Big Data Analytics Market Report Scope & Overview:

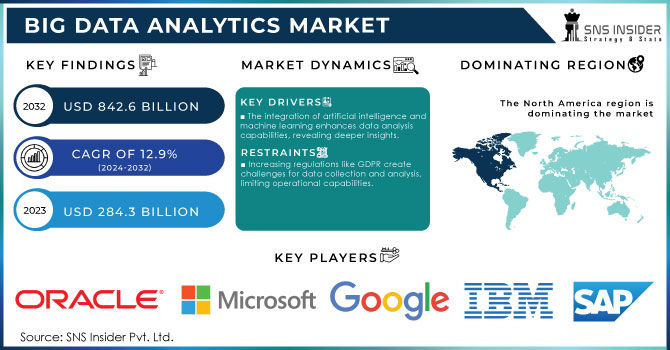

Big Data Analytics Market was valued at USD 320.7 billion in 2025E and is expected to reach USD 842.6 billion by 2033, growing at a CAGR of 12.9% from 2026-2033.

The Big Data Analytics market has experienced significant growth, driven by the increasing volume of data generated across various industries. The exponential increase in data generation, estimated to reach 175 zettabytes by 2025, necessitates advanced analytics solutions for effective data management and decision-making. Organizations leverage this data to gain insights that improve operational efficiency and enhance customer experiences. Additionally, the rise of cloud computing has enabled businesses to access and analyze vast datasets more cost-effectively, further driving market growth. Another critical factor is the growing adoption of artificial intelligence (AI) and machine learning (ML) technologies. These tools facilitate more sophisticated data analysis, enabling companies to uncover patterns and trends that were previously difficult to detect. A report indicates that 55% of organizations are now utilizing AI in their analytics processes, a trend that is likely to continue as AI capabilities advance.

Get More Information on Big Data Analytics Market - Request Sample Report

Big Data Analytics Market Size and Forecast:

-

Market Size in 2025: US$ 320.7 Billion

-

Market Size by 2033: US$ 842.6 Billion

-

CAGR: 12.9% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Big Data Analytics Market Key Trends:

-

AI-driven augmented analytics – Artificial Intelligence and machine learning are automating data insights, simplifying complex analytics, and enabling faster, more accurate business decisions.

-

Cloud migration and data democratization – Organizations are moving data to cloud platforms, ensuring scalable storage, real-time processing, and wider access to actionable insights across departments.

-

Real-time and streaming analytics – Growing demand for instant data analysis allows businesses in finance, healthcare, and retail to act immediately on live data for competitive advantage.

-

Predictive and prescriptive analytics – Companies are leveraging historical and real-time data to forecast trends and recommend optimal actions, improving operational efficiency and reducing risks.

-

Data privacy and governance – Stricter regulations and ethical considerations are driving enterprises to implement robust data governance and compliance frameworks.

-

Integration with IoT and edge computing – IoT-generated data is being analyzed at the edge, enhancing decision-making speed and operational efficiency for industries like manufacturing and logistics.

Moreover, industries such as healthcare, retail, finance, and manufacturing increasingly leverage big data analytics for predictive analytics, customer segmentation, and risk management. For instance, in healthcare, data analytics is being used to improve patient outcomes and optimize operational workflows, leading to a projected market growth in this sector of around 23% annually.

The U.S. Big Data Analytics market size was valued at an estimated USD 118.5 billion in 2025 and is projected to reach USD 315.8 billion by 2033, growing at a CAGR of 13.0% over the forecast period 2026–2033. Market growth is driven by the increasing volume of structured and unstructured data generated across industries such as BFSI, healthcare, retail, IT & telecom, and government. Rising adoption of cloud computing, artificial intelligence, and machine learning technologies to gain real-time insights and improve decision-making is significantly boosting demand. Additionally, growing investments in data-driven digital transformation initiatives, advancements in data visualization and predictive analytics, and the presence of major technology providers further strengthen the growth outlook of the U.S. big data analytics market during the forecast period.

