Aviation Engine MRO Market Report Scope & Overview:

To get more information on Aviation Engine MRO Market - Request Free Sample Report

The Aviation Engine MRO Market Size was valued at USD 33.5 billion in 2023 and is expected to grow to USD 53.3 billion by 2032, achieving a compound annual growth rate (CAGR) of 5.32% over the forecast period of 2024 to 2032.

Increased air traffic in emerging nations, the requirement for adequate engine and component maintenance, and rising investment in MRO facilities are likely to boost the Aircraft Engine MRO Market throughout the forecast years. The Global Aircraft Engine MRO Market research offers a comprehensive analysis of the market. The research provides a detailed analysis of the market's key segments, trends, drivers, restraints, competitive landscape, and determinants.

The abbreviation MRO, which is commonly used for aviation maintenance, stands for maintenance, repair, and overhaul. Aircraft engine MRO services refer to the repair, maintenance, and overhaul of engines supplied by corporations to airlines for the optimum health of the aircraft engine.

Engine for an aeroplane MRO services are required for the aircraft to ensure that it is fit to transport passengers and cargo safely. The market is divided into two categories based on engine type: turbo engine and piston engine. The market is divided into two segments based on application: civil aviation and military aviation.

Market Dynamics

Key Drivers

-

Engine Development For Next-Generation Aircraft

-

Improve Mro Outsourcing Activities

Restraints:

-

Mro Of Aviation Engines Is Expensive.

-

Growing Environmental Dangers Related To Aviation Engine Mro Services

Opportunities

-

Internet of Things (Iot) Integration In Mro

-

Aftermarket Parts Availability On E-Commerce Platforms

Challenges:

THE IMPACT OF COVID-19

The COVID-19 epidemic has had a significant impact on the aviation sector and aircraft MRO market. The industry experienced a difficult period in March-April and is expected to suffer significant losses in terms of air passenger revenues in 2020 as a result of containment measures implemented by several countries. While the aviation industry has begun to recover, it will take time to return to pre-pandemic levels. The pandemic has compelled many regulators and aviation organisations to investigate remote working and social distancing options. The Federal Aviation Administration (FAA) has established a new policy that would authorise the use of remote technology and video links for performing inspections and certifying regulatory compliance during COVID-19.

The market is divided into two segments based on engine type: turbo engine and piston engine. The Turbo Engine sector is projected to dominate the market. The factors are due to its strong thrust and fuel efficiency.

The market is divided into two segments based on application: civil aviation and military aviation. In the foreseeable time frame, the Civil Aviation category is expected to have the greatest CAGR. The factors can be linked to increased passenger traffic and increased penetration and expansion of low-cost carriers.

Fixed-wing aircraft have wings rather than vertical lift rotors. Control surfaces, such as ailerons, rudders, and elevators, are built into the wings of this aircraft. This configuration has various advantages over rotary-wing aircraft, including endurance, vast area coverage, flight speed, and a higher passenger carrying capacity. As a result, commercial airlines and military organisations typically use these aircraft for long-distance travel. Furthermore, due to an increase in air passenger traffic, demand for fixed-wing aircraft is increasing globally. As a result, rising demand for fixed-wing aircraft is likely to fuel expansion in the fixed-wing aircraft segment of the global aviation engine MRO market. The fixed-wing aircraft segment has the largest market share.

KEY MARKET SEGMENTATION

By Engine Type

-

Turbo Engine

-

Piston Engine

By Application

-

Civil Aviation

-

Military Aviation

By Aircraft Type

-

FIXED-WING AIRCRAFT

-

ROTARY-WING AIRCRAFT

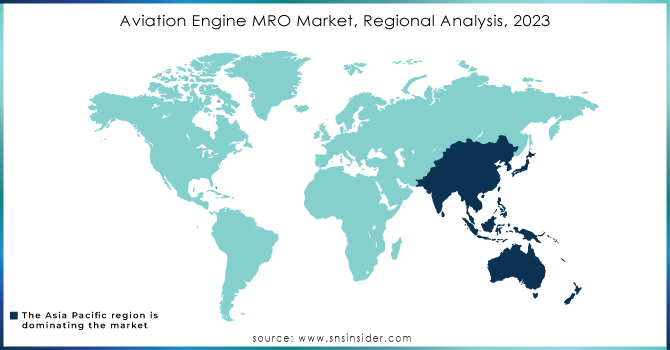

REGIONAL ANALYSIS:

North America, Europe, Asia Pacific, and the Rest of the World comprise the Aircraft Engine MRO Market. Because of the large-scale civil aviation sector in countries such as China, Asia Pacific will hold the highest share of the market. Every day, China experiences a great number of flying activities. It is the world's second-biggest aviation market in terms of air passenger traffic, and it is expected to overtake the United States to become the world's largest aviation market by 2022.

Need any customization research on Aviation Engine MRO Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Key Players are AIR FRANCE KLM Group, Delta TechOps, GE Aviation, Hong Kong Aircraft Engineering Company Limited, Lufthansa Technik, MTU AERO ENGINES AG, Rolls-Royce plc, Safran, SIA Engineering Company, and United Technologies, Honeywell International Inc. & Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 33.5 Billion |

| Market Size by 2032 | US$ 53.3Billion |

| CAGR | CAGR of 5.32% From 2023 to 2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Engine Type (Turbo Engine, Piston Engine) • By Application (Civil Aviation, Military Aviation) • By Aircraft Type (FIXED-WING AIRCRAFT, ROTARY-WING AIRCRAFT) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | AIR FRANCE KLM Group Delta TechOps, GE Aviation, Hong Kong Aircraft Engineering Company Limited, Lufthansa Technik, MTU AERO ENGINES AG, Rolls-Royce plc, Safran, SIA Engineering Company, and United Technologies, Honeywell International Inc. |

| KEY DRIVERS | • Engine Development For Next-Generation Aircraft • Improve Mro Outsourcing Activities |

| Restraints | • Mro Of Aviation Engines Is Expensive. • Growing Environmental Dangers Related To Aviation Engine Mro Services |