AI in Video Surveillance Market Report Scope & Overview:

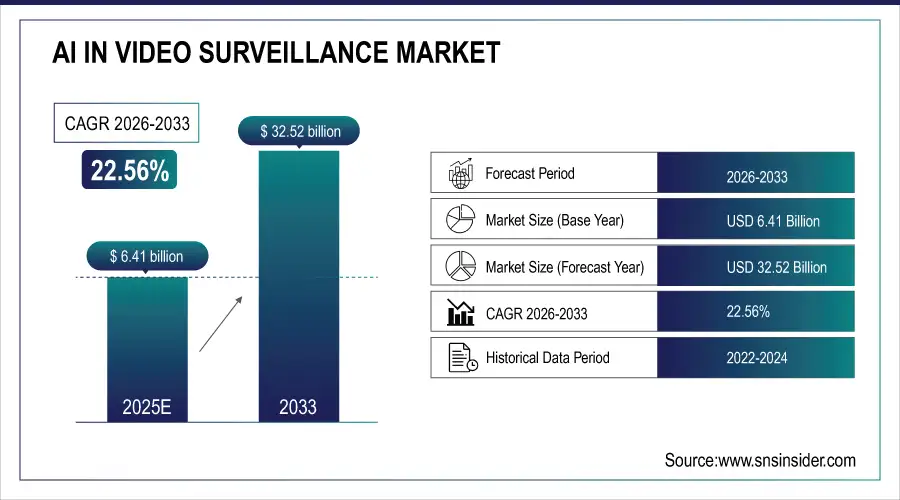

The AI in Video Surveillance Market Size is estimated at USD 6.41 Billion in 2025E and is projected to reach USD 32.52 Billion by 2033, growing at a CAGR of 22.56% over 2026–2033.

The AI in Video Surveillance Market analysis gives a full picture of how artificial intelligence-enabled video analytics, intelligent monitoring systems, and next-generation security infrastructure are being used. The growing use of AI-powered video surveillance systems in business, home, industrial, and government settings is being driven by rapid urbanization, rising security threats, smart city efforts, and developments in deep learning, computer vision, and edge AI.

AI-based video surveillance is expected to be deployed across over 420 million active cameras globally by 2025, with increasing integration of facial recognition, behavior analysis, weapon detection, and real-time anomaly detection capabilities.

Market Size and Growth Projection:

-

Market Size in 2025: USD 6.41 Billion

-

Market Size by 2033: USD 32.52 Billion

-

CAGR: 22.56% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on AI in Video Surveillance Market - Request Free Sample Report

AI in Video Surveillance Market Trends:

-

Accelerating adoption of deep learning-based video analytics for real-time threat detection and behavioral analysis.

-

Increasing deployment of edge AI cameras to reduce latency, bandwidth usage, and cloud processing costs.

-

Expansion of smart city projects integrating AI surveillance for traffic monitoring, public safety, and urban planning.

-

Rising focus on facial recognition and biometric identification for access control and law enforcement applications.

-

Growing demand for cloud-based video surveillance platforms offering scalability, centralized management, and AI model updates.

-

Integration of AI with IoT, 5G, and edge computing to enable high-speed, low-latency video analytics.

U.S. AI in Video Surveillance Market Analysis:

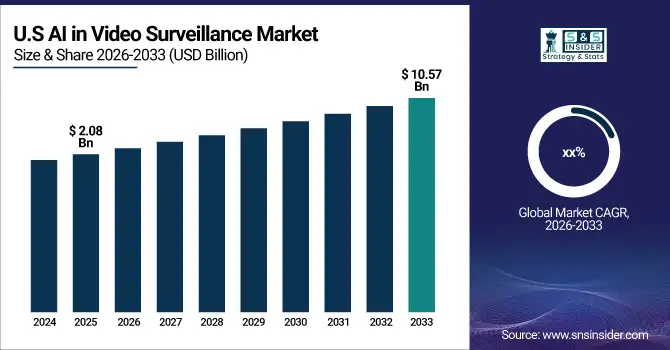

The U.S. AI in Video Surveillance Market size was valued at USD 2.08 Billion in 2025E and is projected to reach USD 10.57 Billion by 2033. Growth is fueled by big investments from the federal and local governments in public safety and smart city projects, the growing need for smart security in commercial retail and key infrastructure, and the quick use of AI-driven analytics to improve operations and find threats.

