Smart Sensors Market Size & Growth Trends:

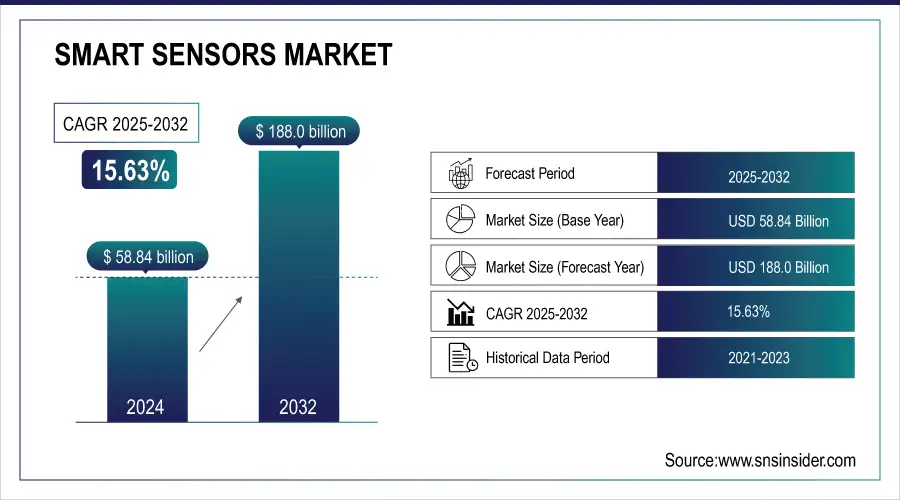

The Smart Sensors Market Size was valued at USD 58.84 Billion in 2024 and is expected to reach USD 188.0 Billion by 2032, with a growing at CAGR of 15.63% over the forecast period of 2025-2032. The smart sensors market is surging owing to growing adoption across various sectors with the expansion of the Internet of Things IoT and improvements in artificial intelligence (AI). For IoT-enabled devices, precise real-time data is essential and comes with a need for more communication, which has led to a rise in demand for smart sensors in consumer electronics, Automotive, and industrial applications. So, wearable devices, smart homes, and intelligent sensors in advanced driver-assistance systems (ADAS) in vehicles, for example, rely on smart sensors. Cellular IoT connections as a whole in the industrial sector, continued this trend of growth in 2024 with a YoY increase of 27% in 2024.

To get more information on Smart Sensors Market - Request Sample Report

The Other Major Catalyst Is The Growing Development Of Smart Cities And Infrastructure Projects Globally

Smart sensors are used in these initiatives for energy management, traffic control, and environmental monitoring applications. Along with this, the booming healthcare market with rising demand for real-time health data and remote patient monitoring has led to increased adoption of smart actuators in diagnostic equipment and wearable health monitors. Further growth of the market can be attributed to the favorable government initiatives encouraging digitization and automation, and decreasing the price of sensors along with increased technological advancement in miniaturization technologies. The IoMT market is expected to reach more than USD 70 billion by 2024, and more than 80% of U.S. hospitals are expected to have implemented remote patient monitoring systems. Also, global government spending will reach USD 5 trillion on digitization and automation between 2023 and 2026, to help support smart sensors in urban and healthcare applications.

Key Highlights of Smart Sensors Market Report:

-

Predictive Maintenance Adoption: Smart sensors enable real-time monitoring of machinery, reducing unplanned downtime by 30–50%, lowering maintenance costs by 20–30%, and enhancing reliability by up to 40%.

-

Industry 4.0 Integration: Smart sensors are essential in automating production processes, improving throughput, efficiency, and operational safety across manufacturing, energy, and transportation sectors

-

Environmental Monitoring & Sustainability: Smart sensors support air and water quality monitoring, waste management, and optimization of renewable energy, driving sustainable development and efficiency improvements.

-

Energy Efficiency Improvements: Smart grids and sensors in solar panels and wind turbines can increase energy output efficiency by up to 30% and reduce urban energy use by 10–20%.