Big Data Analytics Market Drivers:

-

The integration of artificial intelligence and machine learning enhances data analysis capabilities, revealing deeper insights.

-

Widespread use of cloud services allows for scalable, cost-effective data storage and processing

-

Companies leverage data analytics to improve decision-making, optimize operations, and enhance customer experiences.

Companies are increasingly leveraging data analytics to refine decision-making, optimize operations, and enhance customer experiences, significantly impacting the big data analytics market. As organizations face the challenge of navigating vast amounts of data—projected to reach 175 zettabytes by 2025—they rely on analytics to derive actionable insights. For decision-making, analytics enables businesses to analyze trends and patterns that inform strategic choices. For example, 67% of executives report that data-driven decisions improve performance and foster innovation. This capability is especially crucial in competitive markets where timely and informed decisions can lead to a significant edge. In terms of operational optimization, data analytics identifies inefficiencies and bottlenecks within processes. A study revealed that organizations using data analytics in their operations see a 10% increase in productivity on average. This operational efficiency translates into cost savings and improved resource allocation, directly benefiting the bottom line.

Enhancing customer experiences is another critical area where analytics shines. By analyzing customer behavior and preferences, companies can tailor their offerings and marketing strategies. Research indicates that businesses utilizing advanced analytics for customer insights can achieve up to a 15% increase in customer satisfaction and loyalty. As organizations continue to harness the power of data, the demand for sophisticated analytics solutions will only intensify.

Big Data Analytics Market Restraints:

-

Increasing regulations like GDPR create challenges for data collection and analysis, limiting operational capabilities.

-

A lack of skilled professionals in data science and analytics hinders organizations from fully leveraging Big Data technologies.

-

Growing cyber threats and vulnerabilities can deter companies from adopting Big Data solutions due to concerns about data breaches.

Growing cyber threats and vulnerabilities pose significant challenges for the big data analytics market, as concerns over data breaches can deter companies from fully embracing these solutions. Data breaches can result in serious consequences, such as financial losses, damage to reputation, and regulatory fines. Furthermore, regulatory frameworks like the General Data Protection Regulation (GDPR) impose strict guidelines on data usage and security, creating additional compliance burdens. Failure to comply can result in fines of up to 4% of annual global revenue, incentivizing companies to be cautious in their data analytics initiatives. As businesses grapple with the dual challenges of leveraging big data while ensuring robust cybersecurity, the demand for integrated solutions that prioritize data protection is growing. This interplay between cyber threats and data analytics adoption will continue to shape the landscape of the big data analytics market in the coming years.

A significant barrier to maximizing the potential of big data technologies is the lack of skilled professionals in data science and analytics. As organizations increasingly recognize the value of data-driven insights, the demand for skilled data scientists and analysts has surged. According to the World Economic Forum, by 2025, 85 million jobs may be displaced by automation, but 97 million new roles in data science and analytics will emerge, highlighting the urgent need for skilled talent in this field. However, the skills gap remains pronounced. A report by IBM indicates that by 2022, the U.S. may encounter a shortfall of 250,000 data scientists. This scarcity limits organizations' ability to implement and effectively utilize big data solutions, resulting in underexploited data assets. Companies may struggle with data interpretation, predictive modeling, and the development of actionable strategies without the necessary expertise. This lack of qualified personnel can slow down project timelines, inhibit innovation, and ultimately affect an organization's competitiveness in the market. To bridge this skills gap, investments in training programs and partnerships with educational institutions are essential. Addressing this issue will be crucial for organizations aiming to fully leverage Big Data technologies and drive successful data analytics initiatives.

Big Data Analytics Market Segmentation Analysis:

By Component, Software Leads the Big Data Analytics Market with 38% Share in 2025

In 2025, The software segment dominated the market with a revenue share of more than 38%, due to its diverse offerings such as credit risk management, business intelligence, CRM analytics, and compliance analytics, catering to organizations shifting to digital platforms. These solutions provide real-time insights and advanced decision-making capabilities, driving their adoption amid the data growth.

