Wound Care Devices Market Report Scope and Overview:

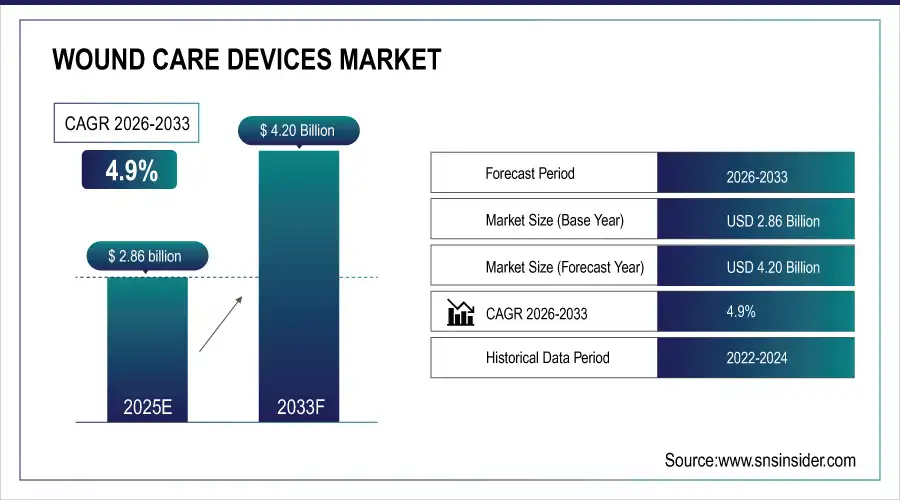

The Wound Care Devices Market Size was valued at USD 2.86 Billion in 2025E and is expected to reach USD 4.20 Billion by 2033 and grow at a CAGR of 4.9% over the forecast period 2026-2033.

The global wound care devices market is booming, driven by various growth factors. Chronic wounds like diabetic foot ulcers, pressure ulcers and venous leg ulcers are the greatest contributing factors. Data from the Centers for Disease Control and Prevention (CDC) estimates that, in 2023, 37.3 million Americans (11.3% of the population) have diabetes, and 96 million adults (38.0%) have prediabetes. Such a high incidence of diabetes leads to a greater number of diabetic foot ulcers, a key market application for wound care devices. Moreover, the rising geriatric population is supporting the market growth, as older people are more vulnerable to chronic wounds. According to the U.S. Census Bureau, all baby boomers will be over the age of 65 by 2030, increasing the number of older Americans to 73 million. The growing geriatric population is anticipated to raise the need for advanced wound care.

Wound Care Devices Market Size and Forecast:

-

Market Size in 2025: USD 2.86 Billion

-

Market Size by 2033: USD 4.20 Billion

-

CAGR: 4.9% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information on Wound Care Device Market - Request Sample Report

Wound Care Devices Market Highlights:

-

Innovations in wound care devices, including smart dressings, negative pressure wound therapy (NPWT) systems, and bioactive materials, are improving treatment efficiency and patient outcomes.

-

Technological advancements, such as biodegradable sutures generating electrical stimulation and electronic dressings with sensors, accelerate wound healing and enable real-time monitoring.

-

The COVID-19 pandemic increased focus on healthcare and wound management, boosting demand for wound care devices in hospital and home care settings.

-

Government initiatives, like the U.S. efforts to prevent and treat diabetic foot ulcers, support market growth by enhancing healthcare infrastructure.

-

High costs of advanced wound care technologies and complex approval processes limit accessibility and slow adoption, particularly in low-income or resource-constrained regions.

-

Insurance coverage limitations and lack of user-friendly solutions in some markets further restrain widespread adoption despite proven clinical benefits.

Moreover, innovations in wound care devices such as smart dressings, negative pressure wound therapy systems, and others are improving treatment efficiency, which will boost market growth. The demand for the market has also been indirectly affected by the COVID-19 pandemic, as hospital and home care settings put more emphasis on healthcare and wound care than ever before. Market growth is also augmented by government efforts to enhance healthcare infrastructure and minimize economic insurance of chronic wounds. For example, the U.S. Department of Health and Human Services has initiated efforts to prevent and treat diabetic foot ulcers because of their large cost to public health and the healthcare systems.

Wound Care Devices Market Drivers:

-

Innovations such as negative pressure wound therapy (NPWT) systems and bioactive materials enhance treatment efficacy and patient outcomes.

