Aggregates Market Report Scope & Overview:

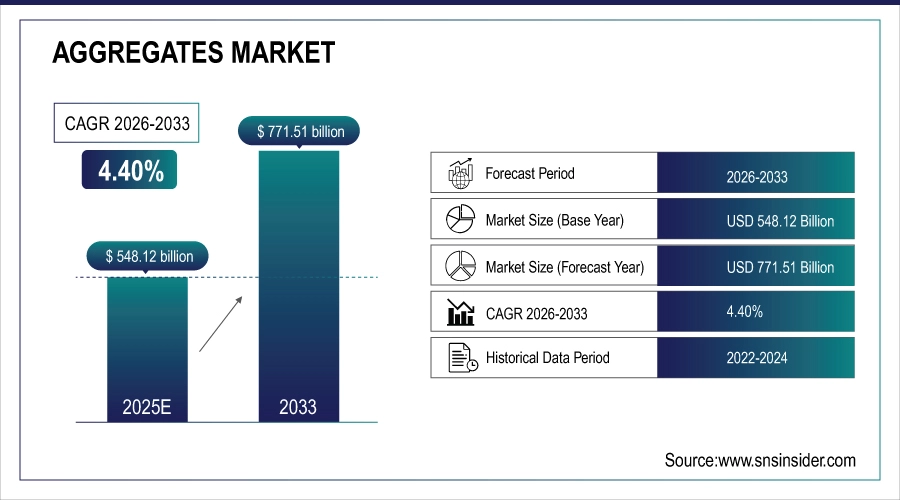

The Aggregates Market Size was valued at USD 548.12 Billion in 2025 and is projected to reach USD 771.51 Billion by 2033, growing at a CAGR of 4.40% during the forecast period 2026–2033.

The Aggregates Market analysis report offers a systematic approach to the competitive scenario, along with thoughtful of the main potential and revenue forecasts. Increasing infrastructure development, swift urbanization and growing use of recycled aggregates are the factors influencing consumption positively which will assist in accelerating the market growth during the projection period.

Aggregates demand reached 56.8 billion tons in 2025, boosted by rapid infrastructure expansion and growing construction activities.

Market Size and Forecast:

-

Market Size in 2025: USD 548.12 Billion

-

Market Size by 2033: USD 771.51 Billion

-

CAGR: 4.40% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Aggregates Market - Request Free Sample Report

Aggregates Market Trends:

-

Increasing demand for low-carbon and recycled aggregates is changing the way companies source material, forcing producers to look to sustainable material innovation.

-

Digital platforms and automated logistics will speed up bulk aggregate sourcing and increase transparency across the supply chain.

-

Major infrastructure partnerships between contractors and quarries are opening up pipelines.

-

High-performance, uniform-grade aggregates harvesting is on the rise due to a high demand for ‚modular and pre-fab construction'.

-

Developments in AI-enabled quarry optimization and drone-based mine monitoring are changing the game for how efficiently rock can be removed and raw materials plans can be managed.

-

Growing urban redevelopment projects are increasing the need for green-building and resilient construction materials such as specialty aggregates.

U.S. Aggregates Market Insights:

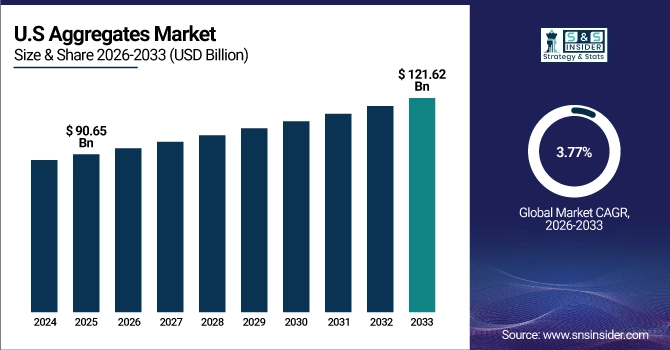

The U.S. Aggregates Market is projected to grow from USD 90.65 Billion in 2025E to USD 121.62 Billion by 2033, at a CAGR of 3.77%. Growth is derived from major infrastructure projects, urban rehabilitation and residential, non-residential construction activity and increasing use of the green recycled aggregates across urban common areas.

Aggregates Market Growth Drivers:

-

Accelerating infrastructure investments significantly boosting large-scale demand for construction-grade aggregates across sectors.