AI in Video Surveillance Market Growth Drivers:

-

Rising Security Threats and Urban Surveillance Demand Augment Growth Globally

Rising security threats and increasing urban population density are key drivers of AI in Video Surveillance Market growth. Governments and businesses are using AI-powered surveillance systems to improve situational awareness, find risks before they happen, and rely less on people to do the monitoring. AI-powered video analytics can find suspicious behavior, objects that are left alone, breaches of the perimeter, and violent events in real time, which makes response times much faster.

Cities are using AI surveillance more and more as part of their smart city plans to keep an eye on traffic jams, crowd movement, and public safety. AI-enabled solutions cut down on false alarms by more than 35%, make incident detection more accurate by 40–50%, and lessen the cost of monitoring operations by substituting constant human supervision.

Investments in AI-based video surveillance are expected to rise by more than 18% in 2025 as smart city projects and business security enhancements are becoming more common.

AI in Video Surveillance Market Restraints:

-

Privacy Concerns and Regulatory Compliance Challenges May Restrain Market Expansion Globally

Privacy issues and strict rules can restrain the AI in Video Surveillance Market. The widespread use of facial recognition and biometric analytics has made people worried about privacy issues, permission, and the exploitation of surveillance data. In Europe, GDPR and in North America and Asia-Pacific, data protection regulations are changing, which means that companies must follow tight rules when collecting, storing, and processing data.

Also, the high initial expenditures of AI-enabled cameras, GPU-based processing devices, and advanced analytics software can make it hard for small and medium-sized businesses to use them. Concerns about algorithmic bias and false identification make it even harder to use in sensitive public places.

AI in Video Surveillance Market Opportunities:

-

Expansion of Smart Cities and AI-Driven Public Safety Infrastructure Can Create Market Growth Opportunities

The rapid expansion of smart city initiatives presents a significant opportunity for the AI in Video Surveillance Market. Global governments are spending a lot of money on AI-powered surveillance systems to help with managing traffic flow, stopping crime, responding to emergencies, and keeping an eye on infrastructure. Combining AI monitoring with traffic lights, emergency services, and public transportation networks makes it possible to administer cities based on data.

Edge AI, federated learning, and privacy-preserving analytics are all making it possible to implement systems that are both compliant and scalable. By 2025, smart city-related surveillance systems are predicted to make up more than 30% of all AI video surveillance systems. This will give technology companies long-term growth potential.

AI in Video Surveillance Market Segmentation Analysis:

-

By Offering, Hardware held the largest market share of 46.38% in 2025, while Software is expected to grow at the fastest CAGR of 17.42% during 2026–2033.

-

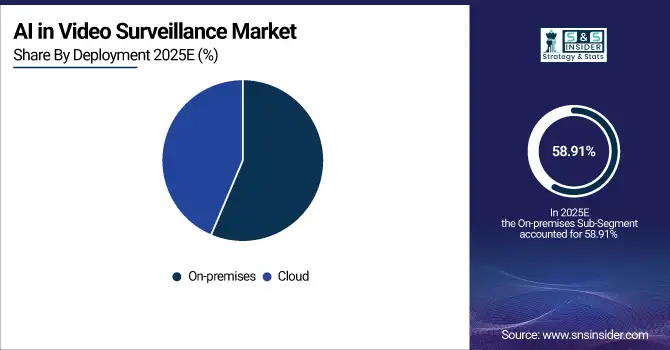

By Deployment, On-premises solutions dominated with a 58.91% share in 2025, while Cloud-based deployments are projected to expand at the fastest CAGR of 18.05% during the forecast period.

-

By Use Cases, Facial Recognition accounted for the largest share of 24.76% in 2025, while Weapon Detection is expected to grow at the fastest CAGR of 19.21% through 2026–2033.

-

By End-use, Commercial sector dominated with a 39.84% share in 2025, while Government & Public Facilities are projected to expand at the fastest CAGR of 17.68% during the forecast period.

By Deployment, On-Premises Dominates While Cloud Expands Rapidly in the Market

On-premises deployments segment led the market due to data security requirements, low-latency processing, and regulatory compliance, particularly in government, defense, and critical infrastructure applications. Over 60% of public sector AI surveillance systems remained on-premises in 2025.

Cloud-based deployments are the fastest-growing segment due to the scalability, centralized monitoring, AI-as-a-service models, and reduced infrastructure complexity. Cloud surveillance adoption grew across smart campuses, retail chains, and logistics hubs, enabling real-time multi-site analytics.