-

Market Penetration Trends: Over 50% of industrial plants and smart towns are expected to implement AI-powered or environmental smart sensors by 2024–2025, expanding market growth.

-

Integration & Data Security Challenges: Compatibility with legacy systems, data privacy concerns, and adherence to regulations like GDPR and HIPAA remain significant barriers to adoption.

Smart Sensors Market Drivers:

-

Predictive Maintenance and Industry 4.0 Driving Smart Sensors Adoption for Enhanced Efficiency and Reliability

Apart from the IoT boom and the increasing use of AI, growing requirements of predictive maintenance in industrial applications are another major factor contributing to the growth of the smart sensors market. For example, machinery fitted with smart sensors will automatically detect key performance indicators in real time, ensuring that abnormal trends and machinery are identified and maintained on time. Transitioning from reactive to predictive maintenance ultimately decreases downtime, lowers repair costs, and enhances operational efficiency in manufacturing, energy, transportation, and other industries. As Industry 4.0 is disrupting production processes, smart sensors have now been an integral part of ever more electronics systems that have automated required production processes with higher throughput, efficiency, and safety. More than 50% of industrial plants will implement AI-powered smart sensors for predictive maintenance by 2024 Such systems can decrease unplanned downtime by 30-50%, reduce maintenance expenses by 20-30%, and enhance the reliability of the machines by up to 40%. Similarly, organizations like Nanoprecise continuously monitor 6 important parameters (vibration, acoustic emissions, speed, temperature, and humidity) to avoid machine failure and increase operational efficiency.

-

Smart Sensors Driving Environmental Monitoring and Energy Efficiency Innovations for Sustainable Global Development

Smart sensor technologies are gaining traction globally in environmental management as governments and organizations look for innovative solutions to localized issues such as air and water quality monitoring, waste management, and optimizing renewable energy production and use. Smart sensors play a major role here, from pollution detection to smart grid energy usage optimization to solar panel and wind turbine monitoring. With the world sustainability goal and various green initiatives taking place these technologies are slowly penetrating public and private sectors. With increasing environmental awareness, the need for smart sensors will increase, hence ensuring the growth potential of this market in the long run. The smart towns are expected to incorporate air quality sensors at a rate of more than 50% by 2025, leading to the reduction of localized pollution by 35%. In 2025 there will be 10 million sensors introduced globally that help improve the efficiency by 30% in case of detecting water quality issues in the Water Management area. Smart grids will also reduce energy use in city areas by 10-20%, and sensors in solar panels and wind turbines will increase energy output efficiency by up to 30%.

Smart Sensors Market Restraints:

-

Challenges in Smart Sensors Integration Data Security and Privacy Concerns Slowing Market Adoption

Challenges mentioned in Overview of Smart Sensors In general, smart sensors need to be integrated well with currently deployed systems and networks, which can be particularly difficult if there are communication protocols and data format differences. The required level of engineering and strong standards that ensure interoperability but also system reliability and system trustworthiness are a fence for adoption, especially in sectors working with legacy systems. A second issue comes to data security and privacy-related concerns. Due to the sensitive nature of the data collected by smart sensors, which may include health metrics or industrial performance statistics, such devices also become attractive targets for cyberattacks. Protecting this data while meeting strict laws such as GDPR and HIPAA makes this complex. Additionally, concerns regarding misuse and breach of data may deter certain organizations from using these technologies, causing a slowdown in market penetration.

Smart Sensors Market Segment Analysis:

