IP CAMERA MARKET KEY INSIGHTS:

To Get More Information on IP Camera Market - Request Sample Report

The IP Camera Market was valued at USD 1.42 Billion in 2023 and is expected to reach USD 2.49 Billion by 2032 and grow at a CAGR of 6.51% over the forecast period 2024-2032.

The IP camera market is growing due to increasing demand for improved security among residential, industrial, and commercial applications. Rising security threats are opting for the trend of IP cameras with advanced features including HD videos, remote monitoring, and real-time alerts. IP cameras are much better than their analog counterparts as they offer higher resolution, easier scalability, and can be integrated with other IoT-enabled devices thus making them the perfect solutions for a modern security system. Over 90% of units sold during the current year in the IP camera market support at least 1080p resolution or greater. The utilization of AI-enabled cameras that have features like human detection and motion sensing experienced a 40% year-over-year increase between the years 2023 and 2024. Cloud storage and built-in mobile app features have accounted for 60% of the fresh installations. India continues to feel the rise of property crimes that account for more than 60% of all reported crimes with IP camera demand and multi-camera systems forecast for a consistent growth rate of 30% through the commercial and residential segments.

Furthermore, IoT trends and technologies like artificial intelligence (AI) and machine learning (ML), are supporting the IP camera market to implement innovative features including facial recognition, movement of object detection, and motion analysis. Such intelligent features allow automating the security protocols to reduce human intervention and thus, enhance the efficiency of the surveillance system. Furthermore, the growing use of cloud-based storage solutions for storing video content is also increasing the demand as it offers users a wide range of flexible storage options as well as convenient accessibility to archived footage. Facial recognition was featured in 25% of all new IP camera systems deployed in 2023–2024, and the use of AI and ML for many other advanced camera features, such as object movement detection, motion analysis, etc., showed a strong growth of over 30%. 50% of IP cameras were integrated with the cloud for video storage, a more flexible and scalable approach. The overall robustness of security awareness along with technological advancement is driving the IP camera market.

MARKET DYNAMICS

KEY DRIVERS:

-

Smart City Investments Drive IP Camera Market Growth with 5G and Cloud Integration for Enhanced Security

Infrastructure modernization is one of the significant factors fuelling the demand for the IP camera market, especially among growing cities. Governments and private entities are pouring billions into smart city projects with a focus on advanced security and surveillance networks, as quick urbanization continues. Such projects place a tremendous focus on IP cameras since they can be effortlessly connected to larger networks, and provide real-time data transmission important for augmenting the successful monitoring of public areas. The modernization of this infrastructure also includes improved connectivity choices, like 5G, enabling IP cameras to stream HD video with low delay time. Smart city use cases have attracted over USD 35 billion of investments worldwide in 2023-2024, resulting in the installation of 10 million IP cameras. These systems with integrated 5G connectivity with 60% could even allow for 4K video streaming at near-zero latency. Moreover, 80% of installations utilized cloud integration for expandable storage, and 75% were developed to be integrated into larger IoT ecosystems to promote public safety monitoring. The rapid urbanization of cities, coupled with their robust expansion, has once again brought attention to the need for seamless interoperability between surveillance infrastructure such as IP cameras to keep the public safe and secure.

-

Industrial Demand Drives IP Camera Market Growth with Enhanced Safety Productivity and Efficiency Solutions

Another important factor is the increasing requirement for IP cameras in industrial and critical infrastructure applications, where safety and monitoring are also vital to business operations as well as security. IP cameras are increasingly used in industries such as energy, transportation, and manufacturing for equipment monitoring, anomaly detection, and regulatory safety compliance. High-definition and thermal imaging helps detect potential hazards early on, leading to fewer accidents and damage in these high-risk areas where cameras are invaluable. Furthermore, IP cameras generate data that can be tracked and analyzed to increase productivity, decrease downtime, and improve workflow.

