Speech And Voice Recognition Market Report Scope and Overview:

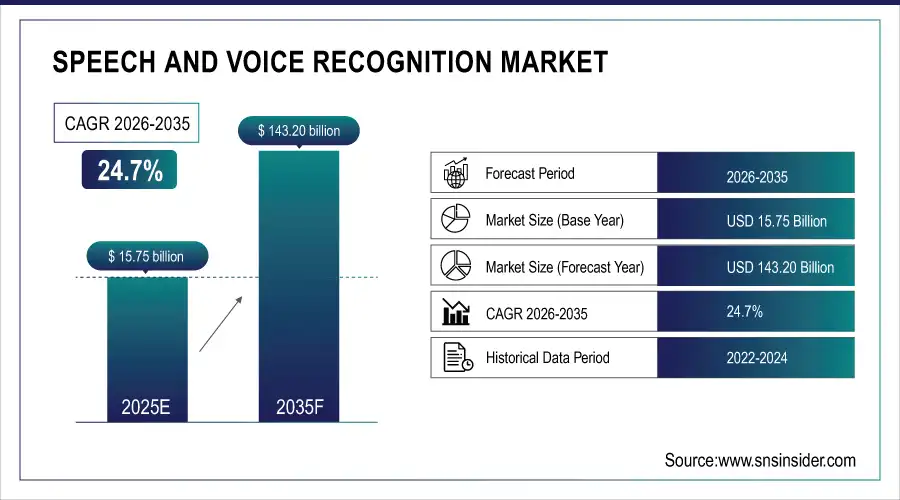

The Speech and Voice Recognition Market Size was valued at USD 15.75 billion in 2025 and is expected to reach USD 143.20 billion by 2035 and grow at a CAGR of 24.7% over the forecast period 2026-2035.

The Speech and Voice Recognition market represents a dynamic and transformative sector within the broader technology landscape. This technology enables machines to interpret and respond to human speech, fostering seamless interactions between individuals and devices. Speech and voice recognition are regarded as minor components of biometric systems. Speech recognition is described as the act of translating spoken words into a digitally changed and saved collection of words through the use of microphones and telephones. The speed, which evaluates how closely the program matches human speakers, is one of two metrics that assess the quality of speech recognition.

Speech And Voice Recognition Market Size and Forecast:

-

Market Size in 2025: USD 15.75 Billion

-

Market Size by 2033: USD 143.20 Billion

-

CAGR: 24.7% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

Get more information on Speech and Voice Recognition Market - Request Sample Report

Speech And Voice Recognition Market Highlights:

-

Rising adoption of edge-based voice recognition enables offline, low-latency speech processing on devices, improving privacy and reducing cloud dependency.

-

Healthcare is a major growth driver, with speech recognition streamlining clinical documentation, EHR integration, and reducing physician administrative burden.

-

Advancements in AI and deep learning are significantly improving speech-to-text accuracy across accents, medical terminology, and noisy environments.

-

Privacy-centric and secure voice AI solutions are gaining traction, especially in healthcare, IoT, and regulated industries.

-

Expansion of voice recognition into embedded systems and wearables is broadening market applications beyond traditional consumer and enterprise software.

-

Growing demand for workflow automation and productivity enhancement is accelerating adoption across healthcare, research, and smart device ecosystems.

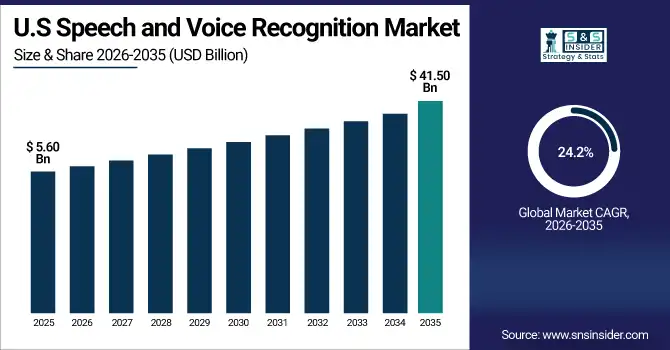

The U.S. Speech and Voice Recognition market size was valued at an estimated USD 5.60 billion in 2025 and is projected to reach USD 41.50 billion by 2035, growing at a CAGR of 24.2% over the forecast period 2026–2033. Market growth is driven by rapid adoption of voice-enabled technologies across consumer electronics, automotive, healthcare, BFSI, and enterprise applications. Increasing use of virtual assistants, smart speakers, and voice-based authentication solutions, along with advancements in artificial intelligence, deep learning, and natural language processing (NLP), are accelerating market expansion. Additionally, rising demand for hands-free and contactless interfaces, integration of voice recognition in customer service and smart home ecosystems, and strong investments in AI-driven innovation further strengthen the robust growth outlook of the U.S. speech and voice recognition market during the forecast period.

