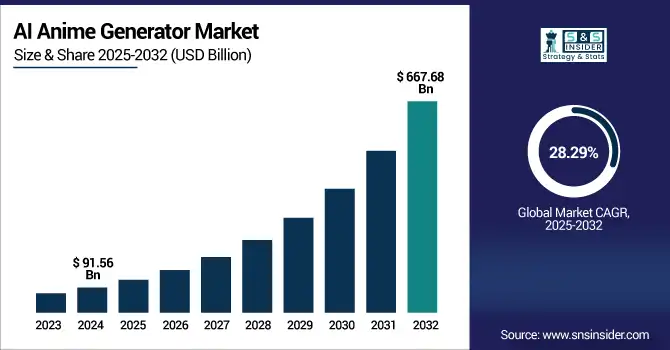

AI Anime Generator Market Size Analysis:

The AI Anime Generator Market was valued at USD 91.56 billion in 2024 and is expected to reach USD 667.68 billion by 2032, growing at a CAGR of 28.29% from 2025-2032. The AI Anime Generator Market is witnessing rapid growth due to rising demand for personalized and cost-effective animation content across entertainment, gaming, and social media platforms. Advancements in generative AI models, such as image-to-video and text-to-animation technologies, enable creators to produce high-quality anime with minimal resources. A recent study analyzing a major Chinese art-outsourcing platform revealed that the introduction of generative AI reduced average prices for anime-style images by 64%, while order volume surged by 121% and overall platform revenue increased by 56%, highlighting the economic impact of AI adoption.

To Get more information on AI Anime Generator Market - Request Free Sample Report

Platforms like Pixiv, which processes over 100 million submissions and 1 billion monthly page views, reported approximately 2.4 million AI-generated submissions in 2023 alone demonstrating the widespread acceptance of AI-generated imagery among creators. Increasing adoption by individual artists, animation studios, and marketing agencies is further driving usage. Moreover, the surge in virtual influencers, VTubers, and metaverse applications is expanding commercial use cases.

For example, Kizuna AI, a flagship VTuber, has attracted over 3 million YouTube subscribers and 459 million views, and resumed production in February 2025 underscoring the long-term viability of AI-powered virtual characters. Integration with mobile and web platforms is enhancing accessibility, while the growing global popularity of anime continues to accelerate market expansion across diverse user segments.

U.S. AI Anime Generator Market was valued at USD 18.71 billion in 2024 and is expected to reach USD 132.49 billion by 2032, growing at a CAGR of 27.72% from 2025-2032.

The U.S. AI Anime Generator Market is growing due to strong demand for AI-driven content creation tools in entertainment, gaming, and social media. Widespread adoption by creators, studios, and marketers, coupled with advancements in generative AI and increased anime popularity, is fueling rapid market expansion across consumer and commercial segments.

Market Dynamics

Drivers

-

Rising Demand For Personalized Content Creation Is Driving The Adoption Of Ai Anime Generators Across Creators, Studios, And Fan Communities Globally.

The increasing demand for personalized anime-style content by digital creators, game studios, and social media users is driving the growth of AI anime generators. These techniques help users instantiate personalized characters, avatars, and scenes with less manual design. Fan-powered services and VTuber communities are helping to drive use and creativity both in terms of offerings and access. A heightened level of user engagement and reduced cost of entry that AI enables are mechanisms to democratize the medium itself and extend the scope of that content around the world.

-

The prevalence of 2.4 million AI-generated images on Pixiv reflects how fan communities are deeply integrating AI into their creative practices.

-

Excitingly, 403 million hours of VTuber content were watched on YouTube in Q1 2024, signaling growing engagement. Moreover, approximately 50–60% of VTuber audiences are aged 13–24, with females comprising around 72% of the global fanbase further emphasizing how personalized, AI-generated anime content resonates with younger, highly active digital communities.

Restraints

-

High Computational Requirements And Lack Of Accessibility For Non-Technical Users Are Restricting Market Penetration Of Advanced AI Anime Generation Tools.

Most AI anime-generators operates with lots of GPU and technical cost, which requires sophisticated computer skills to operate for casual users. The premium models are usually behind paywalls or through limited APIs, that mostly benefit users with enough funds. Things get complex when it comes to tuning for a uniform style, which makes it difficult for small players. Creators of emerging markets are left behind without friendly interfaces and cheap options. This kind of exclusiveness is limiting for wider acceptance and limiting for the global market expansion of the AI anime generator market.

Opportunities

-

Integration Of AI Anime Generators Into Gaming, Education, And Metaverse Platforms Presents Major Cross-Industry Growth Opportunities.

Anime-style avatars and narratives are also becoming more and more present in the interfaces of gaming studios, VR developers and online education platforms. AI anime generators offer a scalable and effective means to generate such content. In the metaverse, custom anime avatars let users ascribe to and identify as imaginary characters, in education, anime storytelling helps foster engagement, especially among young students. Such cross-industry applications will not only expand AI anime tools outside of entertainment – including new product development, user engagement and strategic partnerships within a wide variety of fields they will also elevate the competitiveness of AI anime tools in the domestic market.