The hardware segment is expected to grow with a high CAGR during the forecast period, including communication and connected devices, supports real-time analytics, ensuring steady growth. services like data management and implementation are Important in driving the big data analytics market, supporting businesses in leveraging data for strategic decision-making and competitive advantage.

By Application, Data Discovery and Visualization Leads with Over 39% Revenue Share in 2025

The data discovery and visualization segment dominated the market and represented over 39% of revenue share in 2025. The increasing volume of both structured and unstructured data is expected to drive the demand for analytics solutions focused on data discovery and visualization. Large enterprises are utilizing data analytics to provide valuable insights for their decision-makers. The growth of the Data Discovery and Visualization segment in the Big Data Analytics market is driven by the demand for real-time insights, user-friendly tools for non-technical users, and the need for effective storytelling through data to support strategic decision-making across various industries.

Advanced analytics is projected to experience substantial growth during the forecast period. Organizations are adopting this technology, along with other advanced tools, to uncover meaningful patterns from diverse databases. The integration of machine learning and data mining into advanced analytics is anticipated to further boost the demand for data analytics solutions.

By Vertical, BFSI Dominates the Market with 32% Revenue Share in 2025

In 2025, the BFSI segment accounted for over 32% of the total revenue share, making it the largest. due to its expanding customer base, leveraging big data for efficient customer acquisition, development, and retention. The implementation of data analytics solutions is enabling the BFSI industry to effectively acquire, develop, and retain customers. For example, BBVA, serving over 47 million customers across 30 countries, adopted a social media analytics tool to gain insights into product performance and brand perception. Similarly, Citibank in Singapore offers retail discounts based on transaction patterns to enhance customer retention.

The retail segment is projected to experience the highest CAGR during the forecast period, as retailers leverage advanced analytics tools to better understand customer preferences and adapt to dynamic market trends, ultimately improving customer experiences. For instance, online retailers use product recommendation links to boost sales and enhance customer satisfaction. Additionally, the telecom sector's large client base is driving product demand, while the healthcare and life sciences industries are increasingly adopting analytics tools to better understand customer needs and improve services for both healthcare workers and patients.

By Enterprise Type, Large Enterprises Lead with Over 54% Revenue Share in 2025

In 2025, the large enterprises segment dominated the market and represented over 54% of revenue share. these are driving significant growth in the Big Data Analytics market due to several key factors. First, the increasing volume of data generated from diverse sources—such as IoT devices, social media, and customer interactions necessitates advanced analytics for effective management and insight generation. Second, the need for data-driven decision-making is becoming critical in a competitive landscape, pushing organizations to adopt analytics solutions that enhance operational efficiency and strategic planning.

Moreover, large enterprises are investing in cloud-based analytics platforms for scalability and cost-effectiveness, allowing them to process vast datasets in real-time. The integration of artificial intelligence and machine learning further enhances their analytical capabilities, enabling deeper insights and predictive modeling. Additionally, regulatory compliance and risk management requirements are driving the adoption of analytics tools to ensure data security and adherence to industry standards. Collectively, these factors position large enterprises as a significant growth segment within the Big Data Analytics market.

Small and medium enterprises are expected to experience rapid growth during the forecast period, driven by the rising number of SMEs in developing regions like the Middle East and Africa, South America, and Asia Pacific.

