Biometric System Market Size & Overview:

Get more information on Biometric System Market - Request Sample Report

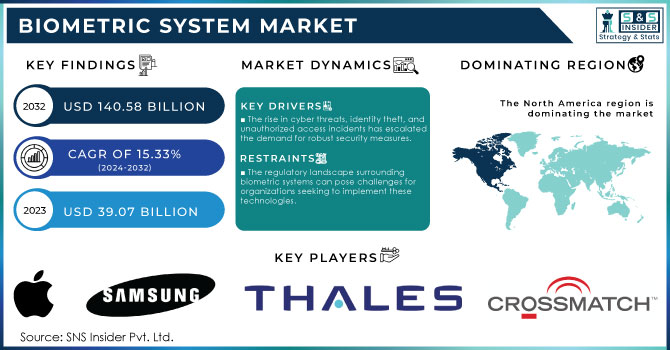

The Biometric System Market Size was valued at USD 39.07 Billion in 2023 and is expected to reach USD 140.58 Billion by 2032, growing at a CAGR of 15.33% over the forecast period 2024-2032.

The biometric system market is witnessing significant growth, driven by the increasing demand for advanced security measures and rapid advancements in biometric technology. In recent years, the global focus on security has intensified due to rising concerns about identity theft, fraud, and unauthorized access. The average cost of a data breach reached USD 4.88 million in 2024, marking the highest amount recorded to date. Human error is a significant factor in cybersecurity incidents, accounting for 88% of breaches. It takes an average of 194 days to identify a breach, and the total lifecycle from identification to containment lasts about 292 days. In 2023, the average ransomware payout rose to USD 1.54 million, and 75% of organizations experienced at least one ransomware attack last year. Phishing remains a leading threat, with 57% of organizations encountering daily or weekly attempts. Biometric authentication solutions offer a robust solution to these challenges, providing a higher level of accuracy compared to traditional password-based systems. As organizations seek to protect sensitive data and streamline user access, the adoption of biometric systems is becoming increasingly prevalent.

In the healthcare sector, hospitals and clinics are utilizing these technologies to streamline patient identification, ensuring that the right patient receives the appropriate care. Compliance with regulations like GDPR is increasingly crucial, with companies facing mounting pressure to maintain data privacy standards. In the U.S., the cost of compliance can approach USD 10,000 per employee for larger firms, and in 2023, total HIPAA violation fines exceeded USD 4 million. Biometric systems help reduce errors related to patient misidentification, which can lead to serious medical consequences. by integrating biometric authentication into electronic health record systems, healthcare providers can enhance data security and protect patient privacy, further driving the market's growth.

Biometric System Market Dynamics

Drivers

-

The rise in cyber threats, identity theft, and unauthorized access incidents has escalated the demand for robust security measures.

Conventional security measures like passwords and PINs are now considered insufficient due to their vulnerability to breaches and ease of being forgotten or stolen. Data breaches increased by 72% in 2023 compared to 2022. Approximately, 2,365 cyberattacks occurred in 2023, affecting 343 lakh victims. Biometric systems, using distinct physical or behavioral traits like fingerprints, facial recognition, or iris scans, offer increased security and dependability. Biometric systems effectively tackle these issues by allowing only authorized users to access sensitive information or secure areas. For example, financial institutions are more and more using biometric verification to secure customer accounts from unauthorized entry. With the increasing frequency of cyberattacks and data breaches, organizations are forced to spend money on biometric systems to protect their assets, leading to the growth of the market. Additionally, the market is being strengthened by the incorporation of biometric technology in different industries like healthcare, finance, and government. Countries globally are adopting biometric technology for identity verification in different services, such as issuing passports and managing borders, to strengthen security on a national scale. An increase in global security concerns is predicted to lead to a rise in demand for biometric systems, which will be a major factor driving the biometric system market.

-

The proliferation of mobile devices is significantly contributing to the growth of the biometric system market.

The prevalence of smartphones and tablets has led to the widespread adoption of biometric technology in these devices, making biometric authentication easier and more convenient for users. Consumers are increasingly attracted to mobile devices that come with biometric features like fingerprint scanners and facial recognition abilities. This trend is improving user convenience and also offering a secure way to access sensitive information and applications. For example, biometric authentication is increasingly being used in mobile banking apps, boosting its use in the financial industry. Furthermore, the increasing popularity of mobile payment options is also boosting the need for biometric authentication. With the growing popularity of contactless payment methods among consumers, incorporating biometrics into mobile payment platforms enhances security during transactions and helps lower the chances of fraud.

Restraints

-

The regulatory landscape surrounding biometric systems can pose challenges for organizations seeking to implement these technologies.

