Aerial Work Platform Market Report Scope & Overview:

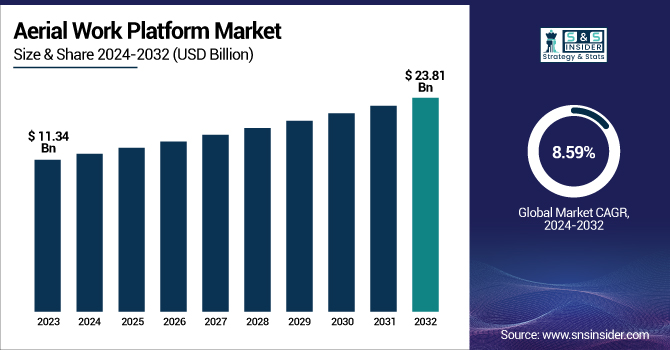

The Aerial Work Platform Market size was estimated at USD 11.34 Billion in 2023 and is expected to reach USD 23.81 Billion by 2032 at a CAGR of 8.59% during the forecast period of 2024-2032.

To Get more information on Aerial Work Platform Market - Request Free Sample Report

The Aerial Work Platform (AWP) market is driven by growing demand for safer and more efficient access solutions for working at height. Mainly, these platforms are referred to boom lifts, scissor lifts, vertical mast lifts, etc., & they are widely used in construction, maintenance & even industrial sectors. Their rising global adoption can be attributed to their ability to increase worker safety, boost productivity, and lower downtime.

One trend that is positively impacting the market is the rising demand for electric-powered aerial work platforms due to the greater focus on environmental sustainability and lower operational expenditure. Kyoto is quieter and produces less carbon dioxide – the perfect platforms for indoor and urban work environments. Technological progress is also a major driver of growth, as manufacturers adopt solutions such as advanced control systems, telematics, and automation to enhance operational efficiency, accuracy, and safety. Demand for AWPs is further driven by a booming construction and infrastructure sector, especially in emerging markets. With the growth of urban settlements and structures, there will always be a need for safe and efficient access equipment to allow workers to undertake jobs at height. Furthermore, the increasing adoption of rental facilities for AWPs, mainly across construction projects with inconsistent requirement, is also supporting the growth of the market.

MARKET DYNAMICS

DRIVERS

-

The rapid growth of the construction industry, particularly in emerging economies, drives the demand for Aerial Work Platforms (AWPs) to enhance safety, productivity, and efficiency in high-rise and infrastructure projects.

AWPs demand heavily fueled by the rapid growth of construction industry in emerging economies. With rapid urbanization and the rise of new infrastructure projects such as high-rise buildings, bridges, and roads, the accessibility of high-rise workplaces becomes a critical issue. AWPs is a safe solution for people working at heights and significantly reduce the risk of accidents associated with conventional scaffold or ladder setups. AWPs also increase productivity because they allow workers to reach their work area faster, more easily, and more efficiently to complete tasks, including the construction, maintenance, and cleaning of tall buildings. AWP Adoption is further driven by the increasing need for modern construction approaches focusing on workers safety and operational efficiency. The growing complexity and ambition of construction projects, particularly in developing markets, make AWP an increasingly indispensable instrument for maintaining safety, improving productivity and compliance with regulations.

RESTRAINT

-

AWPs require high initial investment which creates hindrances to the growth of the market especially from small businesses and developing economies with financial constraints.

AWPs are comparatively high up-front investments; therefore, the initial investment in the equipment can limit market growth, particularly for small and medium-sized businesses (SMB). They are capital equipment, and companies working on a tight budget can find AWPs to be quite the expensive purchase. If AWPs need to be deployed with a big upfront capital, they often become a deterrent for SMBs, more so in the instance of developing frontiers. Financial investment poses a hindrance for businesses operating on thin margins or who only require AWPs for shorter-term jobs. As a result, the adoption rate of AWPs in these sectors is relatively slower, thereby restricting the overall market growth. For new entrants to the market, this cost can be a barrier due to the required capital upfront, which is particularly true in emerging economies. Such an option already exists for rentals but does not consistently demonstrate the same long-term value, contributing to the lack of adoption of AWPs by certain sectors and localities.

