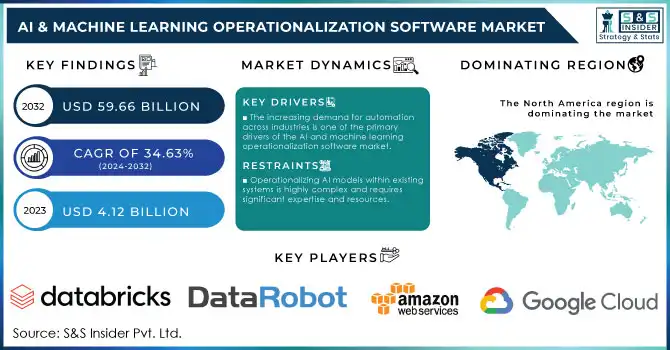

AI & Machine Learning Operationalization Software Market Key Insights:

The AI & Machine Learning Operationalization Software Market size was valued at USD 4.12 billion in 2023 and is expected to reach USD 59.66 billion by 2032, growing at a CAGR of 34.63% over the forecast period 2024-2032. As organizations increasingly recognize the potential of AI and machine learning (ML) to gain a competitive edge, the need to transition models from research and development (R&D) phases to full-scale deployment has never been more critical. This transition, known as AI and ML operationalization, enables businesses to seamlessly integrate these technologies into their daily operations, ensuring consistent and actionable insights over time. AI & ML operationalization software is playing a pivotal role in this process, helping businesses optimize their workflows and harness the full value of AI-driven technologies. Currently, 48% of companies are utilizing AI to manage large datasets more effectively, while 57% are leveraging machine learning to enhance consumer experiences. These technologies have become central to marketing and sales strategies, with 49% of businesses relying on them to improve operations. The effectiveness of AI-driven systems is evident in companies like Netflix, which generates USD 1 billion annually from automated recommendations powered by machine learning and saves an additional USD 1 billion from content personalization algorithms. Furthermore, machine learning is proving highly accurate across various industries, from predicting stock market trends with 62% accuracy to forecasting patient mortality with an impressive 95% accuracy.

To Get More Information on AI & Machine Learning Operationalization Software Market - Request Sample Report

The AI & machine learning operationalization software market is expanding rapidly, as businesses look for solutions to deploy, manage, and scale AI models. These tools are essential for ensuring that AI and ML technologies continue to deliver value and drive innovation across industries, reinforcing the growing importance of operationalization in today’s data-driven business landscape.

Market Dynamics

Drivers

- The increasing demand for automation across industries is one of the primary drivers of the AI and machine learning operationalization software market.

Businesses are increasingly seeking ways to streamline operations, improve efficiency, reduce human error, and drive cost savings. Automation in business processes, especially in data management, analytics, and decision-making, has become crucial for staying competitive in the global market. AI and ML operationalization software enables organizations to deploy AI and machine learning models that can operate in real-time environments, making automated decisions based on dynamic data inputs. These models can analyze vast amounts of information at high speed, allowing businesses to make decisions faster and with greater accuracy. Moreover, AI and ML can automate complex processes that were traditionally handled by humans, such as customer service, inventory management, and financial forecasting. For instance, AI-powered chatbots can automate customer interactions, while predictive analytics in retail can optimize inventory and sales forecasting. The overall AI & ML learning operationalization software market is expanding rapidly as organizations of all sizes adopt AI-powered automation solutions to enhance productivity, decision-making, and customer experience.

- AI and ML models can streamline intricate processes and minimize the requirement for human involvement, resulting in substantial cost reductions.

The AI and Machine Learning Operationalization Software Market is rapidly growing as companies seek to scale AI and ML models and integrate them into their operations. These software solutions enable businesses to automate tasks like data cleansing, report generation, and fraud detection, while also enhancing overall business processes by identifying inefficiencies and offering recommendations for improvement. For example, in supply chain management, AI can forecast demand and optimize inventory, while in manufacturing, it can monitor machinery and predict maintenance needs, reducing costly downtime. By implementing AI and ML models, companies can significantly improve their return on investment (ROI), automating routine tasks, reducing labor costs, and speeding up decision-making with greater precision. This is especially valuable in industries with tight profit margins, such as retail and logistics, where the benefits of automation and optimization are particularly impactful. Additionally, AI and ML operationalization software allows businesses to expand their AI capabilities across various departments, ensuring that the advantages of automation and resource optimization are felt throughout the entire organization. As the demand for cost-effectiveness and better resource utilization grows, the AI and ML operational software market continues to expand, offering businesses the tools they need to thrive in an increasingly data-driven world.