Governments and regulatory bodies are increasingly scrutinizing the use of biometric data, leading to the establishment of various laws and guidelines governing its collection, storage, and usage. Compliance with these regulations can be complex and resource-intensive, particularly for organizations operating in multiple jurisdictions with differing legal requirements. The lack of standardized regulations across regions can create uncertainty for businesses, hindering their ability to adopt biometric systems confidently. Moreover, the evolving nature of regulations means that organizations must stay updated on compliance requirements, which can necessitate additional investments in legal counsel and compliance resources. This regulatory burden can deter organizations from adopting biometric technologies, especially smaller companies with limited resources. To successfully navigate these regulatory challenges, organizations must prioritize compliance and implement robust data protection measures. However, the complexities and uncertainties associated with regulatory requirements can serve as a restraint on the growth of the biometric system market.

Biometric System Market Segmentation Analysis

by Authentication Type

The single-factor authentication led the market with a 59% market share in 2023, primarily due to its simplicity and ease of use. This approach usually depends on a single biometric characteristic, like a fingerprint or facial recognition, to confirm the identity of the user. Single-factor systems are commonly used in a range of uses, such as smartphones, laptops, and security access points, where fast and effective verification is crucial. Apple and Samsung have incorporated fingerprint scanners and facial recognition technology into their devices, enabling users to effortlessly unlock their phones and approve transactions.

Multi-factor authentication is expected to become the fastest-growing segment in the biometric system market during 2024-2032, due to increasing security concerns and regulatory compliance requirements across industries. This technique merges multiple biometric characteristics, like facial and voice recognition, or incorporates biometric information with other authentication methods, such as passwords or tokens. This stratified method greatly improves security, which appeals to secure environments like banks, hospitals, and governmental buildings. Amazon and Google use multi-factor systems to protect user accounts and sensitive data, reducing the chance of unauthorized access.

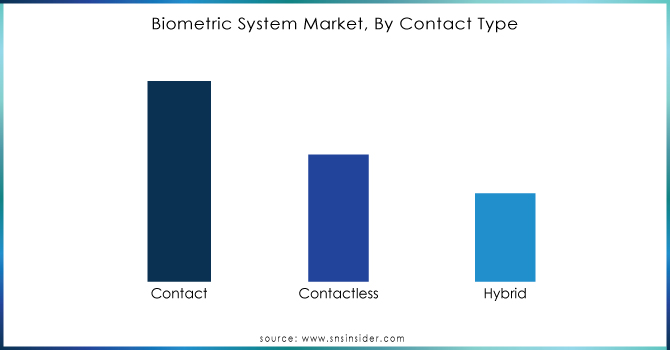

by Contact Type

The contact dominated in 2023 with a 45% market share. Typically, these systems use fingerprint recognition and palm scanning methods, offering high accuracy and reliability. The reason for the prevalence of this sector is its well-established presence in a range of uses, including controlling access in secure buildings, tracking time and attendance at work, and managing retail transactions. Key players in the industry, such as Futronic and Suprema, provide advanced fingerprint scanners tailored for different sectors such as finance and healthcare.

The contactless is projected to have the fastest CAGR during 2024-2032, driven by the increasing demand for convenience, hygiene, and quick processing. This section uses technologies like facial recognition, iris scanning, and voice recognition, enabling users to verify their identity without touching anything. The COVID-19 outbreak has sped up the implementation of contactless technologies in a range of industries, such as airports, retail, and banking, where reducing in-person contact is essential. NEC Corporation and Face++ are at the forefront, offering advanced facial recognition solutions for security and access management in smart cities and public transportation.

Get Customized Report as per your Business Requirement - Request For Customized Report

by Offering

The hardware held a market share of 56% in 2023 and led the market. This segment is currently the dominating force in the market due to the increasing demand for secure access control in various applications, including government security, financial services, and healthcare. Hardware solutions provide reliable and fast identification methods, enhancing security and streamlining operations. Companies like HID Global offer fingerprint and facial recognition systems, while NEC Corporation provides advanced facial recognition technology widely used in airports and law enforcement agencies.

The software segment is projected to have the fastest CAGR during 2024-2032. Software solutions provide enhanced flexibility and scalability, allowing organizations to integrate biometric systems into existing infrastructures easily. Companies like Microsoft offer biometric authentication solutions through Windows Hello, enabling secure access to devices and applications. Similarly, Gemalto (now part of Thales Group) provides identity management solutions that leverage biometric data for secure transactions in financial services.

Biometric System Market Regional Outlook

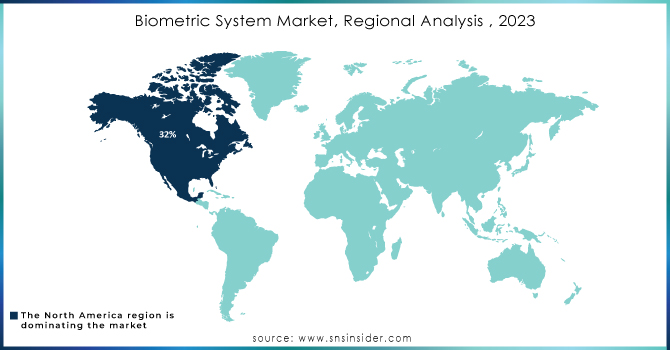

North America dominated the biometric system market in 2023 with a 32% market share, accounting for a significant share due to its advanced technological landscape and high adoption rates across various sectors. Strict government regulations on security and identification, combined with an increasing focus on improving security measures in industries like banking, healthcare, and law enforcement, are the main factors. Big corporations such as Apple and Microsoft utilize biometric technology for securing devices and verifying users, while companies like IDEMIA and HID Global offer sophisticated biometric options for governments and businesses. Continuous innovation in biometric technologies like facial recognition and fingerprint scanning, along with the existence of established players, further solidify North America's dominance in this market.

