Supply Chain Analytics Market Report Scope & Overview:

Get more information on Supply Chain AnalyticsMarket - Request Free Sample Report

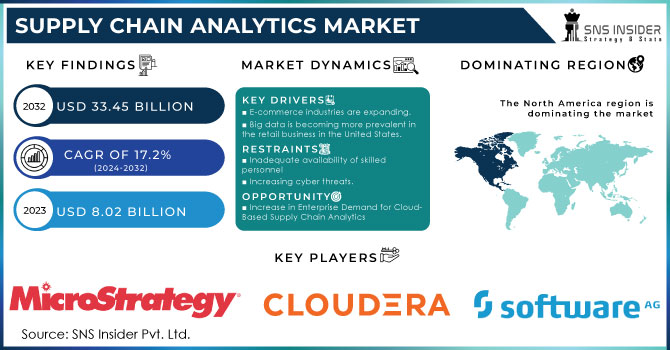

The Supply Chain Analytics Market was worth USD 8.02 billion in 2023 and is predicted to be worth USD 33.45 billion by 2032, growing at a CAGR of 17.2% between 2024 and 2032.

Supply chain analytics (SCA) demand is expected to increase mainly due to growing awareness about benefits associated with these solutions such as forecast accuracy improvement, supply chain optimization waste reduction and business data synthesis effectiveness. The growing number of small and medium-sized enterprises (SMEs) along with their spending on analytics for enhancing the market position and to improve competitiveness is expected to boost demand in coming years. SCA enables businesses to make better decisions regarding technology adoption, organizational infrastructure, strategic partnerships, and resource management. For instance, Accenture PLC took over logistics solution provider EINR AS in April 2023 to fortify its SAP capabilities and expedite supply chain reinvention across the consumer electronics & retail segments.

SCA can also help businesses see the broader perspective of supply chain activities, so that they are able to address issues promptly before these problems evolve into profitability or sustainability concerns. Mobile-based solutions, in particular can assist organizations to track supplier networks that are not very efficient and overpriced warehouse & inaccurate forecasts. In addition, better inventory management through the use of analytics solutions is critical to reducing costs that might otherwise hinder growth. According to a 2024 National Retail Federation (NRF) report, US retailers who use supply chain analytics have realized an average ROI of roughly 25% from their investments into platforms. According to a report from the 2024 U.S. Data Management Institute, data managed by such supply chain analytics systems in the United States has seen an increase of 28% over last year due to the growing complexity of supply chains. Industry growth is expected to increase due to high adoption of mobile based solution. The rise of unethical activities and cyber threats poses challenges to SCA adoption, with concerns about security and data breaches potentially slowing future growth. Despite these risks, SCA solution providers are hard at work to deliver secure products in the future which may reduce this risk element and support well-regulated market growth over coming years. As per the report released in 2024, relatively a total of 62% companies have already deployed advance supply chain analytic solution for better business decision making and to enhance operational effectiveness. According to the 2024 Data Management Institute, this volume has increased approximately 30% annually in supply chain analytics systems as a result of global supply chains becoming so much complex.

Market Dynamics

Drivers

-

Companies need real-time visibility to make quick, informed decisions and respond to market changes effectively.

-

AI and machine learning enhance predictive capabilities, improving demand forecasting and risk management.

-

The expansion of e-commerce increases the need for efficient supply chain management and data optimization.

-

Analytics help companies optimize resources, reduce waste, and meet sustainability goals.

-

Cloud platforms offer advanced analytics with lower upfront costs, driving widespread adoption.

Integration of AI & ML in supply chain analytics AI and Machine Learning (ML) integrated into the solution further strengthened the predictive capabilities resulting in an improved operational efficiency. Utilizing AI and ML algorithms, the software processes immense data-sets to infer patterns and anticipate demand while balancing effective supply chain operations with unprecedented accuracy. For example, AI-driven demand forecasting has shown significant improvements in accuracy. A recent report suggests that companies using AI for demand forecasting have experienced accuracy improvements reaching 20% above the performance of their traditional-counterparts. Likewise, this improved accuracy results in the reduced stockouts and excess inventory that loser operational efficiency while improving customer satisfaction.

