Software Defined Vehicles Market Report Scope & Overview:

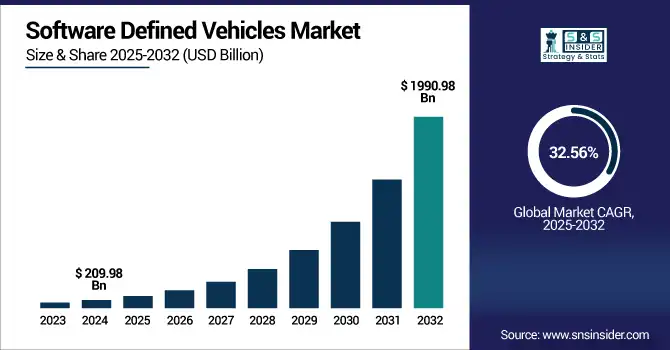

Software Defined Vehicles Market was valued at USD 209.98 billion in 2024 and is expected to reach USD 1990.98 billion by 2032, growing at a CAGR of 32.56% from 2025-2032.

To Get more information on Software Defined Vehicles Market - Request Free Sample Report

The growth of the Software Defined Vehicles (SDV) market is driven by the rapid evolution of automotive electronics, rising demand for advanced driver-assistance systems (ADAS), and increasing consumer expectations for connected, personalized, and upgradeable in-vehicle experiences.

-

According to the U.S. National Highway Traffic Safety Administration (NHTSA), vehicles equipped with ADAS technologies can prevent approximately 20,841 crashes annually, underscoring their growing importance in modern vehicle design.

Automakers are shifting toward centralized computing and over-the-air (OTA) software updates such as Ford’s BlueCruise and Tesla’s frequent software releases to improve functionality, reduce recalls, and enable real-time enhancements.

-

As of 2024, the U.S. Department of Energy (DOE) reported over 3.6 million electric vehicles on the road in the U.S., highlighting the accelerating shift toward electrification. T

The rise of electric and autonomous vehicles further accelerates SDV adoption, requiring flexible and scalable software architectures. Additionally, partnerships between tech companies and OEMs such as Qualcomm’s collaboration with BMW and General Motors are expanding the SDV ecosystem, fostering innovation in infotainment, safety, and mobility services, thereby boosting long-term SDV market growth

U.S. Software Defined Vehicles Market was valued at USD 51.54 billion in 2024 and is expected to reach USD 480.92 billion by 2032, growing at a CAGR of 32.20% from 2025-2032.

The U.S. Software Defined Vehicles market is growing due to increasing EV adoption, demand for connected car features, regulatory support for ADAS, and strong investments by automakers and tech firms in centralized computing, OTA updates, and autonomous driving technologies.

Market Dynamics

Drivers

-

Rising demand for connected mobility and OTA updates is accelerating software-defined transformation in next-generation vehicles worldwide

Rising demand for connected mobility and over-the-air (OTA) software updates is revolutionizing how vehicles operate, communicate, and evolve. Automakers are integrating cloud connectivity, real-time diagnostics, and software-centric features to meet growing consumer expectations for digital experiences and real-time functionality. OTA capabilities not only reduce the need for physical recalls but also enable continuous innovation, security patches, and performance upgrades. These advancements position software as a critical differentiator in vehicle value and lifecycle management. As vehicles shift from hardware-centric to software-defined architectures, OEMs increasingly prioritize embedded systems, enhancing efficiency, user experience, and monetization opportunities through data-driven services.

-

General Motors announced in 2023 that it plans to deliver OTA updates to over 30 million vehicles globally by 2030 using its Ultifi software platform.

-

Volkswagen provides regular OTA updates to its ID. family of electric vehicles via its “We Connect” platform, enabling software improvements without the need for physical service visits.