The Asia-Pacific region is anticipated to become the fastest-growing during 2024-2032, driven by rapid urbanization, increasing security concerns, and a rising demand for advanced authentication solutions. Nations such as China and India are experiencing substantial investments in biometric technologies in different sectors like banking, retail, and government. India's Aadhaar program, leveraging biometric identification for a large population, is one of the initiatives driving growth in the region. NEC Corporation and Gemalto (now part of Thales Group) are broadening their biometric solutions, with a focus on cutting-edge uses such as facial recognition and iris scanning.

Key Players

The major key players in the Biometric System Market are:

-

Apple Inc. (Face ID, Touch ID)

-

Samsung Electronics (Samsung Pass, Fingerprint Scanner)

-

Thales Group (Gemalto Biometric Enrollment, Biometric Border Control)

-

NEC Corporation (NEC Biometric Authentication, NeoFace Watch)

-

HID Global (HID DigitalPersona, HID BioClass)

-

Crossmatch (DigitalPersona, Verifier 300)

-

Fujitsu (Fujitsu PalmSecure, Fujitsu Biometric Authentication)

-

Gemalto (CST Biometric Solutions, Biometric Smart Cards)

-

IDEMIA (MorphoWave, MorphoBLOOD)

-

BioID (BioID Facial Recognition, BioID Web Service)

-

Safran Identity & Security (MorphoTrust, MorphoManager)

-

Innovatrics (Innovatrics AFIS, Innovatrics Biometric SDK)

-

Suprema (Suprema BioStar, Suprema FaceStation)

-

Vision-Box (SmartFace, Biometric Boarding Solutions)

-

Aware, Inc. (Aware BioSP, Aware NIST Biometric Test Suite)

-

Veridium (VeridiumID, 4 Fingers Touchless ID)

-

SecuGen (SecuGen Hamster Pro, SecuGen SDA04P)

-

ZKTeco (ZKTeco F18, ZKTeco ProFace X)

-

Paravision (Paravision Face Recognition, Paravision Document Verification)

-

Rank One Computing (Rank One Face Recognition, Rank One Iris Recognition)

Suppliers of Raw Materials/Components

-

Texas Instruments

-

STMicroelectronics

-

NXP Semiconductors

-

Qualcomm

-

Infineon Technologies

-

Microchip Technology

-

Analog Devices

-

Maxim Integrated

-

Broadcom

-

Synaptics

Recent Development

-

September 2024: NEC Corporation announced a new wave of brainwave-based biometric authentication technology able to quickly identify thousands of people simultaneously even if one bee it up and much more. It should speed up admissions and ease bottlenecks for those events and infrastructure that are busy.

-

August 2024: The new Entry/Exit System (EES) will digitally log the data of non-EU citizens on each entry and exit from the external Schengen borders, replacing the physical stamping of passports at passport control in Europe.

-

October 2023: Abu Dhabi Airports has signed an agreement with the Federal Authority for Identity, Citizenship, Customs and Port Security (ICP) to implement the world’s first ‘Smart Travel' biometrics project at Zayed International Airport in Abu Dhabi.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 39.07 Billion |

| Market Size by 2032 | USD 140.58 Billion |

| CAGR | CAGR of 15.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Authentication Type (Single Factor, Multi-factor) • By Contact Type (Contact, Contactless, Hybrid) • By Offering (Hardware, Software) • By Deployment Mode (On-premises, Cloud-based) • By Application (Face Recognition, Iris Recognition, Voice Recognition, Vein Recognition, Fingerprint Recognition, Others) • By End User (Government, BFSI, Consumer Electronics, Healthcare, Transportation & Logistics, Defense & Security, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Samsung Electronics, Thales Group, NEC Corporation, HID Global, Crossmatch, Fujitsu, Gemalto, IDEMIA, BioID, Safran Identity & Security, Innovatrics, Suprema, Vision-Box, Aware, Inc., Veridium, SecuGen, ZKTeco, Paravision, Rank One Computing |

| Key Drivers | • The rise in cyber threats, identity theft, and unauthorized access incidents has escalated the demand for robust security measures. • The proliferation of mobile devices is significantly contributing to the growth of the biometric system market. |

| RESTRAINTS | • The regulatory landscape surrounding biometric systems can pose challenges for organizations seeking to implement these technologies. |