Predictive Maintenance predictions with Machine Learning Models in Supply Chains. The enterprises with machine learning-powered predictive maintenance achieved 10-20% reduction in maintenance costs and up to 25% decrease on equipment downtime. This helps in improved supply chain operations and saves considerable cost. Effective risk management is further benefited by AI and ML analysing historical data to predicting potential disruptions. Similarly, an organization who feels it needs to hold large buffer stock due to geopolitical instability or natural disasters can use AI models that predict supply chain disruptions before they happen and prepare for contingencies ahead of time. In today’s rapidly changing global scenario having the ability to give quick responses in such situations can mitigate potential losses.

Restraints

-

Increased digitization raises risks of data breaches, impacting adoption rates.

-

Integrating new analytics tools with existing systems can be complex and time-consuming, A lack of expertise in data analysis and AI limits the effective use of analytics tools.

-

Inconsistent or inaccurate data can lead to flawed insights and hinder the effectiveness of analytics.

Integrating advanced supply chain analytics tools with existing systems remains a significant challenge for many organizations. An recent survey in 2024 found that about 47% of companies said they struggled to implement new analytics tech with on-premises solutions. This is difficult because existing IT infrastructures are so complex and fragmented, encompassing decades of outdated software and incompatible data sources. Resistance to integration can become even more of a problem if systems are not standardized or have operating differences, which could cause delays and higher costs while trying to make them work together. A report from it also notes, over 57% of enterprises experienced delays in realizing the full benefits of their analytics investments due to integration issues. may well cause inefficient data flow and, therefore operational inefficiency being lower than desired effectively rendering analytics solutions less effective in their potential to provide insight for better decision making or optimization of operations.

Segment Analysis

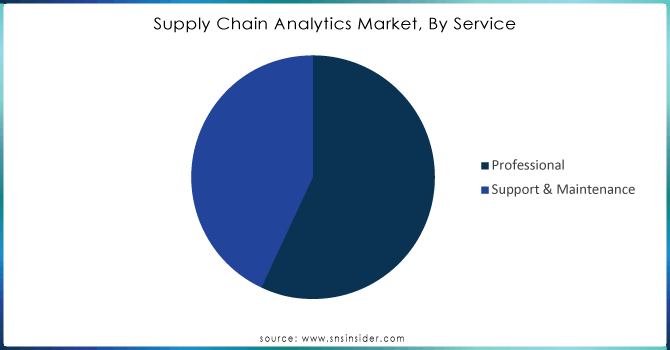

By Service

The professional services segment accounted for over 59% of the market share in 2023. This growth is attributed to the need for ensuring that new systems are compatible with existing ones across various departments, helping to prevent data loss or theft. There has been increasing demand for professional services where Business is looking out for analysing and securing its critical data along with advice on new technologies. But the challenge remains there is scarcity of skilled professionals capable of identifying and interpreting trend and use it for better decision-making.

On the other hand, support and maintenance segment is likely to grow at a highest CAGR during forecast period. Third-party support is increasingly sought after for its cost-saving benefits and access to highly trained professionals. The implementation of SCA solutions poses many challenges, incomprehensible software complexity, system repair and maintenance after collapse, reconciliation with data import/export, continuous updating of the applicable applications. Failure to do this will lead to lower productivity. Therefore, the need for support and maintenance services is expected to experience a significant surge in the forecast period.

Need any customization research on Supply Chain Analytics Market - Enquiry Now

By End use

Manufacturing segment generated the highest market share exceeding 22.6% in 2023. SCA solutions now play an essential role in the manufacturing industry as they provide everyone across all regions or processes real-time data access ensuring that updates to any particular region, politics information is uniformly using them throughout organization. The demand for improved supply chain efficiency to meet the customer trends upward and be sure that goods turn up on time, is high. Also, in April 2023 Snowflake, a data cloud company announced the manufacturing data cloud designed for automotive manufacturing and technology including industrial use. This combination will enable manufacturers to better work with suppliers, partners and customers by improving supply chain performance while accelerating smart manufacturing operations.

Manufacturing Data Cloud allows manufacturers to securely transact with their partners, suppliers and customers-strengthening agility and visibility across the value chain. With the scope of operations being so broad, there are ample opportunities for businesses to optimize their supply chain performance. In today’s digital-industrial landscape, Snowflake’s Manufacturing Data Cloud helps businesses strengthen their supply chain performance, implement smart manufacturing strategies, and build a robust data foundation for their operations.

