AI Orchestration Market Size & Overview:

Get more information on AI Orchestration Market - Request Free Sample Report

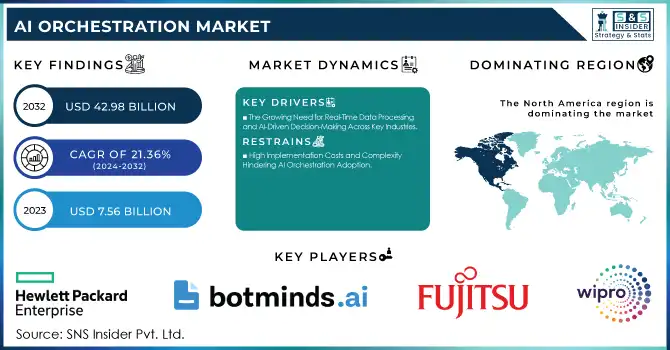

AI Orchestration Market was valued at USD 7.56 billion in 2023 and is expected to reach USD 42.98 billion by 2032, growing at a CAGR of 21.36% from 2024-2032.

The AI Orchestration market is growing rapidly as businesses increasingly adopt artificial intelligence and automation technologies to streamline operations and enhance decision-making. This adoption is driven by the need to optimize workflows, reduce operational costs, and improve overall productivity, creating significant demand for AI orchestration solutions. As organizations strive for greater efficiency, they are turning to AI orchestration to integrate disparate systems, which enables seamless processes across various platforms and ensures smooth collaboration. Industries such as healthcare, finance, retail, and manufacturing are leading the way in this transformation, using AI orchestration to improve customer experiences, automate routine tasks, and create more intelligent workflows. Notably, In 2024, the European Commission approved Nvidia's USD 700 million acquisition of the AI infrastructure startup Run:ai, which will enhance its AI computing capabilities, including the DGX Cloud platform.

This growing demand for AI orchestration is fueled by the increasing complexity of business processes and the need to manage large volumes of data in real-time. In 2024, Emergence AI introduced its autonomous multi-agent orchestrator to advance web automation and enterprise efficiency, marking a significant step forward in addressing these challenges. As the amount of data businesses generate continues to surge, the need for tools that can effectively manage and optimize this information becomes more critical, which further accelerates the demand for AI orchestration solutions. Additionally, the rise of cloud computing, big data analytics, and the Internet of Things is pushing organizations to consolidate their technological infrastructure, making AI orchestration even more essential. With businesses aiming to simplify operations and leverage the full potential of AI, AI orchestration has become a crucial element in achieving these goals.

Looking ahead, the future of the AI orchestration market is filled with promising opportunities, driven by advancements in machine learning, natural language processing, and edge computing. In November 2024, Microsoft introduced three AI frameworks, AutoGen 0.4, Magentic-One, and TinyTroupe—designed to enhance AI development through collaborative multi-agent systems. These innovations are expected to unlock new applications and use cases for AI orchestration, thus broadening its scope and accelerating market growth. As organizations increasingly prioritize personalized customer experiences and intelligent decision-making, they will demand more sophisticated AI orchestration systems that can handle complex, multi-layered AI environments. This, in turn, will fuel global expansion, with emerging economies recognizing the value of AI orchestration to drive digital transformation and enhance their technological capabilities.

MARKET DYNAMICS

DRIVERS

-

The Growing Need for Real-Time Data Processing and AI-Driven Decision-Making Across Key Industries

The growing need for real-time data processing and decision-making is transforming industries like healthcare, finance, and manufacturing. With the surge in data volume and the necessity for rapid insights, organizations are increasingly relying on AI orchestration to streamline workflows that operate in real-time. In healthcare, real-time AI helps in diagnosing and predicting patient outcomes instantly, while in finance, it enables faster risk assessments and fraud detection. Manufacturing benefits from real-time AI by optimizing production lines and detecting issues before they escalate. As these industries strive for greater efficiency and competitiveness, AI orchestration is essential in managing and automating real-time workflows, ensuring accurate and timely decisions. This shift is accelerating the demand for advanced AI solutions capable of handling dynamic, high-speed operations.

