Aloe Vera Market Report Scope & Overview:

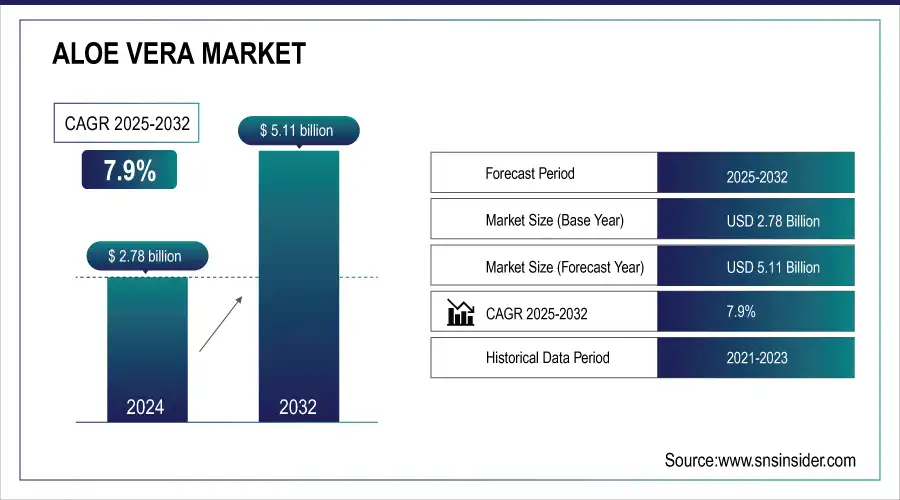

The Aloe Vera Market size was USD 2.78 billion in 2024 and is expected to Reach USD 5.11 billion by 2032 and grow at a CAGR of 7.9% over the forecast period of 2025-2032.

Aloe Vera is available in a variety of forms, including liquid gels, capsules, powder, gels, and others. Aloe vera has been used to treat a variety of skin, hair, and diabetic conditions. Unprocessed aloe vera extract, in particular, is widely utilized in healthcare, cosmetics, and other applications. Organic aloe vera products are becoming more popular among consumers.

To Get more information on Aloe Vera Market - Request Free Sample Report

Aloe vera is classified into three application sectors food and beverages, pharmaceuticals, and cosmetics. The increased use of aloe vera in aloe-based beverages drives market demand. Cosmetics are expected to rise significantly. The prevalence of several skin illnesses and other associated concerns has increased the demand for cosmetic products.

Most organizations are investing in research and development and introducing innovative products to obtain a competitive advantage and increase their global presence. Currently, one of the significant market trends is the increasing usage of aloe Vera extracts in sugar-free drinks, which is predicted to broaden the product's application reach. Due to growing customer awareness of leading a healthy lifestyle, markets for producers include nations like India, China, and the U.S.

Market Size and Forecast:

-

Market Size in 2024 USD 2.78 Billion

-

Market Size by 2032 USD 5.11 Billion

-

CAGR of 7.9 % From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Key Aloe Vera Market Trends:

-

Rising consumer preference for natural and herbal products like aloe vera to support health and wellness.

-

Growing use of aloe vera in managing chronic diseases such as diabetes, heart disease, and cancer.

-

Increasing demand for aloe vera-based personal care and cosmetic products, including lotions, creams, and soaps.

-

Expanding application of aloe vera in skincare due to its moisturizing, soothing, and anti-aging properties.

-

Rising adoption of aloe vera in hair care, sunscreen, and acne treatment products for its hydrating and protective benefits.

Aloe Vera Market Growth Drivers:

-

Rising demand for aloe vera in the healthcare sector

Aloe vera is widely known for its many medicinal properties, which include the capacity to treat wounds, heal burns, and strengthen the immune system. Customers are increasingly looking for natural items like aloe vera to boost their health as they become more health-conscious. Numerous chronic illnesses, including diabetes, heart disease, and cancer, can be naturally treated using aloe vera. The market for aloe vera products will rise as these diseases become more common.

Aloe Vera Market Restraints:

-

Adversely clinical effects of the Aloe vera

Some people, particularly those who are allergic to other members of the lily family, such as tulips and onions, may have skin discomfort from aloe vera. Aloe vera may increase the skin's sensitivity to sunlight, increasing the chance of getting sunburned.

Aloe vera can induce low potassium levels (hypokalemia) in some persons, particularly those who take diuretics or have kidney problems. When used in high quantities, aloe vera can cause diarrhea. Because aloe vera can interfere with blood clotting, those with bleeding issues should use it with caution.

Aloe Vera Market Opportunities:

-

Rising usage in cosmetics and skincare industries

Lotions, creams, and soaps that are used for personal care and cosmetic purposes frequently contain aloe vera as an ingredient. It is perfect for these products because of its calming and hydrating qualities. Aloe vera naturally attracts moisture to the skin since it is a humectant. Due to this, it works well as a moisturizer, which keeps the skin hydrated, as well as an ingredient in sunscreen, anti-aging products, acne treatments, and hair care products.

Aloe Vera Market Segment Analysis:

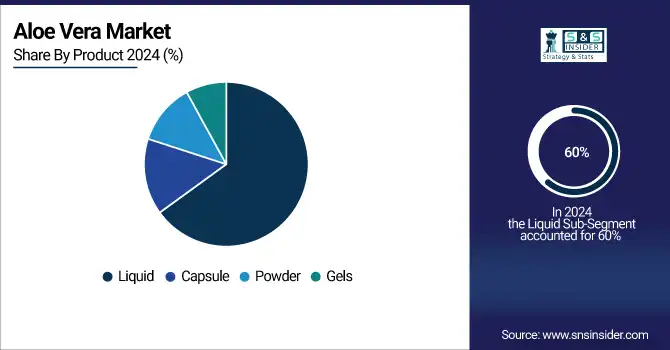

By Product

In 2024, liquid aloe vera products dominated the market with 60%, driven by their widespread use in beverages, cosmetics, and pharmaceutical formulations due to easy consumption and high bioavailability. From 2025 to 2032, the capsule segment is expected to grow at the fastest CAGR, fueled by rising consumer preference for convenient dosage forms, expanding nutraceutical applications, and increasing awareness of aloe vera’s role in boosting immunity and managing chronic health conditions, making it a preferred option among health-conscious consumers globally.