-

Ready Player Me, for example, enables cross-platform 3D avatar creation for games and VR environments. As of December 2024, it had raised $56 million in Series B funding and launched PlayerZero, allowing users to carry avatars across multiple gaming titles.

-

In education, the open-source VTutor SDK (released in May 2025) utilizes anime-style animated agents with real-time lip-sync and LLM-driven feedback. In trials with 50 learners, it demonstrated significant improvements in naturalness, expressiveness, and user preference over traditional virtual agents.

Challenges

-

Biases And Inconsistencies In AI-Generated Anime Outputs Pose Credibility Risks And Undermine Creative Control For Users And Developers Alike.

AI anime generators such as these struggle to maintain the same drawing style between frames, poses, or even scenes, resulting in disjointed or faulty outputs. Further, biases in the training data can lead to stereotyped or inappropriate content. These problems are annoying professional users who desire consistent good quality output. The inconsistencies are eroding creative trust and pushing some back to the old ways. Developers need to create algorithms and techniques that support robustness and defenses against these flaws in response to demand for increased accuracy, control over style, and ethical content generation in today's creative environment.

-

A 2023 University of Washington study found that Stable Diffusion overwhelmingly produces light-skinned, male faces when prompted to generate “a person,” while sexualizing women of color and erasing Indigenous appearances.

-

A related analysis revealed that when generating images of professionals, women appeared in only ~3% of “judge” images, despite women constituting about 34% of actual U.S. judges.

-

A 2025 arXiv audit of 16,000+ images across hundreds of prompts confirmed that popular text-to-image models (Stable Diffusion 1.5, Midjourney, DALL·E 3) systematically reproduced harmful stereotypes relating to gender, occupation, age, and geography.

Segment Analysis

By Platform

Web-based platforms dominated the AI Anime Generator Market share with a 35% in 2024 due to their accessibility, cross-device compatibility, and ease of integration with social media and creative tools. These platforms require no installations, attract casual and professional users alike, and support quick updates. Their browser-based architecture facilitates collaborative creation and allows users to generate anime content instantly, driving wider user engagement and monetization at scale.

App-based solutions are expected to grow at the fastest CAGR of 29.78% from 2025–2032 due to rising mobile usage, enhanced app features, and offline generation capabilities. As smartphones become more powerful, users seek intuitive anime generation apps with customization, sharing, and AR features. The growing creator economy, especially among Gen Z users and mobile-first audiences, is fueling rapid adoption, making apps the preferred medium for real-time, on-the-go anime content creation.

By Technology

Image-to-Image Transformation Models dominated the market with a 44% revenue share in 2024 because of their superior visual fidelity, style transfer accuracy, and creative flexibility. These models allow artists to sketch or upload rough drafts, which are transformed into polished anime-style images, reducing manual labor. Their appeal spans both professional animators and casual users seeking quality output, solidifying their dominance across web-based and desktop creative platforms globally.

Text-to-Video Generation Models are projected to grow at the fastest CAGR of 31.41% from 2025–2032, driven by rising demand for automated animation production using simple text inputs. These models enable creators to produce dynamic anime-style video content without animation expertise, saving significant time and cost. With applications in storytelling, advertising, and social media content, this technology is expected to revolutionize narrative formats across entertainment and education sectors.

By End User

Individual Creators led the market with a 47% revenue share in 2024, driven by the surge in user-generated content, influencer culture, and VTuber activities. These users leverage AI anime generators for creating avatars, digital art, and branded content. Low cost, high customization, and social media integration have made these tools essential for solo creators seeking visual expression without needing animation skills, fueling consistent usage across global creator communities.

Game Developers are forecast to grow at the fastest CAGR of 31.86% from 2025–2032 due to increasing demand for anime-style game assets and characters. AI tools offer scalable asset generation, reducing design cycles and development costs. As anime aesthetics grow popular in global gaming, developers turn to these models for rapid prototyping and unique visual elements. Cross-platform gaming trends further accelerate adoption of AI-generated anime content in this segment.

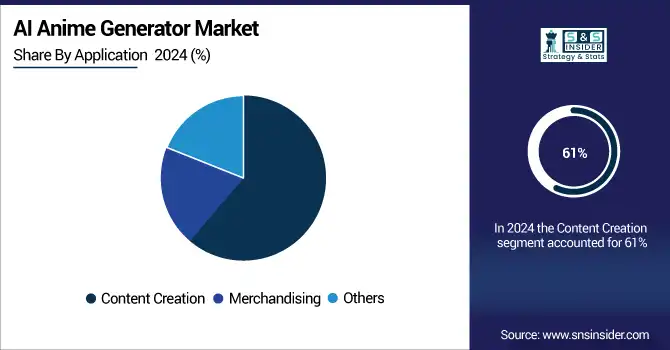

By Application

Content Creation held the largest share of 61% in 2024 due to widespread use of AI anime tools in social media posts, digital storytelling, animation shorts, and VTuber content. These tools support quick, low-cost generation of visually engaging media, appealing to influencers, marketers, and indie creators. Integration with platforms like YouTube, TikTok, and Twitch has expanded reach and revenue potential, making content creation the dominant application segment in this market.