-

Rising Adoption of AI and Machine Learning Across Industries

According to research, 42% of large organizations have already deployed AI, while 40% are still exploring AI adoption. As businesses increasingly adopt AI and machine learning technologies to automate operations, improve decision-making, and deliver personalized customer experiences, the need for effective management and integration of these technologies becomes critical. AI orchestration tools play a pivotal role in streamlining the deployment and coordination of AI models, ensuring seamless interaction between systems, and optimizing resource allocation. With the growing reliance on AI-powered solutions in sectors like healthcare, finance, retail, and manufacturing, orchestration platforms are essential for scaling AI workloads, managing data pipelines, and integrating AI components. As AI adoption continues to rise, the demand for orchestration tools will grow, enabling businesses to harness these technologies for innovation and operational efficiency.

RESTRAINTS

-

High Implementation Costs and Complexity Hindering AI Orchestration Adoption

Deploying AI orchestration platforms demands substantial investment in both technology and skilled personnel, which can be a significant challenge for smaller organizations or those with limited budgets. The process involves not only the purchase of specialized software but also the integration of complex systems across various departments. Additionally, the need for expert knowledge to configure, manage, and optimize these platforms further increases costs. AI project costs are influenced by a variety of factors, including development, hardware, data quality, feature complexity, and integration with existing systems. As a result, costs can range from USD 5,000 for simple models to over USD 500,000 for more complex solutions. As AI orchestration platforms are often tailored to specific use cases, customization can also add to the complexity and price. For businesses with constrained resources, the upfront financial and time commitments required for implementation can be a major deterrent. This barrier limits the accessibility of AI orchestration tools, especially for smaller companies or those in emerging markets.

-

Challenges in Integrating AI Orchestration with Existing Systems

Integrating AI orchestration tools with a company's existing IT infrastructure, systems, and processes can be a complex and time-consuming task. This is particularly true for businesses with fragmented or outdated technological ecosystems, where multiple systems might not be compatible with modern orchestration platforms. The integration process often requires substantial customization, data migration, and re-engineering of workflows to ensure seamless functionality. As a result, businesses may face delays in implementation or encounter significant roadblocks during the integration phase. Moreover, the lack of standardized systems can make it difficult to achieve full compatibility, further complicating the adoption of AI orchestration tools. These integration challenges can deter organizations from fully embracing AI orchestration solutions, particularly when the perceived effort and costs outweigh the benefits.

SEGMENT ANALYSIS

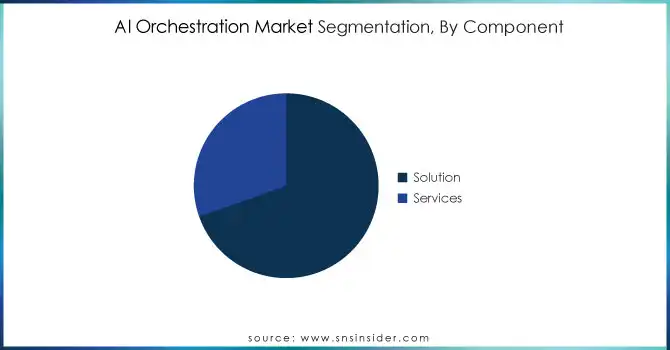

By Component

In 2023, the Solution segment dominated the AI orchestration market, accounting for around 70% of the revenue share. This dominance can be attributed to the increasing demand for comprehensive, ready-to-deploy AI orchestration tools that address specific business needs. Solutions offer businesses the ability to quickly integrate AI into their operations, automate workflows, and optimize processes, making them a preferred choice for organizations seeking immediate, scalable results with minimal operational disruption.

The Services segment is expected to grow at the fastest CAGR of about 23.91% from 2024 to 2032. As businesses continue to invest in AI orchestration solutions, the need for expert guidance, customization, and ongoing support has surged. Services such as consulting, system integration, and maintenance play a vital role in helping organizations optimize their AI deployments, adapt to evolving technologies, and ensure seamless performance. This growing reliance on specialized services is driving rapid expansion in this segment.