Accelerating infrastructure investments are a primary force driving Aggregates Market growth. Huge investments in transportation networks, urban renovation, industrial corridors and smart cities projects are creating never before demand for construction grade aggregates. It is largely the rising middle classes in developing economies that are driving demand, as governments spend on new highways, rail expansion and low-cost housing. Further, private sector involvement, public–private partnerships and quicker project clearances are also hardening up the aggregate supply chains, allowing producers to expand and eventually sustain long-term market growth.

Construction Aggregate consumption rose 5.6% in 2025, propelled by rapid highway development, large-scale urban infrastructure upgrades and expanding industrial project pipelines.

Aggregates Market Restraints:

-

Strict mining regulations, environmental restrictions, and permitting delays are limiting aggregate production and slowing market expansion.

Strict mining regulations, environmental restrictions, and lengthy permitting processes are major restraints for the Aggregates Market. Truck compliance is very strict and has high cost, restrict quarry’s expansion and a lot of time to new production capacity was postponed. Community opposition is further stoked by environmental impact concerns, delaying approvals for mining operations. These bottlenecks limit supply even as demand for construction climbs. Together, these regulatory pressures place limits on industry scalability and require producers to reconcile sustainability with the requirements of large-scale infrastructure.

Aggregates Market Opportunities:

-

Rising adoption of recycled and low-carbon aggregates offers opportunities for sustainable construction and innovative material solutions.

Rising adoption of recycled and low-carbon aggregates presents a significant opportunity for market growth. Stakeholders in construction industry are now paying more attention to green and environmentally friendly materials that help reduce carbon footprint and promote green building ratings. At the same time, processing, recycling advancements and material performance are enabling new levels of profitability and versatility with aggregates. Manufacturers who are committed to environmentally-friendly offerings and cutting-edge technology are poised for demand, recognition, and long-term market expansion.

Recycled and low-carbon aggregates accounted for 18% of aggregate production in 2025, driven by increasing green construction initiatives.

Aggregates Market Segmentation Analysis:

-

By Type, Crushed Stone held the largest market share of 42.36% in 2025, while Recycled Aggregates is expected to grow at the fastest CAGR of 5.22% during 2026–2033.

-

By Application, Concrete dominated with a 48.52% share in 2025, while Railway Ballast is projected to expand at the fastest CAGR of 5.45% during the forecast period.

-

By End User, Infrastructure accounted for the highest market share of 37.68% in 2025, while Residential Construction is anticipated to record the fastest CAGR of 5.12% through 2026–2033.

-

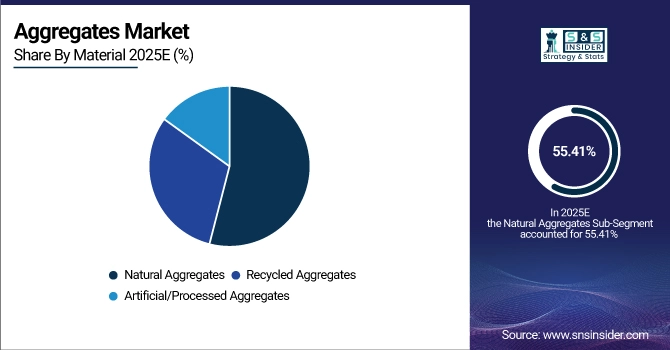

By Material, Natural Aggregates held the largest share of 55.41% in 2025, while Recycled Aggregates is expected to grow at the fastest CAGR of 5.37% during 2026–2033.

By Material, Natural Aggregates Dominate While Recycled Aggregates Expand Rapidly:

Natural Aggregates segment dominated the market as they are easily available, possess superior structural properties and cost lesser than traditional construction methods. In 2025, natural aggregates consumption totaled 30.3 billion tons, underscoring their critical role.

Recycled Aggregates are the fastest growing material segment, due to the growing trend of a circular economy and in sustainable construction. In 2025, recycled aggregates accounted for 10.4 billion tons, reflecting increasing investment in environmentally friendly and low-carbon building solutions.

By Type, Crushed Stone Dominates While Recycled Aggregates Expand Rapidly:

Crushed Stone segment dominated the market is used in various products such as cement to aid the development of low-cost construction materials. It’s still the most adopted for concrete and road-base amongst infrastructure projects. In 2025, crushed stone consumption reached 24.1 billion tons, reflecting its dominant role in construction.

Recycled Aggregates are the fastest growing segment which are being adopted based on the green and sustainable building philosophies. In 2025, recycled aggregates recorded 6.5 billion tons of consumption, highlighting growing awareness for low-carbon alternatives.