MARKET SEGMENT ANALYSIS

By Product

The scissor lifts segment dominated with a market share of over 48% in 2023, due to their extensive use across a variety of industries, including construction, warehousing, and maintenance. These lifts have a patented crisscrossing "scissor" mechanism that offers superior stability and enables higher lift capacities over other platforms. The design makes them ideal for vertical height and horizontal distance operations at height in tight or confined spaces. For their ease of use, low maintenance, and safe operation at high heights, scissor lifts are a long-term go-to for many industrial applications. The cost-effectiveness paired with this versatility has made their market dominance inescapable.

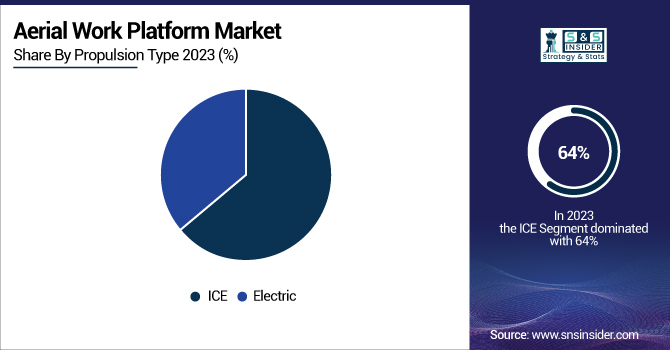

By Propulsion Type

The internal Combustion Engine (ICE) segment dominated with a market share of over 64% in 2023. Due to most of the processes and industrial scenarios demanding higher lifting capacity and longer operating hours, ICE-powered platforms are preferred. They can work in the wild, such as construction sites with no adequate power supply infrastructure, where wet weather and terrain could hinder the use of electric models. More continuous use of ICE machines is not so reliant on the need to recharge. It makes them especially useful for industries that need to keep operations running most of the time for maximum productive output.

By Lifting height

The More than 51 Ft segment dominated with the market share over 46% in 2023, due to the high demand of the high lifting AWP. In construction, maintenance, utilities, and many more environments where access to heights is necessary, there are few platforms more necessary than these. The high-altitude capability enables the performance of various tasks including building repairs, high-rise construction operations, and utility lines maintenance. Lifting heights over 51 feet are popular on its versatility in accomplishing demanding work at a significant height. The versatile high-reaching AWPs are in high demand as industries continue to grow, and urban infrastructure expands, which is why these machines are now commonplace in the market

KEY REGIONAL ANALYSIS

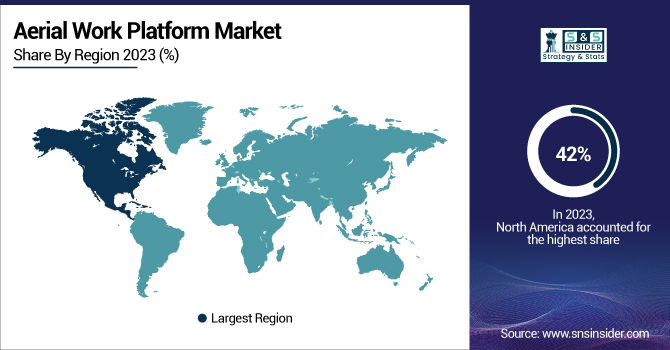

The North America segment dominated with a market share of over 42% in 2023. A well-established construction, maintenance, and industrial sector further increases the demand for AWPs in the region. The USA is also a major player investing in significant infrastructure and construction projects. The demand for AWPs in the region is projected to increase, owing to continuous investments in commercial, residential, and industrial developments. Moreover, the implementation of advanced AWP technology in oil & gas, utilities, and entertainment industries is also expected to continue contributing to the market growth, securing the leading market position of North America in the global AWP market.

Asia Pacific is anticipated to witness the highest growth rate owing to rapid urbanization, infrastructure development and the growing construction and industrial sector in the regional countries such as China, India and Japan. These countries are seeing huge expansion in both residential and commercial buildings, which is driving demand for AWPs to provide effective, safe work at height. Further growth drivers include rising investments in infrastructure projects, government initiatives, and increasing industrial automation. Rising number of rental companies providing affordable access to AWPs is another factor driving market growth.

