Aircraft Seals Market Report Scope & Ovrview:

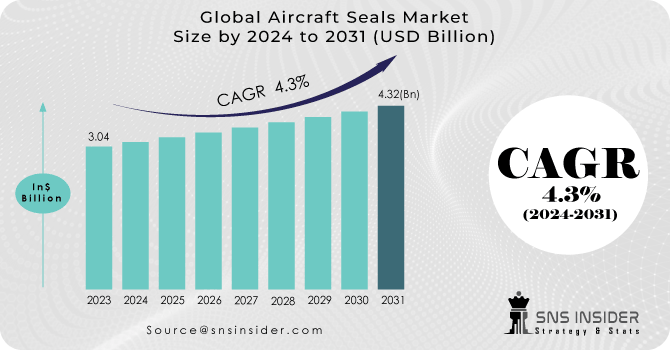

The Aircraft Seals Market Size was valued at USD 3.04 billion in 2023 and is expected to reach USD 4.32 billion by 2031 and grow at a CAGR of 4.3% over the forecast period 2024-2031. A seal is a key component of an aircraft that keeps gas or fluid from passing, flowing, or leaking between flaps, slats, access panels, doors, and other sections of the aircraft. It is intended to provide a long service life and minimal friction for intense pressure applications throughout a wide temperature range. Companies have recently invested in technology research in order to provide materials for a wide range of applications, such as aviation gearboxes, air turbine motor starters, and main shaft seals for both aircraft turbine engines and aircraft auxiliary power units. As a result, more money is being spent on developing highly robust aircraft seals that can endure high temperatures. This is likely to have a favorable impact on market growth throughout the forecast period.

To get more information on Aircraft Seals Market - Request Free Sample Report

Seal type, application, material, vendor, platform, and geography are the segments of the worldwide aircraft seals market. The dynamic seal sector is extensively utilized and has the greatest market share in terms of seal type because it provides strengthening and lubrication between machine components during various movements such as rotation, reciprocation, and oscillation. Because of the strong need for lightweight components, the composites category is widely used and has the biggest market share. Carbon composite materials have excellent sealing features such as self-lubrication, heat resistance, and high thermal conductivity, making them an excellent choice for sealing materials.

MARKET DYNAMICS

KEY DRIVERS

-

Growing Manufacturing

-

Rising A.I Technology

RESTRAINTS

-

High manufacturing cost

-

Good quality material

OPPORTUNITIES

-

Lightweight

-

Durable seals

CHALLENGES

-

Quality of component

THE IMPACT OF COVID-19

The COVID-19 epidemic has had a significant influence on the global market for aviation seals. The COVID-19 epidemic slowed economic growth in nearly all major countries, altering consumer purchasing patterns. National and international travel have been hampered as a result of the lockdown applied in several nations, which has greatly disrupted the supply chain of numerous sectors around the world, consequently increasing the supply-demand gap.

As a result, a lack of raw material supply is projected to slow the manufacturing rate of aircraft seals, severely impacting the growth of the aviation seals market.

However, the situation is expected to improve as governments around the world begin to reduce regulations for resuming corporate operations.

By End Use

The OEM category is expected to develop at a faster CAGR for the aircraft seals market during the forecast period. OEMs are in charge of installing aircraft seals during the assembly stage, after which they are made available for delivery to aircraft manufacturers. The Aftermarket category, on the other hand, is expected to have a larger market share in the aircraft seals industry. Demand for various aircraft types has increased significantly across geographies throughout the years in the aircraft seals market, the aftermarket segment is expected to generate greater income.

By Type

By type the dynamic seals category is expected to have the largest share of the aircraft seals market throughout the forecast period. The dynamic seals section of the aviation seals market is growing due to its widespread use in a variety of applications, and the majority of aircraft components are in motion rather than stationary. These are commonly utilized in aviation engine systems, flight control systems, and hydraulics systems.

By Material

The composites category is expected to have the biggest revenue share in the aircraft seals market. The widespread usage of many types of composites in the manufacture of aviation seals, as well as their demonstrated benefits such as heat resistance and strength, good chemical characteristics, low weight, and so on, can be contributed to their significant market share. These are employed in applications with a high risk of corrosion and a high operating temperature.

By Application

By Application the engine system sector is predicted to be the largest market in terms of value. The engine system segment of the aircraft seals market is growing because of the several sub-systems it includes, such as air supply, temperature control, cabin pressurization, avionics cooling, smoke detection, and fire suppression. Aircraft seals are also employed in critical systems such as the airframe, flight control, and hydraulics system, avionics and electrical system, and landing gear system. Aircraft seals are employed in these aircraft systems to prevent the spread of fire or flames in the aircraft's engine system, to prevent air leakage, water or dust intrusion, corrosion, or any aircraft fluid leakage.

By Aircraft Type

Because of the increased demand for commercial and business aircraft, the fixed-wing market is likely to have the most demand.

KEY MARKET SEGMENTATION

By End-Use

-

OEM

-

Aftermarket

By Type

-

Dynamic

-

Static

By Material

-

Composites

-

Polymers

-

Metals

By Application

-

Engine

-

Airframe

-

Avionics

-

Flight Control System

-

Landing Gear

By Aircraft Type

-

Fixed Wing

-

Rotary Wing

Need any customization research on Aircraft Seals Market - Enquiry Now

REGIONAL ANALYSIS

North America is expected to be the largest regional market share for aviation brands at the time of forecasting. An important issue facing North America, which is leading the aviation brand market due to the presence of a large number of aircraft brand manufacturers in the region. Also, the region has seen an increase in new flights. In North America, an increase in orders for aircraft goods is encouraging aircraft brand manufacturers to increase their sales year after year. The growing demand for commercial aircraft and the presence of some of the leading players in the market, such as Parker Hannifin Corporation, Kirkhill, Inc., Brown Aircraft Supply are expected to drive the aviation brand in North America. These players are focused on R&D to grow their product lines and utilize advanced systems, sub-systems, and other components to produce aircraft brands. The European region is expected to have the highest growth rate in the aviation market.

REGIONAL COVERAGE

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Eaton Corporation, Esterline Technologies Corporation, Meggitt Plc, Parker Hannifin Corporation, SKF, Trelleborg Sealing Solutions, Brown Aviation Supply Inc., Hutchinson SA, Saint-Gobain, Technetics Group and Other Players.

Esterline Technologies Corporation-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.04 Billion |

| Market Size by 2031 | US$ 4.32 Billion |

| CAGR | CAGR of 4.3% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End Use (OEM, Aftermarket) • By Type (Dynamic and Static) • By Material (Composites, Polymers, Metals) • By Application (Engine, Airframe, Avionics, Flight Control System, Landing Gear) • By Aircraft Type (Rotary and Fixed wing) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Eaton Corporation, Esterline Technologies Corporation, Meggitt Plc, Parker Hannifin Corporation, SKF, Trelleborg Sealing Solutions, Brown Aviation Supply Inc., Hutchinson SA, Saint-Gobain, and Technetics Group |

| DRIVERS | • Growing Manufacturing • Rising A.I Technology |

| RESTRAINTS | • High manufacturing cost • Good quality material |