Big Data Analytics Market Regional Analysis

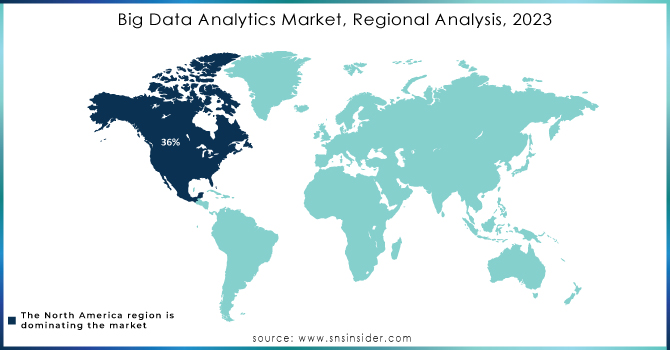

North America dominates the Big Data Analytics market in 2025

In 2025, North America holds an estimated 38% share of the Big Data Analytics market, driven by high adoption of cloud computing, AI-driven analytics, and enterprise digital transformation initiatives. The region benefits from advanced IT infrastructure, growing data-driven decision-making in BFSI and healthcare, and strategic investments by leading technology providers. Strong collaborations between tech vendors and large enterprises accelerate solution deployment. Additionally, government support for AI, smart city initiatives, and R&D investment enhances big data adoption. These factors collectively maintain North America’s leadership position and support sustained market growth in the region.

-

United States leads North America’s Big Data Analytics market

The U.S. dominates due to its mature IT ecosystem, extensive presence of global analytics vendors, and high digital adoption among enterprises. Large organizations leverage big data for predictive analytics, customer insights, and operational efficiency. BFSI, healthcare, and retail sectors are key adopters, implementing advanced analytics, AI, and cloud-based platforms. Government initiatives promoting AI and smart infrastructure further accelerate market growth. Robust venture funding, strategic partnerships, and ongoing technological innovation ensure the U.S. remains the largest contributor to North America’s big data analytics revenue.

Asia Pacific is the fastest-growing region in the Big Data Analytics market in 2025

The Asia Pacific market is projected to expand at an estimated CAGR of 14.8% from 2026 to 2033, driven by increasing digital adoption, IoT integration, and growing enterprise reliance on analytics for business decisions. The region benefits from rapidly expanding IT infrastructure, cloud services, and government-backed AI initiatives. Enterprises are investing in predictive analytics and advanced data platforms to optimize operations, improve customer engagement, and support e-commerce and manufacturing growth. These factors collectively accelerate adoption and position Asia Pacific as the fastest-growing region during the forecast period.

-

China leads Asia Pacific’s Big Data Analytics market

China dominates due to its rapid industrial digitization, extensive IoT deployment, and government initiatives supporting AI and data-driven decision-making. Enterprises across banking, e-commerce, and manufacturing use analytics for predictive insights, supply chain optimization, and customer behavior analysis. Investments in cloud infrastructure and smart city projects further fuel adoption. Collaborations between domestic and international technology providers accelerate deployment of advanced platforms, while SMEs increasingly adopt scalable cloud-based analytics solutions. These factors position China as the leading contributor to Asia Pacific’s big data analytics market.

Europe Big Data Analytics market insights, 2025

Europe shows steady growth in 2025, supported by regulatory compliance, digital transformation, and AI adoption across BFSI, healthcare, and retail industries. Enterprises increasingly adopt analytics to enhance operational efficiency, optimize customer experiences, and improve data-driven decision-making.

-

Germany, as the dominating country, drives market expansion

Stringent data privacy and compliance regulations in Germany compel organizations to adopt robust analytics solutions, boosting market growth. Germany leads due to advanced IT infrastructure, strong industrial base, and widespread enterprise adoption of predictive analytics, AI, and cloud-based platforms, making it Europe’s largest contributor to big data analytics revenues.

Middle East & Africa and Latin America Big Data Analytics market insights, 2025

The Middle East & Africa and Latin America markets show moderate growth in 2025. In the Middle East, countries like UAE and Saudi Arabia are investing in smart city initiatives and cloud adoption, accelerating analytics deployment. Africa’s emerging digital infrastructure and increasing enterprise digitization support steady adoption. In Latin America, Brazil and Mexico lead growth due to rising e-commerce, retail analytics, and banking sector transformation. Expanding cloud services and regional partnerships with technology vendors further enhance big data adoption across these regions.