By Organization Size

In 2023, the Large Enterprises segment dominated the AI orchestration market, with the 77% of the revenue share. This dominance can be attributed to their substantial investments in advanced AI technologies and the need for complex, large-scale orchestration solutions. Large enterprises often have diverse and fragmented systems, making AI orchestration critical for ensuring seamless integration, optimizing workflows, and enhancing operational efficiency across multiple departments and functions.

The Small and Medium-sized Enterprises segment is expected to grow at the fastest CAGR of about 24.01% from 2024 to 2032. As AI technology becomes more accessible, Small and Medium-sized Enterprises are increasingly adopting AI orchestration tools to streamline their operations and improve decision-making. With growing awareness of the benefits of automation and data-driven insights, Small and Medium-sized Enterprises are leveraging these platforms to remain competitive, reduce costs, and scale more efficiently, driving significant growth in this segment over the forecast period.

By Deployment Mode

In 2023, the On-Premise segment led the AI orchestration market, accounting for approximately 56% of the revenue share. This dominance is driven by the preference of large organizations for greater control over their data and infrastructure. On-premise solutions offer enhanced security, compliance with industry regulations, and customization options, making them ideal for businesses with stringent data privacy requirements and complex, legacy systems that require high levels of integration and management.

The Cloud segment is expected to experience the fastest CAGR of about 22.83% from 2024 to 2032. Cloud-based AI orchestration offers scalability, cost-efficiency, and flexibility that attract a growing number of businesses, particularly Small and Medium-sized Enterprises. With the increasing adoption of cloud services and the demand for agile, remote solutions, companies are turning to cloud-based platforms to streamline operations, scale efficiently, and benefit from continuous updates and innovation, driving substantial growth in this segment.

By Application

In 2023, the Customer Service Orchestration segment led the AI orchestration market, capturing approximately 41% of the revenue share. This dominance is driven by the increasing demand for automated, AI-powered customer service solutions that enhance efficiency and improve customer experiences. Businesses are leveraging AI to streamline support processes, provide personalized interactions, and reduce response times, making customer service orchestration a critical component in driving customer satisfaction and operational efficiency.

The Workflow Orchestration segment is poised to grow at the fastest CAGR of 23.21% from 2024 to 2032. The rising need for businesses to automate and optimize internal processes is fueling this growth. Workflow orchestration allows organizations to streamline tasks across departments, improve productivity, and ensure seamless collaboration between systems. As companies continue to adopt AI-driven solutions for greater operational agility, the demand for workflow orchestration is expected to surge, driving substantial growth in this segment.

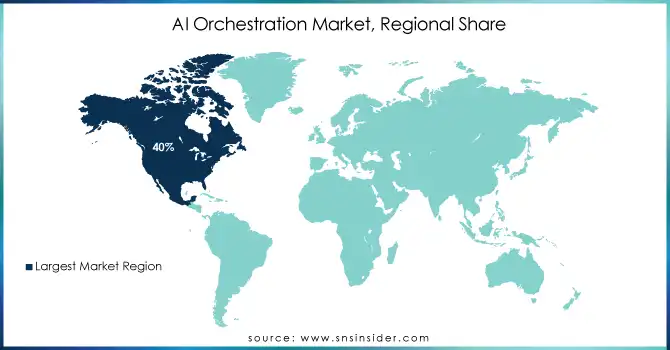

REGIONAL ANALYSIS

In 2023, North America dominated the AI orchestration market, capturing around 40% of the revenue share. This leadership can be attributed to the region’s strong technological infrastructure, high investment in AI research and development, and the presence of numerous key market players. Businesses across North America are early adopters of AI technologies, driving demand for advanced orchestration solutions to streamline operations and enhance productivity across industries such as healthcare, finance, and retail.

The Asia Pacific region is expected to experience the fastest CAGR of about 23.94% from 2024 to 2032. The rapid digital transformation across countries like China, India, and Japan is fueling the adoption of AI orchestration solutions. With a large number of SMEs embracing AI for cost-efficiency and scalability, combined with growing investments in technological infrastructure, Asia Pacific is poised for significant market expansion. This dynamic growth is driven by increasing demand for AI-powered automation and integration across various sectors.

