interest in aesthetic enhancement in this segment.

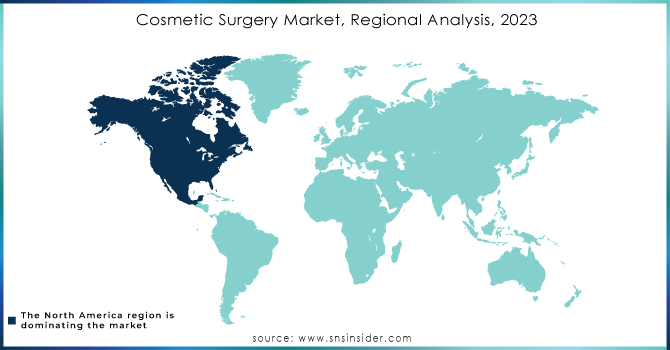

Cosmetic Surgery Market Regional Analysis

The market value in North America was USD 18.10 billion in 2023, mainly because of the existence of very qualified plastic surgeons and because of the large number of aesthetic clinics in the U.S. and Canada. The same reason with high adoption rates of advanced aesthetic devices lead to higher demand for cosmetic procedures by the region, thus making it dominant. For instance, statistics by the Aesthetic Society show that 320 surgical procedures were performed by plastic surgeons in 2021 compared to 220 procedures in the previous year, and this reflects a strong growth of cosmetic surgery operations within the region.

Europe is the second biggest market for cosmetic surgery globally. Rising non-invasive surgeries and the proliferation of medical spas, particularly in Germany and France, are major factors sustaining growth in the market. The German National Tourist Board said around 350 operating medical spas have been reported in Germany in 2020. The region is slowly turning to be a hotspot for aesthetic treatment facilities.

The region is expected to achieve the highest compound annual growth rate (CAGR) over the estimated period. The rise in demand for medical tourism, the adoption of cosmetic procedures, and innovative aesthetic clinics for low-cost cosmetic procedures are key factors that boost the market growth in Latin America. For example, a Silicone Center clinic in Brazil was the first of its type in June 2022 to say that different sizes of silicone prosthesis implants would be available at "competitive prices" for breast augmentation because of changing customer demands.

Do You Need any Customization Research on Cosmetic Surgery Market - Enquire Now

Key Players

-

Johnson & Johnson Services, Inc. (MENTOR)

-

Fotona

-

AbbVie Inc.

-

Solta Medical

-

Cutera

-

Evolus Inc.

-

Merz Pharma

-

GALDERMA

-

Sientra, Inc.

-

Lumenis

-

Alma Laser

-

Cynosure

-

REVANCE AESTHETICS

-

Apyx Medical

-

Long Island Plastic Surgical Group, PC, and others.

Recent Developments

-

May 2024: AbbVie gained FDA approval for a new generation of injectable dermal fillers new offering in its expanded cosmetic surgery product line. The new fillers are designed to last longer and provide a more natural look.

-

April 2024: Cynosure announced its new laser technology, which should ensure improved precision and reduced recovery times for patients. The company's advanced cooling features are designed to help keep patients comforted during the procedure.

-

August 2023: TELA Bio, Inc. launched OviTex PRS Long-Term Resorbable in the United States. It is designed for use in plastic and reconstructive surgery.

-

March 2023: Establishment Labs Holdings Inc. established four partnerships with European partners and a second wave of partnerships in Japan to make Mia Femtech a procedure that helps restore the shape of the breast in as little as 15 minutes.

| Report Attributes | Details |

| Market Size in 2023 | US$ 56.8 billion |

| Market Size by 2032 | US$ 94.5 billion |

| CAGR | CAGR of 5.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Procedure Type (Surgical Procedures, Non-Surgical Procedures) • By Gender (Male, Female) • By Age Group (18 Years and Younger, 19 to 34 Years, 35 to 50 Years, 51 to 64 Years, 65 Years & Above) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Bausch Health Companies Inc., Candela Corporation, Johnson & Johnson Services, Inc. (MENTOR), Fotona, AbbVie Inc., Solta Medical, Cutera, Evolus Inc., Merz Pharma, GALDERMA and other players |

| Key Drivers | • Rising Demand for Cosmetic Procedures Driven by Aesthetic Enhancement Trends |

| Market Restraints | • Complications from Aesthetic Procedures • Facial Filler Side Effects • High Costs |