Restraints

-

Rising cybersecurity vulnerabilities and data privacy concerns pose major compliance and trust challenges for market players

Rising cybersecurity risks and data privacy concerns are emerging as significant restraints in the adoption of software-defined vehicles. As vehicles become more connected and reliant on cloud-based services, they face increased exposure to malicious attacks, remote exploits, and ransomware threats. Securing in-vehicle networks, OTA infrastructure, and user data requires constant monitoring and advanced encryption, pushing up development costs. Regulatory compliance with evolving frameworks like UNECE WP.29, GDPR, and ISO/SAE 21434 adds complexity and legal risk. Moreover, consumer trust can erode quickly if breaches occur, discouraging adoption. Automakers must invest significantly in cyber-resilient architecture, which delays ROI and increases cost pressures.

-

The ISO/SAE 21434 standard first published in August 2021 defines structured cybersecurity engineering processes across a vehicle’s lifecycle. It forms the technical foundation for UNECE Regulation No. 155, which became mandatory for new type approvals in UNECE member countries from July 2024.

-

Premium vehicles today contain 70–100 ECUs, with around 100 million lines of code per vehicle a figure expected to increase to 300 million lines by 2030, significantly expanding the cybersecurity attack surface.

Opportunities

-

Expansion of vehicle-as-a-platform services and in-car commerce opens monetization opportunities for OEMs and software developers

Expansion of vehicle-as-a-platform (VaaP) services and in-car commerce is unlocking new revenue models for OEMs and software ecosystem players. With vehicles acting as digital platforms, users can access subscription-based features, real-time navigation, entertainment, and e-commerce directly from dashboards. This transformation creates opportunities for app marketplaces, branded services, and targeted advertising tailored to driving behavior and location. As data monetization becomes a core strategy, automakers can leverage telemetry for insights, fleet management, and insurance customization. Partnerships with fintech and cloud providers are multiplying, enabling flexible service bundling and long-term user engagement, positioning vehicles as recurring revenue platforms rather than one-time sales assets.

-

Mercedes-Benz surpassed USD 1.10 billion in software-enabled revenue in 2022, driven by offerings like Live Traffic, Navigation, and in-car purchases via the Mercedes me Store. The company aims to reach mid-single-digit billions by the mid-2020s, and high-single-digit billions by 2030 through the continued rollout of subscription-based digital services.

Challenges

-

Legacy vehicle infrastructure and long development cycles hinder agile deployment of software-defined capabilities across OEM portfolios

Legacy vehicle infrastructure and traditionally long automotive development cycles pose significant challenges to adopting agile, software-defined approaches. Most OEMs still rely on hardware-driven architectures with multiple ECUs and tightly coupled software-hardware stacks, which limits flexibility. Migrating to centralized platforms involves substantial reengineering of electronic and electrical (E/E) architecture, which takes years to standardize across vehicle generations. This transition is further complicated by stringent validation, homologation, and safety testing requirements, extending development timelines. OEMs must balance innovation with backward compatibility, often slowing down the deployment of next-gen features. These structural barriers delay market responsiveness and increase costs in a highly competitive landscape.

Segment Analysis

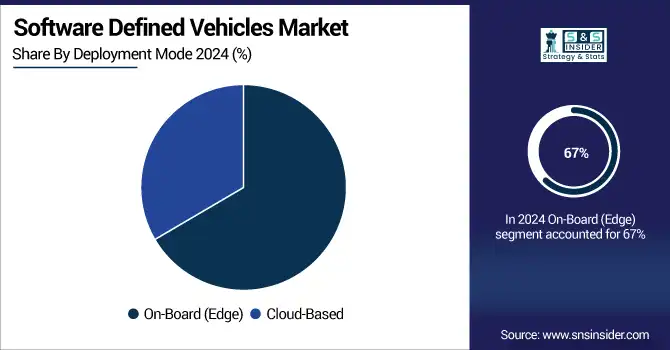

By Deployment Mode

On-Board (Edge) segment dominated the Software Defined Vehicles Market with the highest revenue share of about 67% in 2024 due to its low-latency processing, enhanced vehicle autonomy, and real-time decision-making capabilities. It reduces dependency on external networks, ensures higher data privacy, and supports safety-critical functions like braking and steering. Automakers prefer edge solutions for mission-critical tasks, improving reliability and operational control within the vehicle environment.