Speech And Voice Recognition Market Drivers:

-

Increased utilization of speech and voice recognition software among healthcare practitioners.

Many healthcare practitioners invest a significant portion of their time documenting notes and maintaining meticulous patient records, recognizing the critical importance of comprehensive documentation in the healthcare sector. However, these tasks divert valuable time from more impactful activities like direct patient care and personal interactions. Consequently, doctors and physicians increasingly prefer utilizing voice recognition software solutions based on natural language processing (NLP) algorithms. Speech and voice recognition technologies find extensive use in healthcare for reporting health checkups, data entry, and in scenarios where the healthcare professional is unavailable. These software solutions empower healthcare providers to input notes into the electronic health record (EHR) system or their computers seamlessly, without interrupting patient care, ensuring sustained productivity throughout the day. This approach alleviates the need for healthcare professionals to extend their work hours for paperwork, enabling them to attend to more patients within regular working hours. The user-friendly and hands-free features of automated speech recognition systems in medical applications enable doctors to efficiently complete their tasks, contributing to the growth of the speech and voice recognition market. Consequently, heightened productivity translates into increased cash flow for healthcare providers.

Speech And Voice Recognition Market Restraints:

-

Limitation of software to understand contextual relation of words in different languages

Homophones are words that share similar sounds but possess different meanings. Identifying homophones in a sentence can pose a challenge for AI without a robust language model and training that includes comprehensive exposure to these terms within relevant contexts. Numerous words in English and Romance languages carry multiple meanings. Consequently, determining the appropriate usage of homonyms during translation may prove challenging. To overcome this hurdle, a translator needs a profound familiarity with both the spoken language and the language into which the text is being translated. This necessitates a thorough understanding of both languages by the translator.

Speech And Voice Recognition Market Opportunities:

-

The growing trend of online shopping.

Customer purchasing behavior is transforming both developed and developing nations, marked by a noticeable shift toward online shopping trends. Consumers can now conveniently browse products, inquire about prices and features, and receive personalized recommendations from the comfort of their homes. Activities such as searching for products and services, creating shopping lists, adding items to carts, making purchases, tracking order statuses, providing feedback, utilizing customer support, and offering recommendations to potential customers are just a few touchpoints where voice assistants prove beneficial. The increasing and swift adoption of voice assistants by customers, coupled with the rising prevalence of online commerce, presents a valuable opportunity for providers of voice assistant applications and services.

Speech And Voice Recognition Market Segment Analysis:

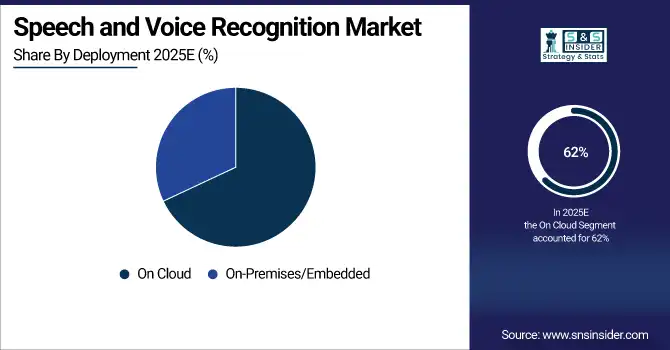

By Deployment, Cloud Deployment Leads Growth in the Market

The cloud segment is estimated to hold around 62% market share in 2025 and is projected to grow at the highest CAGR of nearly 27% from 2026 to 2035. The rapid shift toward cloud-based speech and voice solutions is driven by cost-efficiency, scalability, and seamless integration with AI and analytics platforms. SMEs and enterprises increasingly prefer cloud models due to reduced infrastructure needs and enhanced accessibility for remote teams. Meanwhile, the on-premise segment, holding about 38% share in 2024, is expected to witness slower growth, as organizations move away from high upfront investments and limited flexibility associated with traditional deployments.