Restraints

- Operationalizing AI models within existing systems is highly complex and requires significant expertise and resources.

Numerous organizations encounter difficulties when trying to integrate AI solutions with legacy infrastructure since the compatibility of AI models and current systems can often be problematic. This complexity discourages companies from completely adopting operationalization software since implementation can be expensive and time-intensive. Challenges in integration, along with the requirement for specialized expertise, restrict the number of companies that can maximize the benefits of AI operationalization solutions. These obstacles, particularly for smaller businesses with restricted resources, hinder market expansion and the widespread uptake of these technologies.

Market Segmentation Analysis

By Deployment

The cloud-based segment led the market, holding a 50% market share in 2023 because of its scalability, versatility, and affordability. Cloud-based AI and ML operationalization tools allow companies to swiftly implement and oversee ML models without the need for significant investment in on-site infrastructure. Firms like Amazon Web Services (AWS), featuring its SageMaker platform, and Microsoft Azure Machine Learning, represent cloud-based alternatives that offer comprehensive tools for model training, deployment, and monitoring, facilitating the scaling and integration of ML models into business operations.

The on-premises is expected to expand rapidly during 2024-2032 driven by increasing demand from industries that have strict data privacy and compliance needs, including finance, healthcare, and government fields. On-premises solutions offer full control over data and infrastructure, improving security and reducing risks associated with data transfer. They are perfect for organizations handling sensitive or regulated information that needs to stay within internal systems. Examples are IBM Watson Machine Learning and H2O.ai’s Driverless AI, which can both be implemented on-premises, offering resources for model creation and operationalization in a private setting.

By Functionality

The model deployment & management led the segment in 2023, holding a 45% market share. Efficient model deployment frameworks facilitate the shift from model training to practical use, an essential phase for sectors where AI must consistently operate at scale, like in finance for detecting fraud or in retail for tailored recommendations. Leading firms like Amazon Web Services (SageMaker) and Google Cloud AI Platform provide strong deployment and management solutions that automate processes like version control, scaling, and continuous integration. These platforms enable companies to effortlessly implement and oversee AI models across various cloud or hybrid settings, guaranteeing dependable, on-demand AI solutions.

The data preprocessing & feature engineering is projected to have the fastest CAGR from 2024 to 2032. This section emphasizes converting unrefined data into a practical format for machine learning models through processes of cleaning, normalizing, and choosing important features. This phase is essential as high-quality, well-structured data improves model precision and strength, aiding predictive analytics in numerous applications. Firms such as DataRobot and H2O.ai provide solutions equipped with automated data preprocessing and feature engineering functions, allowing data scientists to optimize and expand these processes for enhanced efficiency.

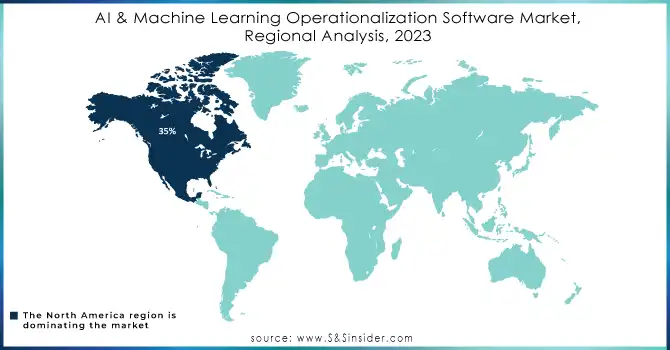

Regional Analysis

In 2023, North America dominated with a 35% market share because of its advanced technology, well-developed infrastructure, and early integration of AI/ML tools. This area is home to numerous leading tech firms like Microsoft, Google, and IBM, that are actively creating and implementing solutions to enhance the deployment, monitoring, and management of machine learning models. These instruments are particularly influential in industries such as finance, healthcare, and IT, as they facilitate the automation of intricate decision-making processes, boost operational efficiency, and improve user experiences.