Innovation in the field of sciences or technology is also one of the leading factors contributing to the wound care devices market growth. One such advance is a biodegradable suture that provides electrical stimulation via patient motion, promoting faster wound healing and smaller infection risk. When the suture moves through the skin, the process works through the triboelectric effect, creating an electric field surrounding the wound for faster healing.

Also, with the advent of smart wound care devices, like electronic dressings with sensors, it is now possible to monitor the condition of the winding in real time. They are also capable of detecting the presence of bacteria or an overabundance of fluid, as well as dispensing targeted treatments where needed, ultimately speeding up the recovery process while also reducing the need for follow-up interventions. Not only do these technological innovations enhance the efficiency of wound management, but they are also cost-effective solutions that make advanced wound care more accessible to a wider patient population.

Wound Care Devices Market Restraints:

-

Complex approval processes can delay the introduction of new products to the market.

The high cost of advanced technologies such as negative pressure wound therapy (NPWT) systems, bioengineered skin substitutes, and advanced dressings is one of the major restraints in the wound care devices market. These solutions are typically made from advanced materials and require complicated manufacturing processes, driving up their overall cost. While they offer superior outcomes in managing chronic wounds and promoting faster healing, their pricing can be prohibitive for many patients, particularly in low-income or resource-constrained settings. In addition, these high-end devices are not user-friendly enough to be integrated with routine care in developing parts of the world, as the healthcare system has a limited budget. Even in developed markets, insurance coverage often varies, with some payers limiting reimbursements for high-cost wound care products. The cost can hinder healthcare providers from adopting the system, to change patients still rely on traditional methods that may not be able to provide the same effectiveness.

Wound Care Devices Market Segment Analysis:

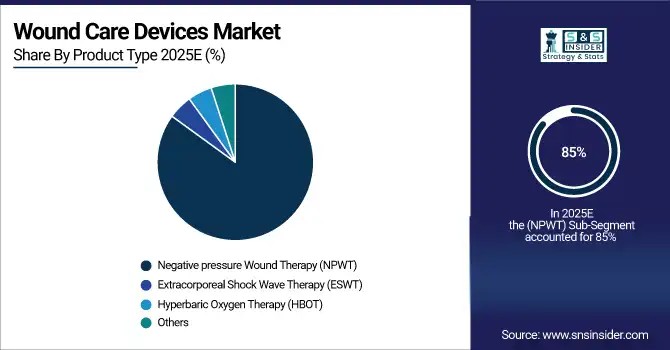

By Product Type

In 2025, negative pressure wound therapy (NPWT) held the largest share 85% of the market. The reasons for this dominance are related to the very strong efficacy in the treatment of complex and chronic wound management but they also promote faster healing and reduce the wound infection. The Centers for Medicare & Medicaid Services (CMS) has recognized the clinical benefits of NPWT and provides coverage for its use in various wound types, which has significantly contributed to its widespread adoption. AHRQ 2021 published a report suggesting that there is emerging evidence to support the use of NPWT for several types of wounds, including diabetic foot ulcers, and pressure ulcers. The Food and Drug Administration (FDA) of the United States has also approved many NPWT devices, which confirms their safety and effectiveness.

Additionally, the National Institutes of Health (NIH) has funded numerous studies on NPWT, contributing to the growing body of evidence supporting its use. The portability and ease of use of modern NPWT devices has also expanded the scope of their utilization in hospital and home care settings, propelling the market growth. Also, the cost-effectiveness of NPWT against standard wound management techniques has rendered NPWT a preferable option for healthcare providers and payers given that it may reduce overall treatment costs and length of hospital stay.

By End User

In 2025, the largest revenue share of the market was held by the hospitals segment. There are a number of reasons for this leadership position, including the number of complex wound cases being treated in hospitals, as well as access to advanced wound care technologies in the hospital environment. In 2023, there are 6,093 hospitals (source American Hospital Association (AHA)) in the USA alone, creating an immense ecosystem for usage of wound care devices. According to the Centers for Disease Control and Prevention (CDC), in 2019, there were 36.2 million hospital admissions in the U.S., and countless of those admissions included patients needing wound care. Severe and chronic wounds are usually treated in hospitals, as they require an environment with infrastructure, qualified professionals, and modern equipment to manage complex cases. Alongside the Centers for Medicare & Medicaid Services (CMS) efforts that establish quality measures and reimbursement policies to encourage hospitals to enhance patient outcome systems to reduce hospital-acquired pressure ulcer, it can lead to the wider use of advanced wound care technologies in hospitals. Thereby, propelling the demand for advanced wound care management products in the hospitals. Moreover, the NPUAP has also set the standards for pressure ulcer prevention and management which are commonly adopted by hospitals, making use of specialized wound care devices.