1.5 million IP cameras were deployed in energy, transportation, and other manufacturing sectors between 2023-2024, resulting in 30% fewer accidents thanks to HD and thermal imaging. Data from some of the top companies reveals that 85% of companies used IP cameras for anomaly detection and hence reduced 20% downtime. Data from these systems increased productivity by 70% while increasing safety compliance in industrial processes. This increasing demand for industrial safety and operational insight is noticed as the key factor when it comes to driving the IP camera market owing to that companies across various core sectors are on the lookout for comprehensive by way of effective solutions with which they can improve their industrial process safety and efficiency.

RESTRAIN:

-

Privacy and Security Challenges Pose Hurdles for IP Camera Market Growth Amid Rising Cyber Risks

One of the key challenges in the IP camera market, limited to this report is that privacy concerns with IP cameras not only suites for outside footage but also records videos inside homes/offices and other places constantly. Additionally, the ethical implications of this continuous monitoring can trigger regulatory activity and stricter data protection legislation. Furthermore, meeting data privacy laws like GDPR is harder than ever enterprises need to apply the right practices for securely handling personal data while still having a demand for monitoring deep. Network security is another big hurdle that must be crossed as IP cameras are connected to the internet and may be open targets for cyber-attacks. If these devices are affected by hacking risks, they may have functionality issues where footage is compromised and opens up to anyone other than the eyes that were meant for it. The vulnerability is more impactful for organizations that depend on IP camera cameras to protect, a breach can cause great damage such as operational bankruptcy and critical equipment being destroyed. While necessary to combat these cyber risks, this will create significant challenges around the implementation and maintenance of IP camera systems through default encryption and cybersecurity protocols mounting up.

KEY SEGMENTATION ANALYSIS

BY COMPONENT

The IP camera hardware segment accounted for a major share of 72% of the overall market in 2023. This supremacy layers over the significance of physical elements high degree video cameras, high degree sensing units, and storage space tools that are needed for the performance of IP surveillance systems. The growing demand for advanced hardware solutions to support high-definition image quality and sophisticated functionalities is mainly driven by enterprises and consumers alike. Such as infrared vision, weather-proof covering, and mass storage capacity all of these functions gain favor for dogged and reliable components during installation keeping in mind that the equipment will be housed in many practical areas i.e. commercial sites of work and public facilities.

The services segment is projected to have the highest CAGR growth from 2024-2032 as well because of the increasing need for maintenance and other cloud storage solutions along with real-time monitoring services. With the increasing sophistication of IP camera systems, users increasingly seek professional support for both installation and network integration along with ongoing technical support. Moreover, cloud-based services are gaining a lot of popularity as they save more time and allow users to access the footage from anywhere by storing it online such as video storage and AI-driven video analytics together. Therefore, the transition towards service-dependent solutions enables end users to leverage their IP camera systems further contributing to the robust growth of the services segment for the rest of the forecast period.

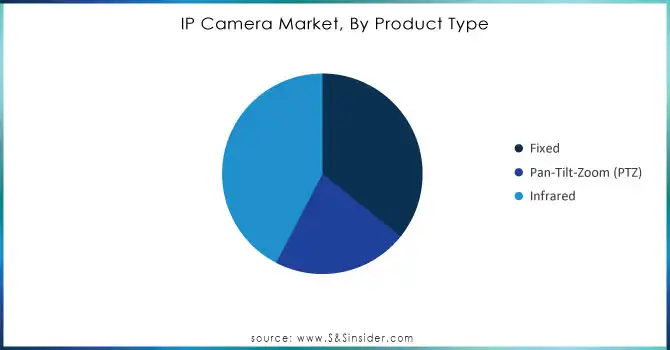

BY PRODUCT TYPE

Infrared IP cameras accounted for the largest market share of 42% in 2023 The increasing need for these cameras, being used for 24×7 surveillance in sensitive areas such as banks and ATMs where low-light or no-light visibility is desired, has led to its dominance. Infrared cameras are famously used in night vision applications: they can take high-resolution images using just their infrared sensors, which makes this technology very popular among people who want to spotlight locations such as warehouses, parking lots, and industrial sites even in total darkness. Growing focus on continuous monitoring across numerous end-use applications has propelled the infrared technology adoption, strengthening its market share.