Cloud-Based segment is expected to grow at the fastest CAGR of about 33.97% from 2025–2032, driven by the rising need for remote diagnostics, continuous software updates, and scalable vehicle data management. As vehicles become more connected, cloud infrastructure enables seamless over-the-air (OTA) updates, predictive maintenance, and real-time fleet management, empowering OEMs to deliver enhanced services, monetize data insights, and optimize operational efficiency across geographies.

By Application

Advanced Driver-Assistance Systems (ADAS) segment dominated the Software Defined Vehicles Market with the highest revenue share of about 29% in 2024 due to widespread integration of safety features such as adaptive cruise control, lane-keeping assistance, and automatic emergency braking. Regulatory mandates and rising consumer demand for safer driving experiences have made ADAS standard in most new vehicles, supporting consistent revenue across mass-market and premium segments.

Autonomous Driving segment is expected to grow at the fastest CAGR of about 35.67% from 2025–2032, propelled by advancements in AI, sensor fusion, and high-performance computing. OEMs and tech firms are accelerating investments in L3+ autonomous capabilities to meet consumer expectations for self-driving mobility. Regulatory progress and urban pilot programs are further fueling development, making autonomous systems a focal point of next-gen automotive innovation.

By Type

Connected Software-Defined Vehicles segment dominated the Software Defined Vehicles Market with the highest revenue share of about 31% in 2024 due to the rapid adoption of telematics, infotainment, and vehicle-to-cloud platforms. Connected vehicles enable OTA updates, real-time navigation, predictive diagnostics, and usage-based insurance. This connectivity enhances driver experience and operational control, becoming a foundational layer for smart mobility and fleet applications.

Autonomous Software-Defined Vehicles segment is expected to grow at the fastest CAGR of about 35.30% from 2025–2032 due to increasing R&D in self-driving systems, edge computing, and AI algorithms. These vehicles rely on software-driven decision-making, object recognition, and sensor integration. As technology matures, OEMs aim to commercialize autonomous functions for ride-hailing, logistics, and personal mobility, unlocking transformative potential in transportation.

By Level of Autonomy

Level 2 segment dominated the Software Defined Vehicles Market with the highest revenue share of about 39% in 2024 owing to its balance between automation and affordability. Many OEMs have implemented Level 2 features like lane-centering and adaptive cruise control across mainstream models. Consumers are comfortable with semi-autonomous functions, while regulations still support human oversight, making Level 2 a commercially viable sweet spot for scale.

Level 4 segment is expected to grow at the fastest CAGR of about 34.59% from 2025–2032 due to progress in sensor technologies, AI processing, and regulatory testing environments. Level 4 vehicles enable fully autonomous operation under defined conditions, attracting interest for urban shuttles, delivery fleets, and robotaxis. With strong backing from tech giants and cities, Level 4 promises scalable, low-intervention mobility solutions in coming years.

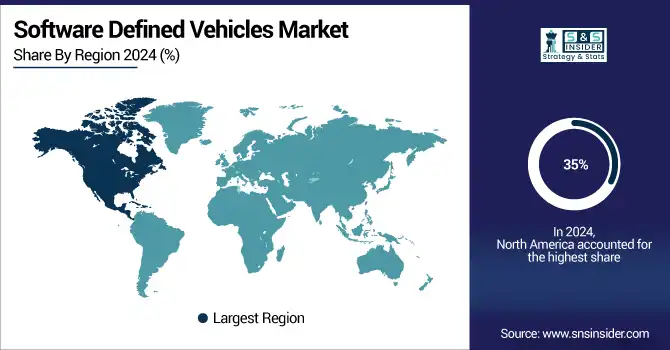

Regional Analysis

North America dominated the Software Defined Vehicles Market with the highest revenue share of about 35% in 2024 due to strong presence of leading automotive OEMs, advanced tech firms, and infrastructure for connected mobility. Early adoption of ADAS, autonomous systems, and regulatory support for vehicle software compliance have fueled growth. High consumer demand for premium, connected vehicles also contributes to the region’s market leadership and innovation capacity.