By Indication

Diabetic foot ulcers segment lead the market in 2025. The increasing number of people with diabetes and its complications around the globe is the reason behind its prominence. Historically, the Centers for Disease Control and Prevention (CDC) estimated that in 2020, approximately 34.2 million Americans (10.5% of the population) had diabetes; 1 out of 4 survived long enough to develop a diabetic foot ulcer (DFU) in their lifetime. Diabetic foot ulcers are the most common cause of non-traumatic lower extremity amputations, according to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK). These statistics indicate the high unmet need for effective wound care devices in the diabetic foot ulcer market. The economic impact of diabetic foot ulcers has been great, with the American Diabetes Association estimating that total direct medical costs of diabetes per year in the U.S. reached $237 billion in 2017, a large part of which was accounted for by foot complications. This financial burden has led to more investments in advanced wound care technologies for diabetic foot ulcers. Furthermore, the U.S. Department of Health and Human Services' Healthy People 2020 initiative included objectives to reduce the rate of lower extremity amputations in persons with diagnosed diabetes, which has spurred the development and adoption of innovative wound care devices for diabetic foot ulcers.

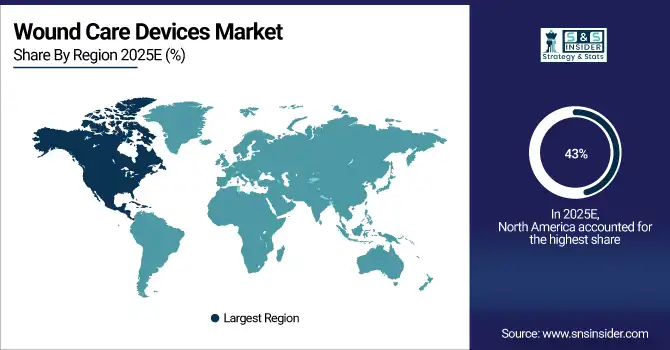

Wound Care Devices Market Regional Analysis:

North America Wound Care Devices Market Trends:

In 2025, North America accounted for the largest share of the wound care devices market. In 2023, the North American market share is estimated to be about 43% of the global market. Several factors across the region such as developed healthcare infrastructure, high healthcare expenditure, and high patient population with chronic wounds contribute to its dominance. As the prevalence of chronic wounds increases with age, the U.S. Census Bureau projects that the number of Americans aged 65 years and older will almost double in those years, from 52 million in 2018 to 95 million by 2060.

Do You Need any Customization Research on Wound Care Device Market - Enquire Now

Asia-Pacific Wound Care Devices Market Trends:

The fast growth of the Asia-Pacific region is attributed to the improvement of healthcare infrastructure, rising awareness of advanced wound care, along the surge in the diabetic population. According to the International Diabetes Federation (IDF), 163 million adults were living with diabetes in the Western Pacific region (including much of Asia) in 2019, and the number of victims is expected to rise to 212 million by 2045. Such an increase in the incidence of diabetes will propel the demand for wound care devices, especially for diabetic foot ulcers. The increasing investment in healthcare access and quality from governments in countries such as China and India is driven by the need for sustainable large market growth.

Europe Wound Care Devices Market Trends:

Europe holds a significant share in the wound care devices market due to advanced healthcare infrastructure, well-established reimbursement systems, and high awareness of chronic wound management. Countries such as Germany, the UK, and France lead in adoption of advanced wound care technologies. The aging population in Europe, with rising prevalence of diabetes and vascular diseases, further fuels demand for effective wound care solutions.

Latin America Wound Care Devices Market Trends:

Latin America is experiencing moderate growth due to expanding healthcare infrastructure, rising prevalence of chronic wounds, and increasing government initiatives to improve patient care. Brazil, Mexico, and Argentina lead the region in adoption of advanced wound care products. Growing awareness of diabetic foot ulcers and enhanced access to wound management technologies are expected to drive market demand over the coming years.

Middle East & Africa (MEA) Wound Care Devices Market Trends:

The MEA region is witnessing steady growth in the wound care devices market driven by increasing healthcare investments, rising incidence of diabetes, and growing awareness about advanced wound management. Countries such as Saudi Arabia and the UAE are prioritizing modern healthcare facilities and access to innovative medical devices, supporting market expansion in both urban and semi-urban areas.

