AI-enabled Biometric Market Size & Trends:

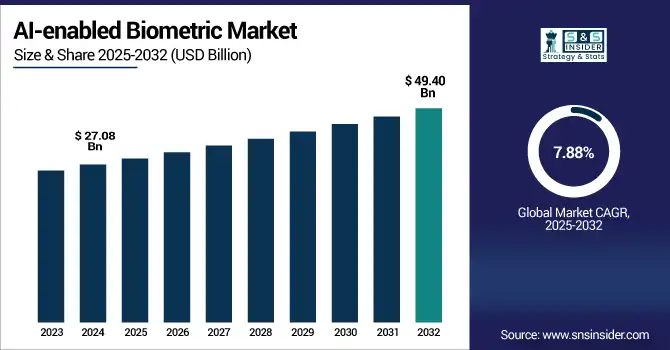

The AI-enabled Biometric Market Size was valued at USD 27.08 billion in 2024 and is expected to reach USD 49.40 billion by 2032 and grow at a CAGR of 7.88% over the forecast period 2025-2032.

To Get more information on AI-enabled Biometric Market - Request Free Sample Report

The global AI-enabled Biometric Market is witnessing significant growth, due to the rapid digital transformation of multiple industries and surging requirement for advanced authentication solutions. Artificial intelligence-based, contactless biometrics are increasingly critical in verticals, such as finance, healthcare and government services for the added security and convenience. Growing fears of identity theft, data breaches and unauthorized access have spurred demand for AI-infused biometric offerings. Moreover, the growing deployment of smart infrastructure, surveillance ecosystem and mobile technologies is also accelerating the growth of the market in developed as well as developing countries.

According to research, Voice, iris, and facial recognition now account for more than 45% of contactless biometric transactions globally

AI reduces biometric verification time by up to 65% compared to traditional systems, enhancing real-time usability.

The U.S. AI-enabled Biometric Market size was USD 6.35 billion in 2024 and is expected to reach USD 10.09 billion by 2032, growing at a CAGR of 6.03 % over the forecast period of 2025–2032.

The U.S. AI-enabled biometric market growth is fueled by increasing government spending on national security, advancements in technology and growing application of biometric identification system across the healthcare, banking, and border control. Growing threat of cybercrimes, deployment of sophisticated camera systems and increased demand for non-intrusive recognition has also led the demand for this market in public and private sectors.

According to research, over 65% of the U.S. hospitals and healthcare providers now use biometric systems for patient identification and access control.

85% of private security firms in the U.S. are either using or evaluating AI-based biometric surveillance technologies.

AI-enabled Biometric Market Dynamics:

Key Drivers:

-

Integration of AI into Biometric Systems Enhances Accuracy and Reduces False Acceptance/Rejection Rates, Fueling Adoption across Industries

AI-based biometric systems superior to traditional models and learn from them while using vast quantities of data to adapt to real-world noise and getting better over time. Demand is spurred by improvements in low-light facial recognition, anti-spoofing and demographics. With AI’s precision, it prevents false negatives and positives, and is helpful especially in industries, such as to law enforcement, border control, and fintech. The technological advantage also creates higher reliance in biometric systems, driving deployments in high security applications. As AI continues to evolve, it has enhanced real-time adaptability and greater scalability for use cases globally, due to its convergence with biometrics.

According to research, more than 80 countries have adopted AI-powered facial recognition systems for border security and law enforcement applications.

Real-time biometric verification speeds have improved by 3x on average with AI-based models, enabling scalability for high-throughput environments including airports.

Restraints:

-

Data Privacy and Ethical Concerns Surrounding Biometric Data Collection Limit Adoption Despite Technological Advancements

The use of biometric data, and in particular in combination with AI, brings with it many privacy concerns in terms of unauthorized surveillance and misuse. There are plenty of ethical questions surrounding facial recognition in public, lack of user consent, and data ownership preventing widespread adoption. Meanwhile, uncertainty around regulation and a public skepticism in places, such as the EU drag down deployment times. It also makes biometric data vulnerable to cyber-attacks if it’s stored in a central database. In the absence of clear legal guidelines and transparent usage guidelines, many organizations have been reluctant to fully deploy AI-enhanced biometric technologies due to potential public outrage and penalties for non-compliance.

Opportunities:

-

Expansion of Biometric Authentication in Mobile Banking and Fintech Services Drives New Application Growth in Emerging Markets

With the mobile-first approach and the surge of digital wallets, biometric authentication is a must-have for protected and easy payments. Even on condition of low-bandwidth or bad image inputs, AI improves biometric verification, and then it can be applied to the mass-market mobile devices. Fintechs are using fingerprints, and facial recognition to onboard new customers, authorize payments, and prevent fraud. In areas without much access to traditional banking, biometric-based mobile authentication provides secure transactions. Nowhere is this trend more striking than in the Asia-Pacific and Africa regions, where biometric tech use is aligned with the push for financial inclusion.

According to research, new AI models for biometric verification maintain over 95% accuracy even under low-bandwidth and poor image conditions.