By Technology, Speech Recognition Dominates While Voice Recognition Gains Momentum

The speech recognition segment commands approximately 68% share in 2025, driven by the widespread integration of AI, NLP, and machine learning into smart devices, smartphones, automotive systems, and enterprise software. It is expected to register a strong CAGR of around 24% during the forecast timeline. The voice recognition segment, although smaller with nearly 32% share, is forecast to grow at the fastest CAGR of about 26.5%. Its rising adoption in BFSI, healthcare, and public security enhances fraud prevention, authentication, and secure access. Increasing demand for personalized voice-based interactions further accelerates technology expansion.

By Vertical, Healthcare & BFSI Drive Largest Revenue Share Among Verticals

The healthcare and BFSI sectors together are estimated to capture around 45% market share in 2025, supported by growing demand for secure, efficient, and real-time voice-based operations. Healthcare uses speech recognition for clinical documentation, patient data capture, and telemedicine, boosting productivity and reducing manual workloads. BFSI adoption grows due to rising fraud risks and regulatory compliance needs, promoting voice biometrics for authentication. These sectors are projected to grow at a CAGR of over 25.8% through 2033. Other key contributors include automotive, retail, government, and enterprise-level deployments as voice-enabled ecosystems and smart communication interfaces accelerate adoption.

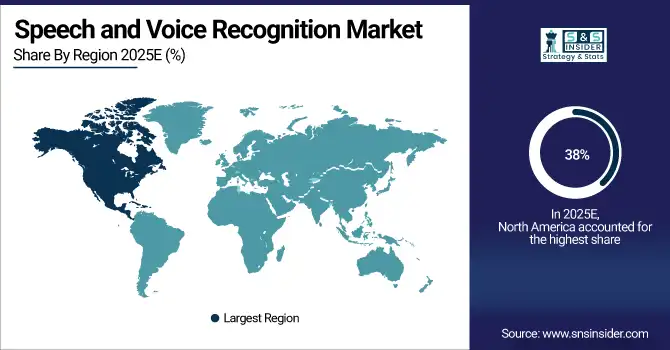

Speech And Voice Recognition Market Regional Analysis:

North America Dominates Speech and Voice Recognition Market

In 2025, North America commands an estimated 38% share of the Speech and Voice Recognition Market, solidifying its position as the leading region. Dominance is driven by rapid integration of AI-powered voice technologies across consumer electronics, enterprise communication, automotive infotainment, and healthcare systems. The rise of voice assistants, speech analytics in call centers, and secure voice biometrics enhances market penetration. Strong investments in AI innovation and automation enable North America to remain the global hub for advanced speech and voice recognition solutions.

Need any customization research on Speech and Voice Recognition Market - Enquiry Now

United States Leads North America’s Speech and Voice Recognition Market

U.S. enterprises deploy speech analytics and biometric authentication to improve customer service and secure digital interactions. Advanced R&D infrastructure and aggressive investments in AI enhance the U.S. leadership in the Speech and Voice Recognition Market in 2025.

Asia Pacific is the Fastest-Growing Region in Speech and Voice Recognition Market

The Asia Pacific market is projected to grow at a CAGR of nearly 28.5% from 2026 to 2035, making it the fastest-expanding region globally. Growth is powered by explosive smartphone penetration, AI investments, and government digitalization programs. Enterprises are rapidly adopting voice-driven automation across BFSI, telecom, healthcare, and retail sectors. Countries like China, Japan, South Korea, and India are expanding smart city infrastructures, voice-enabled payment systems, and intelligent consumer electronics, establishing Asia Pacific as a key accelerator of global market growth.

China Leads Asia Pacific’s Speech and Voice Recognition Market

China leads the region due to a strong domestic AI ecosystem, extensive application of voice biometrics in security, and rapid integration of voice assistants in everyday consumer devices. Chinese technology firms are scaling speech recognition solutions tailored to multiple dialects and real-time use cases in banking, public services, and mobility. Government emphasis on digital identity verification and intelligent automation amplifies market adoption. With heavy investments in local-language NLP development and expanding smart home demand, China secures its dominance in Asia Pacific’s Speech and Voice Recognition Market in 2024.

Europe Speech and Voice Recognition Market Insights

Europe shows strong market performance in 2025 supported by digital innovation, stringent cybersecurity regulations, and growing demand for multilingual voice solutions. Speech and voice recognition systems are increasingly deployed in automotive voice assistance, enterprise automation, and government accessibility programs. Wider adoption of voice authentication in BFSI and healthcare boosts secure, contactless operations across the region.