Asia-Pacific is projected to become the fastest-growing market from 2024 to 2032. In the APAC region, nations such as China, India, and Japan are undergoing swift digital transformation, fueled by significant government funding in AI infrastructure and a rising need for automation in various sectors. Businesses in the APAC region, including Alibaba and Baidu, are concentrating on AI-based solutions customized to regional demands in areas like manufacturing, retail, and logistics.

Do You Need any Customization Research on AI & Machine Learning Operationalization Software Market - Inquire Now

Key Players

The major key players in the AI & Machine Learning Operationalization Software Market are:

-

Databricks (Lakehouse Platform, MLflow)

-

DataRobot (DataRobot MLOps, Paxata Data Preparation)

-

Amazon Web Services (AWS) (SageMaker, SageMaker Autopilot)

-

Google Cloud (AI Platform, Vertex AI)

-

Microsoft Azure (Azure Machine Learning, Azure Databricks)

-

IBM (Watson Studio, Watson Machine Learning)

-

H2O.ai (H2O Driverless AI, H2O MLOps)

-

Domino Data Lab (Domino Data Science Platform, Domino Model Monitor)

-

Alteryx (Alteryx Designer, Alteryx Promote)

-

TIBCO (TIBCO Data Science, TIBCO ModelOps)

-

Cloudera (Cloudera Machine Learning, Cloudera Data Platform)

-

Dataiku (Dataiku DSS, Dataiku AutoML)

-

SAS (SAS Viya, SAS Model Manager)

-

RapidMiner (RapidMiner Studio, RapidMiner AI Hub)

-

Anaconda (Anaconda Enterprise, Anaconda Distribution)

-

KNIME (KNIME Analytics Platform, KNIME Server)

-

C3.ai (C3 AI Suite, C3 AI CRM)

-

SAP (SAP Data Intelligence, SAP Analytics Cloud)

-

Palantir (Foundry, Apollo)

-

MathWorks (MATLAB, Simulink)

Providers of AI & ML Operationalization Software and Platforms:

-

Intel (AI Optimized CPUs and GPUs)

-

NVIDIA (NVIDIA DGX for ML Infrastructure)

-

Red Hat (OpenShift for scalable MLOps)

-

Kubernetes (Container orchestration for model deployment)

-

GitLab (GitLab CI/CD for model version control)

-

Apache Kafka (Real-time data streaming support)

-

MongoDB (NoSQL database for managing unstructured data)

-

Snowflake (Data warehousing services)

-

Vmware (vSphere for virtualization of ML environments)

-

Oracle (Oracle Cloud Infrastructure for MLOps)

Recent Developments

-

October 2024: Databricks launched AI/BI, an advanced tool aimed at merging AI with business intelligence for immediate analytics. It features AI-driven dashboards and a dialogue interface named Genie, which can constantly be enhanced via human input. This product is developed on Databricks' current platform, guaranteeing smooth data governance and excellent performance.

-

August 2023: DataRobot and Google Cloud have collaborated to offer you a comprehensive solution that accelerates the implementation of your predictive and generative AI applications.

-

March 2022: H2O.ai revealed an enhancement of its healthcare data functionalities, providing 40 AI applications in Population Health, Precision Medicine, Public Health, and Smart Supply Chain.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.12 Billion |

| Market Size by 2032 | USD 59.66 Billion |

| CAGR | CAGR of 34.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-Premises, Cloud-Based, Hybrid) • By Functionality (Model Deployment & Management, Data Preprocessing & Feature Engineering, Model Monitoring & Performance Evaluation, Integration with Existing Systems) • By Application (Predictive Analytics, Natural Language Processing, Computer Vision, Speech Recognition, Anomaly Detection) • By End User (Healthcare, Finance, Retail, Manufacturing, Automotive, Government, Media & Entertainment, Telecommunications, Energy & Utilities, Education) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Databricks, DataRobot, Amazon Web Services (AWS), Google Cloud, Microsoft Azure, IBM, H2O.ai, Domino Data Lab, Alteryx, TIBCO, Cloudera, Dataiku, SAS, RapidMiner, Anaconda, KNIME, C3.ai, SAP, Palantir, MathWorks |

| Key Drivers | • The increasing demand for automation across industries is one of the primary drivers of the AI and machine learning operationalization software market. • AI and ML models can streamline intricate processes and minimize the requirement for human involvement, resulting in substantial cost reductions. |

| RESTRAINTS | • Operationalizing AI models within existing systems is highly complex and requires significant expertise and resources. |