Biometric mobile verification has helped enable banking access for more than 500 million previously unbanked individuals globally.

Challenges:

-

Lack of global standardization for AI-biometric protocols complicates interoperability and compliance in cross-border applications

Avoiding lack of consistent global standards for AI driven biometric latent systems for slowing down cross platform or cross-border consolidation. There are various legislations in place among different countries with regard to data retention, use of facial recognition, and transparency of algorithms. This non-harmonization interferes with the interoperability among of the systems and global deployment of business for multi-national organizations. Vendors who must ensure compliance across regions see escalating cost and operational complexity. With a lack of unified regulations, namely in the area of AI transparency and ethical use, businesses are wary of tech that could make them uncompliant in major markets.

AI-enabled Biometric Market Segmentation Analysis:

By Deployment Mode

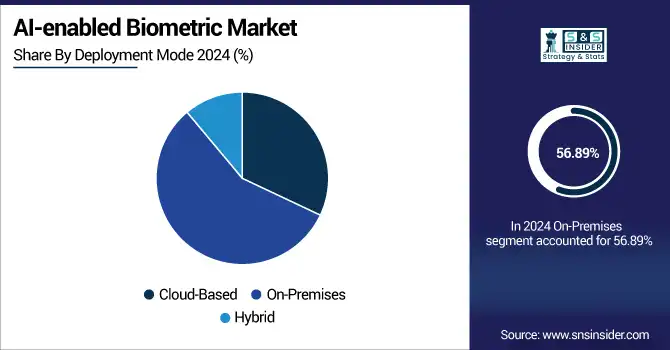

The On-Premises segment dominated the AI-enabled Biometric Market with a revenue share of 56.89% in 2024, as government and defense agencies are increasingly concerned about data privacy and regulatory compliance. Legacy entities handling PII prefer on-prem facilities to keep biometric data in their control. Furthermore, legacy systems and security procedures still bind industries such as manufacturing, energy and finance to on-premises deployment for control and customizability. NEC Corporation delivers strong on-premise biometric solutions and is a major player in supporting secure and localized deployments.

The Cloud-Based segment is projected to witness the fastest growth, with a CAGR of 8.93% from 2025 to 2032, prompted by the increasing need for scalable, cost-efficient, and remotely accessible biometric systems. Rising penetration in SME sector, evolving AI-driven cloud security and growing remote working setups are some of the factors fueling the demand for cloud-based biometrics. For instance, Microsoft Azure provides cloud based biometric identity verification tools and allows businesses to provide an identity platform that is trusted, standards-compliant and provides an alternative to using cards for access control.

By Application

The Government segment dominated the AI-enabled Biometric Market with a revenue share of 32.82% in 2024, owing to the significant investments in biometric systems for national ID programs, border control, law enforcement, and public safety programs. AI-integrated biometric systems, have been adopted by governments at home and abroad to improve citizen authentication, voting integrity, and immigration enforcement. Thales Group is one of the most known system providers of biometric IT aiming toward governmental applications such as e-passports, digital IDs, and borders control.

The Banking and Financial Services segment is expected to grow at the fastest CAGR of 9.20% during 2025-2032, driven by the industry’s demand for stronger fraud prevention and secure customer authentication. Amid the fast-digitalization of banking services, banks are adopting AI-based biometrics solutions to ease the customer sign-up process, meet KYC requirements and secure access both to online and mobile banking. Mastercard, for example, is working on biometric card services and AI-based authentication to enhance banking security and customer experience.

By Technology

Fingerprint Recognition dominated the highest AI-enabled Biometric Market share of 35.82% in 2024, due to its maturity, low cost and standard integration in devices, access control devices and government ID programs. It is of great popularity due to its high precision, user friendliness, and wide compatibility with the existing facilities. IDEMIA, the global leader in Augmented Identity technology has expanded its market share by offering its technology for government and commercial applications around the world, thus consolidating its position as the most trusted biometric identity platform.

Voice Recognition is anticipated to register the fastest CAGR of 9.22% over 2025-2032, fueled by integration in contactless and hands-free applications. The technology is growing in importance in areas such as customer service, healthcare and smart home devices, due to the ease of voice-enabled authentication and how simple it tends to make user experiences. Nuance Communications, a leader in voice biometrics, is furthering the use of AI for secure and effortless voice-first authentication across the call center and enterprise security platforms.

By End-Use

The Security and Surveillance dominated the AI-enabled Biometric Market in 2024 with a 31.39% revenue share, as AI-driven biometric systems for surveillance and assault detection becoming increasingly ubiquitous. Public safety organizations, travel facilities, and vital asset sectors are deploying more facial recognition, gait analysis, and behavior-prediction tools in support of perimeter security. AI-enabled Biometrics Companies like Hikvision has played an important role in offering modern advanced biometric surveillance solutions to detect and act on potential menaces around the clock by applying AI.