Need any customization research on Aerial Work Platform Market - Enquiry Now

Some of the major key players in the Aerial Work Platform Market

-

AICHI CORPORATION (Truck-mounted aerial platforms, Boom lifts)

-

Advance Lifts, Inc. (Scissor lifts, Lifting tables)

-

Altec Industries (Aerial devices, Bucket trucks, Digger derricks)

-

Bronto Skylift (Truck-mounted lifts, Aerial work platforms)

-

DINOLIFT OY (Self-propelled boom lifts, Trailer-mounted lifts)

-

EdmoLift AB (Lifting tables, Mobile work platforms)

-

HAULOTTE GROUP (Boom lifts, Scissor lifts, Articulated lifts)

-

JLG Industries (Boom lifts, Scissor lifts, Telehandlers)

-

Linamar Corporation (Self-propelled lifts, Telescopic handlers)

-

MEC (Scissor lifts, Articulating lifts)

-

RUNSHARE Heavy Industry Company, Ltd. (Boom lifts, Scissor lifts)

-

Manitou Group (Telehandlers, Boom lifts)

-

Terex Corporation (Aerial work platforms, Scissor lifts)

-

Genie (Terex) (Boom lifts, Scissor lifts, Vertical lifts)

-

Snorkel (Boom lifts, Scissor lifts, Mast lifts)

-

Skyjack (Scissor lifts, Boom lifts)

-

Toyota Industries Corporation (Aerial work platforms, Telehandlers)

-

Tadano Ltd. (Aerial work platforms, Hydraulic cranes)

-

Haulotte Group (Articulating lifts, Scissor lifts)

-

JCB (Boom lifts, Telehandlers)

Suppliers for (Articulating lifts, Scissor lifts, and Vehicle-mounted platforms) on Aerial Work Platform Market

-

AICHI Corporation

-

Altec Industries

-

Bronto Skylift

-

HAULOTTE Group

-

JLG Industries

-

MEC Aerial Work Platforms

-

LINAMAR Corporation

-

Dinolift Oy

-

EdmoLift AB

-

RUNSHARE Heavy Industry Co., Ltd.

RECENT DEVELOPMENT

-

In March 2024: Manitou Group revealed its new series of scissor lifts, aiming to introduce cutting-edge designs in the key market segment and complete its portfolio of self-propelled aerial work platforms.

-

In May 2023: JCB launched two versatile boom aerial work platforms, the A45E and A45EH, which come with diesel/electric hybrid and battery-electric power options. These machines are designed to boost user productivity through enhanced efficiency, better operator accessibility, and advanced monitoring features.

-

In February 2023: MEC introduced the NANO10-XD electric scissor lift, equipped with a standard Xtra Deck to easily maneuver in confined areas, such as 2x2 ceiling grids. This compact lift minimizes environmental impact with a fully electric lift, steering, and drive system, thus eliminating the risk of oil leaks.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 11.34 billion |

|

Market Size by 2032 |

USD 23.81 billion |

|

CAGR |

CAGR of 8.59% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product (Boom Lifts, Scissor Lifts, Vertical Lifts) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

AICHI CORPORATION, Advance Lifts, Inc., Altec Industries, Bronto Skylift, DINOLIFT OY, EdmoLift AB, HAULOTTE GROUP, JLG Industries, Linamar Corporation, MEC, RUNSHARE Heavy Industry Company, Ltd., Manitou Group, Terex Corporation, Genie (Terex), Snorkel, Skyjack, Toyota Industries Corporation, Tadano Ltd., Haulotte Group, JCB. |

|

Key Drivers |

• The rapid growth of the construction industry, particularly in emerging economies, drives the demand for Aerial Work Platforms (AWPs) to enhance safety, productivity, and efficiency in high-rise and infrastructure projects. |

|

RESTRAINTS |

• AWPs require high initial investment which creates hindrances to the growth of the market especially from small businesses and developing economies with financial constraints. |