By Technology Type

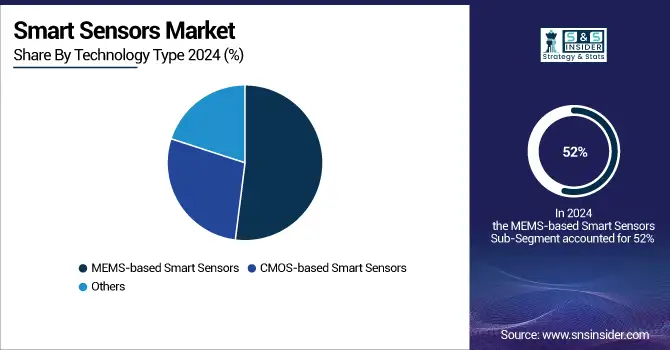

The MEMS-based smart sensors segment accounted for the highest market share of 52% in 2024 as they are mainly used in consumer electronics, automotive, and industrial applications. The combination of miniaturization, low cost, and high precision has enabled their use in devices, including, but not limited to, accelerometers, gyroscopes, and pressure sensors. Moreover, the ability of MEMS technology to scale supports the integration of more than one element into a single sensor, accelerating the adoption of high-volume applications.

CMOS-based smart sensors will witness the fastest CAGR from 2024 to 2032 for advanced imaging and processing functionalities. CMOS technology is also widely used in applications including digital cameras, medical imaging, and machine vision systems. With the capability of embedding advanced processing elements within the sensor itself, it is well-suited for AI-enabled systems and IoT applications. In addition to this, the increasing need for high-resolution and low-power imaging solutions in applications such as autonomous, security systems as well as augmented reality is likely to stimulate the growth of the CMOS smart sensor market also making it an essential technology soon.

By Sensor Type

Pressure sensors segment accounted for the highest market share of 34% in 2024 in the smart sensor market and are expected to grow with the fastest CAGR during 2024-2032. The widespread usage of these in automotive, industrial automation, and healthcare domains makes them an essential element of the technology stack globally. Pressure sensors are used in many applications including advanced driver-assistance systems (ADAS), monitoring equipment in industrial machinery, and medical devices such as ventilators, and are capable of providing accurate measurements and safety. Accelerated growth in this sector is driven by ongoing improvements in MEMS (Micro-Electro-Mechanical Systems) that have increased sensor performance, compactness, and affordability. In addition, the increasing penetration of IoT and smart devices, which leverage pressure sensor data for continuous monitoring and to optimize operations, is propelling demand growth. Such a trend can be observed in emerging economies where there is an expansion of industrial automation and healthcare digitization. This makes them integral to the global market, with an extension of features like predictive maintenance and environmental monitoring gaining more attention.

By Component

Microcontrollers segment accounted for a dominating market share of 31% in 2024, and are expected to register the highest growth rate during 2024-2032. They have become the leaders responsible for processing and managing the data within smart sensor systems to support real-time monitoring, automation, and connectivity in such applications as IoT devices, industrial automation, and automotive systems. They seem to be on a growth path roughly in line with the increasing implementation of IoT solutions and smart devices around various industries. Amidst growing demand for low-power, high-efficiency operations, microcontrollers (MCUs) form the backbone of wearable electronics, home automation, and healthcare devices. In addition, the microcontroller architecture like integrated AI and machine learning capabilities continues to enhance their availability in autonomous systems, predictive maintenance and utilized in low power or energy-intensive applications. With the Smart Manufactured Evolution of sensor domains within an intelligent and connected environment, the family of microcontrollers shall remain the pioneer.

By End Use

In 2024, Automotive segment led the market, accounting for a significant share of 32%, owing to the penetration of smart sensors in advanced driver-assistance systems (ADAS), autonomous vehicles, and safety features such as collision detection, lane-keeping systems, and airbag deployment. Rising emphasis on vehicle electrification and adoption of connected or IoT-based systems has further created a demand for the automotive smart sensor market. Key applications in automotive such as advanced driver assistance systems (ADAS), smart vehicles, and in-vehicle infotainment heavily rely on sensors to improve overall vehicle performance, safety, and efficiency, which makes the automotive sector the largest consumer of smart sensor technologies.

The Healthcare segment is expected to witness the highest compound annual growth rate (CAGR) from 2024 to 2032. The growth in this market is fuelled by the increasing adoption of telehealth care based on wearable medical devices and personal health monitoring tools based on smart sensors which represent the high market potential for the growth of the smart sensor market for the health monitoring equipment market which collects real-time data. The rapid rise in healthcare costs across the globe, increased adoption of medical technologies, and the need for advanced personalized healthcare solutions are causing this boom in demand. In addition, the pandemic has also modified telemedicine and connected health solution adoption, making the smart sensor necessary in this field. With healthcare providers focusing more on maximizing efficiency and care quality, the adoption of smart sensors will likely grow substantially.