By Offering, Hardware Dominates While Software Expands Rapidly in the Market

Hardware segment dominated the market due to the large deployment of AI-enabled cameras, edge processors, GPUs, and smart sensors forming the backbone of surveillance infrastructure. Over 280 million AI-capable cameras were deployed globally in 2025, supporting real-time analytics and edge inference.

Software segment is the fastest-growing segment owing to the increasing demand for advanced video analytics, AI model updates, behavior recognition, and cloud-based management platforms. In 2025, software-based analytics platforms were deployed across over 110 million camera endpoints, enabling scalable intelligence and continuous learning.

By Use Cases, Facial Recognition Dominates While Weapon Detection Expands Rapidly in the Market During the Forecast Period

Facial recognition dominated the market due to its widespread use in access control, law enforcement, airport security, and identity verification. Over 75 countries actively deployed facial recognition systems in public and commercial spaces in 2025.

Weapon detection is the fastest-growing use case segment, driven by the rising concerns over mass violence and school security. AI-based weapon detection systems demonstrated over 95% accuracy, enabling rapid threat identification and emergency response across public facilities.

By End-Use, Commercial Dominates While Government Expands Rapidly in the Market Globally

Commercial sector dominated due to high adoption across retail, corporate offices, airports, stadiums, and campuses. AI surveillance improved theft detection, crowd management, and operational efficiency.

Government & Public Facilities are the fastest-growing segment, driven by national security investments, border surveillance, smart policing, and critical infrastructure protection initiatives globally.

AI in Video Surveillance Market Regional Analysis:

Asia Pacific AI in Video Surveillance Market Insights:

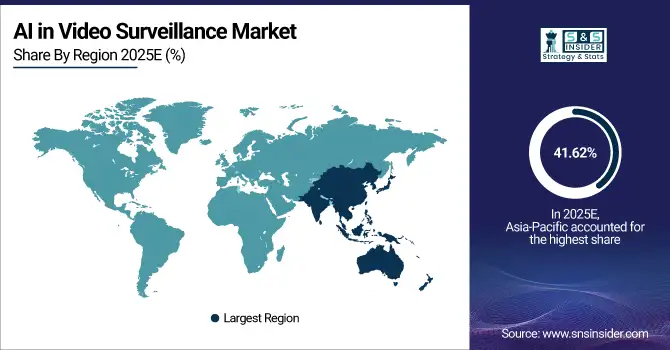

In 2025, Asia Pacific had the biggest share of the AI in Video Surveillance Market, with 41.62%. Large-scale smart city projects, a lot of cameras, and strong domestic manufacturing capabilities in China, South Korea, and Japan are all driving growth. Asia-Pacific is the biggest geographical market because of government-backed surveillance projects and the use of AI in transportation and urban monitoring.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China AI in Video Surveillance Market Insights: China is the biggest contributor in the Asia Pacific area, bringing in more than 55% of the region's revenue. Smart city projects around the country, improvements in public safety, and new AI technology are all driving growth. China is still the leader in AI-enabled surveillance systems because of its high use of facial recognition, traffic analytics, and behavioral monitoring, as well as its strong local vendors.

North America AI in Video Surveillance Market Insights:

North America is the geographic market that is growing the fastest, with a predicted CAGR of 16.82%. Enterprise security modernization, critical infrastructure protection, and the use of AI analytics in transportation and public safety are all driving growth. The U.S. leads the way in adoption in the region, with 72% of North America's revenue coming from airport surveillance, cloud-based analytics, and AI solutions that respect privacy, which significantly drive the market growth.

-

U.S. AI in Video Surveillance Market Insights: The U.S. dominates North America, contributing 72% of regional market revenue. Growth is supported by enterprise security upgrades, transportation and airport surveillance, and AI-driven threat detection across critical infrastructure. Over 65% of large U.S. enterprises have adopted AI video analytics, with cloud-based and privacy-compliant solutions accelerating adoption and establishing the U.S. as a leader in regional AI surveillance.

Europe AI in Video Surveillance Market Insights:

Transportation security, smart infrastructure, and industrial monitoring are some of the things that provide Europe a large market share. Germany, the U.K., and France are some of the most important countries. AI solutions that follow the rules are becoming more popular in the area, which is helping stable growth and use in both the public and private sectors.

-

Germany AI in Video Surveillance Market Insights: Germany is the biggest contributor in Europe, with 24% of the market share. AI is driving growth by being used in smart transportation systems, industrial surveillance, and modernizing public infrastructure. AI video analytics for traffic flow, railway security, and industrial monitoring, along with rigorous adherence to regulations, help the industry develop at a rate of more than 14% per year.