The United States is dominating the Software Defined Vehicles Market due to strong OEM presence, advanced tech infrastructure, and early adoption of connected vehicle technologies.

Asia Pacific is expected to grow at the fastest CAGR of about 34.67% from 2025–2032, driven by rapid vehicle production, smart city initiatives, and digital transformation in countries like China, Japan, and South Korea. Government incentives, rising middle-class demand for connected mobility, and growing investments in autonomous driving R&D are accelerating adoption. Emerging local OEMs and tech collaborations further enhance Asia Pacific’s growth trajectory in software-defined vehicle technologies.

China is dominating the Software Defined Vehicles Market in Asia Pacific due to its massive automotive production, rapid digitalization, and strong government support for smart mobility.

Europe holds a significant share in the Software Defined Vehicles Market due to advanced automotive technology, strong regulatory standards, high adoption of ADAS, and growing investments in connected and autonomous vehicle innovations across the region.

Germany is dominating the Software Defined Vehicles Market in Europe, driven by its strong automotive manufacturing base, advanced engineering expertise, and investment in vehicle software innovation.

Middle East & Africa and Latin America are emerging markets in the Software Defined Vehicles sector, driven by gradual adoption of connected mobility, growing urbanization, and increasing investments in automotive infrastructure, though limited by economic constraints and slower technological readiness.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Amazon Web Services, Inc. (AWS), Aptiv PLC, General Motors Company, Hyundai Motor Company, Mercedes-Benz Group AG, NVIDIA Corporation, Qualcomm Technologies, Inc., Robert Bosch GmbH, Tesla, Inc., Toyota Motor Corporation, Volkswagen AG, Stellantis NV, BYD Company Limited, Ford Motor Company, Honda Motor Co., Ltd., BMW Group, Suzuki Motor Corporation, BlackBerry Limited, Renesas Electronics Corporation, Continental AG.

Recent Developments:

-

2025 – Intel & AWS unveiled in January 2025 that SDV development cycles can shrink by six months using cloud-based environments and early-stage virtual testing.

-

2025 – Volvo Cars shifted left by virtualizing ECU testing via AWS Graviton on Amazon EKS, replacing costly HiL rigs with cloud-native SDV validation.

| Report Attributes | Details |

| Market Size in 2024 | USD 209.98 Billion |

| Market Size by 2032 | USD 1990.28 Billion |

| CAGR | CAGR of 32.56% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Mode (On-Board (Edge), Cloud-Based) • By Type (Autonomous Software-Defined Vehicles, Connected Software-Defined Vehicles, Electric Software-Defined Vehicles, Infotainment and Comfort Software-Defined Vehicles, Hybrid Software-Defined Vehicles) • By Application (Advanced Driver-Assistance Systems (ADAS), Autonomous Driving, Infotainment Systems, Electric Vehicle (EV) Management, Vehicle-to-Everything (V2X) Communication, Personalization) • By Level of Autonomy (Level 1, Level 2, Level 3, Level 4) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Amazon Web Services, Inc. (AWS), Aptiv PLC, General Motors Company, Hyundai Motor Company, Mercedes-Benz Group AG, NVIDIA Corporation, Qualcomm Technologies, Inc., Robert Bosch GmbH, Tesla, Inc., Toyota Motor Corporation, Volkswagen AG, Stellantis NV, BYD Company Limited, Ford Motor Company, Honda Motor Co., Ltd., BMW Group, Suzuki Motor Corporation, BlackBerry Limited, Renesas Electronics Corporation, Continental AG |