Merchandising is projected to grow at the fastest CAGR of 31.18% from 2025–2032, as businesses increasingly use AI-generated anime art for customized products. These include prints, clothing, accessories, NFTs, and fan merchandise. The ability to quickly produce diverse designs tailored to niche audiences enhances personalization and speeds up product launches. This creates new revenue streams and expands creative freedom for both individual sellers and major e-commerce platforms.

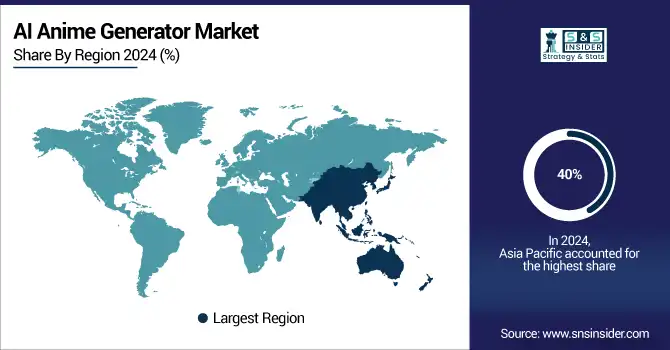

Regional Analysis

Asia Pacific dominated the AI Anime Generator Market with the highest revenue share of about 40% in 2024 and is projected to grow at the fastest CAGR of 29.63% from 2025 to 2032. This growth is driven by the region’s strong cultural affinity for anime, high digital content consumption, and rapid adoption of AI-driven creative tools. Countries like Japan, China, and South Korea lead in animation, gaming, and mobile technology, fostering innovation and user engagement.

-

A WorldMetrics study found that 70% of anime production studios in Japan are experimenting with AI animation tools, with reported production cost reductions of up to 40% and render/display pipelines accelerated by 25–50%.

-

Furthermore, the Nippon Anime & Film Culture Association (NAFCA) polled approximately 4,000 industry professionals in 2023, revealing that over 70% support legal restrictions on AI usage, emphasizing the need for creators’ consent and ethical training data.

Japan is dominating the AI Anime Generator Market in Asia Pacific due to its anime industry leadership, technological innovation, and strong domestic demand for creative AI tools.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America

North America holds the second largest share in the AI Anime Generator Market trends, driven by a mature digital infrastructure, strong presence of AI startups, and growing demand for personalized content among creators and influencers. The region benefits from widespread anime fandom, especially in the United States, and increasing integration of AI tools in gaming, animation, and social media platforms. This ecosystem supports innovation, monetization, and user engagement across creative industries.

-

Hedra, another New York-based startup, raised US $32 million in Series A (led by a16z) for its Character-3 “omnimodal” AI model enabling high-fidelity character animation generation.

-

In the U.S., approximately 56 million people (1 in 3 aged 18–54) regularly watch viral anime titles, with 44% of U.S. adults aged 18–24 tuning into trending anime.

The United States is dominating the AI Anime Generator Market in North America due to its strong tech infrastructure, creator economy, and advanced AI adoption.

Europe

Europe is witnessing growing adoption in the AI Anime Generator Market, driven by increasing demand for digital content creation, creative AI tools, and anime-inspired media. Countries like Germany, France, and the UK are leading innovation, fueling regional market expansion.

Germany is dominating the AI Anime Generator Market in Europe, driven by strong AI innovation, digital art adoption, and a growing animation-focused creative community.

Middle East & Africa and Latin America

In the AI Anime Generator Market, Latin America and the Middle East & Africa are experiencing steady growth, driven by rising mobile usage, expanding youth digital culture, and increased interest in anime-inspired content creation across social platforms and entertainment sectors.

Key Players

AI Anime Generator Market companies are Midjourney, Runway AI, Reallusion Inc., Krikey Inc., Artbreeder, DeepArt, PaintsChainer (Preferred Networks, Inc.), Toonify, Waifu Labs, Fotor AI.

Recent Developments:

-

In 2025: Reallusion Launched AccuPOSE in iClone, an AI-powered posing assistant enabling intuitive character rigging and seamless export to Blender/Unreal, making professional-level posing accessible to non-experts.

-

In 2024: Krikey Unveiled new “Video-to-Anime” converter plus AI Cartoon Generator, YouTube Shorts & Save‑the‑Date intro tools empowering users to turn live-action videos into 3D anime-style animations in minutes.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 91.56 Billion |

| Market Size by 2032 | USD 667.68 Billion |

| CAGR | CAGR of 28.29% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (App-based, Web-based) • By Technology (Text-to-Video Generation Models, Image-to-Image Transformation Models, Image to Video Animation Models, Video to Video Models, Custom Models) • By Application (Content Creation, Merchandising, Others) • By End User (Individual Creators, Animation Studios, Game Developers, Advertising and Marketing Agencies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Midjourney, Runway AI, Reallusion Inc., Krikey Inc., Artbreeder, DeepArt, PaintsChainer (Preferred Networks, Inc.), Toonify, Waifu Labs, Fotor AI |