Wound Care Devices Market Key Players:

-

Smith & Nephew (PICO 7, Allevyn Gentle Border)

-

3M Healthcare (Tegaderm, Coban 2)

-

ConvaTec Group plc (Avelle, Aquacel Ag+)

-

Medtronic (V.A.C. Therapy, Kendall SCD)

-

Molnlycke Health Care AB (Mepilex, Mepitel One)

-

Coloplast A/S (Biatain Silicone, SenSura Mio)

-

Hollister Incorporated (Endoform Dermal Template, Hydrofera Blue READY)

-

Cardinal Health (Kendall Foam Dressings, CURAD Non-Adherent Pads)

-

Derma Sciences, Inc. (Integra LifeSciences) (MEDIHONEY, TCC-EZ)

-

B. Braun Melsungen AG (Prontosan, Askina Calgitrol Ag)

-

Hartmann Group (HydroClean, HydroTac)

-

Kinetic Concepts, Inc. (Acelity) (ActiV.A.C., Prevena Therapy)

-

Medline Industries, Inc. (SilvaSorb Gel, Optifoam Gentle)

-

Advanced Medical Solutions Group plc (LiquiBand, ActivHeal Foam)

-

Integra LifeSciences Holdings Corporation (Omnigraft, PriMatrix Dermal Repair Scaffold)

-

Lohmann & Rauscher (L&R) (Suprasorb, Debrisoft)

-

Zimmer Biomet (Gel-One, wound VAC systems)

-

MiMedx Group, Inc. (EpiFix, AmnioFix)

-

Organogenesis Inc. (PuraPly, Affinity)

-

Convexity Scientific (AquaMed Advanced, PICO technology solutions)

Wound Care Devices Market Competitive Landscape:

Smith & Nephew, founded in 1856, is a global medical technology company headquartered in London, UK. It specializes in advanced wound management, orthopedics, and sports medicine products, including joint reconstruction, trauma, and biologics. The company focuses on innovative solutions that improve patient outcomes, enhance mobility, and support healthcare professionals worldwide through research-driven product development and cutting-edge medical technologies.

-

Smith & Nephew launched its new innovative negative pressure wound therapy system which has received clearance from the FDA for hospital and homecare use in June 2024. It uses AI-powered pressure adjustment technology for the quick healing process of wounds.

Medtronic, founded in 1949 and headquartered in Dublin, Ireland, is a leading global medical technology company. It develops innovative healthcare solutions, including cardiac devices, diabetes management systems, surgical technologies, and smart wound care products. Medtronic focuses on improving patient outcomes, enhancing quality of life, and supporting healthcare providers worldwide through advanced research, cutting-edge technology, and clinically proven medical devices.

-

In March 2025, smart wound dressing was launched by Medtronic where sensors are integrated for wound healing and data are transferred to care providers as real-time updates. The product aims to revolutionize wound care management by enabling early intervention and personalized treatment plans.

3M Healthcare, a division of 3M Company founded in 1902 and headquartered in St. Paul, Minnesota, USA, provides innovative medical solutions worldwide. It offers products in wound care, infection prevention, surgical supplies, oral care, and health information systems. The division focuses on improving patient outcomes, enhancing safety, and supporting healthcare professionals through advanced technologies, research-driven solutions, and sustainable medical innovations.

-

In November 2024, 3M Healthcare launched novel antimicrobial wound dressings incorporating silver nanoparticles to treat chronic wounds infected by antibiotic-resistant bacteria. CDC's efforts to combat the rising threat of antibiotic resistance in healthcare settings are reflected in this product launch.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.86 Billion |

| Market Size by 2033 | USD 4.20 Billion |

| CAGR | CAGR of 25.9% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Negative pressure Wound Therapy (NPWT), Extracorporeal Shock, Wave Therapy (ESWT), Hyperbaric Oxygen Therapy (HBOT), Others) • By Indication (Diabetic Ulcers, Surgical wounds, Pressure Ulcers, Others) • By End User (Hospitals, Homecare settings, Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Smith & Nephew, 3M Healthcare, ConvaTec Group plc, Medtronic, Molnlycke Health Care AB, Coloplast A/S, Hollister Incorporated, Cardinal Health, Derma Sciences, Inc. (Integra LifeSciences), B. Braun Melsungen AG, Hartmann Group, Kinetic Concepts, Inc. (Acelity), Medline Industries, Inc., Advanced Medical Solutions Group plc, Integra LifeSciences Holdings Corporation, Lohmann & Rauscher (L&R), Zimmer Biomet, MiMedx Group, Inc., Organogenesis Inc., Convexity Scientific. |