Need any customization research on Big Data Analytics Market - Enquiry Now

Competitive Landscape for the Big Data Analytics Market:

IBM

IBM is a U.S.-based global leader in enterprise technology and big data analytics solutions, offering cloud-based platforms, AI-driven analytics, and data management tools. The company provides end-to-end solutions including predictive analytics, business intelligence, and real-time decision-making for industries such as BFSI, healthcare, and retail. By partnering with large enterprises and governments, IBM accelerates digital transformation and enables scalable, data-driven strategies. Its role in the big data analytics market is pivotal, delivering advanced platforms that improve operational efficiency, risk management, and customer insights across diverse sectors.

-

-

In 2024, IBM launched enhanced AI-powered analytics and cloud-native data management solutions to strengthen enterprise adoption and real-time insights.

-

Microsoft

Microsoft is a U.S.-based technology giant offering big data analytics solutions through its Azure cloud platform, Power BI, and machine learning services. The company integrates advanced analytics, predictive modeling, and real-time data processing into enterprise workflows, supporting industries like manufacturing, BFSI, and healthcare. Microsoft’s solutions empower organizations to make data-driven decisions, optimize operations, and enhance customer engagement. Its role in the market is central, providing scalable cloud infrastructure and intuitive analytics tools that simplify data visualization and operational insights for businesses globally.

-

-

In 2024, Microsoft expanded Azure Synapse Analytics and Power BI features, enabling deeper insights, AI integration, and enterprise-level data governance.

-

Google is a U.S.-based leader in cloud computing and big data analytics, offering platforms like Google Cloud, BigQuery, and AI-powered data services. The company provides analytics, machine learning, and real-time data processing for enterprises, enhancing operational efficiency and business intelligence. Google partners with organizations across BFSI, retail, healthcare, and manufacturing to integrate scalable analytics solutions. Its role in the market is significant, enabling organizations to analyze massive datasets quickly, leverage predictive insights, and implement data-driven strategies that improve productivity and customer engagement.

-

-

In 2024, Google introduced upgraded BigQuery and AI analytics solutions, enhancing real-time processing, predictive analytics, and enterprise data integration.

-

Amazon Web Services (AWS)

AWS is a U.S.-based global cloud and big data analytics leader, providing scalable platforms, AI/ML services, and real-time analytics tools. AWS solutions include Amazon Redshift, QuickSight, and AWS Data Lakes, which help enterprises process massive datasets, gain actionable insights, and optimize business operations. By serving BFSI, retail, healthcare, and telecom sectors, AWS accelerates digital transformation and supports predictive decision-making. Its role in the market is vital, offering secure, flexible, and scalable infrastructure for advanced analytics and operational efficiency across global organizations.

-

-

In 2024, AWS launched enhanced analytics and AI services, enabling enterprises to streamline big data processing, improve forecasting, and integrate predictive insights.

-

Big Data Analytics Market Key Players:

-

IBM

-

Microsoft

-

Google

-

Amazon Web Services (AWS)

-

Oracle

-

SAP

-

SAS

-

Tableau

-

Teradata

-

Cloudera

-

Snowflake

-

Qlik

-

Micro Focus

-

TIBCO Software

-

Palantir Technologies

-

Domo

-

Sisense

-

Zoho

-

Hitachi Vantara

-

Fractal Analytics

|

Report Attributes |

Details |

|

Market Size in 2025E |

US$ 320.7 Billion |

|

Market Size by 2033 |

US$ 842.6 Billion |

|

CAGR |

CAGR of 12.9% From 2026 to 2033 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2033 |

|

Historical Data |

2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Software, Hardware and Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

IBM, Microsoft, Google, Amazon Web Services (AWS), Oracle, SAP, SAS, Tableau, Teradata, Cloudera, Snowflake, Qlik, Micro Focus, TIBCO Software, Palantir Technologies, Domo, Sisense, Zoho, Hitachi Vantara, Fractal Analytics. |