Pan-Tilt-Zoom cameras are poised to have the highest CAGR growth rate throughout 2024–2032. Part of this growth comes from PTZ cameras for their versatility, they offer the ability to control the camera remotely and pan, tilt, or zoom in on a given field of study. PTZ cameras are best for moving surveillance locations such as large public spaces, event venues, and city monitoring where flexible coverage is needed. PTZ cameras are highly popular for modern security needs due to their features of covering broad areas and aligning views from remote locations, thereby making them expected to grow rapidly over the next few years.

Do You Need any Customization Research on IP Camera Market - Inquire Now

BY CONNECTION TYPE

The consolidated market segment accounted for a 71% share of the overall IP Camera market in 2023. The major share can be attributed to the rising demand for a unified solution in security systems, organizations from large enterprises, government, and critical infrastructure all prefer conventional IP camera systems over scattered subsystems which provide better control, monitoring, and scalability. With looks like high-resolution video feeds, cloud storage, and remote accessibility as key features of a consolidated system, they can be ideal for large-scale surveillance projects.

The distributed segment shall rise with a significant CAGR from 2024 to 2032. As small and medium-sized businesses, as well as residential communities, become more open to consolidation, distributed systems are inherently much more adaptable and scalable than their consolidated counterparts. Cameras can be connected in stand-alone mode from different locations, without requiring a central server. The growing popularity of edge computing, which moves data processing closer to the camera as well as cloud-based solutions, bolsters distributed systems. This availability, cost-efficiency, and increasing need for more decentralized security solutions in other sectors are driving the high CAGR of the distributed segment.

BY END USE

In 2023, the commercial segment accounted for 62% of the total market share, due to the growing demand for surveillance solutions across different commercial sectors, from retail and banking to transportation and government buildings. These sectors require security, asset protection, and a compliance environment with multiple safety standards and regulations that need surveillance technologies due to high demand. With features of high-definition video quality, remote monitoring, and integration with other security systems that make them suitable for large-scale commercial operations they are IP Cameras.

The residential segment is projected to have the highest CAGR from 2024 to 2032. The increasing trend of smart homes, rise in home security awareness and affordable price of IP cameras have propelled the demand for residential surveillance solutions. Consumers across the region are becoming more concerned about their safety and the security of property, which makes them use IP camera systems for home monitoring even more compared to the previous few years with rising online shopping trends supported by less push towards on-site visit primaries.

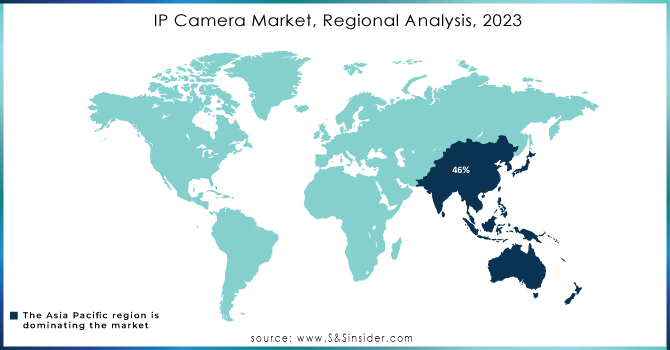

REGIONAL ANALYSIS

The IP camera market was led by Asia Pacific in 2023, which accounted for 46% of the overall market. The growth in the region is due to rapid urbanization, increasing investments for infrastructural development, and security interest by burgeoning economies like China Japan, India, and South Korea. High-definition video surveillance has emerged to fulfill the need of demand in sectors such as transportation, retail, and government. China's "Safe Cities" program, for instance, has driven the proliferation of millions of IP cameras to improve public safety. The rising penetration of smart city initiatives in multiple metropolitan regions has also supported the growth of demand for IP cameras across the region, awarding Asia Pacific with a lion's share in the market.

