Maritime Logistics and Services Market Report Scope & Overview:

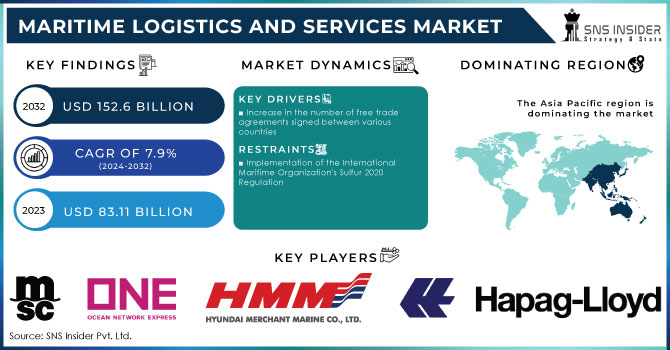

The Maritime Logistics and Services Market Size was valued at USD 83.11 billion in 2023 and is expected to reach USD 152.6 billion by 2032, growing at a CAGR of 7.9% from 2024-2032.

The Global Shipping Industry is the economic and cultural backbone of the world. The exchange of goods and services will be impossible without quick and dependable shipping services. Many other kinds of items would not have been available. Maritime transport logistics enables firms to keep their commodities moving smoothly and without delay across all locations.

To get more information on Maritime Logistics and Services Market - Request Free Sample Report

Maritime logistics is described as the delivery of products from one location to another using cargo ships. The tremendous expansion of global trade in recent decades has increased the Global Maritime Logistics and Services Market. Global Maritime Logistics and Services have benefited from new advancements and deregulation.

The mechanism of global trade and container transportation has undergone significant transformation. And these changes have raised demand for logistics services and other modes of transportation.

MARKET DYNAMICS

KEY DRIVERS

-

Increase in the number of free trade agreements signed between various countries

-

Improving Economic Conditions in Several Countries, Combined With Increased Export and Import

RESTRAINTS

-

Implementation of the International Maritime Organization's Sulfur 2020 Regulation

OPPORTUNITY

-

Consolidation of the Container Shipping Industry, as well as Digitalization and Automation

-

Rapid Growth of New Ports in Developing Countries

CHALLENGES

-

The Global Maritime Logistics and Services Market may face challenges due to guidelines and the availability of other shipping mediums.

IMPACT OF COVID-19

Businesses all throughout the world suffered as a result of the COVID-19 Pandemic. Almost every country has been infected with the virus. Lockdown is being imposed across the countries. The global economy is suffering as a result of the lockdown and social distancing norms. The COVID-19 also had an adverse effect on the maritime industry. Shipping of goods and services was halted due to travel restrictions, affecting the Global Maritime Logistics and Services Market. To deal with the interruptions caused by the Covid-19 issue, the leading actors in the Global Maritime Logistics and Services Industry modified their finance, operations, safety regulations, and working methods.

The countries' governments made precautions to keep trade flowing while keeping people secure. Various industries were forced to suspend output due to the lockout. As a result, the shipping market was severely impacted, but the Global Maritime Logistics and Services Industry will experience favourable growth following the post-covid-19 situation.

The Global Maritime Logistics and Services Market is divided into two types: general cargo and bulk cargo. General freight is further classified as break bulk, neo bulk, and containerized cargo. The general cargo was responsible for the biggest Maritime Logistics and Services Market Share in 2021. General cargo is intended to transport meals, machines, chemicals, clothing, and other items. Bulk cargo is further classified as liquid bulk or dry bulk. Because it transports enormous amounts of items, the bulk category will have the largest CAGR during the projection period.

Port handling, route surveys, lifting equipment management, packing, and crafting are the service segments of the Global Maritime Logistics and Services market. Among them, the port sector held the largest share of the Global Maritime Logistics and Services Market in 2021 and is predicted to increase rapidly during the forecast period.

The maritime operator now provides effective and high-quality logistics services as well as better transportation. The traditional port environment is evolving due to technological, demographic, and sustainability drivers that impact day-to-day company operations. Many opportunities are predicted in the worldwide shipping business. Because it is an important trading route for various nations, China has a robust Global Maritime Logistics and Services Market. Because of factors such as low cost, secure transportation, and vast space, the maritime shipping industry accounts for around 90% of global trade.

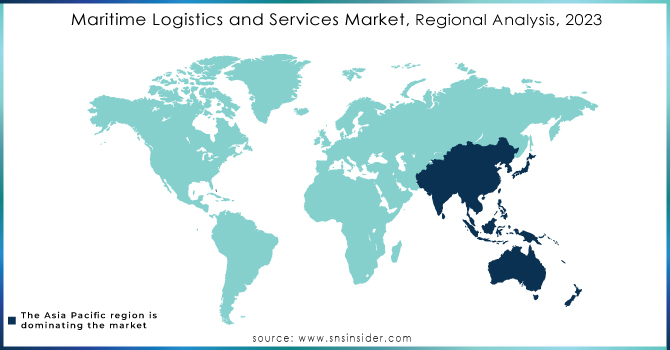

The Global Maritime Logistics and Services Market is divided into four regions: North America, Europe, Asia Pacific, and the rest of the world.

KEY MARKET SEGMENTATION

By Operation

-

Manned

-

Remotely Operated

-

Autonomous

By Type

-

Fully Electric

-

Hybrid

By Ship Type

-

Commercial

-

Defense

By System

-

Power Conversion

-

Power Distribution Systems

REGIONAL ANALYSIS

North America, Europe, Asia Pacific, and the rest of the world are the major regions in the Global Maritime Logistics and Services Market. The Asia Pacific region had the largest Maritime Logistics and Services Market Share in 2021, and it is expected to continue to dominate the market during the projected period. Major countries such as India and China are making significant contributions to the Global Maritime Logistics and Services Market. North America exhibits a consistent CAGR over the projection period, and the tension between China and the United States will have an impact on market growth in this region. Despite the European countries' economic crises, Europe is predicted to develop in the Global Maritime Logistics and Services Market.

This is because important essential players are present in this region. Due to increased seaborne economic activity, the remainder of the world will experience positive growth during the projection period.

Need any customization research on Maritime Logistics and Services Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Mediterranean Shipping Company SA, Ocean Network Express Pte. Ltd, Pacific International Lines, Hyundai Merchant Marine, Hapag-Lloyd AG, China Ocean Shipping Company Limited, CMA CGM SA, Evergreen Line, YangMing Marine Transport Corp., P. Moller-Maersk A/S and Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 183.11 Billion |

| Market Size by 2032 | USD 152.6 Billion |

| CAGR | CAGR of 7.9% From 2023 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Operation (Manned, Remotely Operated and Autonomous) • By Type (Fully Electric and Hybrid) • By Ship Type (Commercial and Defense) • By System (Energy Storage Systems, Power Generation, Power Conversion and Power Distribution Systems) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Mediterranean Shipping Company SA, Ocean Network Express Pte. Ltd, Pacific International Lines, Hyundai Merchant Marine, Hapag-Lloyd AG, China Ocean Shipping Company Limited, CMA CGM SA, Evergreen Line, YangMing Marine Transport Corp., P. Moller-Maersk A/S. |

| DRIVERS | • Increase in the number of free trade agreements signed between various countries • Improving Economic Conditions in Several Countries, Combined With Increased Export and Import |

| RESTRAINTS | • Implementation of the International Maritime Organization's Sulfur 2020 Regulation |