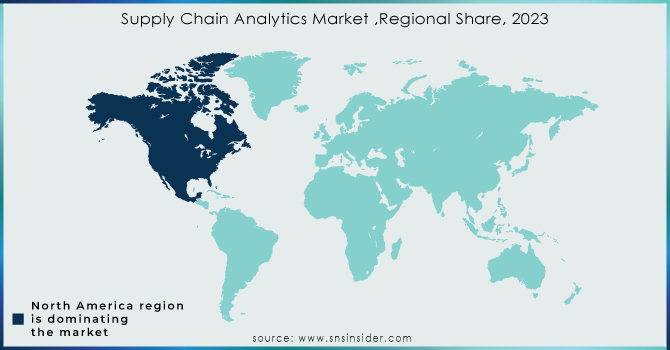

Regional analysis

North America accounted for 35% revenue share of the global market in 2023, The region’s industrial organizations are increasingly focusing on the visual display of operational data due to the complexity of corporate processes. This approach more rapidly allows businesses to evaluate the health of their supply chains in terms of data and aids strategic decision making with greater information. The European regional market is projected to grow at a promising rate during the forecast period. The European Commission’s single market strategy, which allows for the free movement of goods, services, people, and capital across the region, expands the geographic market for European businesses and increases opportunities for the adoption and implementation of SCA solutions.

Asia-Pacific is projected to grow with the fastest CAGR at 20%. This growth is powered by growing awareness among enterprises about the advantages of analytics solutions. Additionally, the rapid increase in the number of small and medium-sized businesses (SMBs) and their growing investments in advanced technology to scale their operations are expected to contribute to the expansion of the regional SCA market.

Key Players:

The major players are IBM, Cloudera, Software AG, SAS Institute, SAP, MicroStrategy, Tableau, Qlik, Logility, Savi Technology, Oracle, Infor, Antuit, RELEX Solutions, TIBCO, TARGIT, Voxware, The AnyLogic Company, Hum Industrial Technology, SS Supply Chain Solutions, Manhattan Associates, Axway, Datameer, AIMMS, Salesforce, Zebra Technologies, Dataiku, DataFactZ, and others in final report.

Recent developments

-

In January of 2023, project44 and SAS combined the largest repository of real-time transportation data in the world with advanced supply chain planning capabilities to deliver improved accuracy and visibility throughout end-to-end global supply chains

-

In May 2023, SAP SE claimed to have run a mutual cooperation with Microsoft Corporation in developing its latest Artificial intelligence solution ready for SAP Business AI due out soon enough targeted at helping customer strengthen their experience on logistic capabilities and address likely future Supply chain challenges.

-

In January 2023 as well, SAS teamed with supply chain visibility platform provider Project44 to reduce impacts on the customer experience from disruptions by delivering insight into how businesses are running statewide.

-

Everstream Analytics Everstream produces supply chain risk and compliance solutions Jaguar Land Rover signed up to enable AI driven next-generation capability throughout the company’s global supplier network in June 2023. By collaborating they can monitor their supply chain in real-time, with JLR able to avoid potential shortages of supplies.

| Report Attributes | Details |

| Market Size in 2023 | US$ 8.02 Bn |

| Market Size by 2032 | US$ 33.45 Bn |

| CAGR | CAGR of 17.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Logistics Analytics, Manufacturing Analytics, Sales & Operations Analytics, Planning & Procurement, and Visualization & Reporting) • By Enterprise Size (Large Enterprise and Small & Medium Enterprises) • By Service (Professional and Support & Maintenance) • By Deployment (Cloud and On-premise) • By End-use (Retail & Consumer Goods, Healthcare, Aerospace & Defence, Manufacturing, Transportation, High Technology Products and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | IBM, Cloudera, Software AG, SAS Institute, SAP, MicroStrategy, Tableau, Qlik, Logility, Savi Technology, Oracle, Infor, Antuit, RELEX Solutions, TIBCO, TARGIT, Voxware, The AnyLogic Company, Hum Industrial Technology, SS Supply Chain Solutions, Manhattan Associates, Axway, Datameer, AIMMS, Salesforce, Zebra Technologies, Dataiku, DataFactZ |

| Key Drivers | • The expansion of e-commerce increases the need for efficient supply chain management and data optimization. • Cloud platforms offer advanced analytics with lower upfront costs, driving widespread adoption. |

| Market Restraints | • Increased digitization raises risks of data breaches, impacting adoption rates. • Integrating new analytics tools with existing systems can be complex and time-consuming, A lack of expertise in data analysis and AI limits the effective use of analytics tools. |