Latin America is estimated to register a maximum CAGR during 2024–2032. The reasons for this growth include growing concerns about safety and crime rates, increased urbanization, and the adoption of more intelligent technologies within homes and companies. High urban crime in Brazil, Mexico, and Argentina has created a greater demand for security solutions. Take Brazil for example, the increasing adoption of IP cameras used by both private and public institutions to monitor urban security as well as hosting large-scale events such as the World Cup and Olympics has been a solid market driver. With the growing middle class in the region and cheaper IP technology,

Key Players

Some of the major players in the IP Camera Market are:

-

Bosch Security Systems (Bosch IP 4000, Flexidome IP Camera)

-

Arecont Vision Costar LLC. (MegaVideo IP Camera, ConteraIP Series)

-

Avigilon Corporation (H4 IP Camera, H5 Camera)

-

Canon Inc. (VB-C60, VB-M50B)

-

Belkin International Inc. (NetCam HD, F7D7601)

-

Zhejiang Dahua Technology Co. Ltd. (IPC-HFW1431S, IPC-HDW5231R-Z)

-

D-Link Corporation (DCS-5222L, DCS-8010LH)

-

GeoVision Inc. (GV-BX4700, GV-EFD6700)

-

Hangzhou Hikvision Digital Technology Co. Ltd. (DS-2CD2085FWD-I, DS-2CD3132-I)

-

Honeywell International Inc. (EquIP Series, Performance Series)

-

Guangzhou Juan Intelligent Joint Stock Co. Ltd. (JUAN 4K IP Camera, JN-2105)

-

March Networks Corporation (8200 Series, 9000 Series)

-

MOBOTIX AG (MOBOTIX M15, MOBOTIX M24)

-

Netgear Inc. (Arlo Pro 3, Arlo Ultra)

-

Pelco by Schneider Electric (Sarix Professional, Opera 180)

-

Samsung Electronics Co. Ltd. (SNB-6004, SNV-7080)

-

Shenzhen Apexis Electronic Co. Ltd. (Apexis IP Camera, APM-J903)

-

Shenzhen Wanscam Technology Co. Ltd. (Wanscam HW0039, Wanscam JW001)

-

Sony Corporation (Sony SNC-VM772R, SNC-ER580)

-

Vivotek Inc. (IB8369, IP9160-H)

Some of the Raw Material Suppliers for IP Camera Companies:

-

3M

-

LG Chem

-

SABIC

-

BASF

-

DuPont

-

Dow

-

Solvay

-

BASF

-

Mitsubishi Chemical

-

Sumitomo Chemical

RECENT TRENDS

-

In September 2024, Artificial Intelligence Technology Solutions, Inc. unveiled RADCam™, an innovative residential security product, through its subsidiary Robotic Assistance Devices Residential, Inc. (RAD-R).

-

In July 2024, Honor launched the Xiaopai Smart Camera Pro, a home security device with a triple-lens system and 4MP sensors for high-definition video capture.

-

In January 2024, Xiaomi introduced the 360 Home Security Camera 2K, offering AI Human Detection, 2K resolution, and 360-degree coverage for enhanced security.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.42 Billion |

| Market Size by 2032 | USD 2.49 Billion |

| CAGR | CAGR of 6.51% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Component (Hardware, Services) • by Product type (Fixed, Pan-Tilt-Zoom (PTZ), Infrared) • by Connection Type (Consolidated, Distributed) • by End Use (Residential, Commercial, Government) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bosch Security Systems, Arecont Vision Costar LLC., Avigilon Corporation, Canon Inc., Belkin International Inc., Zhejiang Dahua Technology Co. Ltd., D-Link Corporation, GeoVision Inc., Hangzhou Hikvision Digital Technology Co. Ltd., Honeywell International Inc., Guangzhou Juan Intelligent Joint Stock Co. Ltd., March Networks Corporation, MOBOTIX AG, Netgear Inc., Pelco by Schneider Electric, Samsung Electronics Co. Ltd., Shenzhen Apexis Electronic Co. Ltd., Shenzhen Wanscam Technology Co. Ltd., Sony Corporation, Vivotek Inc. |

| Key Drivers | • Smart City Investments Drive IP Camera Market Growth with 5G and Cloud Integration for Enhanced Security • Industrial Demand Drives IP Camera Market Growth with Enhanced Safety Productivity and Efficiency Solutions |

| Restraints | • Privacy and Security Challenges Pose Hurdles for IP Camera Market Growth Amid Rising Cyber Risks |