By Application, Concrete Dominates While Railway Ballast Expands Rapidly:

Concrete segment dominated the market due to its demand in residential, commercial and infrastructure projects. It is a valued building material, due to its versatile nature, the strength it provides and the long-lasting ability that have. In 2025, concrete-related aggregates consumption reached 27.5 billion tons globally.

Railway Ballast is the fastest growing segment as there are continuous rail expansions and high-speed rail projects in place globally. In 2025, ballast consumption totaled 4.2 billion tons, reflecting rapid adoption in infrastructure-heavy regions.

By End User, Infrastructure Dominates While Residential Construction Expands Rapidly:

Infrastructure segment dominated the market owing to high investment in roads, bridges, airports and industrial corridors. The problem is that they need huge amounts of aggregate if you want lasting results. In 2025, infrastructure-related aggregate usage reached 20.7 billion tons globally.

Residential Construction is the fastest growing segment, owing to demand for urban housing and affordable shelter programs in developing regions. In 2025, residential construction aggregates recorded 13.8 billion tons, highlighting rapid expansion in urban and suburban development.

Aggregates Market Regional Analysis:

Asia-Pacific Aggregates Market Insights:

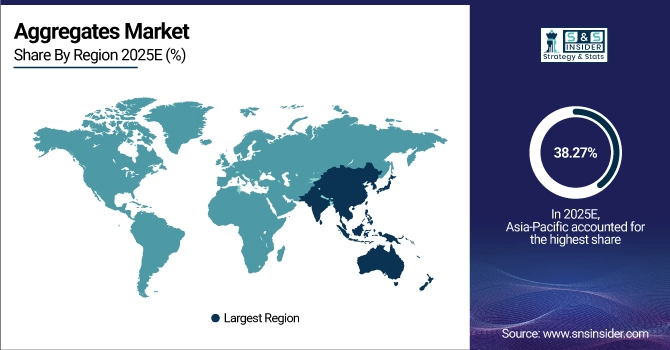

The Asia-Pacific dominated the Aggregates Market, holding a 38.27% market share in 2025. The market is growing due to construction of infrastructure, urbanization and housing and commercial construction in China, India, Japan and Southeast Asia. Growing government expenditure on highways, flyovers, railway tracks and smart city projects along with rising penetration of new age construction practices including ready mix concrete will augment aggregate demand. Increased quarrying capacities and technological enhancements are driving success in the regional market.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Aggregates Market Insights:

China Aggregates Market is driven by rapid urbanization, infrastructure development and large-scale residential and commercial construction projects. Infrastructure spending on highways, high-speed rail and smart city projects, helps bolster demand. To this is added the increasingly widespread use of modern construction materials, the growth of below ground quarrying and advanced technology adoption with China emerging as one of the Asia-Pacific region’s major aggregates markets.

North America Aggregates Market Insights:

The North America Aggregates Market is in the growing phase due to building renovations in cities, infrastructure investments and expenditures on construction increasing across both United States and Canada. Increasing use of sustainable and recycled aggregates is influencing supplier tactics. Innovations in quarrying technology, automated logistics and materials handling are fueling market participation and further establishing North America as a powerhouse in the aggregates realm, amid strong demand from residential, commercial and industrial sectors.

U.S. Aggregates Market Insights:

The U.S. Aggregates Market is heavily influenced by Infrastructure Modernization, Sustainable Construction Practices and Rapid Advancements of Quarrying and Crushing technology and Equipments. Use of recycled aggregates, modular construction techniques and innovative logistics are transforming supply chains while strategic contractor-supplier alignments can further enhance efficiency in a market focused on ensuring the nation remains at the forefront when it comes to construction-grade outputs.

Europe Aggregates Market Insights:

Europe Aggregates Market is predominantly driven by the large-scale infrastructure modernization, urban renewal and industrial expansion in Germany, France and UK. Demand for recycled and sustainable aggregates is increasing, aided by legislation to enforce reprocessing on site. Developed quarrying techniques, an increasing amount of public–private construction initiatives and the rise in demand for environmentally-friendly buildings have all contributed toward Europe proving itself as a strong player on the aggregates market.

Germany Aggregates Market Insights:

Germany is one of the largest end supplier markets in Europe for Aggregates demand. Strong rates of recycled and sustainable aggregates adoption, combined with technical advances in mining systems, have also benefitted the market. Mixes that include a combination of new innovative materials with public-private cooperation continue the emerging realisation of German strategic significance in the European aggregates sector.