Latin America AI in Video Surveillance Market Insights:

Latin America is witnessing steady growth, supported by rising crime rates, urban expansion, and public safety surveillance investments. Brazil, Mexico, and Chile are leading adopters, with AI-enabled analytics deployed for city surveillance, traffic management, and law enforcement modernization.

-

Brazil AI in Video Surveillance Market Insights: Brazil is the largest contributor in Latin America, representing 38% of regional demand. Market expansion is supported by urban crime monitoring, metropolitan surveillance networks, and federal public safety investments. AI-enabled facial recognition and real-time incident detection are increasingly deployed across major cities, ensuring steady adoption and regional market growth.

Middle East & Africa AI in Video Surveillance Market Insights

The Middle East & Africa market is expanding due to smart city projects, critical infrastructure investments, and AI surveillance adoption in transportation hubs and public facilities. GCC countries are leading adopters, driving regional expansion.

-

Saudi Arabia AI in Video Surveillance Market Insights: Saudi Arabia leads the Middle East & Africa region, contributing 30% of regional revenue. Growth is driven by Vision 2030 smart city initiatives, large infrastructure projects, and enhanced security needs. AI video surveillance adoption is strong in airports, metro systems, and public venues, supporting a CAGR above 15%, making Saudi Arabia the regional leader in AI-enabled monitoring solutions.

AI in Video Surveillance Market Competitive Landscape:

Hikvision, founded in 2001 and based in Hangzhou, China, is a world leader in AIoT solutions and video surveillance equipment. The company sells IP cameras, video management software, access control, and AI-powered analytics for security and smart city uses in businesses, governments, and industries globally

-

In 2024, Hikvision added to its AI-powered video analytics offering, which improved edge intelligence for real-time danger detection and traffic control.

Dahua Technology, founded in 2001 and situated in Hangzhou, China, the company focuses on smart IoT solutions that are centered on video. Its products include CCTV cameras, thermal imaging systems, AI analytics, and integrated security platforms that are used around the world in the transportation, retail, energy, and public safety sectors. Dahua puts a lot of emphasis on combining AI, cloud, and edge computing.

-

In 2024, Dahua introduced upgraded WizMind AI cameras with improved facial and behavior recognition accuracy for large-scale surveillance deployments.

Axis Communications, founded in 1984 and based in Lund, Sweden, is a leader in network video technology. The company makes IP cameras, video encoders, analytics software, and access control solutions that are utilized a lot in smart cities, transit, retail, and security for important infrastructure. Axis is noted for its work in cybersecurity and open-platform innovation.

-

In 2023, Axis launched next-generation ARTPEC-8 chip–based cameras, delivering enhanced AI analytics, image quality, and improved cybersecurity performance.

Bosch Security Systems, founded in 1886 as part of Robert Bosch GmbH and based in Germany, this company offers a full range of security and communication services, such as video surveillance, intrusion detection, access control, and fire protection systems. The company works in the commercial, industrial, and public infrastructure areas all around the world, with a strong focus on reliability and AI integration.

-

In 2024, Bosch added more features to its AI-powered video analytics suite to make it better at protecting the perimeter and keeping an eye on traffic.

AI in Video Surveillance Companies are:

-

Dahua Technology

-

Axis Communications

-

Bosch Security Systems

-

FLIR Systems

-

Vivotek

-

Samsung Techwin

-

GeoVision

-

PureTech Systems

-

Avigilon (Motorola Solutions)

-

Mobotix

-

Uniview (UNV)

-

Netvue

-

BriefCam

-

Genetec

-

Honeywell Security Solutions

-

Verkada

-

Eagle Eye Networks

-

NEC Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 6.41 Billion |

| Market Size by 2033 | USD 32.52 Billion |

| CAGR | CAGR of 22.56 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Software, Hardware, Services) • By Deployment (On-premises, Cloud) • By Use Cases (Weapon Detection, Facial Recognition, Intrusion Detection, Smoke & Fire Detection, Traffic Flow Analysis, Parking Monitoring, Vehicle Identification, Others) • By End-use (Commercial, Residential, Military & Defense, Government & Public Facilities, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Hikvision, Dahua Technology, Axis Communications, Bosch Security Systems, Hanwha Techwin (Hanwha Vision), FLIR Systems, Vivotek, Samsung Techwin, GeoVision, PureTech Systems, Avigilon (Motorola Solutions), Mobotix, Uniview (UNV), Netvue, BriefCam, Genetec, Honeywell Security Solutions, Verkada, Eagle Eye Networks and NEC Corporation. |