Germany Leads Europe’s Speech and Voice Recognition Market

Germany dominates the European market due to its leadership in connected automotive technologies, industrial digitization, and R&D advancements in natural language processing. Automotive OEMs are enhancing in-vehicle voice interaction systems, and enterprises are prioritizing AI-enabled speech analytics to improve operational efficiency. Germany’s focus on privacy-compliant voice technologies and industrial automation solidifies its position as the key market driver in Europe’s Speech and Voice Recognition Market in 2025.

Middle East & Africa and Latin America Speech and Voice Recognition Market Insights

The Speech and Voice Recognition Market in the Middle East & Africa and Latin America is experiencing steady growth in 2025. In MEA, smart city initiatives, digital banking expansion, and enterprise automation boost the adoption of voice-enabled technologies. Countries like the UAE and Saudi Arabia integrate AI speech solutions in public services and security. In Latin America, mobile penetration, contact-center modernization, and e-commerce voice applications contribute to rising demand. While infrastructure development is progressing, both regions are emerging as attractive markets for voice technology adoption.

Speech And Voice Recognition Market Competitive Landscape:

Google is a global leader in speech and voice recognition technologies, powering applications across its extensive ecosystem including Google Assistant, Android devices, YouTube, and enterprise AI solutions. The company integrates advanced machine learning and natural language processing to enable highly accurate real-time voice interaction. With a strong presence in smart homes, automotive infotainment, and enterprise cloud services, Google plays a crucial role in scaling voice-enabled user experiences worldwide.

-

Google expanded its conversational AI models in 2025, introducing more natural voice interaction and deeper cross-application functionality powered by enhanced large language model architecture.

Apple is a major innovator in the speech and voice recognition market, with Siri serving as a cornerstone of its ecosystem across iPhone, iPad, Mac, Apple Watch, and HomePod devices. The company focuses on privacy-centric, on-device AI processing to deliver secure and seamless voice interactions. Apple continuously enhances voice recognition for accessibility, device control, and personalized assistance, reinforcing user engagement across its product lineup.

-

In 2025, Apple upgraded Siri with enhanced natural language capabilities and more personalized multimodal responses aligned with its next-generation AI strategy.

Amazon

Amazon is a dominant force in voice recognition technologies through its Alexa voice assistant and Echo smart device ecosystem. The company leads in smart home adoption, offering voice-controlled solutions for home automation, retail, and entertainment. Amazon also expands voice AI into commercial applications, including customer service, retail automation, and in-vehicle systems.

-

In 2025, Amazon introduced upgraded Alexa capabilities that better understand emotional tone and conversational context, delivering more intuitive user interaction across devices.

Microsoft is a key enterprise leader in speech and voice recognition through its Azure AI services, including Azure Cognitive Speech and enterprise communication platforms like Teams. The company supports secure, scalable speech recognition for transcription, voice biometrics, call analytics, and accessibility solutions across industries such as BFSI, healthcare, and government.

-

In 2025, Microsoft enhanced Azure Speech services with improved real-time transcription accuracy and AI-powered voice authentication to strengthen enterprise security and analytics adoption.

Speech And Voice Recognition Market Key Players:

-

Google

-

Apple

-

Amazon

-

Microsoft

-

IBM

-

Baidu

-

iFLYTEK

-

Cerence

-

Sensory

-

Speechmatics

-

Verint

-

Pindrop

-

Twilio

-

Qualcomm

-

Alibaba Cloud

-

Huawei

-

Oracle

-

Cisco

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 15.75 billion |

| Market Size by 2035 | USD 143.20 billion |

| CAGR | CAGR of 24.7% from 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-Premises/Embedded, On Cloud) • By Technology (Speech Recognition, Text-To-Speech, Speaker Identification, Automatic Speech Recognition, Voice Recognition, Speaker Verification) • By Vertical (Automotive, Consumer, Government, Healthcare, Legal, Enterprise, BFSI, Retail, Military, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Egypt, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Google, Apple, Amazon, Microsoft, IBM, Nuance Communications, Baidu, iFLYTEK, SoundHound AI, Cerence, Sensory, Speechmatics, Verint, Pindrop, Twilio, Qualcomm, Alibaba Cloud, Huawei, Oracle, Cisco. |