Latin America Aggregates Market Insights:

The Latin America Aggregates Market is growing at a CAGR of 5.49%, due rapid expansion in the construction industry and increasing investment into infrastructure in Brazil, Mexico and Argentina. Product demand is driven by the construction of housing, commercial, industrial buildings and expanding utilization of sustainable and recycled materials. Increasing public works, advanced ways of construction and enhanced collaborations are the factors driving growth of the regional market.

Middle East and Africa Aggregates Market Insights:

The Middle East & Africa Aggregates Market is witnessing large scale infrastructure development projects, growth in urbanization and industrialization. Consumption is being propelled by increasing demand for green and quality construction materials. Growth and development are driven by primary markets such as Saudi Arabia, UAE, South Africa and Nigeria on the back of public–private construction projects.

Aggregates Market Competitive Landscape:

Heidelberg Materials, headquartered in Germany, is a leader in building materials, with extensive operations spanning cement, aggregates, ready-mixed concrete and asphalt. Its vertically integrated chain, comprising some hundreds of quarries and few thousands of distribution spots around the world, enables the company to efficiently serve huge construction and infrastructure demand. Through innovation, quality control and corporate scale, the company has become the leading aggregates supplier in the world including both developed and developing markets.

-

In March 2025, Heidelberg Materials launched evoZero, the world’s first industrial-scale carbon-captured net-zero cement, alongside evoBuild aggregates and concrete. These sustainable products reduce CO₂ emissions, supporting green infrastructure and reinforcing Heidelberg’s market leadership.

LafargeHolcim is a multinational building-materials company renowned for its wide portfolio of cement, aggregates and sustainable construction solutions. The company focuses on green and low-carbon recycled aggregates and environmentally friendly building materials to meet green regulations and standards. With the ability to produce in large volumes, its international presence and sustainable aggregates innovation it has become a force across multiple localities, meeting infrastructure, commercial and industrial construction requirement whilst holding key position within the aggregate market Bohae Plant & Parks Engineering’s reputation is promising.

-

In August 2025, LafargeHolcim launched EcoLabel, certifying low CO2 and recycled content aggregates, cement, and concrete solutions. This initiative strengthens its sustainable building portfolio and supports growing demand for environmentally friendly infrastructure projects.

CRH plc, headquartered in Dublin, Ireland, is one of the largest building-materials firms, providing a comprehensive range of aggregates, cement, concrete and asphalt solutions. With thousands of locations spanning continents, CRH supports the construction of world-class infrastructure and residential development. With a wide range of value-added material solutions and an unmatched distribution network, it’s not hard to see how Sparta has led the aggregates industry with some of the highest quality products for decades.

-

In May 2025, CRH acquired Eco Material Technologies and piloted MevoCem, a mechano-chemical cement process. These developments expand CRH’s low-carbon, sustainable cement and concrete solutions, boosting greener construction and the company’s aggregates market presence.

Aggregates Market Key Players:

-

LafargeHolcim

-

CRH plc

-

CEMEX S.A.B. de C.V.

-

Vulcan Materials Company

-

Martin Marietta Materials, Inc.

-

Rogers Group Inc.

-

LSR Group

-

Adelaide Brighton Ltd

-

Boral Ltd.

-

Aggregate Industries

-

Breedon Group plc

-

Sibelco

-

Lehigh Hanson Inc.

-

Colas S.A.

-

Vicat SA

-

Buzzi Unicem S.p.A.

-

Summit Materials Inc.

-

Oldcastle Materials

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 548.12 Billion |

| Market Size by 2033 | USD 771.57 Billion |

| CAGR | CAGR of 4.40% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Crushed Stone, Sand, Gravel, Recycled Aggregates, Manufactured Aggregates) • By Application (Concrete, Road Base & Sub-Base, Asphalt, Railway Ballast, Drainage, Others) • By End Use (Residential Construction, Commercial Construction, Industrial Construction, Infrastructure) • By Material (Natural Aggregates, Recycled Aggregates, Artificial/Processed Aggregates) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Heidelberg Materials, LafargeHolcim, CRH plc, CEMEX S.A.B. de C.V., Vulcan Materials Company, Martin Marietta Materials, Inc., Rogers Group Inc., Eurocement Group, LSR Group, Adelaide Brighton Ltd, Boral Ltd., Aggregate Industries, Breedon Group plc, Sibelco, Lehigh Hanson Inc., Colas S.A., Vicat SA, Buzzi Unicem S.p.A., Summit Materials Inc., Oldcastle Materials |