Smart Sensors Market Regional Outlook:

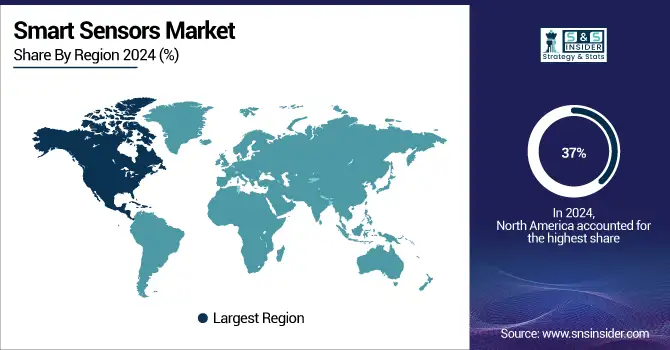

North America Smart Sensors Market Trends

North America led the global market , accounting for 37% of the global smart sensors market in 2024 due to its high adoption of innovative technologies and investment in the IoT infrastructure. A notable instance is the health care industry where, smart sensors are being extensively utilized by smart wearables such as Fitbit and Apple watch that provide real-time information on health metrics including heart rate, oxygen levels, and activity level. Texas Instruments, Analog Devices, and STMicroelectronics are among the companies that drive innovation in sensor solutions for industrial automation and automotive applications. Smart sensors, for example, are used in a multitude of manufacturing environments for predictive maintenance and process optimization. In addition, the demand for smart sensors in transportation energy and other sectors is complemented by the strategic focus of the U.S. government on IoT and smart city projects.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Smart Sensors Market Trends

The Asia Pacific region will achieve the fastest CAGR through 2032 driven by accelerating industrialization, ancient consumer electronics demand, and smart cities growth. This growth is driven by a few countries among them China, India, and Japan. To cite an instance, Chinese behemoths like Huawei and Xiaomi assemble innovative sensors in cell phones and wearable gadgets. Japan, known for its automotive industry, makes extensive use of smart sensors to improve safety and efficiency in autonomous and electric vehicles. For instance, initiatives such as Digital India in India and the advancement of smart manufacturing in China incentivize adopting smart sensor technology. For instance, South Korea's Songdo, a global hub for smart city technology, depends heavily on sensor system-based systems for energy efficiency and traffic management.

Europe Smart Sensors Market Trends

Europe holds a significant share in smart sensors, driven by automotive, aerospace, and industrial automation sectors. Germany, France, and the UK lead with smart manufacturing and Industry 4.0 initiatives. Companies like Bosch, STMicroelectronics, and Infineon provide solutions for predictive maintenance, smart factories, and connected vehicles.

Latin America Smart Sensors Market Trends

Latin America’s growth is supported by industrial modernization, transportation, and energy sector adoption. Brazil and Mexico lead demand, particularly in automotive sensors and smart infrastructure projects. Investments in IoT and smart city initiatives drive market expansion.

Middle East & Africa (MEA) Smart Sensors Market Trends

MEA growth is driven by energy management, smart city projects, and industrial automation. UAE, Saudi Arabia, and South Africa are key markets, with adoption in utilities, transportation, and industrial IoT applications. Strategic government initiatives for smart cities further support market development.