Need any customization research on AI Orchestration Market - Enquiry Now

KEY PLAYERS

-

Wipro Limited (Wipro HOLMES, AI and Automation Platform)

-

Fujitsu Limited (Fujitsu AI Orchestration, Fujitsu RunMyProcess)

-

Cisco Systems, Inc. (Cisco Webex, Cisco AI-Driven Network Automation)

-

Hewlett Packard Enterprise Company (HPE GreenLake, HPE OneView)

-

BMC Software, Inc. (BMC Helix, BMC Control-M)

-

TIBCO Software Inc. (TIBCO Cloud Integration, TIBCO Spotfire)

-

General Electric Company (Predix, GE Digital)

-

Oracle Corporation (Oracle Cloud Infrastructure, Oracle Autonomous Database)

-

IBM Corporation (IBM Watson Orchestrate, IBM Cloud Pak for Automation)

-

Rapid Acceleration Partners, Inc. (RAP AI Solutions, AI-driven Workflow Automation)

-

Botminds.ai (Botminds AI, Document Automation)

-

CA Technologies (CA Automic, CA Digital Automation)

-

Activeeon S.A.S. (ProActive Orchestration, ProActive Cloud Scheduler)

-

AltaSigma GmbH (AltaSigma Automation, AltaSigma AI Orchestrator)

-

ModelOp (ModelOp Center, ModelOp Deploy)

-

Appian (Appian Low-Code Automation, Appian AI)

-

Union.ai (Union.ai Orchestration Platform, Union.ai Data Pipelines)

-

Eaton (Eaton Intelligent Power Manager, Eaton AI-driven Energy Management)

-

VMware (VMware vRealize Automation, VMware Cloud Foundation)

-

SAP (SAP AI, SAP Business Technology Platform)

-

Microsoft (Microsoft Azure AI, Microsoft Power Automate)

-

Google (Google Cloud AI, Google Kubernetes Engine)

-

Schneider Electric (EcoStruxure, Schneider Electric AI Solutions)

-

ABB (ABB Ability, ABB AI and Automation Solutions)

RECENT DEVELOPMENTS

-

In 2024, Wipro announced a strategic partnership with Dell Technologies to enhance its Enterprise AI-Ready Platform, integrating advanced AI capabilities from Dell and NVIDIA.

-

In October 2024, Fujitsu launched the first AI application to prevent quality degradation in 5G networks, integrated with its O-RAN orchestration platform for optimized performance and cost efficiency.

-

In June 2024, Cisco unveiled new AI-powered innovations and a $1 billion global AI investment fund at Cisco Live 2024, aimed at enhancing digital resilience, security, and observability for customers, while supporting AI-driven growth and infrastructure development.

-

In June 2024, Hewlett Packard Enterprise introduced new AI and hybrid cloud programs, including AI channel tools, NVIDIA collaborations, and enhanced HPE GreenLake capabilities, to boost partner profitability and drive hybrid cloud growth.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 21.36 Billion |

| Market Size by 2032 | USD 44.82 Billion |

| CAGR | CAGR of 21.36% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Organization Size (Large Enterprises, Small and Medium-sized Enterprises) • By Application (Workflow Orchestration, Customer Service Orchestration, Infrastructure Orchestration, Manufacturing Orchestration, Others) • By Deployment Mode (On-Premise, Cloud) • By End User (IT and Telecom, Healthcare, Manufacturing, Retail, Finance) • By Component (Solution, Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Wipro Limited, Fujitsu Limited, Cisco Systems, Inc., Hewlett Packard Enterprise Company, BMC Software, Inc., TIBCO Software Inc., General Electric Company, Oracle Corporation, IBM Corporation, Rapid Acceleration Partners, Inc., Botminds.ai, CA Technologies, Activeeon S.A.S., AltaSigma GmbH, ModelOp, Appian, Union.ai, Eaton, VMware, SAP, Microsoft, Google, Schneider Electric, ABB. |

| Key Drivers | • The Need for Seamless Integration Across Complex AI and Technology Ecosystems • Rising Adoption of AI and Machine Learning Across Industries |

| RESTRAINTS | • High Implementation Costs and Complexity Hindering AI Orchestration Adoption • Challenges in Integrating AI Orchestration with Existing Systems |