By Distribution Channel

In 2024, the offline distribution channel dominated the aloe vera market, supported by supermarkets, pharmacies, and specialty stores that provide direct product access and trust. From 2025 to 2032, the online channel is projected to witness the fastest CAGR, driven by e-commerce growth, wider product availability, attractive discounts, and the increasing shift of consumers toward digital purchasing platforms offering convenience and doorstep delivery of aloe vera-based products across personal care, health, and wellness categories.

By Application

In 2024, the cosmetic segment dominated the aloe vera market, driven by its extensive use in skincare, haircare, and personal care products due to hydrating and soothing properties. From 2025 to 2032, the pharmaceutical segment is expected to grow at the fastest CAGR, fueled by rising demand for natural remedies in treating chronic illnesses, wound healing, and immunity-boosting solutions.

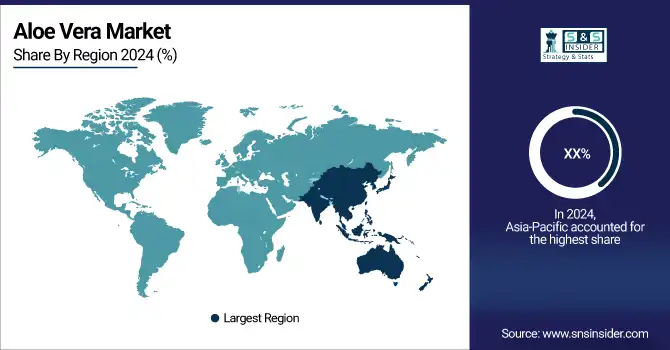

Aloe Vera Market Regional Analysis:

Asia Pacific Aloe Vera Market Insights

Asia-Pacific has taken over the global market for aloe vera extracts. China and India are driving the region's industry due to rising demand in the pharmaceutical and cosmetics industries. Growing population and rising per capita income levels are predicted to drive demand for skincare and cosmetic products. India has the world's fastest-growing cosmetics market. The aloe vera industry is being driven by an expanding number of organic product manufacturers.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Aloe Vera Market Insights

North America was the market with the second largest share in the world attributed to rising product usage for the treatment of conditions including cancer, diabetes, gum disease, hair loss, etc, Aloe vera's biggest market in North America is in Mexico, which is followed by the US and Canada.

Europe Aloe Vera Market Insights

Another attractive market is Europe, which is anticipated to rise significantly over the projection period. Consumers in European nations including the U.K., France, and Germany are becoming more interested in nutritional health and supplement products and therapies to improve their health and treatment as well as to prevent sickness. Europe's biggest aloe vera market is in Germany, followed by France and Italy.

Latin America (LATAM) and Middle East & Africa (MEA) Aloe Vera Market Insights

The cosmetic and pharmaceutical sectors are increasing their demand for aloe vera throughout Latin America, the Middle East, and Africa. Latin America's largest aloe vera market is in Brazil, followed by Argentina and Colombia. In the Middle East and Africa, Saudi Arabia has the biggest aloe vera market, followed by Egypt and Morocco.

Aloe Vera Market Key Players:

-

Agromayal Botánica S.A. de C.V.

-

Aloe Farms, Inc.

-

Aloe Laboratories, Inc.

-

Lily of the Desert Organic

-

Pharmachem Laboratories, Inc.

-

Foodchem International Corporation

-

Terry Laboratories, Inc.

-

Aloecorp, Inc.

-

Natural Aloe Costa Rica S.A.

-

Aloe Queen Inc.

-

Herbalife Nutrition Ltd.

-

Forever Living Products

-

Patanjali Ayurved Ltd.

-

Dabur India Ltd.

-

Nature’s Way Products, LLC

-

Amway Corporation

-

NOW Foods

-

Nutralo Group Inc.

-

Fruit of the Earth, Inc.

-

Aloecorp Korea Ltd.

Aloe Farms, Inc-Company Financial Analysis

Competitive Landscape for Aloe Vera Market:

Desert Harvest specializes in aloe vera-based health and wellness products, particularly targeting bladder health and skin care. The company offers highly concentrated, freeze-dried aloe vera supplements known for purity and efficacy. With a focus on natural, therapeutic solutions, Desert Harvest supports consumer demand for safe, science-backed aloe vera applications.

Desert Harvest- In 2023 Desert Harvest, a producer of nutritional supplements containing concentrated aloe vera extract, has collaborated with DopDop Salon master stylist Eddie Wünderlich to develop Wünderlich aloe-infused conditioner and shampoo.

| Report Attributes | Details |

| Market Size in 2024 | USD 2.78 Billion |

| Market Size by 2032 | USD 5.11 Billion |

| CAGR | CAGR of 7.9% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Liquid Gels, Capsule, Powder, Gels, Liquid) • By Distribution Channel (Offline, Online) • By Application (Food & Beverages, Pharmaceutical, Cosmetic) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Agromayal Botánica S.A. de C.V., Aloe Farms, Inc., Aloe Laboratories, Inc., Lily of the Desert Organic, Pharmachem Laboratories, Inc., Foodchem International Corporation, Terry Laboratories, Inc., Aloecorp, Inc., Natural Aloe Costa Rica S.A., Aloe Queen Inc. |