Key Smart Sensors Companies are:

-

Honeywell International (Temperature Sensors, Gas Sensors)

-

Bosch Sensortec (IMUs, Environmental Sensors)

-

STMicroelectronics (Motion Sensors, Proximity Sensors)

-

Analog Devices Inc. (Pressure Sensors, Accelerometers)

-

Infineon Technologies (Radar Sensors, Magnetic Sensors)

-

TE Connectivity (Position Sensors, Industrial Sensors)

-

ABB Ltd. (Flow Sensors, Optical Sensors)

-

OmniVision Technologies (Image Sensors, AR/VR Sensors)

-

NXP Semiconductors (Pressure Sensors, RF Sensors)

-

DENSO Corporation (Automotive Sensors, Temperature Sensors)

-

Eaton Corporation (Level Sensors, Proximity Sensors)

-

Emerson Electric Co. (Vibration Sensors, Temperature Sensors)

-

Vishay Intertechnology (Optical Sensors, Proximity Sensors)

-

Legrand (Light Sensors, Occupancy Sensors)

-

AMETEK Inc. (Position Sensors, Flow Sensors)

-

Microchip Technology Inc. (Mixed-Signal Sensors, Environmental Sensors)

-

Balluff GmbH (Industrial Sensors, Magnetic Field Sensors)

-

Siemens AG (Smart Building Sensors, Process Sensors)

-

Texas Instruments (Environmental Sensors, Motion Sensors)

-

Alpha MOS (Chemical Sensors, Gas Sensors)

Some of the Raw Material Suppliers for Smart Sensors Companies:

-

BASF SE

-

DuPont de Nemours, Inc.

-

3M Company

-

LG Chem

-

Dow Inc.

-

Solvay S.A.

-

Asahi Kasei Corporation

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

Sumitomo Electric Industries

-

SK Hynix Inc

Smart Sensors Market Competitive Insights:

STMicroelectronics, founded in 1987, is a global semiconductor leader headquartered in Geneva, Switzerland. The company designs, develops, and manufactures a broad range of integrated circuits and sensors for automotive, industrial, and consumer applications. STMicroelectronics focuses on innovation, energy efficiency, and enabling smart, connected technologies worldwide.

-

In October 2024, STMicroelectronics unveiled the ST1VAFE3BX, a groundbreaking bio-sensing chip for healthcare wearables like smartwatches and fitness bands, combining biopotential sensing with AI-powered activity detection for improved efficiency and lower power consumption.

Bosch Sensortec, a subsidiary of Bosch Group established in 2005 and headquartered in Germany, specializes in designing and manufacturing microelectromechanical systems (MEMS) sensors. The company provides innovative sensing solutions for consumer electronics, IoT devices, and industrial applications, focusing on precision, energy efficiency, and enabling smart, connected technologies globally.

-

In January 2024, Bosch Sensortec used CES 2024 to launch a smart connected sensors platform for full body motion tracking, plus what it claims is the world’s smallest MEMS accelerometers for wearables and wearables.

OmniVision Technologies, founded in 1995 and headquartered in California, USA, is a leading provider of advanced digital imaging solutions. The company develops high-performance image sensors and camera solutions for smartphones, automotive, security, and AR/VR applications, focusing on innovation, image quality, and enabling smarter, connected visual experiences worldwide.

-

In August 2024, OMNIVISION launched the OV50M40, a 50-megapixel CMOS image sensor with advanced HDR capabilities and low-light performance, designed for smartphone front, main, ultra-wide, and telephoto cameras.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 58.84 Billion |

| Market Size by 2032 | USD 188.0 Billion |

| CAGR | CAGR of 15.63% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type (Motion Sensors, Temperature Sensors, Pressure Sensors, Image Sensors, Touch Sensors, Position Sensors, Others) • By Technology Type (MEMS-based Smart Sensors, CMOS-based Smart Sensors, Others) • By Component (Analog-to-Digital Converters (ADC), Digital-to-Analog Converters (DAC), Amplifiers, Microcontrollers, Others) • By End Use (Healthcare, Automotive, Infrastructure, Industrial, Consumer Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Honeywell International, Bosch Sensortec, STMicroelectronics, Analog Devices Inc., Infineon Technologies, TE Connectivity, ABB Ltd., OmniVision Technologies, NXP Semiconductors, DENSO Corporation, Eaton Corporation, Emerson Electric Co., Vishay Intertechnology, Legrand, AMETEK Inc., Microchip Technology Inc., Balluff GmbH, Siemens AG, Texas Instruments, Alpha MOS. |