Fraud Prevention is set to experience the fastest growth, with a CAGR of 9.29% during 2025-2032, due to developments, such as the prevalence of identity theft, cyber fraud, and data breaches in all industries. In the finance, healthcare, and e-commerce industry, companies are using AI biometric authentication to protect users’ identities, transactions, and to meet industry standards. BioCatch is a prominent player in the field of behavioral biometrics, offering Financial Services organizations real-time Fraud Prevention using AI, Deep Learning, Behavioral Analysis, and Customer Profiling.

AI-enabled Biometric Market Regional Outlook:

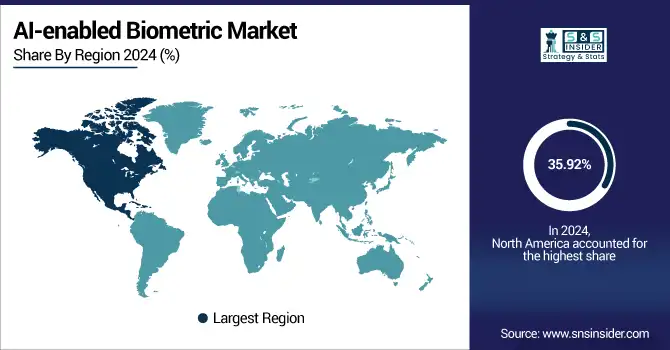

North America held the highest revenue share of 35.92% in 2024, due to strong government support, mature technology, and rapid roll-out of cutting-edge security measures. The market has its share of AI and biometric solution providers, which, along with increasing awareness about cyber security have further spurred the adoption in verticals like homeland security, health; and banking. The momentum is also being supported by regulation that favors digital identity and strong investment in R&D that has further helped position the region as a leader in the world for biometrics.

-

The U.S. leads the North American AI-enabled biometric market on account of robust government support, developed cybersecurity infrastructure and prevalence of AI-enabled biometrics across defense, healthcare and banking verticals. This growth and innovation are further fueled by leading tech companies and substantial R&D investment.

Asia Pacific is forecasted to grow at the fastest CAGR of 9.24% over 2025-2032, driven by high urbanization, increasing mobile penetration along with digital government identity programs. China, India, and Japan are investing heavily in smart cities and e-governance projects, which are underpinned by biometric technologies. With growing need for contactless security offerings in a concentrated population area, and expanding fintech ecosystem is leading to the strong adoption of this market across the region.

-

China dominated the APAC AI biometrics market with large government surveillance programs, fast adoption of facial recognition, and widespread of public safety and fintech applications. Domestic tech firms are strong and receive government support, which also fuels innovation and deployment.

Europe market is growing at a steady pace, due to rising demand from safe digital identity solutions, GDPR compliant technologies, artificial intelligence (AI) integration among others. The area prioritizes privacy-centric biometric technologies from sectors including finance, healthcare and border controls. Nations including Germany, France, and the U.K. are investing in AI-driven authentication to improve security and help citizens more efficiently access government services.

-

The U.K. leads the AI-enabled biometric market in Europe owing to lucrative government initiatives on border monitoring, surveillance and digital identity. Strong fintech and healthcare industries and a leading AI ecosystem are also fueling extensive usage of biometrics.

The Middle East & Africa’s AI-powered Biometric market is dominated by the UAE, propelled by smart governance, airport security, and AI spending. In Latin America, Brazil is supported by the government, engineering projects, a growing number of fintech services, and by a general acceptance of biometrics both in banking and public security and in a wide array of digital identity programs.

Get Customized Report as per Your Business Requirement - Enquiry Now

AI-enabled Biometric Companies are:

Major Key Players in AI-enabled Biometric Market are NEC Corporation, IDEMIA, Thales Group, Aware, Inc., Fujitsu Limited, HID Global, Cognitec Systems GmbH, Nuance Communications, BioID GmbH, and Precise Biometrics AB and others.

Recent Developments:

-

In March 2025, IDEMIA introduced advanced MorphoWave XP/SP terminals featuring faster, touchless fingerprint recognition with enhanced AI algorithms, targeting airports, corporate access control, and public security deployments.

-

In July 2024, Cognitec released FaceVACS Engine 9.9, featuring the B15 and A21 algorithms for improved facial recognition across a wide range of head poses, enhancing security and performance in mobile and surveillance systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 27.08 Billion |

| Market Size by 2032 | USD 49.40 Billion |

| CAGR | CAGR of 7.88% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Mode (Cloud-Based, On-Premises, Hybrid) • By Application (Government, Banking and Financial Services, Healthcare, Travel and Immigration, Consumer Electronics) • By Technology (Fingerprint Recognition, Facial Recognition, Iris Recognition, Voice Recognition, Behavioral Biometrics) • By End Use (Personal Identification, Access Control, Time and Attendance Management, Security and Surveillance, Fraud Prevention) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | NEC Corporation, IDEMIA, Thales Group , Aware, Inc., Fujitsu Limited, HID Global , Cognitec Systems GmbH, Nuance Communications, BioID GmbH, Precise Biometrics AB. |